Key points:

–In 2011, Xinjiang produced 120 million tonnes of coal. In our base case estimate, Xinjiang will produce ~240 million tonnes per year of coal in 2015 and slightly over 750 million tonnes per year in 2020.

–This would make Xinjiang one of the world’s 5 largest coal producers by volume.

–By 2020, Xinjiang could export 200 million tonnes per year of coal to other parts of China by rail, 200 million tonnes per year as electricity, and potentially 100+ million tonnes per year as chemicals and liquid fuel.

–Low-cost thermal coal and coal-by-wire electricity from Xinjiang could pose a significant competitive threat to shale gas development in Central and Southwestern China, which are target markets for coal and electricity produced in Xinjiang.

–Xinjiang coal could be delivered in physical form to Central China at a cost of around US$3.30 per million BTU, whereas shale gas in the region is likely to cost US$5 per million BTU or more to produce.

–Xinjiang could produce more than 250,000 bpd of liquid fuels from coal and potentially as much as 1 million barrels per day if producers increased their water use efficiency and China’s National Development & Reform (NDRC) allowed the expansion.

Rising production costs, an unacceptably high death rate in underground mines, and rail bottlenecks in eastern and northeastern China are setting the stage for a new phase in domestic coal production. The largest new coal provider will be Xinjiang. This northwestern region has the potential to become the world’s single largest producer of thermal coal. Xinjiang is in the early stages of a mining and economic boom like that which Inner Mongolia has experienced over the past decade.

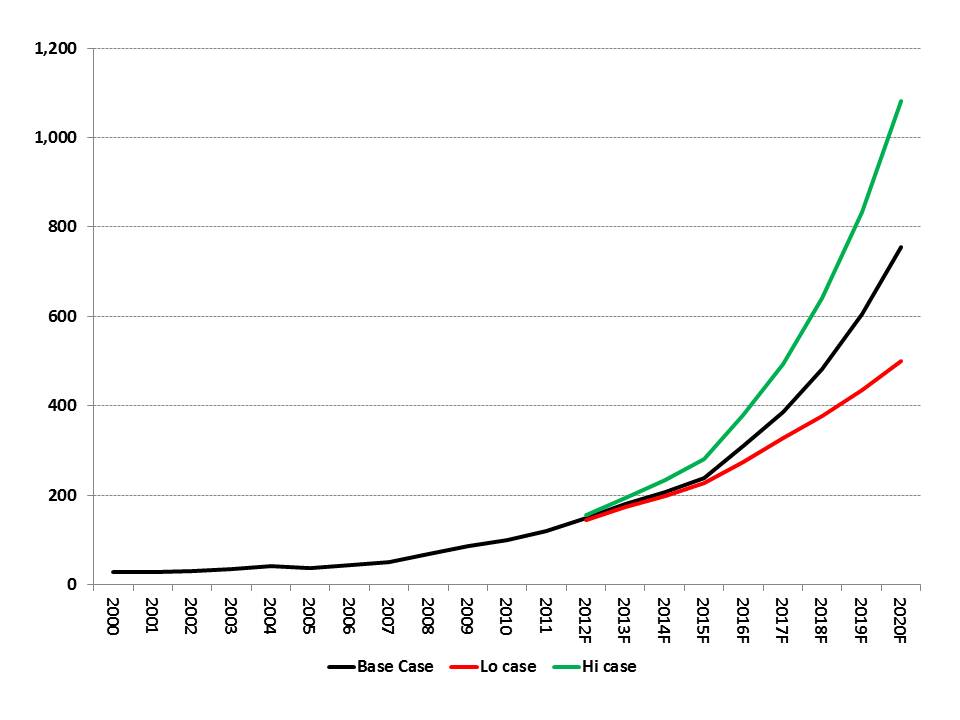

In 2011, Xinjiang produced 120 million tonnes of coal. Industry sources estimate that by 2015, the province is likely to be producing well over 200 million tonnes per year, with production potentially rising to 1 billion tonnes per year by 2020. In our base case estimate, Xinjiang will produce ~240 million tonnes per year of coal in 2015 and slightly over 750 million tonnes per year in 2020 (Exhibit 1).

