Gabriel Collins, “China’s Evolving Passenger Car Sales Patterns and Outlook,” China SignPost™ (洞察中国) 97 (23 June 2016).

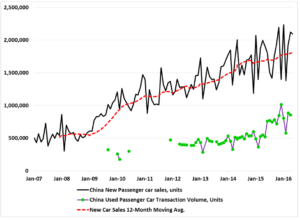

China’s overall passenger fleet car growth will likely be the single most consequential element influencing China’s gasoline demand growth profile over the next two to five years. On a 12-month rolling basis, new car sales are still on an upward trend, but have slowed from the growth rates seen a few years ago (Exhibit 1). The China Association of Automobile Manufacturers forecasts that new passenger vehicle sales will rise by 6% YoY in 2016.[1] Last year saw 21.2 million new passenger vehicles sold in China, so CAAM’s forecast suggests new vehicle sales could rise to approximately 22.5 million vehicles in 2016.

Exhibit 1: China New and Used Passenger Car Sales

Source: CAAM, CADA

Used vehicle sales are also increasingly important from an oil use perspective, as they help drive further market penetration. December 2015 marked the first time monthly used car transactions in China broke the one million mark. China’s nascent—but increasingly robust—used car market is a positive sign for the next 24 months in the country’s car market overall. Detailed used car sales data from 2015 suggest that Chinese new car owners in many cases turn their vehicles over quite rapidly: vehicles 1-to-3 years old accounted for 26% of used cars sold in 2015, while 3-to-5 year old vehicles made up 37% of total sales.[2] Vehicles 8 years and older made up 19% of total used car sales in 2015.[3] Lightly used vehicles offer aspiring car owners the chance to acquire premium brands such as Volkswagen at significant discounts relative to what a new vehicle would cost.

Consider the following example: Sina.com’s used car portal lists a 2009 VW Passat with a manual transmission and 86,000 km on the odometer for 86,800 RMB.[4] The 2016 model year of the vehicle—which is listed for sale in Jining, Shandong—would cost nearly 230,000 RMB including taxes.[5] Based on these economic facts, it becomes clear that the heavy discounts (62% from current new vehicle sticker price in this case) strongly attract buyers who may not be flush with money, but seek quality vehicles capable of comfortably carrying several passengers plus goods and luggage.

Nearly 70% of China’s used car transactions in 2015 were done for 100,000 RMB or less, which suggests that this is an important pricing point for potential buyers.[6] In turn, as the cars sold during the sales spike in 2008-11 begin to age into the 5 year-plus category, used car transactions could rise sharply over the next 2-3 years as wealthier owners seek new rides while less well-heeled drivers capitalize on the growing availability of quality mid-sized vehicles coming onto the used market.

In the 2011 timeframe, many independent used car dealers in China complained about being unable to secure sufficient inventory.[7] Yet as high-tier owners upgrade and more quality vehicles hit the used market, the growing availability of attractive bargains may spur further purchasing and ownership penetration in both core markets and areas on their periphery—for instance the constellations of cities outside of Shanghai and Guangzhou, two of China’s largest markets for new and used vehicles.

On the policy side, several factors contribute to growing month-to-month volatility in sales numbers. The Chinese government cut taxes on small displacement vehicles (engine size less than 1.6 L) in October 2015, which helped prop up sales.[8] In addition, over the past two years, periodic discussions of various ownership restrictions by key municipalities have fueled panic buying as prospective car owners rush to beat ownership caps, higher license plate fees, and the like.[9]

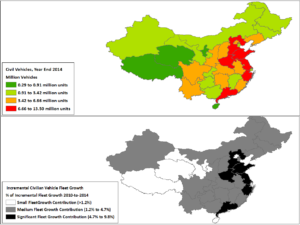

Amidst rising monthly sales variance between months, one trend is clear: China’s wealthier Eastern provinces have been the force behind the bulk of civilian vehicle fleet additions over the past several years. China’s seven largest civilian vehicle owning provinces—Shandong, Guangdong, Jiangsu, Zhejiang, Hebei, and Henan—held approximately 46% of China’s total civilian vehicle fleet at year-end 2014. More notably, these seven provinces accounted for nearly 50% of incremental fleet growth between 2010 and 2014 (Exhibit 2). It appears that the big, predominantly coastal, vehicle owning regions continue to drive the national market.

