Key Points

- Unless Chinese industrial consumers use low-cost coal, they will likely not be competitive in the export market with their global peers in North America and elsewhere who benefit from the shale gas boom and more favorable demographics.

- Energy costs matter more now for Chinese industry because Mexican manufacturing wages have become roughly equivalent to those in many parts of China. By 2015, manufacturing wages in Mexico could be as much as 30% lower than those in China on a productivity-adjusted basis.

- Nuclear, wind, and hydro power will not displace coal significantly for at least 10 years. Even with the current aggressive reactor buildout, China will likely only add 32 GW of nuclear power in the next five years—roughly half of the coal-fired capacity it has added annually in recent years.

- China’s gas market may become increasingly tied to coal as well. The Chinese government has thus far approved at least nine large plants designed to produce more than 4.0 billion cubic feet/day of synthetic natural gas (“SNG”) from coal—1.5 times the volume of gas that China currently imports by pipeline from Turkmenistan.

- We estimate each billion cubic feet (“BCF”) of SNG produced will require ~85,000 tonnes of coal.

- In terms of import substitution, four million tonnes of coal could generate enough SNG to replace one million tonnes of LNG imports.

- Chinese coal plants are cleaner than ever. From 2005-12, sulfur dioxide emissions per kWh of electricity produced fell by 64%, dust emissions by 78%, and nitrogen oxide emissions by 33%.

- China’s leaders will accept increased emissions of odorless, colorless, non-toxic CO2 in order to supply low-cost, secure energy, a position shared by the leaders of other Asian industrial powers.

- In South Korea, coal use rose from 35% of primary energy consumption in 2000 to nearly 53% in 2012, while Taiwan boosted coal use from 57.7% of primary energy use in 2000 to 69.4% in 2012. Japan increased coal use from 28.5% of primary energy in 2000 to 35.6% in 2012—and enduring opposition to nuclear energy post-Fukushima may further this trend.

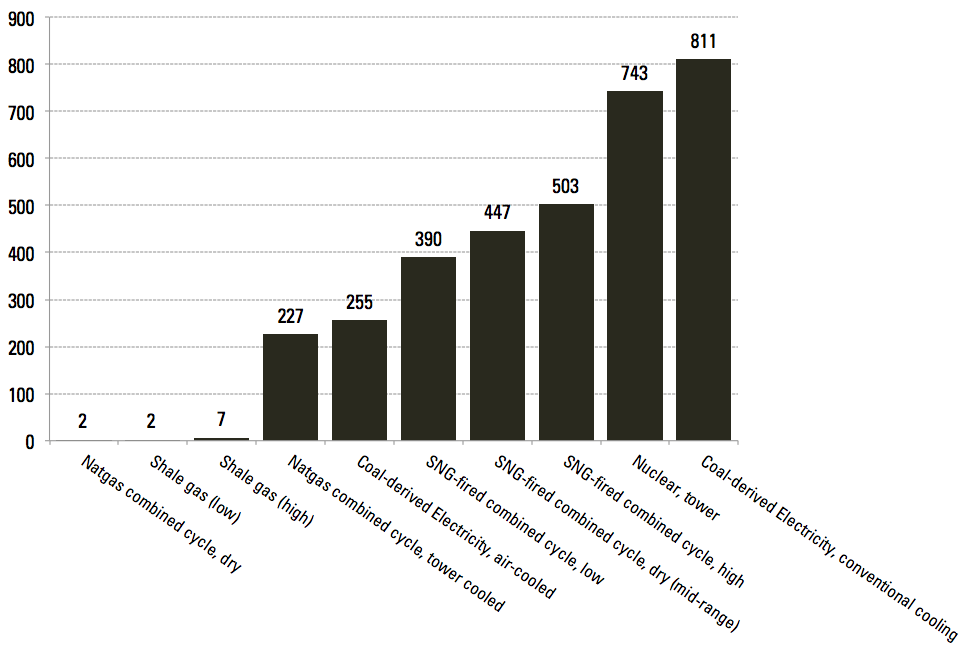

- Air-cooled power technology now accounts for as much as 1/3 of new capacity installed in China and typically uses less than 1/3 the water required by a traditional tower cooled thermal plant (255 liters per MW generated vice 811 liters/MW for traditional plants.

- This frees power plant developers to site new plants closer to large lower cost coal deposits in China’s dry West that are low in sulfur and mercury and removed from coastal cities.

- Air-cooled power plants also free up water resources for SNG production. Indeed, we estimate that coal-derived SNG burned in a dry cooled natural gas turbine plant requires between 390 and 503 liters of water per MW/h generated, a figure that is still from 48% to 63% of what a traditional coal-fired plant would require.

- Large air-cooled power plants represent a major breakthrough for further coal development in Inner Mongolia and Xinjiang, in particular. Xinjiang coal production is likely to come in at around 160 million tonnes for 2013 and has been growing at 15-20% annually for the past several years.

- We estimate Xinjiang will produce 240 million tonnes of coal per year by year-end 2015 and that production will exceed 750 million tonnes per year by 2020.

- Xinjiang boasts superb coal geology, but faces distinct logistical challenges in transporting coal to Central and Eastern China markets.

- China’s current and planned infrastructure is likely sufficient to move approximately 85 million tonnes per year of coal from Xinjiang to external markets by year-end 2015. 50 million tonnes would move as physical coal, 20 million as gas molecules, and 15 million as electrons via coal by wire.

Bottom line: Coal use will remain an economic imperative for China for at least the next decade. China will continue increasing coal use, but the state will push companies to: mine coal more cheaply, access cleaner reserves, use less water, move coal-fired power plants far enough from coastal cities to help clean most urban air, and increase coal gasification significantly.

Slowing but still significant economic growth, with its benefits still unevenly distributed, and continued need for industrial-led development in many parts of China will cause Chinese manufacturers and residential consumers alike to demand low-cost electricity. This is likely to continue driving demand for China’s abundant coal, and may even increase coal dependence in certain regions.

Natural gas will not be price-competitive with coal in China for at least 5-7 more years, and likely further into the future. LNG and pipeline imports are significantly more expensive than coal in per million BTU terms, while the price increases needed to stimulate greater domestic gas resource development make that particular gas stream substantially more expensive than coal as well.

Government infrastructure development and subsidies can ameliorate this, but only on a limited scale. Finally, SNG produced from coal will likely be significantly more expensive than directly burning coal to generate electricity.

Reason 1: China Needs Low Cost Energy to Preserve Global Industrial Competitiveness

The U.S. shale gas boom and surge of cheap energy currently revitalizing North American industrial activity stands to catalyze greater coal use in China as it struggles to maintain industrial competitiveness in a world where rising Chinese wages have made energy input prices much more critical to competitiveness than they were in the early 2000s.