Exhibit 1: Xinjiang coal production history and outlook

Million tonnes per year

Source: Company reports, China SignPost™

The low and high case estimates reflect alternative scenarios with the province mining 500 million tonnes per year by 2020 in the low case and slightly over 1 billion tonnes per year in the high production case. In any event, the province will be a top—perhaps the top—coal producing area by volume in China. Xinjiang appears to have ample coal reserves to support its ambitious production plans, with the NDRC estimating that Xinjiang holds as much as 2.2 trillion tonnes of coal reserves—enough to supply China’s thermal coal demand for more than 100 years if even only 15% of Xinjiang’s estimated coal reserves prove recoverable.

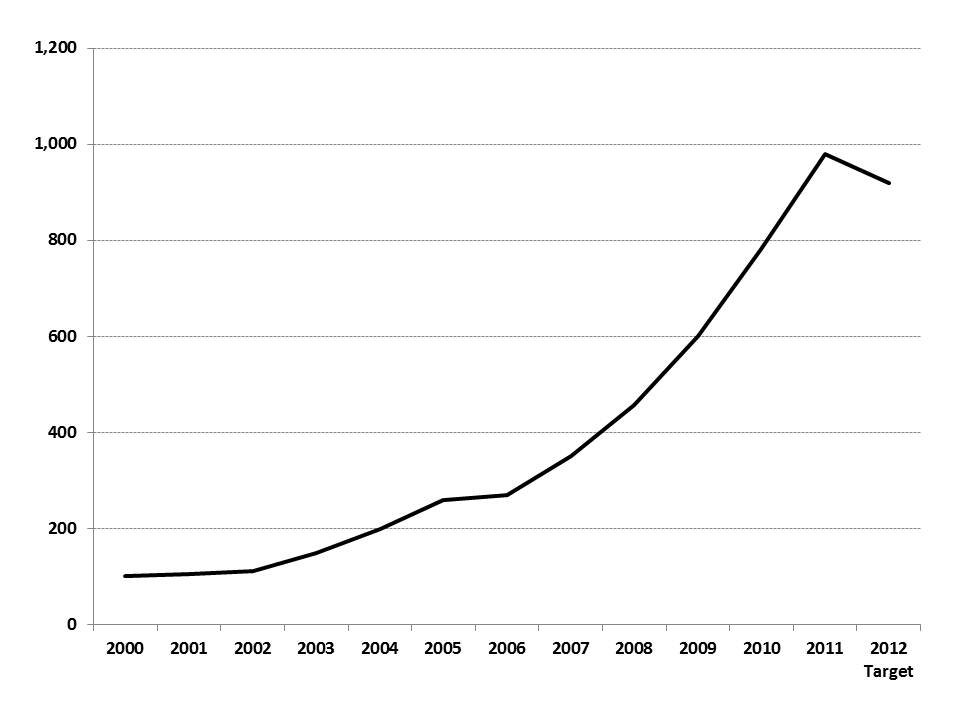

China has experienced a similar explosive coal production story in the past decade. Inner Mongolia increased output from ~100 million tonnes per year in 2000 to more than 900 million tonnes per year in 2011 (Exhibit 2). The resource-rich autonomous region, now China’s largest coal producer by volume, accounts for close to a third of China’s total coal output. In Inner Mongolia, rapid increases in coal output have reshaped the economy by delivering some of the consistently-highest GDP growth rates in the country. Xinjiang and Inner Mongolia have similar population sizes and climates and the Inner Mongolia coal story offers a preview of the coal production and economic growth rates Xinjiang is likely to experience over the next 10-15 years.