Exhibit 2: China Civilian Vehicle Fleet by Province and Provincial Contributions to Incremental Fleet Growth Between 2010 and 2014 (民用汽车保有量)

Source: NBS China, Author’s Analysis

Diving Deeper Into The China Vehicle Sales Picture—a Detailed Provincial- and City-Level Analysis

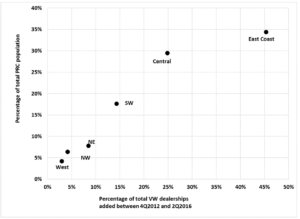

To gain provincial and city-level insights into the behavior of Chinese new car buyers, this analysis draws on and updates an analysis originally done in December 2014 for China SignPost™ that used Volkswagen as an analytical lens to gain insights into the evolving geography of passenger car sales.[10] VW was—and remains—the largest passenger car seller in China’s massive market, accounting for roughly one in every five passenger cars sold in the country. As such, the China SignPost study viewed VW’s sales and service infrastructure decisions as a useful barometer for assessing how the “smart money” saw passenger car demand unfolding in various regions of China.[11]

VW disclosed data for dealerships by province at approximately quarterly intervals between the fourth quarter of 2012 and the second quarter of 2016. Our analysis of the data showed that the 10 provinces with the largest increase in number of dealerships during this time were (in descending order): (1) Jiangsu, (2) Zhejiang, (3) Hebei, (4) Shandong, (5) Guangdong, (6) Sichuan, (7) Henan, (8) Yunnan, (9) Anhui, and (10) a tie between Anhui and Hunan.[12] These 10 provinces reflect a significant East Coast bias in the China sales strategy of one of the world’s premier automakers. Indeed, by our count using VW’s own data, more than 45% of its new China dealerships added between 4Q2012 and 2Q2016 were opened in East Coast provinces that account for little more than 1/3 of China’s population (Exhibit 3). Provinces in Central and Southwestern China saw significant growth in the number of VW dealerships, but at a proportion lower than one would expect based on the provinces’ population and latent demographic and economic potential for increasing auto sales. Dealership additions in Northeast, Northwest, and Western China (Xinjiang, Tibet, Ningxia, Qinghai) were low relative to population, but this is less surprising given these regions’ relative poverty compared to places like Jiangsu and Sichuan.

Exhibit 3: VW Dealership Additions by Region in China, 4Q2012 to 2Q2016

Source: Company Reports, NBS China, Author’s Analysis

Examining trajectories of different cities in the same high growth province—in this case, Jiangsu—further reinforces the theme of just how locally concentrated much of China’s passenger car fleet growth has been. This is an important wrinkle because it suggests that the market may need to price in a more nuanced auto sales and gasoline demand growth picture that is more complex than simply envisioning a wave of cars washing over a vast a populous country.

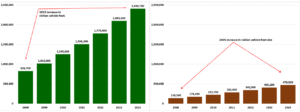

Consider, for instance, the cities of Suzhou in Jiangsu Province and Taizhou in Zhejiang Province, two adjacent areas which comprise one of China’s largest passenger car (and gasoline) markets. The Suzhou metro area, which lies approximately 60 miles northwest of Shanghai, is home to roughly 11 million people. In a seven year span from 2008 to 2014, Suzhou’s passenger vehicle fleet grew by 191% to 2.4 million vehicles (Exhibit 4). In contrast, the Taizhou metro area, which sits 190 miles south of Shanghai and counts approximately 6 million residents, saw its passenger vehicle fleet grow by 240% during the same timeframe, rising to 470 thousand vehicles. While Taizhou’s fleet did grow somewhat faster than Suzhou’s, it started from a much lower absolute numerical baseline and was not nearly rapid enough to compensate for the significant arithmetical disparity between the cities’ respective vehicle fleets.

