Shale gas development plans in China have generated excitement throughout the energy community, and the Chinese Ministry of Natural Resources has just completed its second shale gas exploration block licensing round. The 20 blocks are located in Guizhou, Chongqing, Hunan, Hubei, Jiangxi, Anhui, Zhejiang, and Henan Provinces. Yet no blocks in the shale-rich Ordos Basin of Shaanxi, Inner Mongolia, or Tarim Basin of Xinjiang are up for bidding in this latest round.

The choice of location of the new shale exploration blocks may just be coincidence, but it highlights a geographic reality—shale gas reserves near major low-cost coal production areas such as Xinjiang face tough development challenges because the shale gas is likely to cost substantially more per unit of heat than the coal it must compete with in the electrical power generation market.

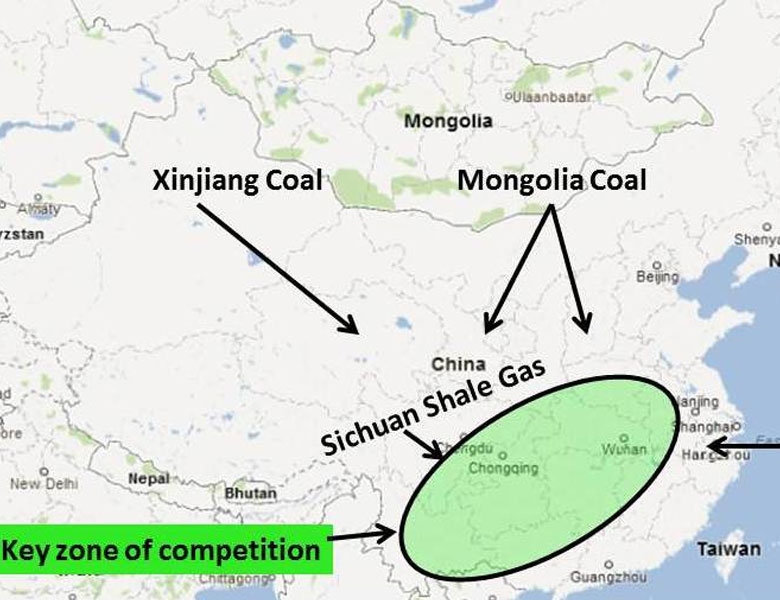

Sichuan in China’s Southwest and Central Chinese provinces such as Hunan and Hubei are far from the low-cost coal supplies, populous, and are poised to continue growing more quickly than the coastal provinces. As such, the Central-Southwest provinces of Sichuan, Chongqing, Hunan, Hubei, and parts of Henan, Anhui, Jiangxi, and Guangdong will be the key battlegrounds where new supplies of low cost physical coal and coal delivered in the form of electricity battle for market share with shale gas (Exhibit 1).

Exhibit 1: China’s coal vs. natural gas battleground region

Source: China Signpost™

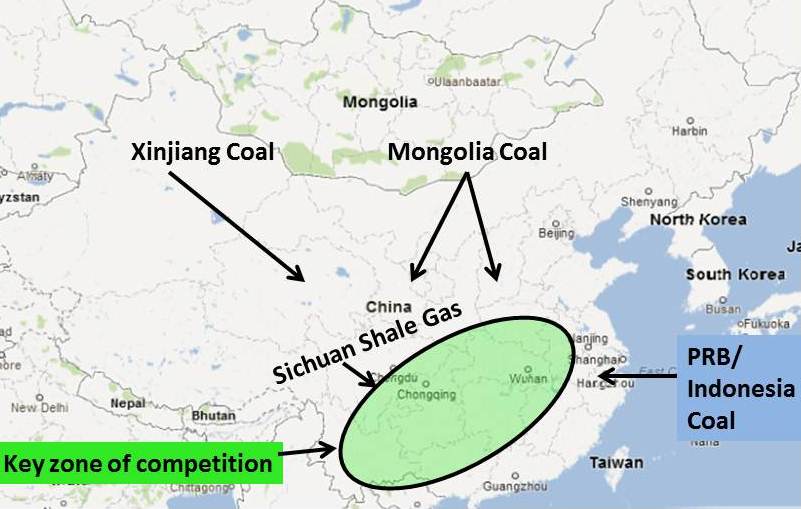

China has massive shale gas reserves that, once proven, will likely be larger than those of the U.S.; but the geology tends to be more complex, as deposits in China lie much deeper and contain higher levels of toxic hydrogen sulfide and other compounds than U.S. shale plays do. The end result will be that Chinese shale gas production will almost certainly cost more than that in the U.S.