Exhibit 2: Inner Mongolia Coal Production

Million tonnes per year

Source: NBS China, Inner Mongolia Government, The Economist, China Daily

Drivers of Xinjiang’s emerging coal boom

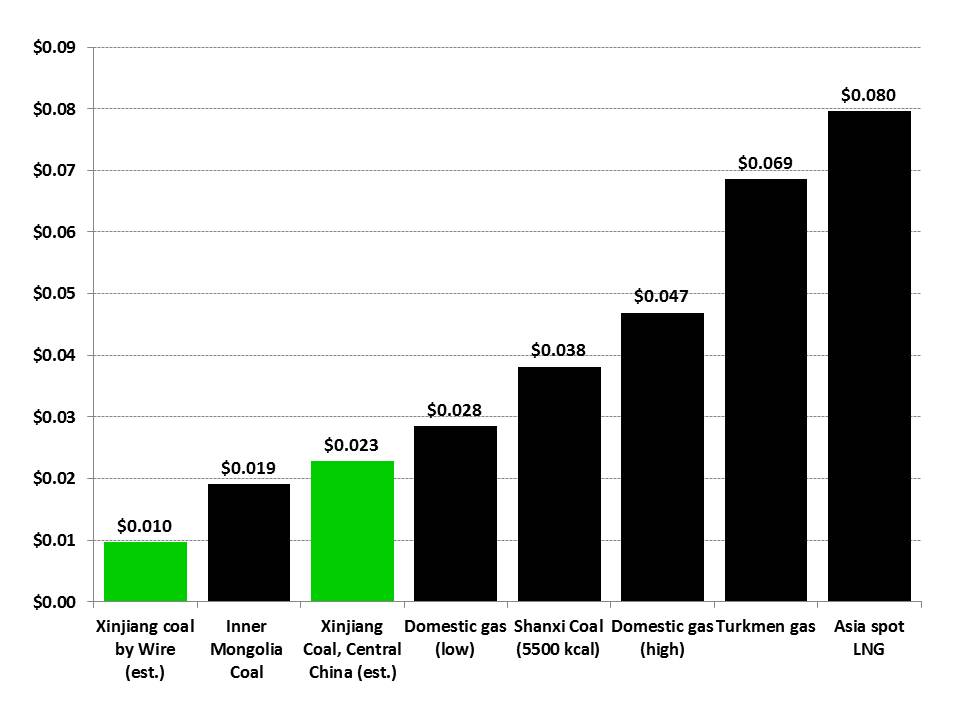

- 1. Coal is still China’s cheapest large-scale source of electricity

For generating electricity in large volumes and at a low cost, coal is king as a fuel supply source in China. Xinjiang coal is likely, on average, to be the country’s cheapest high-volume supply stream because it will be primarily surface mined and thick seams will allow for high mining productivity. We estimate that Xinjiang coal could be supplied to mine-mouth power plants at less than 1/3 the price of mine-mouth power plant coal supplies in Shanxi and nearly half the cost of supplies in Inner Mongolia, China’s current largest coal-producing region (Exhibit 3).

Exhibit 3: Price of fuels for electricity production in China

USD/million BTU

Source: Platts, company reports, Reuters, China SignPost™

- Xinjiang has large reserves that are predominantly shallow, thick coal seams can be strip mined cheaply.

Surface mining is more productive than underground mining and allows production to be rapidly ramped up at a relatively low cost. For instance, in Wyoming, which has total coal reserves estimated at 1.4 trillion tonnes, coal production rose from 7.4 million tons per year in 1970 to 95 million tons in 1980, 184 million tons in 1990, and nearly 470 million tons in 2008. In contrast, Xinjiang has an estimated 2.2 trillion tonnes of coal reserves. If these prove similar to the thick-seam, shallow coal fields of Wyoming’s Powder River Basin, Xinjiang could conceivably sustain coal production well above 500 million tonnes per year and essentially replace the higher-cost coal production by Shanxi and other Central Chinese provinces.

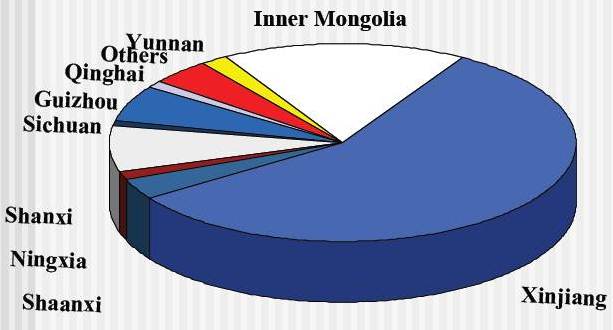

Xinjiang’s large coal seams often lie shallow enough to be surface mined more cheaply and much more safely than underground mines. Xinjiang’s coal reserves are estimated to be China’s largest, but even more important than the overall reserve volume is the portion of the coal in place that can actually be mined. On this account, Xinjiang scores well, holding the lion’s share of Chinese coal reserves located 1000 meters or less from the surface—in essence, those that are potentially economically mineable (Exhibit 4).

Exhibit 4: Distribution of Coal Reserves in China at depths of 1000 meters or less (2005)

Source: Kexi Pan, Fudan University

The reserve figure dates from 2005, but the proportional geographic distribution of the country’s estimated coal reserves have not changed substantially since that time, and if anything, the balance has shifted further in favor of Xinjiang since its production has heretofore been much lower than that of other regions such as Shanxi and Inner Mongolia.