Indeed, comparing price data from China’s key Qinhuangdao coal port to U.S. industrial gas prices illustrates vividly how in the span of just three years, China’s prior energy cost advantages vis-à-vis North American manufacturers have evaporated (Exhibit 1).

Exhibit 1: Qinhuangdao Thermal Coal Prices vs. US Industrial Natural Gas Prices

USD/mmbtu

Sources: EIA, Bloomberg, China SignPost™

Sources: EIA, Bloomberg, China SignPost™

For instance, it has now become cheaper to manufacture yarn in the U.S. than in China. Brian Hamilton, who wrote his doctoral dissertation on the subject in 2012, found that it cost $2.86/kg to spin yarn in the U.S. in 2003, and $2.76 to produce a kilogram of yarn in China. Yet by 2010, yarn could be produced for $3.45/kg in the U.S., while the cost of doing so in China had climbed to $4.13/kg—nearly 20% higher than the American equivalent.

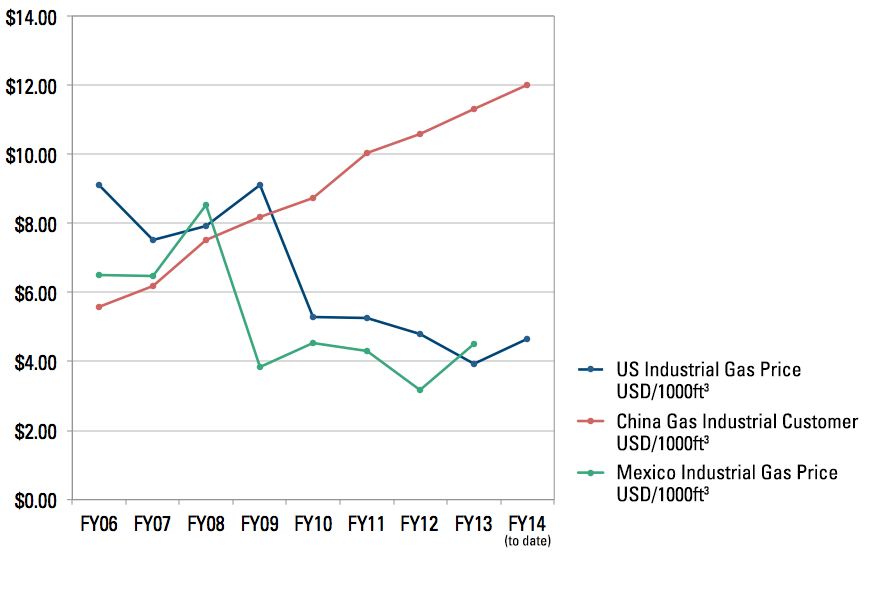

Let’s take a deeper look at this momentous energy shift and what it means for coal’s future as a power source and industrial fuel in China. As a proxy for industrial gas prices in China, we use the average annual sales price at which China Gas, one of the country’s largest gas distributors, supplies its industrial and commercial customers—nearly 57,000 strong and spread across the 137 cities in which China Gas operates.

Between FY 2006 and FY 2013 (ending 31 March 2013), the China Gas sales price to industrial gas customers rose from USD 5.58/1,000 cubic feet to USD 11.30/1,000 cubic feet. As of December 2013, the China Gas-delivered price to industrial consumers had climbed to nearly USD 12.00/1,000 cubic feet (Exhibit 2).

In contrast, between FY 2006 and FY 2013, U.S. industrial gas prices as reported by EIA declined from USD 9.10 to USD 3.93 (Exhibit 2). Mexican industrial gas prices follow a trajectory similar to U.S. prices and will remain tightly linked as additional cross-border pipeline capacity opens later in 2014.

Exhibit 2: Industrial Natural Gas Prices in China, U.S., and Mexico vs. Qinhuangdao Coal

USD per 1000 cubic feet, USD/mmbtu

Sources: China Gas, SENER, Bloomberg, EIA, China SignPost™

Sources: China Gas, SENER, Bloomberg, EIA, China SignPost™

China is already rapidly losing its prior labor cost advantage over Mexico. Mexican manufacturing wages are now roughly equivalent to those in many parts of China. By 2015, manufacturing wages in Mexico could be as much as 30% lower than those in China on a productivity-adjusted basis.

Moreover, in many industries energy is a much greater input cost than labor, meaning that unless Chinese industrial consumers use low-cost coal, they will not be competitive in the export market with their global peers in North America and elsewhere. Such energy input cost pressures will also likely constrain the Chinese government’s ability to use electricity price increases as a way of curtailing consumption growth and improving air quality.

As such, coal will remain an important industrial fuel in China due to its cost advantage over gas. Rebalancing away from exports and toward a more consumption-oriented economy has been a major policy priority in China for at least 18 months.

Nonetheless, even successful reforms will require years and low-cost energy remains critically important for three key reasons.

- Manufacturing remains a core part of China’s economy. As China’s demographic problems help drive wage inflation, factory owners will be increasingly desperate for low cost power supplies to offset labor cost disadvantages.

- Second, restraining power prices helps contain inflationary pressures.

- Third, if Chinese manufacturers cannot access low-cost electrical and thermal energy supplies to stay competitive with peers in Vietnam, Mexico, and other hubs, an increasing slice of China’s growing domestic consumption could end up being fed with imported goods.

Nuclear, wind, and hydro power cannot meet China’s call for affordable power in coming years unless significant new coal-fired capacity continues to come online each year.

Wind is inefficient and intermittent, requiring huge land areas and substantial thermal power backup ready to come online if the wind dies down. Nuclear power is a superb baseload electricity source, but China is not adding sufficient capacity for nuclear to significantly displace coal-fired generation. Even with the current aggressive reactor buildout, China is slated to add a maximum of 32 GW of nuclear power in the next five years—roughly half of the coal-fired capacity it has added annually in recent years. To boot, this high-end number assumes that all reactors currently under construction are (1) actually built and (2) completed on time. Finally, hydropower is vulnerable to droughts and environmental opposition that is much fiercer and more locally-concentrated than that faced by coal plants.