Exhibit 2: China’s main shale gas basins

Source: Energy Information Agency

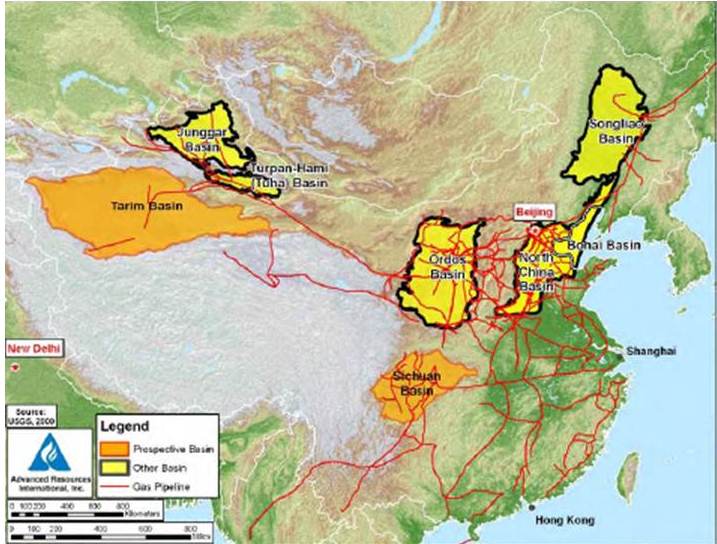

In the residential fuel market, which now accounts for more than 21% of China’s natural gas consumption by volume, gas has a lead on coal that is only likely to grow (Exhibit 3). However, per capita residential gas demand in China is now only about 100 cubic meters per year, according to China Gas Holdings. And even the larger scale industrial and commercial gas users still cannot compete with the power sector in terms of serving as natural gas demand anchors. We estimate that a single 500 MW natural gas-fired power plant produces annual gas demand between 382 and 717 million cubic feet per year—meaning that the gas needs of this single plant are equivalent to as many as 7 million homes per year. On the industrial side, such a power plant would use more gas each year than 250 of the industrial customers served by China Gas Holdings, one of the country’s largest city gas providers.

Exhibit 3: Natural gas demand by end use in China

% of total gas consumed, volume

Source: National Bureau of Statistics

Between 2005 and 2010, China’s consumption of natural gas for power and heat generation rose by 635%. During that time, residential consumption rose by 186% and transport sector consumption climbed by 181%. Industrial consumption increased by 63.5%.

In the power sector and the industrial sector—the traditional natural gas mainstay market—gas will be colliding head on with new low-cost thermal coal supplies from Xinjiang, Wyoming, and Mongolia. We estimate that in total, these new supplies could be equivalent to 250-300 million tonnes per year of coal by 2015 and a billion tonnes per year by 2020. In prior years, natural gas became more competitive each year for power generation as coal production costs in China’s historical Shanxi coal belt rose, but the new thermal coal supplies from the West and North are set to reverse this trend and make it much harder for gas-fired power to compete with that from coal.

