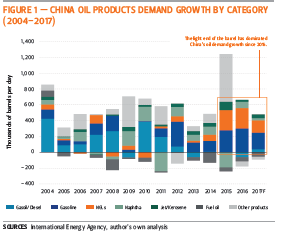

- China’s oil products demand growth over the past several years has been dominated by the light end of the barrel. In 2015, gasoline and natural gas liquids (NGLs) together accounted for 53% of net incremental oil products demand growth in China. By 2016, light ends accounted for such a significant proportion of this demand that without gasoline and NGL demand growth, oil product consumption in China would have actually declined, as consumption of diesel fuel and residual fuel oil fell year-on-year.

- As China’s demand for light oil products continues to drive incremental consumption growth, an interesting theme is becoming apparent: commodities that are framed as “oil products” are increasingly not actually made from crude oil.

- While the lion’s share of China gasoline supply comes from refining crude oil, an increasing proportion effectively comes from China’s coalfields in the forms of methanol and chemicals produced using methanol as a feedstock. Data from Argus Media suggest that more than 400,000 barrels per day (bpd) of China’s gasoline pool—which is currently about 3 million bpd in size—comes from methanol and its derivatives. Expressed in share terms, this means at least 15% of the country’s gasoline comes from methanol and methanol-derived compounds such as methyl tertiary butyl ether (MTBE).

- Oil producers—whether in Riyadh, Moscow, or the Permian Basin— should take stock of how China’s growing use of “oil products” that do not actually come from crude oil and instead bypass the refinery could slow demand growth and weigh on prices for the crude oil they produce.

October 10th, 2017 • Gabe Collins and Andrew Erickson