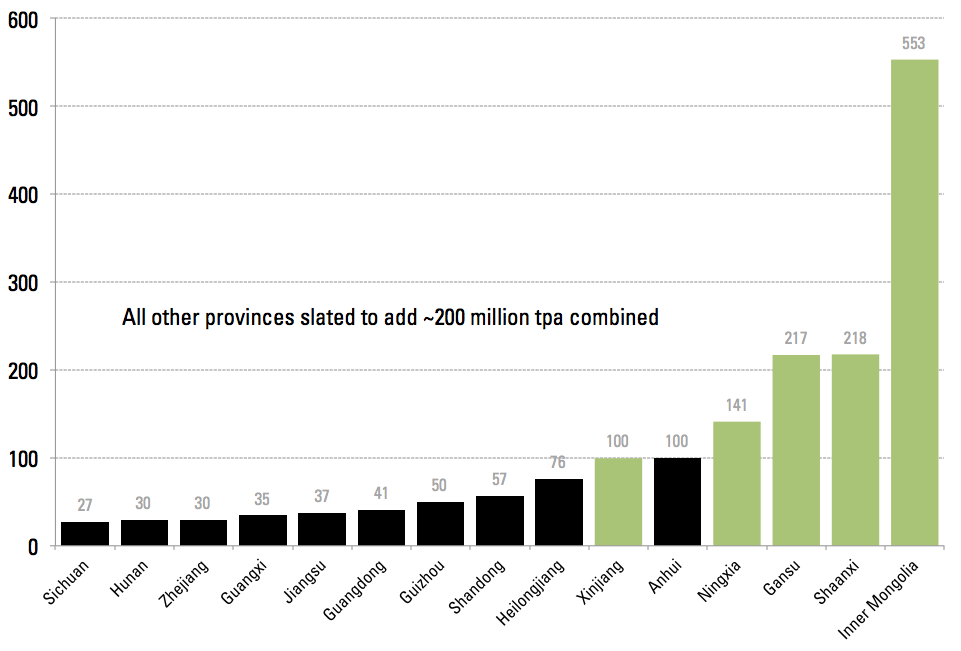

Based on these, and other factors, China’s leadership is voting for coal. On the supply side, the NDRC has approved a number of large new mines as China works to bring an additional 860 million tonnes per year of production capacity online during 2010-15.

Such large-scale projected coal increases make sense when one considers that the 15 provinces and autonomous regions with the most proposed/permitted coal-fired power capacity on the drawing board could by themselves create more than 1.5 billion tonnes per year of new coal demand over the next decade, according to data from the World Resources Institute.

Coal is also finding its way into China’s burgeoning natural gas market. The Chinese government has thus far approved at least nine large plants designed to convert coal to synthetic natural gas (SNG). The approved and currently operating plants would have the capacity to supply more than 4.0 billion cubic feet per day of gas—1.5 times the volume of gas that China currently imports by pipeline from Turkmenistan. We estimate that each BCF of SNG produced will require on the order of 85,000 tonnes of coal.

SNG capacity is already coming online, indicating that the current leadership remains committed to prioritizing secure energy supplies over emissions concerns. Indeed, in October 2013 an SNG plant owned by China Kingho Group (also known as Qinghua Group)—which can produce 135 million cubic feet per day of gas and is the world’s largest single train SNG facility—began operating in Xinjiang.

In June 2013, CNPC finished China’s first dedicated SNG pipeline—running 64km from Yining to Horgos, where it connects with the third West-East pipeline, and is able to carry 2.9 BCF/day of gas. Significant customers in China appear to want SNG, as shown by Datang Power’s December 2013 agreement with PetroChina to pipe four million cubic meters per day (141 mmcf/d) to Beijing.

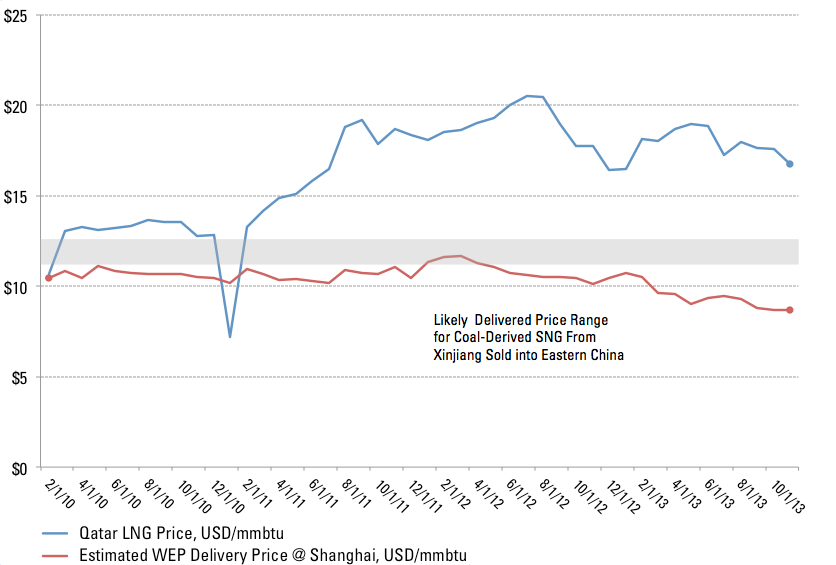

Coal-derived SNG can be used to replace additional natural gas imports that would otherwise be needed as China natural gas demand continues to rise. China’s baseline gas import sources such as Qatar (LNG) and Turkmenistan (pipeline) both price their gas based on crude oil-linked formulas. Local sources estimate the Qinghua Group plant can put gas into the pipeline network at a price of US$7.40-$8.40/mmbtu (Exhibit 3).

We believe this translates into a delivered gas cost of US$11-12/mmbtu to China’s Eastern Seaboard—a price that would be competitive with LNG and roughly 25% more expensive than pipeline imports from Turkmenistan, assuming that Brent crude oil prices remain in the $100-110/bbl range.

In terms of import substitution, four million tonnes of coal could generate enough SNG to replace one million tonnes of LNG imports. Water supplies are the key constraint on SNG development, an issue covered in detail by Section 2 (below).

Exhibit 3: Delivered Costs of LNG, Pipe Imports, and SNG to Eastern China

USD/mmbtu

Sources: Bloomberg, China SignPost™, IEA, Qinghua Group

Sources: Bloomberg, China SignPost™, IEA, Qinghua Group

Reason 2: Coal Power Plants in China Are Now Cleaner and Require Much Less Water

Chinese leaders care the most deeply about emissions that are visible (smoke) or acutely toxic (sulfur, NOX, and mercury). Such properties increasingly generate local opposition, particularly in wealthy coastal cities where residents’ priorities have changed rapidly to emphasize quality of life over rapidity of economic growth. Greenhouse gas emissions—which produce global, not local, problems, are a very different story.

With respect to carbon dioxide (CO2), an odorless, colorless, and non-toxic gas, Zhongnanhai clearly emphasizes the economic and social benefits of stable, low-cost energy generated from domestic coal. China’s leaders will pay lip service to concerns about CO2 emissions, but the reality is that growth still wins out over green energy.