Shale Gas costs more than coal and LNG

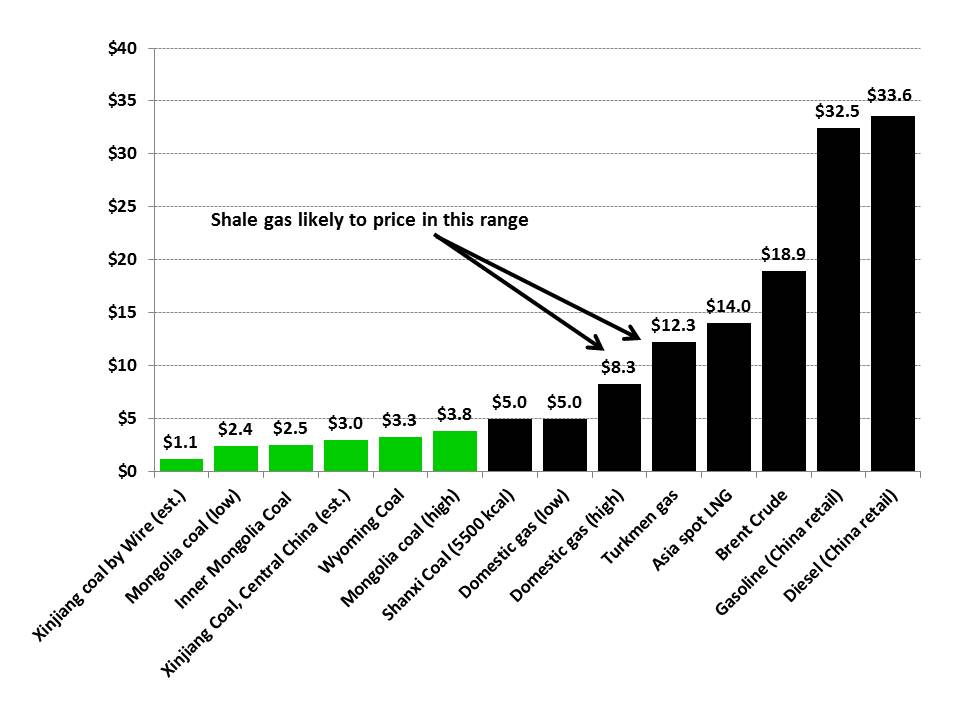

Coal prices in China are typically less than US$5 per million BTU (“MMBTU”). For the new low-cost coal supply streams, the delivered cost ranges from US$1.10 to US$3.80 per MMBTU (Exhibit 4). In comparison, once Chinese companies begin producing shale gas in commercial volumes, the delivered cost is likely to fall somewhere closer to US$10 per MMBTU, which would lead to electricity generation costs that could be twice as high per kilowatt hour as those of plants using the low-cost thermal coal from Western China, Wyoming, or Mongolia.

At delivered prices of US$9-10 per MMBTU, shale gas would be competing on price with LNG imports in coastal areas, as we anticipate that China’s future long-term LNG supply contracts will likely price for more than US$5 and perhaps up to US$7-9, depending on how CNOOC’s negotiations with Indonesia proceed and how strong Japan’s LNG demand remains in the wake of its move away from nuclear power post-Fukushima. The potential for price competition with LNG poses a dilemma for potential shale investors because shale gas will be reliant on fixed pipelines, unlike LNG, which is freer from infrastructure constraints and can be moved into the spot market and sold in substantial quantities in many cases.

Exhibit 4: China fuel costs, September 2012

USD per million BTU, delivered cost

Sources: Company reports, Reuters, NDRC, China Signpost™

Implications

The bottom line is that shale gas developers in North and West China may be forced to consider residential and industrial uses as the primary markets for projects, even though these sectors provide much less demand than power generation. There is also a strong possibility that the unfavorable coal/gas price ratio will induce PetroChina and other shale developers to focus on liquids-rich projects that produce oil and condensate, as opposed to dry gas that must compete directly with coal in many cases.

Another option is to market shale gas production as a motor fuel in the form of compressed natural gas (“CNG”) and LNG serving the growing vehicle fleet in the regions of China near the coalfields and beyond. At current sales volumes, we estimate that between 100 and 187 CNG stations can consume as much gas per year as a 500 MW gas fired power plant. China already has at least 1,650 CNG stations and Gansu province alone intends to add 205 more stations by 2015.

Based on the latest data for the number of stations and natural gas vehicles in China, each station serves approximately 300 vehicles. As China only has about 1 million natural gas vehicles at present, there is substantial upside for CNG and LNG as motor fuels, particularly since shale gas is likely to cost less per BTU than crude oil and gasoline. Gasoline and diesel fuel in China currently retail for US$32.5 and US$33.6 per MMBTU, respectively—roughly three times what we estimate shale gas’s delivered cost will be per heat unit.