Gabriel Collins, “Rising Gasoline Demand Means China’s Crude Oil Use is Decoupling from the Industrial Economy,” China SignPost™ (洞察中国) 95 (3 June 2016).

EXECUTIVE SUMMARY

–Gasoline has taken over as the main driver of incremental oil products demand growth in China.

–This ties China’s crude oil appetite more tightly to consumer trends, as opposed to industrial growth.

–In the Chinese market, it takes approximately 19 passenger cars to equal the annual crude oil demand created by one heavy-duty diesel truck.[i]

–In 2015, 551 thousand new heavy trucks were sold in China, versus 21.2 million new passenger cars—a 38:1 ratio, meaning that passenger cars and their gasoline thirst are now decisively driving incremental oil demand growth in China.

–For the next three years, each million new passenger cars sold in China will likely create approximately 10 kbd of incremental gasoline demand. I estimate each barrel of gasoline is worth approximately 3.8 barrels of crude throughput in a typical Chinese refinery.

–Beyond 2019, higher scrapping rates and technological changes in vehicle powertrains that increase fuel efficiency will likely reduce the incremental fuel demand impact of each new car sold in China.

—The rising importance of gasoline demand and the decline in diesel use reflect a broad structural shift: crude oil is rapidly becoming a consumer good in China, not an industrial commodity as it was during the halcyon years of burgeoning diesel fuel demand.

Between 2003 and 2012, China’s crude oil demand used to be driven primarily by diesel fuel from the trucks, bulldozers, and generators that powered the country’s industrial boom. Yet as heavy industrial activity slowed and gasoline became a more important source of oil demand growth, crude oil started becoming more of a consumer good, as opposed to an industrial one. This shift will profoundly influence global crude oil and refined products markets.

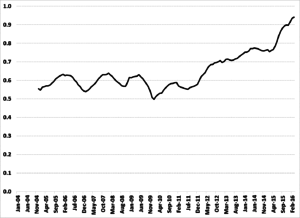

China’s gasoline demand upshifted dramatically in recent years, as passenger car sales skyrocketed. In early 2012, the ratio of gasoline consumption to diesel consumption in China begin to rise noticeably (Exhibit 1). This accelerated dramatically in 2015 as gasoline consumption continued to grow while diesel demand contracted slightly. The ratio currently stands at approximately 0.94 barrels of gasoline consumed per barrel of diesel. In January, February, and March of 2016, moreover, China actually consumed more gasoline than diesel fuel.

Exhibit 1: Ratio of Gasoline to Diesel Demand in China, 12-Month Moving Average

Source: JODI, Author’s Analysis

Gasoline has also steadily gobbled up share in China’s total petroleum liquid fuels and total oil products markets (Exhibit 2). Among petroleum-derived liquid fuels, gasoline’s share has risen from 26% in January 2004 to more than 40% by March 2016, with the growth heavily biased toward the past four years. Note that during this same time frame, gasoline gained share while overall petroleum-derived liquid fuels demand rose by 68%. Gaining a major chunk of market share amidst rapid overall demand growth shows just how dramatic China’s gasoline transformation has been. The analysis uses a 12-month moving average to smooth the seasonal demand spikes in the diesel fuel market and make long term trends more visually apparent.

Exhibit 2: Gasoline as a Percentage of Total Oil Products and Liquid Fuel Demand in China

Source: JODI, Author’s Analysis

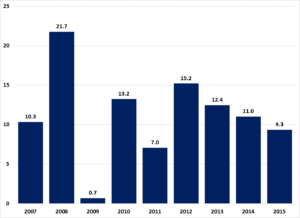

Passenger Car Sales Are Driving Gasoline Demand

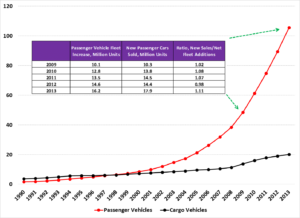

Gasoline-led oil demand growth stems from years of robust passenger car sales growth at a rate and scale not seen since the automobile first took the United States market by storm in the early 20th Century. In 2009, when the China personal car boom took off, the country sold 10.3 million units, a big jump from the 6.7 million cars sold in 2008, according to data from the China Association of Automobile Manufacturers (CAAM). By 2015, 21.2 million passenger cars were sold in China—significantly more than the 17.5 million light cars and trucks sold in the US, long the world’s dominant passenger vehicle market.[ii] Scarcely any passenger cars in China are diesel-powered.[iii]

New car sales numbers closely track the rapid increase in passenger-hauling vehicles’ proportion of the overall fleet in China. Because the cars that have entered the fleet during the recent car buying spree still have many years of service left in them, scrapping rates remain low, and the relationship between new cars sold and the number of cars entering the vehicle fleet on a net basis is much closer to one-to-one than it would be in a more mature market.