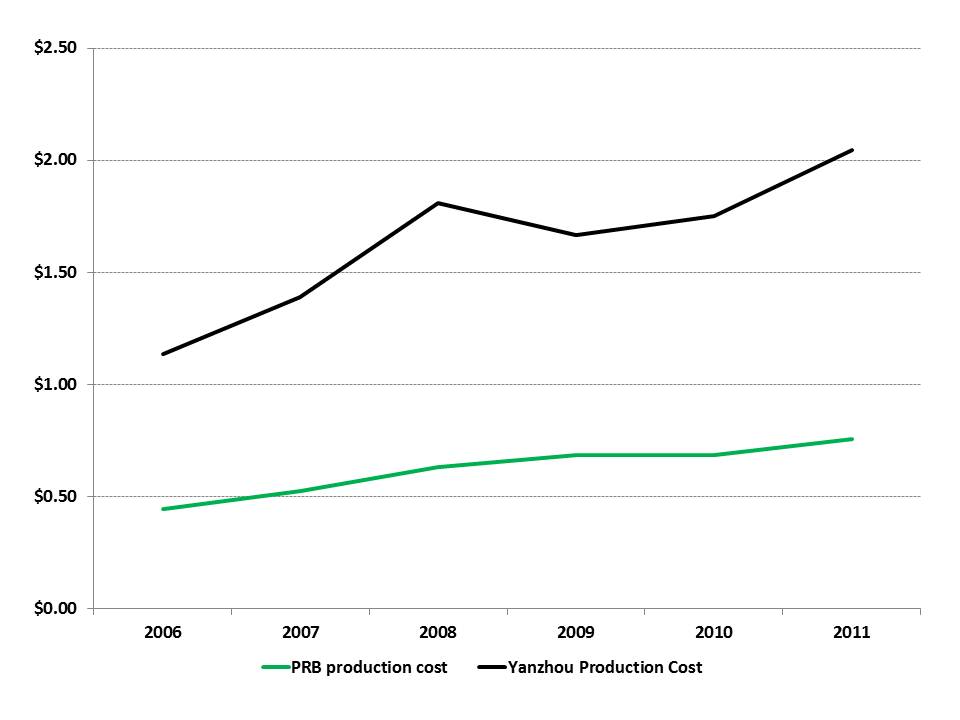

- 3. China’s traditional underground coal sources cannot compete on price with Xinjiang coal

Coal mining in China’s traditional coal heartland of Shanxi and Sha’anxi has become increasingly expensive as coal seams run deeper and labor-intensive underground mines are forced to pay rising wages. In contrast, Xinjiang’s large thermal coal deposits often lie within 60 meters of the surface and can be strip-mined with large equipment that reduces labor costs and drastically boosts coal produced per man hour of labor. The mining operations of Yanzhou Coal—which primarily mines underground—have heat-content-adjusted production costs nearly three times as high as those of Peabody Energy’s for operating its giant surface mines in Wyoming, where geological and climate conditions closely approximate those found in Xinjiang’s major coal basins (Exhibit 5).

Exhibit 5: Coal production and sales costs for Yanzhou Coal and Peabody Energy

USD per million BTU

Source: Yanzhou Coal, Peabody Energy

- 4. Surface mining is much safer than underground mining, which presently dominates Chinese coal output.

In China’s economic and energy policy planning to date, safety has not typically been prioritized. However, increasing publicity of coal mining fatalities in recent years places additional political pressure on various levels of the government, which have responded by consolidating the mining sector and beginning to close smaller mines, which are often more dangerous and less efficient than their larger cousins.

To illustrate the ratio, we use data from India, another large developing economy that relies heavily on coal and is a top global producer with both surface and underground coal production. 12 miners die for each 10 million tonnes of coal produced in India’s underground mines. Meanwhile, during the same nine year study period, surface mines in India only experienced one miner death per 10 million tonnes of coal produced. Chinese coal mines—from which 90% of China’s coal production comes—suffered 5.6 deaths per 10 million tonnes of coal produced, better than India, but still far higher than the mortality rate for surface mines. Similarly, in the U.S., which has modern and well-regulated underground coal mines, during 2007 underground mines still suffered five times as many deaths from accidents as surface mines did.