Exhibit 4: Civilian Vehicle Ownership in Suzhou, Jiangsu and Taizhou, Zhejiang

Source: NBS China, Author’s Analysis

Sales of New Cars Are Slowing

VW data suggests that the company sold approximately 1,655 vehicles per dealership in China during 2012.[13] By 2015, this number declined to an estimated 1,265 vehicles per dealer. The trend is important here because it transcends a common argument—that there are “too many” car dealers in China.[14] From the perspective of dealership economic and profitability, this thesis may well hold. But even consolidating dealerships will not reverse the slowdown in new car sales growth rates, which are the core focus of this analysis due to their significant effects on China’s gasoline demand outlook.

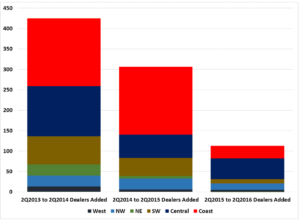

Consider the significant recent slowdown in VW’s China dealership buildout rate, from 425 net dealerships added between 2Q2013 and 2Q2014, 306 net dealerships added between 2Q2014 and 2Q2015, to just 110 net dealerships added from 2Q2015 to 2Q2016 (Exhibit 5).When one of the largest car dealers in a market rapidly scales back their dealership addition rate, the action strongly suggests the operator sees much less sales upside than they perceived even a few quarters prior.

Exhibit 5: Net VW Dealership Additions in China by Region Have Slowed Dramatically in Past Two Years

Source: Company Reports, Author’s Analysis

Perhaps the most notable trend emerging from this granular VW data is that between 2015 and 2016, the company clearly begin to test the limits of dealership penetration in Coastal China.[15] Dealership expansion also slowed significantly in Southwest China, which based on its still low rates of personal car ownership, would be considered a fertile growth market. VW is not alone in realizing that passenger car demand in Western China has grown slower than expected. Several other multinational and domestic automakers saw their sales underperform expectations in Western China beginning as early as June 2015.[16]

Central China dealership additions shrank the least, which suggests that consumers there still have a healthy appetite for VW vehicles. In turn, if consumers can afford premium foreign marks such as VW, this strongly implies that there is also sufficient local purchasing power to drive continued sales growth among other makes, particularly lower cost domestic brands and used vehicles. Dealers are also likely targeting Central China for new car sales because the past few years’ intensive focus on East Coast markets is driving saturation and increases in the traffic congestion issues that dissuade drivers from using their vehicles—or in some cases, even buying a car to begin with.[17]

Outlook

China’s new car market is transitioning into a period where sales will likely expand more slowly than the boom times of the past eight years. Industry data provider IHS expects a compensated annual sales growth rate of 5% between now and 2020.[18] The baseline sales volume is already high enough that even a 5% CAGR means that sales can grow by more than 1 million cars per year. Moreover, China’s car fleet remains young enough that significant scrapping activity most likely will not begin for at least 3-4 more years. As such, net fleet growth will have commensurate impacts on oil demand. Each million new cars sold in China could consume a volume of gasoline equivalent to approximately 40 kbd of crude oil.[19]

Even if car sales slow more significantly than the consensus forecast, the volume of vehicles on the road today, coupled with the fact that each car’s service life is likely to be at least 10 years, means significant gasoline demand is already “baked in.” This holds true even as more efficient vehicles like those described earlier in this section come to comprise a greater share of China’s passenger car fleet in coming years.

[1] Natasha Li, “CAAM Predicted a 6% Growth in the 2016 Chinese Auto Market,” Gasgoo.com, 13 January 2016, http://autonews.gasgoo.com/china-news/caam-predicted-a-6-growth-in-the-2016-chinese-aut-160113.shtml.

[2] “2015 China Used Car Market Report” (2015年中国二手车交易数据报告), QQ.com, 22 January 2016, http://auto.qq.com/a/20160122/052375_all.htm.

