Gabriel Collins, “China Peak Diesel Poses a Serious Challenge to Saudi Arabia, May Help Force OPEC Production Cut,” China SignPost™ (洞察中国) 94 (5 April 2016).

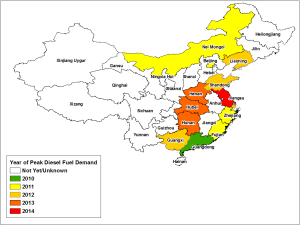

China’s own official data suggest near term diesel fuel demand may have peaked in at least 13 provinces, which collectively account for nearly 60% of the country’s diesel fuel use (Exhibit 1). This development matters greatly because diesel accounted for nearly 1/3 of Chinese oil product consumption in 2015. Furthermore, China’s share of global diesel fuel consumption has increased from 9.6% in 2005 to 13.1% in 2015, and China accounted for nearly 36% of the global net increase in diesel fuel consumption, according to JODI data. Sinopec, China’s largest refiner, takes in approximately 3.27 barrels of crude oil for each barrel of diesel fuel produced. Because the vast majority of diesel fuel used in China is refined in the country, this ratio suggests that conservatively, each 100kbd of diesel consumed requires that refineries process at least 300 kbd of crude.

China’s national diesel consumption declined in both 2014 and 2015. Consecutive years of contraction, coupled with weakness in other physical indicators of industrial activity, increasingly suggests that China’s diesel demand architecture is structurally evolving. It remains somewhat premature to conclude that China’s diesel demand has “permanently” peaked. But the evidence increasingly suggests that for 1-to-4 year oil price path analysis purposes, the Middle Kingdom’s diesel demand is not coming back. Indeed, the IEA itself forecasts a continued decline in Chinese diesel consumption in 2016.

China’s tectonic diesel consumption shift has given pause to the global oil market. And it will continue to do so as producers, traders, and capital providers adjust to a new normal in which sustained massive oil demand growth from China can no longer be taken for granted. China’s diesel demand weakness also points to a potentially massive flaw in certain OPEC producers’ view that demand growth will quickly mop up the current crude supply overhang and resuscitate oil prices even if OPEC maintains current production rates.

Exhibit 1: Chinese Provinces Where Diesel Fuel Demand Has Already Reached a Short-term Peak

Source: NBS China, Provincial Statistical Bureaus, Author’s Analysis

The provinces where diesel demand appears to have peaked fall into three primary groups. First are the export-focused provinces/cities of Beijing, Fujian, Guangdong, Shanghai, and Zhejiang. These areas face stagnant demand abroad for many Chinese-made products and the rising wage and other costs that are undermining China’s historical export competitiveness.

Second are the rustbelt and coal belt provinces of Inner Mongolia, Liaoning, and Shandong, where overcapacity and slowing heavy industrial activity are crimping diesel fuel demand. Given that China has likely hit Peak Coal, it is difficult to imagine diesel demand recovering in these provinces in the next five years. Third are the Hinterland Provinces: Henan, Hubei, and Hunan. The massive economic stimulus efforts of 2008-2010 focused heavily on these areas. China’s stimulus created unsustainably high levels of fixed asset investment and construction activity in these three provinces and after several years of elevated activity, diesel demand began to decline.

China diesel bulls could disagree and say that the apparent provincial demand peaks are simply “local maxima” as opposed to being definitive structural inflection points. To pre-empt this potential criticism, the present analysis divides the peak diesel provinces into two main groups: (1) those which are “clearly in structural demand decline” and (2) those which remains “susceptible to stimulus.”

A stimulus package similar in magnitude to what China unleashed in 2008-2010 (4 trillion RMB) could potentially temporarily revive diesel demand in borderline provinces such as Jiangsu. Such a large infrastructure-oriented stimulus effort could very well temporarily prop up demand for diesel. But it would do so at high cost and introduce risks the Central leadership seeks to avoid. For one, a large stimulus package would increase systemic risk by further bloating the country’s balance sheet. It would also pressure existing real estate and infrastructure assets that are already seriously debt-laden and underutilized, while creating additional Ghost Cities and other “zombie” assets. Finally, it would seriously undermine Beijing’s policy goals of eliminating overcapacity, reducing pollution, and shifting China’s economy toward a more sustainable consumption-oriented structure.

Drivers of China’s Diesel Demand Slowdown

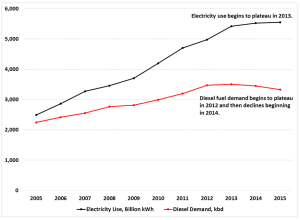

The demand slowdown in China’s prime diesel consuming regions reflects a broader slowdown in industrial activity. A number of industrial activity metrics corroborate the diesel demand decline reflected in official data. Foremost is electricity demand, which is driven primarily by industrial use. Power consumption began plateauing in 2013 and has seen demand growth slow meaningfully each year since (Exhibit 2).