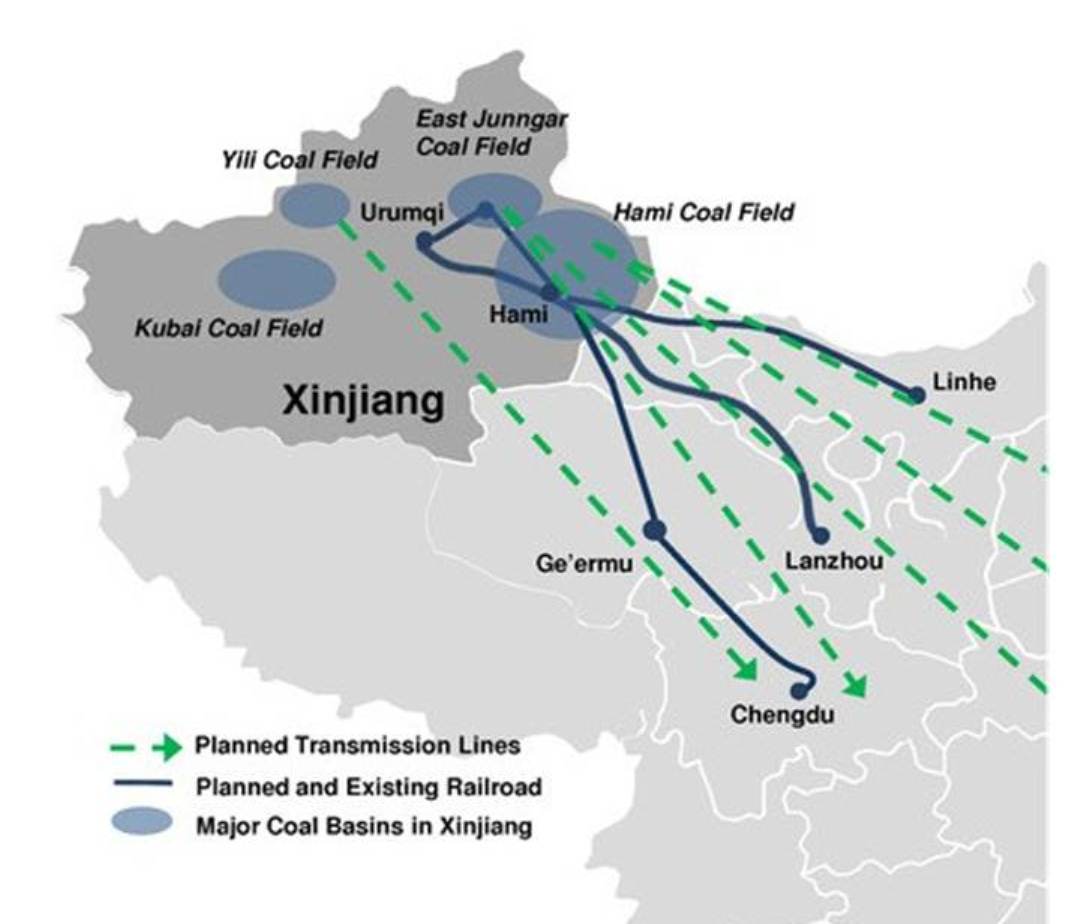

How will Xinjiang’s coal get to market?