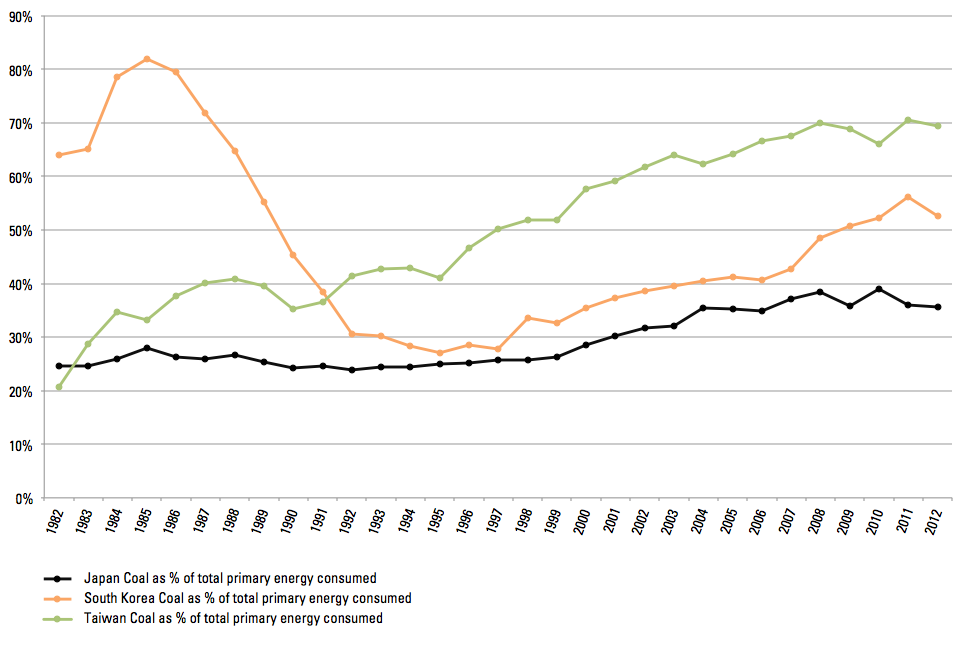

Other Asian industrial powers with significantly less imperative for all-out economic growth than China have already calculated that higher CO2 emissions are a price worth paying to maintain economic competitiveness. Since 2000, South Korea, Taiwan, and Japan have all significantly increased the share of coal in their power generation at the expense of nuclear energy (Exhibit 4). In South Korea, coal use rose from 35% of primary energy consumption in 2000 to nearly 53% in 2012, while Taiwan boosted coal use from 57.7% of primary energy use in 2000 to 69.4% in 2012. Japan increased coal use from 28.5% of primary energy in 2000 to 35.6% in 2012, a trend that could continue with opposition to nuclear power.

It is especially telling that each of these Asian Tigers increased coal use relative to that of other fuels even after they had far surpassed China’s current per capita GDP level. This strongly suggests that leaderships of industrial powers in the region will readily prioritize affordable, secure electricity supplies over more abstract concerns about possible long-term effects of CO2 emissions. This is a classic “tragedy of the commons” problem—individuals and societies tend to prioritize present parochial benefits over future collective goods.

Exhibit 4: Coal as % of Total Primary Energy Consumed in Japan, South Korea, Taiwan

Given that South Korea, Taiwan, and Japan are all representative democracies, it also suggests the populations supported greater use of coal because it was in their economic interest to do so.

Such regional evidence from societies far wealthier (and environmentally conscious) than China and ones in which the government must sell policy changes to citizens directly points to a future in which President Xi and his advisors continue supporting coal use—just in less air-polluting ways.

Power Producers Are Slashing SO2, NOX, and Dust Emissions While Still Making Cheap Electricity. Nearly ¾ of China’s existing thermal power generation capacity has been built since 2001, so the fleet is young and plant designers have enjoyed substantial opportunities to integrate pollution control technologies into the facilities they are building. The fruits are reflected across the emissions board.

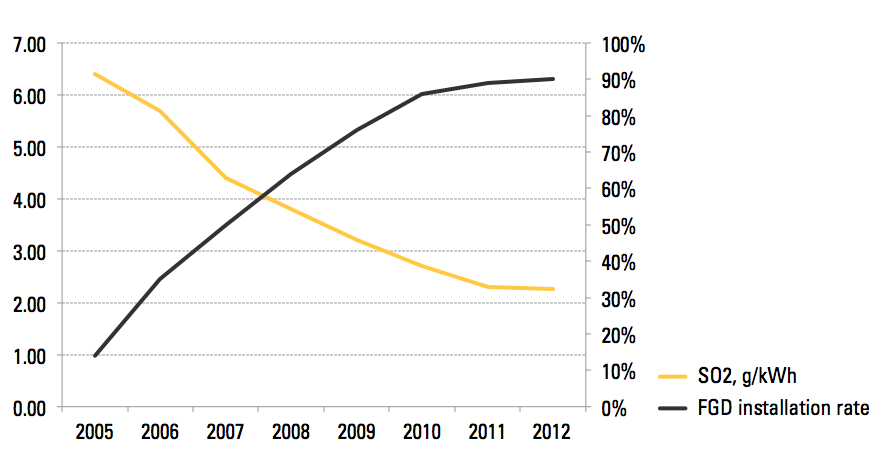

For instance, since 2005, Chinese thermal power plants have installed fluidized gas desulfurization systems (“FGDs”) and slashed their sulfur dioxide (SO2) emissions by 64% (from 6.4 g/kWh in 2005 to 2.26 g/kWh in 2012), according to the China Electricity Council (Exhibit 5). For reference, U.S. coal-fired plants emitted an average of 2.8 g/kWh of SO2 in 2011. Empirical research by Chinese academics including Yuan Xu in Environmental Science & Technology suggests that the plunge in sulfur emissions is a product of both higher FGD installation rates and higher utilization of installed FGDs as power plant operators face more serious emissions penalties.

During the same timeframe (2005-12), power plant dust emissions declined by 78% (from 1.8 g/kWh to only 0.39 g/kWh), while emissions of nitrogen oxides—a key component in smog formation—fell by 33% between 2005 and 2012 (from 3.6 g/kWh to 2.4 g/kWh).

At present, only 28% of Chinese coal power plants have de-nitration equipment to combat NOX emissions. but the NOX emission rate is likely to fall sharply in coming years, as nearly 92% of the coal-fired plants planned in China will feature de-nitration equipment.

