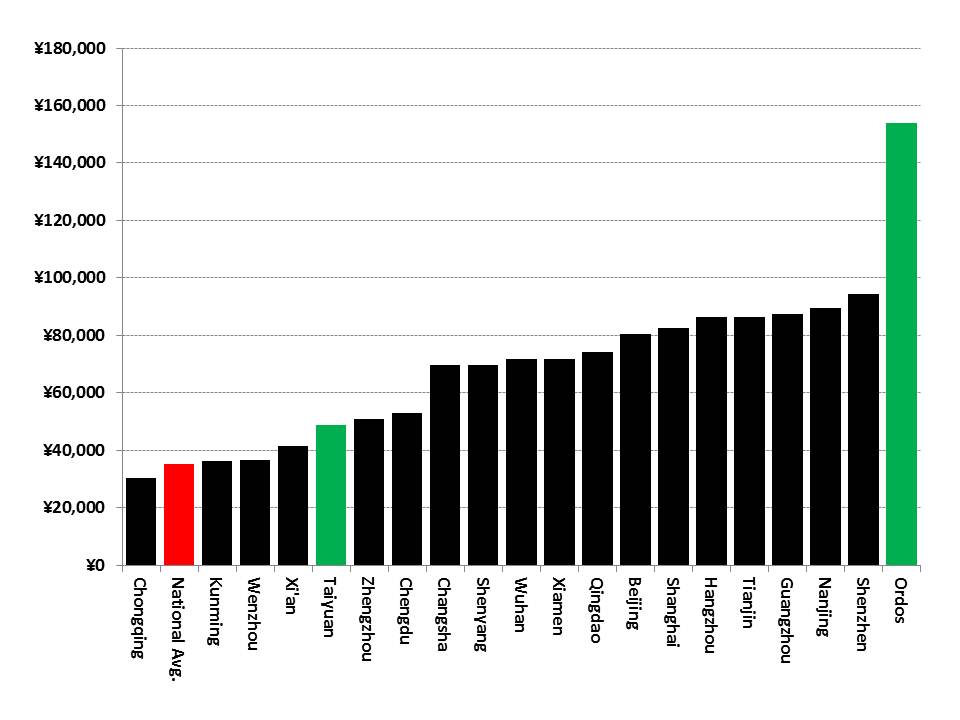

So what do coal mines have to do with high-priced Bentley automobiles? In Chinese coal mining towns, a lot. The roster of Bentley dealerships in China is remarkable because while it includes the predictable wealthy East Coast cities like Beijing, Shanghai, and Guangzhou, it also includes Ordos and Taiyuan, who are better known for their coal mines than for their flashy banks and brokerage houses (Exhibit 1). It is very likely that a similar economic boom is coming for Xinjiang, which is on track to become one of the world’s largest coal producers.

Exhibit 1: Chinese cities with Bentley dealerships, arranged by per capita GDP

2011 per capita GDP, RMB

Source: Bentley, NBS China

Ordos has one of the highest per capita GDPs in China, which is admittedly skewed by the unusually high ratio of investment to actual population in the city. Yet given the low population in coal rich areas of Xinjiang, economic effects on a similar scale are likely when investment in coal mines, power plants, and chemicals facilities gets underway in earnest over the next several years.

Taiyuan also provides an interesting illustration of how coal mining can create disproportionate pockets of wealth that influence the character of the entire local consumer economy as measured in value terms. Taiyuan overall has a per capita GDP that is unremarkable among major Chinese cities, but the fact that Bentley sited a dealership there strongly suggests there is a substantial number of people wealthy enough to buy cars only millionaires can afford. Since the coal industry and affiliated businesses are the most important economic engines in Taiyuan, this suggests a direct correlation between a high-end consumer goods provider and local coal barons.

The miners themselves also stand to benefit. In Wyoming, the average coal miner takes home nearly twice the state average salary. In Xinjiang, creating such well-paying jobs in rural areas near the mines will have substantial direct and trickle down impacts on local economies and drive sales of autos and other consumer goods.

Some consumer-oriented companies are moving to position themselves ahead of this coal boom. For example, Volkswagen, one of the leading foreign car brands in China, has chosen Ürümqi, the capital of Xinjiang, as a key Western China manufacturing site to be constructed as part of the company’s 2012-2016 investment plan.

How the coal boom is likely to materialize

Inner Mongolia (home to Ordos) and Shanxi (home to Taiyuan) are China’s number one and number two coal mining regions, and by themselves would be among the four largest global coal producers. Over the past decade, both regions have enjoyed strong increases in the volumes of coal produced and for the past five years, global coal prices have attained historical highs in nominal terms that have helped feed a steady influx of cash into their economies. As this process unfolded, local coal barons became able to afford Bentley-type vehicles, which can cost more than US$250,000 apiece.