Exhibit 2: China’s Electricity Consumption Slowdown Tracks Declining Diesel Fuel Use

Source: NBS China

Electricity demand is a high-confidence data set for several reasons. First, China’s power supply comes from a small set of generators and grid operators, allowing throughput to be easily tracked. Second, unlike oil, coal, and other energy commodities, the generation and transmission of electricity correlate closely with actual use because electrons cannot be stored economically on a scale large enough to induce potential inventory calculation problems of the type which plague analysis of other commodity markets in China. Third, electricity use is pervasive throughout the industrial sector, since virtually every manufacturing activity has multiple steps for which electricity is an input. For these reasons, the steady and significant slowdown in electricity demand across the Chinese economy suggests that the official diesel fuel demand numbers are probably sufficiently accurate to give confidence in the trends they are showing.

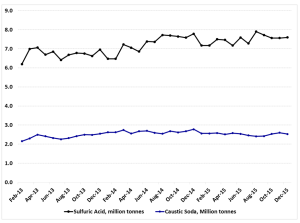

Second, other physical indicators of industrial activity in China have also flat-lined over the past 18 months. Aside from electricity, sulfuric acid and caustic soda also pervade a broad range of industrial processes, making demand for them a lead indicator for the health of an industrial economy. To that point, alkalis (foremost among them caustic soda) are key foundations for the American Chemistry Council’s Chemical Activity Barometer, an index based on comparing more than 60 years’ of data correlating demand for key industrial input chemicals with cycles in the overall US economy. Chinese data only show monthly production of sulfuric acid and caustic soda, not actual “consumption.” Nonetheless, because the country is largely self-sufficient in both chemicals and a relatively small share of total output is exported, the production data provide an acceptable proxy for local usage.

Since late summer 2014, production of each chemical has flat-lined (Exhibit 3). Sulfuric acid production is “choppy” in part because a substantial portion of China’s acid output is a byproduct of oil refining and metal smelting. The lack of growth in caustic soda output is especially noteworthy because from early 2014 onwards, the country has faced a significant overcapacity situation, which would normally prompt increased exports. The lack of such a development suggests weak demand abroad (Australia, for one is a key market for Chinese-made caustic soda), which in turn further weighs on Chinese domestic industrial activity that drives diesel fuel demand.

Exhibit 3: Production of Sulfuric Acid and Caustic Soda in China, Million Tonnes per Month

Source: NBS China

Why China’s Diesel Fuel Demand Likely Will Not Recover to Its Prior Peak in the Next Five Years–Or Perhaps, Ever

Reason one is that China has likely passed “Peak Truck.” The CEO of Cummins stated in the company’s fourth quarter 2015 earnings call that with regard to the number of trucks sold in the country, “it’s not clear that we’ll ever hit that number again.” Cummins data also show that truck engine sales in China declined sharply from more than one million units in 2013 to 750,000 units in 2015, with sales forecast to decline a further 4% year-on-year in 2016. The company’s statements merit close attention because it supplies nearly one in every five diesel engines going into heavy and medium duty trucks manufactured in China, giving it deep visibility into the market (Cummins 2015 Analyst Day Presentation). Slowing truck engine sales strongly suggest that truck replacement rates are declining as the slower pace of infrastructure activity and manufacturing reduces the miles driven each year by much of the truck fleet in China.

Reason two: increasing concerns over diesel engine emissions. Volkswagen’s diesel exhaust emissions scandal crystallized concerns that have been building for some time concerning diesel engine exhaust emissions. Most pointedly, data suggest that even if diesel engines have not been rigged to game emissions tests, they still pose significant health risks due to their propensity to emit small particulates and nitrogen oxides. Chinese policymakers are almost certainly taking note of the air quality problems afflicting many European capitals following many countries’ strategic decision in the 1990s to increase diesel engine use in passenger cars as a way of reducing carbon dioxide emissions. France, for instance, began moving in mid-2015 to begin removing diesel-friendly policies and reportedly plans to ban diesel vehicles manufactured before 2011 from Paris by 2020.

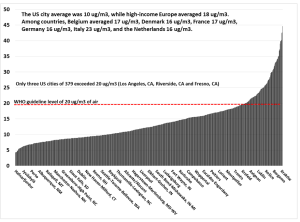

World Health Organization data on PM2.5 particulate emissions support European authorities’ concerns. The latest annual readings showed that Paris had an annual mean PM2.5 level of 17 micrograms per cubic meter of air (Exhibit 4). This figure is nearly 24% higher than the reading for car-choked Houston, which has nearly 2.5 times the rate of per capita vehicle ownership as Paris and also has substantial petrochemical and manufacturing activity within the same air pollution sampling zone. The key difference is that most passenger vehicles in Houston are gasoline-powered, while the overall French passenger car fleet is nearly 80% diesel-propelled. Less CO2, but much more PM2.5s per mile driven.