Exhibit 5: FGD Installation Rate vs. SO2 Emissions

g/kWh (left), FGD install rate for coal plants (right)

Source: China Electricity Council

Source: China Electricity Council

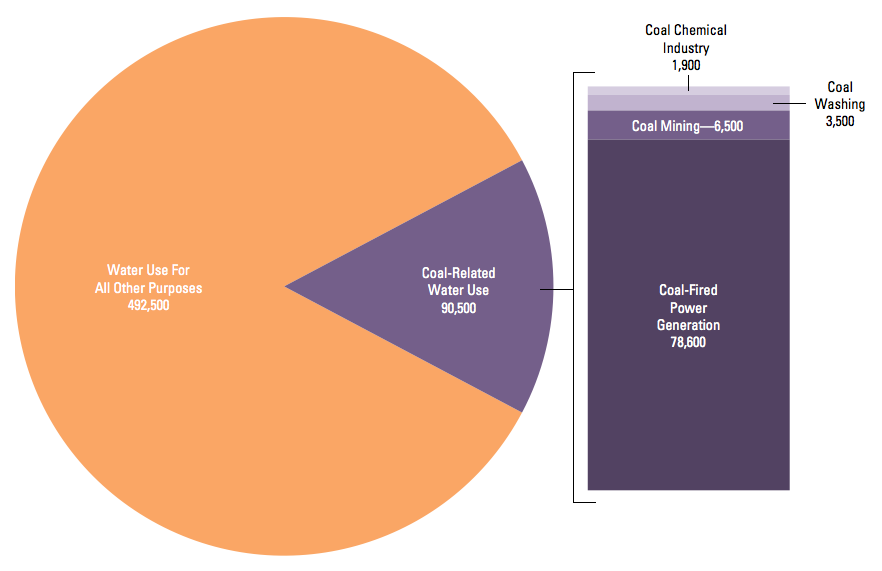

Aside from emissions, coal-fired power faces another serious challenge in China—the high water consumption of thermal power plants. As of 2008 (date of comprehensive data on coal sector water use), the coal supply chain from mine mouth to power plant accounted for roughly 1/5 of all water consumption in China (Exhibit 6).

Of the 90.5 billion cubic meters of water consumed by the coal sector, 87% were consumed by coal-fired power generation. Coal washing accounted for approximately the same amount of water as Beijing uses each year (~3.5 billion cubic meters) and coal mining slightly less than twice Beijing’s annual consumption.

Exhibit 6: Water Demand by Segment of the Coal Value Chain in China

Million cubic meters used in 2008

Sources: Energy Policy, NBS China, China SignPost™

Sources: Energy Policy, NBS China, China SignPost™

Chinese power equipment developers have responded with alacrity to the growing coal-water conflict. In recent years, as much as 1/3 of new power plant installations in China have been air-cooled designs. The rapid penetration of air-cooled plants in China has helped avert the dire coal-induced water shortage scenarios of which Greenpeace and other groups regularly warn.

Indeed, a Duke University China thermal power expert calculates that by 2009 over 100 GW of air-cooled thermal generation capacity had been installed—more than 15% of the national total thermal power generation base.

Air-cooled power technology makes a vital contribution to continuing coal demand growth in China because it uses less than 1/3 the water required by a traditional tower cooled thermal plant (255 liters per MW generated vice 811 liters/MW for traditional plants (Exhibit 7).

It also frees power plant developers to site new plants closer to large, cheaper coal deposits in western China that are low in sulfur and mercury and have the added bonus of being far from major coastal cities.

Air-cooled power plants also support SNG production because they free up water resources that would otherwise be consumed by traditional plants. Indeed, we estimate that even with the water-intensive process needed to produce SNG from coal, if the resulting gas is burned in a dry-cooled natural gas turbine plant, power can be produced for 390-to-503 liters of water per MW generated, a figure that is still less than half of what a traditional coal-fired plant would require.

It appears much of the environmental and investment community has yet to appreciate that the Chinese government’s decision to approve building more coal-fired power plants and coal-based SNG plants is in fact backed by a sound understanding of engineering realities. Beijing’s strategic moves to leverage its massive domestic coal resources are thus likely far more efficient and sustainable than commonly thought.

Exhibit 7: Water Saving Potential of Air-Cooled and SNG Power Plants

Liters of water consumed per MWh of electricity generated

Sources: Harvard Belfer Center, Eskom, NREL, Chi-Jen Yang et.al.

Sources: Harvard Belfer Center, Eskom, NREL, Chi-Jen Yang et.al.

The game changing effect of air-cooled plant technology is reflected in the fact that five of the six provinces and autonomous regions with the most planned coal-fired capacity are in West and Northwest China: very long on coal, very short on water (Exhibit 8).

Exhibit 8: Planned, Permitted, and Proposed Coal Plants in China, by 15 Most Active Provinces & Autonomous Regions

Million tonnes per year in coal demand if plants built and operated at capacity (yellow denotes Western/Northwestern China location)

Reason 3: Xinjiang’s Coal Reserves Are Larger, Safer to Mine, Higher Quality, and Cheaper to Mine Than Those in Central China

Large air-cooled power plants represent a major breakthrough for further coal development in Inner Mongolia and Xinjiang, in particular. A key question is whether Xinjiang could potentially become a producer on the scale of Inner Mongolia, which produced 994 million tonnes of raw coal in 2013, according to SXCoal. Xinjiang coal production is likely to come in at around 160 million tonnes for 2013 and has been growing at 15-20% annually for the past several years. We estimate that Xinjiang will produce 240 million tonnes of coal per year by year-end 2015 and that production will exceed 750 million tonnes per year by 2020.

Xinjiang’s thermal coal reserves are huge (perhaps as much as 2.2 trillion tonnes) and a substantial portion of this total is accessible via low-cost surface mining. This is also much safer than underground mining, a key concern in a country where more than 1,000 coal miners die each year in accidents.

Xinjiang coal is also high-quality. The average sulfur content of the massive Junggar, Yili, and Ku-Bai deposits is 0.2%, 0.4%, and 0.5% or less, respectively. Similarly, coal from the region is also extremely low in mercury, one of the most serious air pollutants coal-fired plants emit. Coal from Xinjiang contains an average of 0.03 mg of mercury per kg of coal—only about 1/5 the amount contained in the average coal grades from Inner Mongolia and Shanxi, China’s current leading producers.

Billion Dollar Question—How to get coal from Xinjiang to Market?

Xinjiang has superb coal geology, but faces distinct logistical challenges to getting coal into markets in Central and Eastern China. At present, a single rail line links Urumqi and the areas near Northern Xinjiang’s coal basins with Lanzhou, after which a number of rail route become accessible. This “Lanxin” (兰新) line can currently move ~30 million tonnes per year of coal out of Xinjiang, with potential to expand to 50 mtpa in 2015 and 100 mtpa thereafter.

Workers completed the electrification of the Lanxin route in December 2012, which will allow the line to carry heavier freight trains. Chinese railway enthusiasts blogged in October 2013 that diesel trains could pull only 2,000 tonnes, while the electric trains now able to use the line can pull 4,000 tonnes per train and could eventually grow to 10,000 tonnes per train.

Xinjiang’s coal output appears poised to continue rising strongly and the infrastructure to transferring coal from mines to rail is materializing. Xinjiang Guanghui and other private parties have invested in the 625 km Hongliuhe-Zhuomaohu electrified rail line, which is slated to enter service in 2014 and will have an initial capacity of 60 mtpa, eventually growing to 150 mtpa. This line alone will exceed to present capacity of the Lanxin line, leaving Lanxin the primary rail bottleneck for getting coal from Xinjiang to markets further east.