Mineral booms can fuel rapid and dramatic growth in local consumer economies, but what does the development of such a sales trajectory actually look like in areas with higher, but broadly-comparable personal incomes to China’s interior provinces?

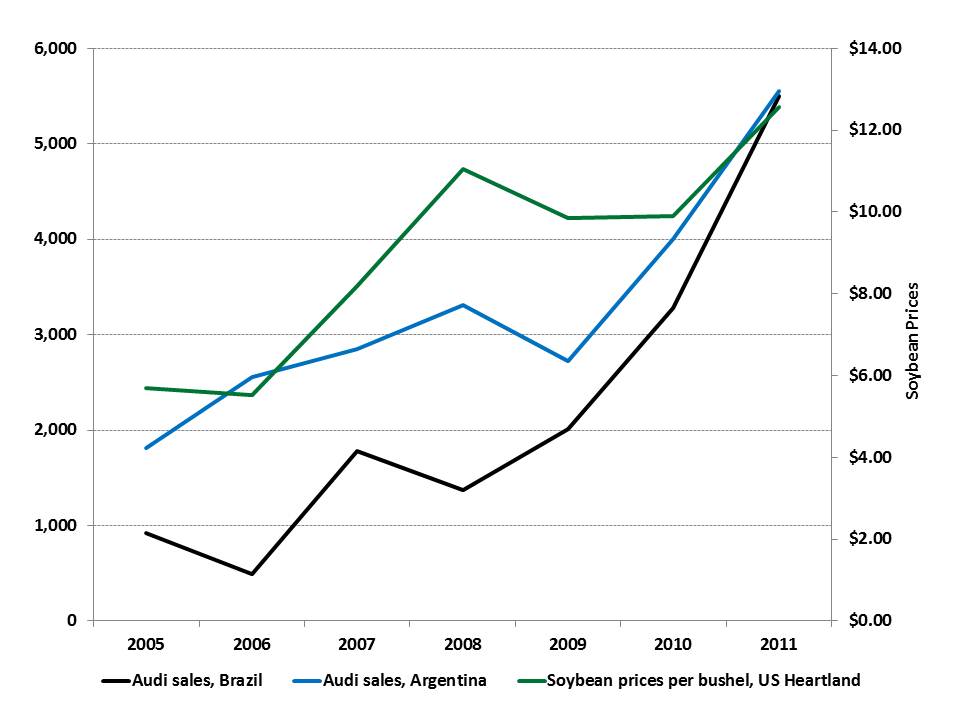

The soybean boom that has transformed the soybean industry in Argentina and Brazil and helped each country to become a global export powerhouse sheds light on how economic booms underpinned by commodities can help drive high-end consumer good sales in Xinjiang. Audi’s car sales in Argentina increased threefold between 2005 and 2011 and sales in Brazil rose nearly sixfold during that period (Exhibit 2). Interestingly, the rate of Audi car sales rose on a very similar trajectory as the price of soybeans as measured by the price in the U.S. soybean farming heartland. We believe it is reasonable to expect a similar trend of rapid increase of consumer goods sales in Xinjiang that roughly parallels increases in coal revenues (driven by both increases in volume and price).

Exhibit 2: Audi sales in Brazil and Argentina vs. soybean prices

Vehicles per year, soybean prices in USD/bushel

Source: Audi, USDA

Implications

Ramped up coal production in Xinjiang will create substantial new local wealth, but through different channels than the Inner Mongolia and Shanxi mining booms did. The reason is that Xinjiang will be dominated by large, capital-intensive strip mines that price out smaller entrepreneurs.

Instead, Xinjiang’s coal boom will create wealth for the service and equipment providers—those who sell the picks and shovels to the miners. Local mining equipment dealers, repair shops, and suppliers of steel, cement, and building materials will benefit greatly from increased mining activity. Other sectors are also likely to benefit if local leaders adopt an integrated development approach that plows mining revenues back into other forms of industrial and agricultural development. For instance, Zhu Falin, the secretary of coal-rich Jimusaer County, says “We are establishing a close bond between the development of the Zhundong coal power and coal chemical industries and the development of our agricultural economy. By doing so, we can take a new road to industrialization, push forward the integration of urban and rural areas.”

The owners and employees of the mining supply firms and other sectors benefitting from coal revenues will upgrade the cars, household appliances, and other goods, as well as consume more and better foods, such as meat and beer/liquor. As the wealthiest among them look to spend, look for Audi, Bentley, BMW, Mercedes, and other high-end auto dealers wishing to expand sales in China to go West.