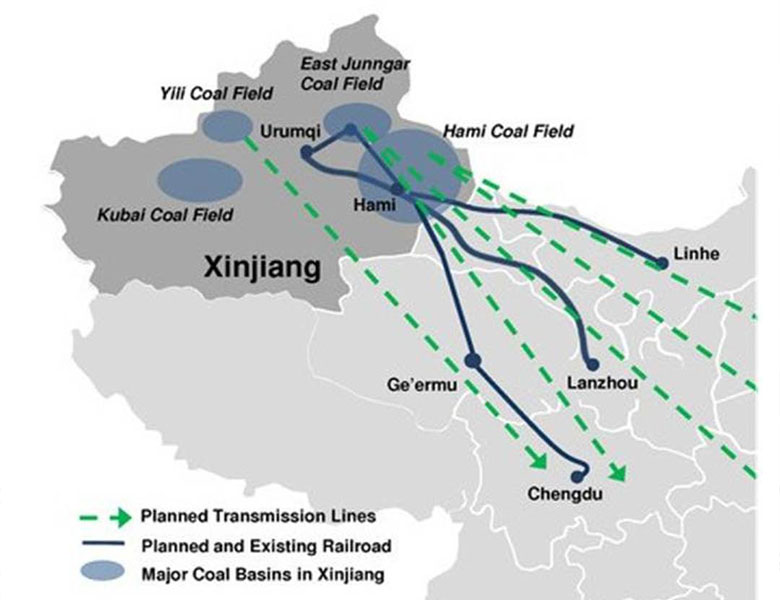

Xinjiang’s coal production is likely to move to market via several channels. The autonomous region is far from China’s traditional Central and East Coast coal markets, but low production costs and a spate of long-stance power transmission and railroad projects now underway and planned for coming years will help keep Xinjiang coal production competitive in China’s core coal markets (Exhibit 6).

Exhibit 6: Xinjiang rail and power line coal export routes

Source: NDRC, Peabody Energy

1) Physical coal will be exported to markets further east. Xinjiang’s outbound rail capacity was sufficient to handle 20 million tonnes per year of coal in 2011 and is expected to expand to 200 million tonnes per year by 2020.

2) Coal will be exported in the form of electricity. Coal-by-wire projects using new, largely Chinese-made ultra-high voltage (UHV) power lines are on track to have 30 gigawatts (“GW”) of eastbound power capacity by 2015 and 50 GW by 2020—an amount equivalent to at least 150 million tonnes of coal exports, and that could potentially climb to 200 million tonnes if the UHV buildout proves successful. Xinjiang is very dry, but China has been a leader in developing modern air-cooled power plants that require only about 1/5 the water their conventional counterparts do.

3) Coal will be used as a chemical feedstock. A number of companies are planning large facilities to produce methanol, polymers, and other chemicals from coal in Xinjiang. Water is likely to become a significant constraint on these projects, as coal to olefins and other chemical production processes are very water-intensive.

4) Xinjiang may move to produce liquid fuels from coal, a process that is likely to be economical at oil prices above $65/bbl. From 15 million tonnes per year of coal, producers could likely generate 100,000 bpd of liquid fuels, according to data from the National Petroleum Council. This would help China trim its oil import dependency. Liquid fuels or synthetic crude oil could be moved by pipeline into Central and Eastern China. However, producing liquid fuels from coal is also water-intensive, requiring a total of 5-6 barrels of water for each barrel of fuel produced.

The amount of water needed to produce 100,000 bpd of liquid fuels from coal (219 million bbl) sounds large, but to put this in perspective, it would only be sufficient to irrigate roughly 136 hectares of corn in Xinjiang’s desert climate. At China’s average corn yield over the past decade, this would mean that for Xinjiang, each 100,000 bpd of liquid fuel production from coal would be worth approximately 30,000 tonnes of corn production.

While domestic food production remains vital to China’s leaders, in weighing priorities and opportunity costs, it is very possible that the could decide that 150 million tonnes per year of coal and the equivalent of 300,000 tonnes per year of staple grain production (or less of cotton) could be worth trading for the energy security and local economic boosts one million barrels per day of coal-based liquid fuel could bring China.

Implications

1) Xinjiang is likely to experience rapid, sustained GDP growth similar to the boom Inner Mongolia enjoyed over the past decade as its coal production rapidly expanded.

2) Power-intensive industries such as aluminum smelting will find Xinjiang an increasingly attractive place to relocate to, especially if the local construction and related markets flourish and increase local metals demand.

3) A flood of low-cost thermal coal and coal-by-wire electrical supplies from Xinjiang are likely to reduce the economic competitiveness of future shale gas production in China. Many U.S. shale gas projects begin to lose money at natural gas prices of between US$4-5 per million BTU. China’s shales are more complex geologically and lie deeper underground, so production costs are going to be much higher—especially compared with thermal coal coming onto market for less than US$2/MMBTU in some cases.

4) Xinjiang has suffered repeated serious incidents of ethnic unrest over the past several years between Uighurs and Han Chinese. Coal mining has exacerbated ethnic tensions in Inner Mongolia, primarily due to destruction of grasslands ethnic Mongols use to graze their herds. We believe that if mining firms and their suppliers make sustained efforts to employ local Uighurs and invest a fair share of mining tax revenues in projects that benefit Uighur communities broadly, the potential for ethnic conflict can be mitigated and shared progress can be achieved.