[3] Ibid.

[4]“VW Passat Sedan, 2009 Model, 1.8T, High-End Edition With Manual Transmission” (大众 帕萨特领驭 09款 1.8T 手动尊品型), Sina.com, http://usedcar.auto.sina.com.cn/buycar/d/1543632. Accessed 22 June 2016

[5] Ibid.

[6] “2015 China Used Car Market Report” (2015年中国二手车交易数据报告), QQ.com, 22 January 2016, http://auto.qq.com/a/20160122/052375_all.htm.

[7] Bob Tita, “Deere Profit Tumbles Amid Glut of Used Farm Equipment at Dealers,” The Wall Street Journal, 21 August 2015, http://www.wsj.com/articles/deere-reports-decline-in-profit-as-sales-tumble-1440158935; Bill Russo, Arnold Sun, Edward Tse, Ken Zhong, “A New Model for Selling Used Cars in China,” Booz & Co., March 2011.

[8] Christian Shepherd and Tim Mitchell, “China car sales accelerate after tax cuts,” FT, 12 January 2016, http://www.ft.com/cms/s/0/c44622a0-b914-11e5-b151-8e15c9a029fb.html#axzz4CK3Y1gfo.

[9] “China’s car sales up 13% as buyers rush to beat ownership limits,” Automotive News, 9 May 2014, http://www.autonews.com/article/20140509/GLOBAL03/140509801/chinas-car-sales-up-13-as-buyers-rush-to-beat-ownership-limits.

[10] Note that this analysis counts dealerships for all of the three core VW brands: VW itself, Audi, and Skoda.

[11] Gabriel B. Collins and Andrew S. Erickson, “Volkswagen’s China Dealership Expansions Suggest Substantial Upside for Continued Growth in Car Sales—and Gasoline Consumption,” China SignPost™ (洞察中国) 87 (17 December 2014).

[12] Ibid.

[13] The author uses the word “suggests” because while car sales are calculated on an annualized basis, VW has continually added dealerships during each of the years in question. Because we do not know when these dealerships opened during a given quarter or what their operational “ramp up” period is, we treat the average sales per dealer as an approximation that reflects an overall trend, as opposed to an exact, time-adjusted number.

[14] “Auto Dealers in China, Ubiquitous as KFCs, Face Shakeout,” Bloomberg, 24 April 2016, http://www.bloomberg.com/news/articles/2016-04-24/foreign-car-dealers-in-china-ubiquitous-as-kfcs-face-shakeout.

[15] It is possible that some of the sales and dealership expansion slowdown stems from VW’s emissions scandal. Yet the company’s sales in China are dominated by gasoline-powered cars, as opposed to the TDI diesel vehicles VW was pushing in the United States market.

[16] “Car Sales Slow in China’s West, Denting Hopes of Global Auto Industry: Sales shift down a gear in region where auto makers saw potential for faster growth,” The Wall Street Journal, 10 June 2015, http://www.wsj.com/articles/car-sales-slow-in-chinas-west-denting-hopes-of-global-auto-industry-1433936986

[17] Gabriel Collins, “Exploring Potential Limits to Gasoline Demand Growth in China,” China SignPost™ (洞察中国) 96 (13 June 2016), http://www.chinasignpost.com/2016/06/13/exploring-potential-limits-to-gasoline-demand-growth-in-china/.

[18] Volkswagen Group China – Balancing the “New Normal,” 13 June 2016, http://www.volkswagenag.com/content/vwcorp/info_center/en/talks_and_presentations/talks_and_presentations.html.

[19] Gabriel Collins, “Rising Gasoline Demand Means China’s Crude Oil Use is Decoupling from the Industrial Economy,” China SignPost™ (洞察中国) 95 (3 June 2016), http://www.chinasignpost.com/2016/06/03/rising-gasoline-demand-means-chinas-crude-oil-use-is-decoupling-from-the-industrial-economy/.