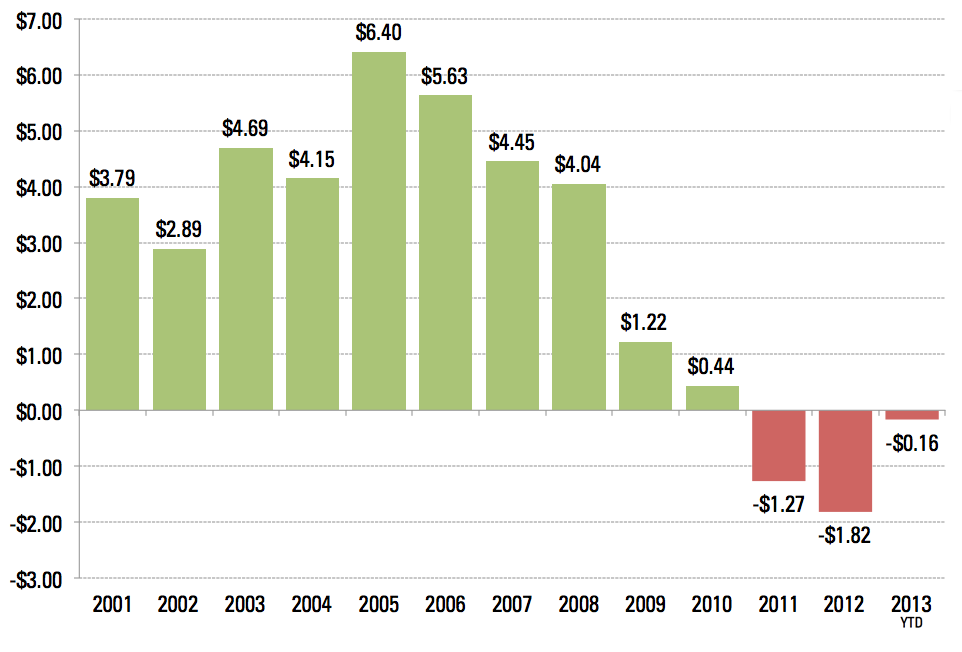

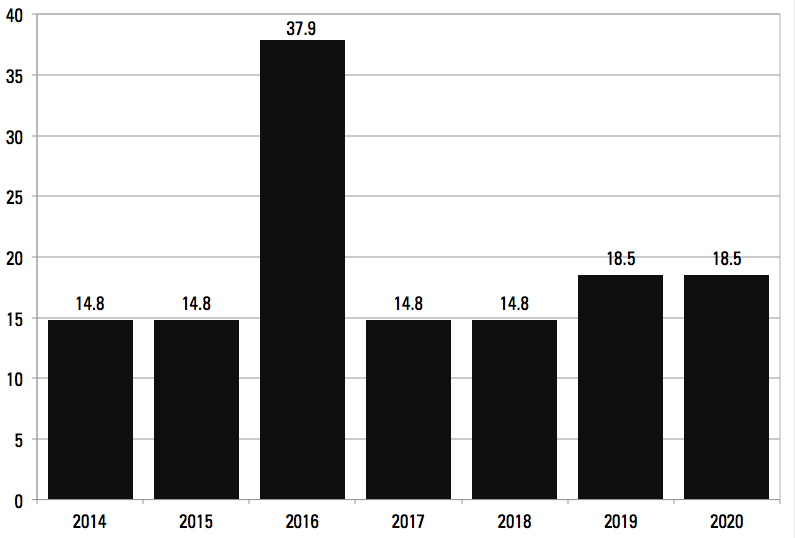

We believe that if Xinjiang coal output continues to grow strongly, coal producers, as well as local and national governments will invest in expanding rail capacity beyond the currently expected parameters. A case study for how coal infrastructure can scale in response to demand in China comes from the Daqin Railway (operated by Daqin Railway, SSE: 601006), which moves coal from Shanxi to Qinhuangdao Port. In 2002, Daqin moved 103 million tonnes of coal. By 2008, it moved 340 million tonnes of coal (Exhibit 9).

Exhibit 9: Daqin Rail Line Coal Hauled vs. Average Train Size

Sources: CITICS, company reports

Sources: CITICS, company reports

The primary mode through which Daqin achieved such massive throughput gains was by expanding train sizes. In 2003, the average trains carried 3,800 tonnes of coal, but within five years, the average train hauled nearly 10,000 tonnes of coal. In 2012, Daqin Railway reported that roughly 2/3 of the trains running per day on its mainline carried a whopping 20,000 tonnes of coal apiece—some of the heaviest freight trains currently operating in the world.

Lanxin likely will not operate such heavy trains, but it is not unreasonable to expect 10,000 tonne trains within the next five years. Given that a 10,000 tonne train requires at least 100 coal cars, this could be a key source of rolling stock demand for China CNR and other domestic railway equipment providers.

Coal-by-Wire

Many commentators—in and outside of China—have suggested that mine mouth power plants feeding power into ultrahigh voltage (“UHV”) transmission lines can free up rail and road logjams by moving coal to market in the form of electrons. Proponents of such a system also extol its ability to move new coal-fired generation capacity further from major East Coast cities.

While China is a leading global investor in UHV technology and has already put a number of lines into service to bring hydropower from Southwest China into Shanghai and other cities, scale remains a challenge. We estimate that at use rates of 5,000 hours per year, the thermal power-oriented UHV projects currently under construction or planned could move the equivalent of just under 135 million tonnes of coal per year into Central and eastern China by 2020 (Exhibit 10).

Exhibit 10: Thermal Power-Oriented UHV Transmission Capacity Scheduled to Come Online in China

Million tonnes’ of coal per year worth of power

Sources: Chinese local media, SGCC, Siemens

Sources: Chinese local media, SGCC, Siemens

Roughly 82 million tonnes of this capacity would be fed by plants in Xinjiang, but of that, 67 million tonnes will not come online any earlier than 2016. Therefore, if UHV is going to be a real game changer in terms of taking coal off of China’s rail network, there will need to be at least double or triple the current number of projects. We believe this is unlikely to happen within the next five years.