Supporting that thesis, the absolute and relative growth rates in the number of passenger-carrying vehicles has risen sharply since 2009, which correlates strongly with new passenger car sales (Exhibit 3). The ratio of new passenger car sales to net additions in the passenger-carrying vehicle fleet between 2009 and 2013 hovered between 0.98 and 1.11, which suggests that on the whole, more than 9 of every 10 new cars sold represented a net addition to the passenger vehicle fleet.

Exhibit 3: Passenger Carrying Vehicles vs. Cargo Carrying Vehicles in China’s Civilian Vehicle Fleet

Million vehicles

Source: NBS China, Author’s Analysis

China’s Gasoline Demand Outlook For 2016-18

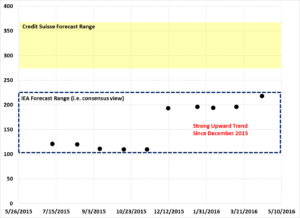

Three fundamental factors drive gasoline use: vehicle fleet size, how the fleet is driven, and what type of powertrain options are available. Industry, government, and private analysts hold a range of views on China’s gasoline demand outlook. At the bullish end of the spectrum, Credit Suisse believes that China’s oil demand will grow at a 4% annual rate in 2016 and 2017 (i.e., more than 415 kbd each year).[iv] The bank believes gasoline demand will be the prime mover of Chinese oil demand growth, with its baseline forecast projecting gasoline demand will increase by between 280 kbd and 360 kbd in both 2016 and 2017.[v] Chinese state oil giant CNPC’s in-house team forecasts a 4.3% increase in crude oil demand in 2016, although it is not clear to what extent, if at all, the Credit Suisse view influenced that of CNPC.[vi]

Credit Suisse was much more bullish than the November 2015 IEA Oil Market Report—the “consensus view”—that called for Chinese gasoline demand to rise by only 110 kbd in 2016.[vii] Subsequent IEA OMRs have raised their China gasoline demand outlook for 2016, which as of April stood at 228 kbd.[viii] Interestingly, the IEA analytical staff became much more bullish in late 2015, as the December 2015 OMR basically doubled the agency’s 2016 China gasoline demand forecast (Exhibit 4). The consensus view appears to have closed a significant portion of the daylight between it and the Credit Suisse forecast, which was formerly a significant outlier.

Exhibit 4: IEA’s 2016 China Gasoline Demand Forecast Became Much More Bullish in Past 6 Months

Projected 2016 gasoline demand growth, kbd

Source: Credit Suisse, IEA Oil Market Report, Author’s Analysis

To put external parties’ estimates in perspective, consider the additional implied gasoline demand per million new cars sold in China. Essentially, because new cars in China correlate to net passenger vehicle fleet growth at rates of nearly 1:1 (see Exhibit 3, above), dividing annual incremental gasoline consumption growth by the number of new cars sold yields a “rule of thumb” for how many barrels of gasoline per day each million new cars sold in China are worth.[ix]

The past five years of car sales and gasoline consumption levels shows that each million new cars sold yields an average of 11 kbd in additional gasoline demand (Exhibit 5). A downward trend in the curve suggests the incremental demand per million new cars sold may now be closer to 9.5 kbd. Based on this model, the author projects that Chinese gasoline demand will grow by 180-to-200 kbd in 2016, 2017, and 2018. At Sinopec’s 2015 refinery gasoline yield rate of approximately 26.5%, this volume of gasoline would translate into roughly 680-to-750 kbd of annual incremental crude oil demand.[x]

Exhibit 5: China Gasoline Demand Growth Per Million New Cars Sold

Source: CAAM, NBS China, Author’s Analysis

Outlook and Implications

Gasoline demand in China is likely to increase by 200-to-250 kbd in 2016 and 2017. Beyond that point, the confluence of vehicle powertrain innovation and other factors—particularly congestion on Chinese roadways—will likely begin to trim gasoline demand growth. This is important because China’s diesel demand has very likely already reached a permanent peak.[xi]

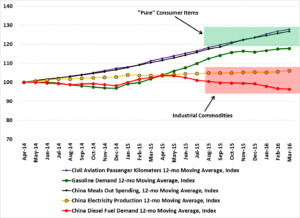

The chairman of Sinopec, China’s largest oil refiner, believes the country’s gasoline demand will peak around 2025, while ExxonMobil’s latest China energy outlook forecasts that passenger car fuel demand (i.e. primarily gasoline) will level off around 2030.[xii] As gasoline demand continues to de-couple from heavy industrial indicators (Exhibit 6) and comprise a larger share of China’s overall oil products demand, things like personal air travel data and spending on meals outside the home will likely become better leading indicators of gasoline demand than the traditional measures such as electricity that would have historically more closely tracked Chinese oil product consumption.