Exhibit 4: Diesel Exhaust Emissions Cause Serious Particulate Pollution

Micrograms of PM2.5 particulates per cubic meter of air, 2014

Source: WHO, Author’s Analysis

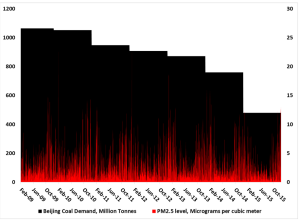

Beijing, China’s car ownership capital, exemplifies why Chinese policymakers will likely maintain a jaundiced eye toward any attempts to increase the use of diesel-powered vehicles in the country. Gasoline-powered cars currently dominate passenger car sales (and in the overall fleet). Despite the fuel economy benefits of small, modern diesel engines, policymakers are likely to shun them due to emissions concerns. Reinforcing the likely role of autos as a driver of air pollution problems, since 2009, Beijing has cut its coal consumption in half, yet PM2.5 pollution as measured by the US Embassy remains severe and has declined much more slowly than would be expected given plummeting local coal use (Exhibit 5).

Exhibit 5: Beijing’s Particulate Pollution Problems Remain Despite Falling Coal Use

PM2.5 levels on left vertical axis, coal use on right vertical axis

Source: US State Department, Author’s Analysis

There are two possible explanations for Beijing’s persistent PM2.5 pollution problems: (1) pollution from surrounding provinces continues to drift into Beijing or (2) motor vehicle tailpipes are in fact the core source of Beijing’s PM2.5 emissions problems. The likely answer is that both are responsible, but that the data affirm motor vehicles’ responsibility for a substantial portion of Beijing’s PM2.5 problems.

Officials in Hebei Province, which is China’s largest steel producer and surrounds the Beijing municipality, say they are eliminating millions of tonnes of output capacity across emissions-intensive heavy industrial sectors including steel, cement, and plate glass. Yet production data for high-emissions commodities show a more mixed picture. Local data show that Hebei’s cement production declined nearly 15% YoY in 2015, but steel products output rose 5.5% YoY. Meanwhile, National Bureau of Statistics data show that Hebei’s electricity production declined very slightly YoY in 2015, but rallied significantly in the past four months of the year.

Uncertainty aside, aggregate heavy industrial activity in Hebei is likely on the low side of the normal range that has defined the past several years. Moreover, Beijing has achieved dramatic reductions in local coal burning, which has been replaced to a large degree by clean natural gas. Such a backdrop suggests that if industry were the primary culprit, PM2.5 levels should have declined more significantly than they have. Yet the data instead appear to validate the view that motor vehicle emissions are indeed a key source of PM2.5 emissions in Beijing. Even though the bulk of the fleet there is gasoline-powered, the fact that air pollution remains a persistent problem and diesel vehicles clearly drive serious air quality issues in European cities suggests policymakers here and elsewhere in China will restrict the sale and use of diesel vehicles more severely. Indeed, the European cities assessed above have little heavy industrial activity and do not burn coal for power, yet have serious particulate emissions problems, for which diesel vehicles appear to be the primary culprit.

Global Implications of China Peak Diesel

With China’s overall S-Curved slowdown finally becoming widely accepted as conventional wisdom nearly five years after China SignPost™ #44 introduced a variant of the broader theme and more than sixteen months since China SignPost™ #81 suggested that the prospects for Xi’s economic reforms had been over-hyped by many market analysts, “Peak China” has become a semi-ubiquitous theme across much of the global commodity complex over the last 18 months. But the implications of peak diesel carry special weight given that the global crude oil trade accounts for more than $1 trillion in annual value for the physical oil trade alone based on physical supply volumes derived from 9 February 2016 IEA Oil Market Report and an average price of $35/bbl. Beyond that, the global crude trade is worth many times this value in the futures and derivatives markets and also supports a vast global infrastructure supply chain itself likely worth more than a trillion dollars.

There is also no other commodity with the deep influence on international security that oil exerts. Peak diesel in China may also signal peak revenue for OPEC. This linkage suggests a potential global chain of geopolitical consequences that provides ample cause for concern. Fewer trucks driving the highways of Guangzhou and Suzhou may ultimately mean economic hardship and political turmoil in Riyadh, more strife in Iraq, and more intrigue in the Kremlin, et cetera.

Watching diesel demand flat-line or peak in many of China’s largest oil-consuming provinces should give OPEC pause. Chinese crude oil demand will have to increasingly rely on gasoline as a prime driver, meaning that incremental demand growth will almost certainly be substantially slower than during the heady days of rapid industrialization and growing diesel demand. It should cause OPEC leaders to think more seriously about curtailing their oil production, since there is not another middle distillate market able to absorb lost Chinese demand during the next several years.

Saudi Oil Minister Ali Al-Naimi remarked at the 2016 IHS CERAWeek conference that the Saudi oil industry can survive $20/barrel oil. That statement is almost certainly factually true. But the bigger question is the extent to which Saudi Arabia’s decades-old social contract can survive a continuation of the fuel and power subsidy reductions, social spending cuts, lost job opportunities, and other socioeconomic pain inflicted by sub-$50 oil. China’s slowing diesel demand just might make the Saudi leadership reconsider its hawkish stance.