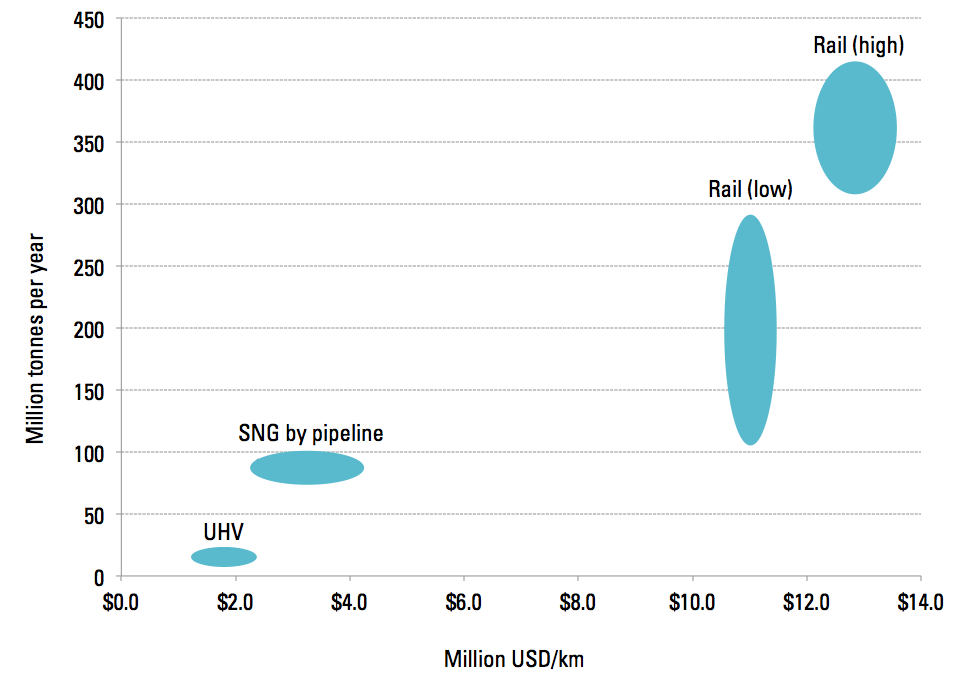

Ultimately, a mix of construction cost and water availability (for SNG) will drive the infrastructure choices on how to bring Xinjiang coal to market. We estimate the following costs for rail, pipeline, and UHV (coal-by-wire) infrastructure:

- Freight rail lines—US$11.0 million to $13.0 million per km (based on estimated costs of coal-focused Zhangtang and Shanxi Central-Southern railways).

- SNG pipelines—US$2.4 to $4.0 million per km (based on construction costs of WEP 3 gas and Yining-Horgos SNG pipelines).

- UHV—US$1.4 and $2.2 million per km (based on China’s current and planned UHV projects for which cost data has been disclosed).

Exhibit 11: Estimated Cost per km vs. Annual Capacity of China Coal Transport Infrastructure Options

Sources: Chinese Internet, Siemens, Mengxi-Huazhong Railway Co., China SignPost™

Sources: Chinese Internet, Siemens, Mengxi-Huazhong Railway Co., China SignPost™

On the basis of this infrastructure cost picture, we believe there is a better than 50/50 chance that China increases the scale of its UHV powerline investments to bring coal-by-wire from Xinjiang. Aggressive rail de-bottlenecking in Shanxi and Inner Mongolia that will exert itself in 2015 and beyond makes it less likely that those areas will prioritize UHV investments.

Bottom Line: The current and planned infrastructure is likely sufficient to move approximately 85 million tonnes per year of coal from Xinjiang to external markets by year-end 2015. 50 million tonnes would move as physical coal, 20 million as gas molecules, and 15 million as electrons via coal by wire.

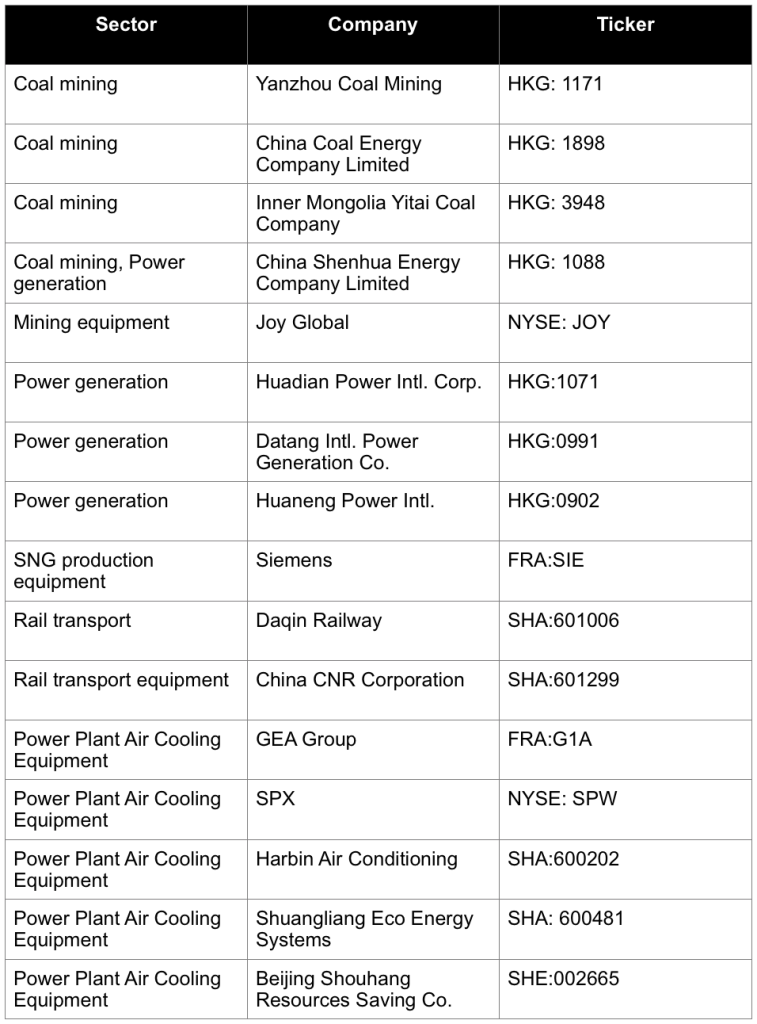

Commodity and Company Impacts

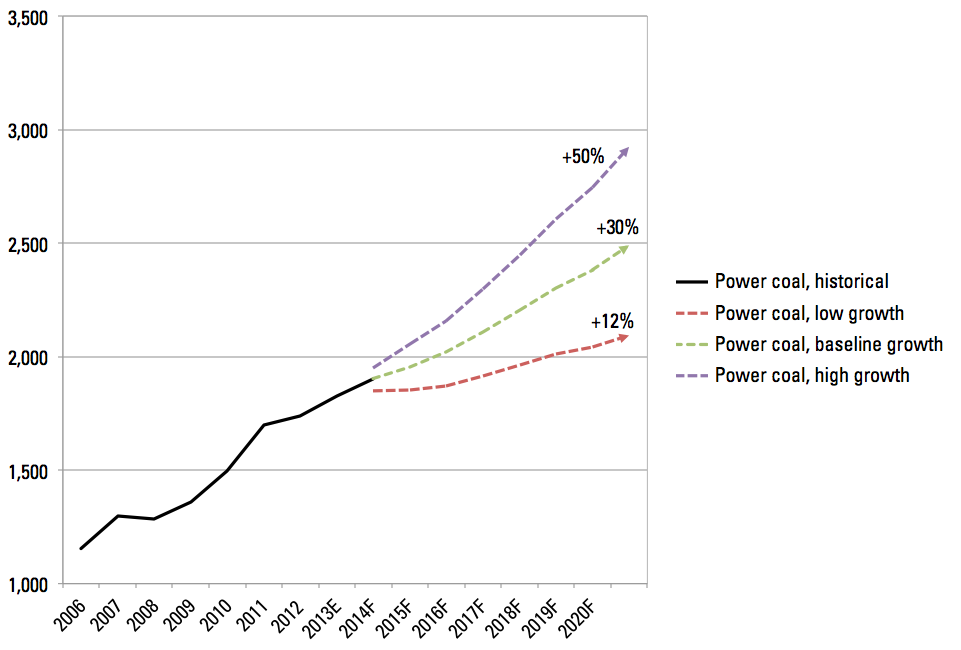

China presently has more than 100 GW of coal-fired capacity planned to come online by year-end 2017. These plants could consume as much as 350 million tonnes per year of coal once they are online.