Exhibit 6: China Gasoline Demand vs. Consumer and Industrial Activity Indicators

Index, April 2014=100

Source: NBS China, Author’s Analysis

[i] This estimate uses the following assumptions: (1) Fuel use—Each heavy truck in China consumes 44 liters of diesel fuel per 100km (Ben Sharpe and Rachel Muncrief, “Literature Review: Real-World Fuel Consumption Of Heavy-Duty Vehicles In The United States, China, And The European Union,” The ICCT, White Paper, January 2015, http://www.theicct.org/sites/default/files/publications/ICCT_HDV_FC_lit-review_20150209.pdf) while China’s passenger car fleet had an average fuel economy of 7.12 liters/100km in 2015 (“China Passenger Vehicle Fuel Consumption,” 2015 Development Annual Report, The Innovation Center for Energy and Transportation

December 2015, http://www.icet.org.cn/english/admin/upload/2015120241280305.pdf.) (2) Annual vehicle km travelled—52,000 km per year for heavy trucks (H. Huo et al. / Energy Policy 43 (2012) 6–16 (10), http://www.tsinghua.edu.cn/publish/ess/7835/20120719144509070242457/[8]%20Huo_EP_2012.pdf) and 13,000 km/year for passenger cars (He, K., Huo, H., Zhang, Q., He, D., An, F., Wang, M., Walsh, M., 2005, “Oil Consumption and CO2 Emissions in China’s Road Transport: Current Status, Future Trends, and Policy Implications,” Energy Policy 33 (2005): 1499–1507). Diesel and gasoline yields per unit of crude oil run through refinery are derived from Sinopec’s 2015 Form 20-F report.

[ii] Mike Spector, Jeff Bennett, and John D. Stoll, “U.S. Car Sales Set Record in 2015,” The Wall Street Journal, 5 January 2016, http://www.wsj.com/articles/u-s-car-sales-poised-for-their-best-month-ever-1451999939.

[iii] “Why Volkswagen’s Problems Don’t Include China,” China Real Time Report, Wall Street Journal, 28 September 2015, http://blogs.wsj.com/chinarealtime/2015/09/28/why-volkswagens-problems-dont-include-china/.

[iv] “Connections Series: Oil and…Chinese Consumers,” Credit Suisse, 19 November 2015, Global Equity Research.

[v] Ibid.

[vi] “China Oil Demand to Grow 4.3 Percent in 2016: CNPC Research,” Reuters, 26 January 2016, http://www.cnbc.com/2016/01/26/china-oil-demand-to-grow-43-percent-in-2016-cnpc-research.html.

[vii] IEA Oil Market Report, 13 November 2015, https://www.iea.org/oilmarketreport/reports/2015/1115/#Demand

[viii] IEA Oil Market Report, 16 April 2016, https://www.iea.org/oilmarketreport/reports/2016/0416/#Demand

[ix] For original study, see Gabriel B. Collins and Andrew S. Erickson, “Gasoline Alley: How Much Gasoline Demand Are Each Million Cars Sold in China Worth?” China SignPost™ (洞察中国) 82 (3 November 2014), http://www.chinasignpost.com/2014/11/03/gasoline-alley-how-much-gasoline-demand-are-each-million-cars-sold-in-china-worth/.

[x] Sinopec 2015 Form 20-F, http://english.sinopec.com/download_center/reports/2015/20160425/download/2016042502.PDF.

[xi] Gabriel Collins, “China Peak Diesel Poses a Serious Challenge to Saudi Arabia, May Help Force OPEC Production Cut,” China SignPost™ (洞察中国) 94 (5 April 2016). http://www.chinasignpost.com/2016/04/05/china-peak-diesel-poses-a-serious-challenge-to-saudi-arabia-may-help-force-opec-production-cut/.

[xii] Timothy Coulter, “China’s Fuel Demand to Peak Sooner Than Oil Giants Expect,” Bloomberg, 1 April 2015, http://www.bloomberg.com/news/articles/2015-04-01/china-s-fuel-demand-to-peak-sooner-than-oil-giants-expect; “The Outlook for Energy: A View to 2040,” ExxonMobil, 24, http://cdn.exxonmobil.com/~/media/global/files/outlook-for-energy/2016/2016-outlook-for-energy.pdf.