More importantly, we believe that China is already much of the way through its campaign to phase out smaller inefficient coal power plants, having retired more than 75 GW GW of old, small plant capacity since 2006. Therefore, the new plants projected to join the fleet stand to drive net demand growth, not just replace older units.

Equally important, because these are modern units that would be expensive to shut down and replace, they are likely to remain in service for decades, underpinning growth in coal demand that we estimate will add 71 million tonnes per year of thermal coal demand for power generation in each of the next four calendar years (Exhibit 12). Total power plant coal demand in China will rise 30% by 2020 from year-end 2013 levels in our base-case scenario of average annual power demand growth of 4.5%.

Exhibit 12: Outlook for Coal Consumption by Power Plants in China

Million tonnes

Sources: CEC, NBS China, China SignPost™

Sources: CEC, NBS China, China SignPost™

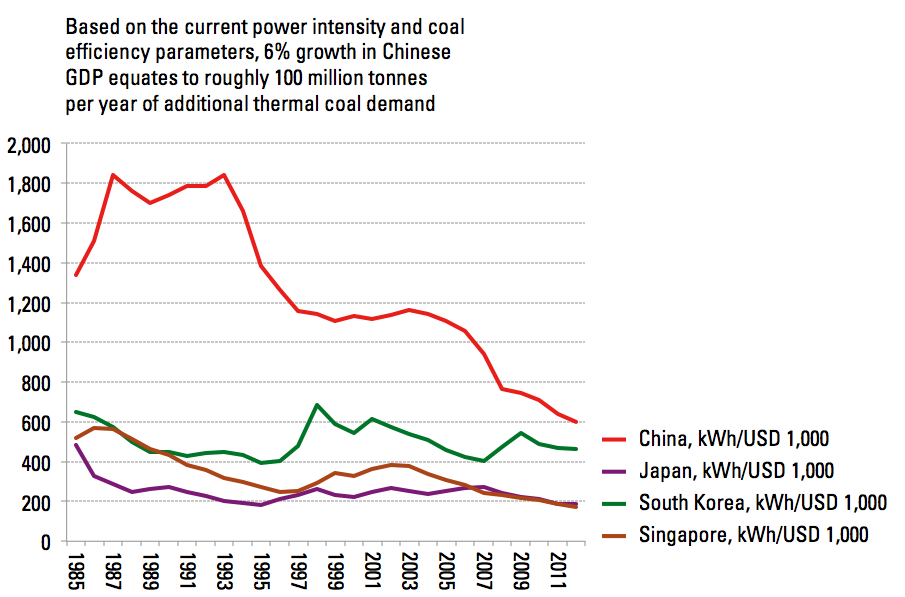

To us, the data also strongly suggest that China’s coal demand faces much less downside risk that widely thought from measures to reduce energy intensity. Indeed, China’s electricity use per unit of GDP in 2012 was roughly half what it was in the late 1990s (Exhibit 13).

South Korea offers an appropriate comparison, as it has created a more diversified economy than it had during its peak Tiger years, but still relies on industrial activity to provide a significant portion of national economic output.

Based on the South Korean example, China’s electricity needs could decline by 15-20% (to around 450 kWh per USD 1,000 of GDP), but even slower growth still translates into massive absolute increases in electricity demand. For instance, at China’s present electricity intensity, 6% growth in GDP creates approximately 100 million tonnes per year of new coal demand.

Exhibit 13: China Electricity Consumption Intensity in Comparative Perspective

kWh per 1000 USD of GDP (current dollars)

Sources: World Bank, China SignPost™

Sources: World Bank, China SignPost™

New Coal Flows Will Favor Domestic Supplies

The shift of new coal-fired power plants to provinces and autonomous regions further inland combined with improvements to rail infrastructure leading out of the Inner Mongolia/Shanxi coal heartland is likely to help slow China’s hitherto rising dependency on imported coal. For instance, the Mengxi-Huazhong Railway will help bring an additional 100 million tonnes of coal per year out of Inner Mongolia and Shanxi by 2015 and as much as 200 million tonnes per year by 2017-18, at the expense of imported coal supplies, which had benefitted as rail bottlenecks made domestic supplies uncompetitive in coastal areas.

A greater move towards domestic coal supplies is also likely to prompt additional investments in expanding the rail carrying capacity between Xinjiang and Central China. We believe this route could be transporting at least 100 million tonnes per year of physical coal by 2020, up from ~30 mtpa at present. Continuing growth of coal-based SNG production in Xinjiang could also motivate the construction of an additional West-East Pipeline dedicated primarily to SNG—something we believe could come online in the 2020-23 timeframe. This could bring an additional 90-100 million tonnes of Xinjiang coal east in the form of gas molecules.

A big rise in coal-based SNG could reduce China’s need for Russian gas significantly. We believe Beijing will seek to take additional Central Asian gas, as these producers (Turkmenistan, Uzbekistan and Kazakhstan now, possibly Tajikistan in the longer-term) are better suppliers than Russia because they are effectively captive to the Chinese market and are less inclined than Moscow to use gas as a weapon for strategic leverage.

Appendix 1: Selected Companies Exposed to China’s Coal-Fired Power Growth

Additional Research:

Gabe Collins and Andrew Erickson, “Central and Southwest China: The Key Battleground for Shale Gas and New Low-Cost Coal Supplies from Xinjiang, Mongolia, and Wyoming,” China SignPost™ (洞察中国) 67 (28 September 2012).

Gabe Collins and Andrew Erickson, “Kings of Coal to Barons of Bling? Xinjiang’s Coal Boom Will Drive Sales of Bentleys, BMWs, and Other ‘Bling’,” China SignPost™ (洞察中国) 66 (21 September 2012).

Gabe Collins and Andrew Erickson, “Xinjiang Poised to Become China’s Largest Coal Producer: Will Move Global Coal, Natural Gas, and Crude Oil Markets,” China SignPost™ (洞察中国) 65 (20 September 2012).