China’s passenger car sales volumes have been strong thus far in 2014, with roughly 15% YoY growth between January and November 2014. Gasoline demand has followed suit, expanding by nearly 9% YoY between January and October 2014 (see China SignPost 87). Against this backdrop, and with oil prices low and China’s demand for other commodities such as steel and coal weak, a question arises: “how sustainable is China’s passenger car sales boom?” Depending on how this question plays out, the implications for oil markets and the large global automakers could be profound.

The question of China’s future passenger vehicle market trajectory is huge in scope and complexity. To begin peeling away some layers of the onion, we examine the evolving dealership footprint of Volkswagen—the largest passenger car seller in China’s massive, growing market. Volkswagen reports that between January and July of 2014, it held a 22% share of the passenger car market in China. The company’s heft and presence across the country, as well as its stated ambition to further grow its sales make its sales and service infrastructure decisions a useful barometer for assessing how the “smart money” sees passenger car demand unfolding in various regions of China.

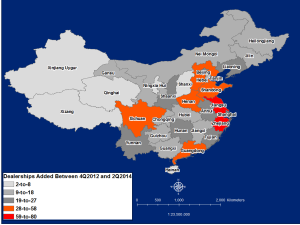

VW discloses data for dealerships by province at approximately quarterly intervals between the fourth quarter of 2012 and the second quarter of 2014. Our analysis of the data shows that the 10 provinces with the largest increase in number of dealerships during this time were (in descending order): (1) Jiangsu, (2) Zhejiang, (3) Hebei, (4) Shandong, (5) Guangdong, (6) Sichuan, (7) Henan, (8) Yunnan, (9) Anhui, and (10) Hunan (Exhibit 1). For reference, Exhibit 2 directly follows Exhibit 1 and shows the total number of VW dealerships by province as of 2Q2014, including Audi, Porsche, and Skoda dealers.

Exhibit 1: VW Dealerships Added by Province between 4Q2012 and 2Q2014

Source: Company reports, China SignPost™

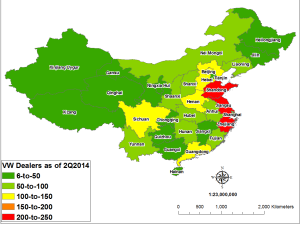

Exhibit 2: VW Dealerships by Province, 2Q2014

Source: Company reports, China SignPost™

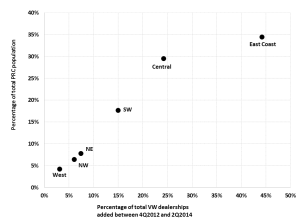

VW’s recent dealership addition patterns distinctly favor the populous and prosperous Eastern provinces. By our count using VW’s data, 45% of its new dealerships opened in East Coast provinces accounting for only 35% of China’s population (Exhibit 3). Provinces in Central and Southwestern China saw significant growth in the number of VW dealerships, but at a proportion lower than we would have expected based on the provinces’ population and latent demographic and economic potential for increasing auto sales. Dealership additions in Northeast, Northwest, and Western China (Xinjiang, Tibet, Ningxia, Qinghai) were low relative to population, but this is less surprising given these regions’ relative poverty compared to places like Jiangsu and Sichuan.

Exhibit 3: VW Dealership Additions by Region, 4Q2012 to 2Q2014

Source: Company reports, NBS China, China SignPost™

An important question with respect to assessing future upside for auto sales increases in China is: “how geographically distributed are dealerships within a given province?” Performing such an analysis for all 31 provinces and administrative areas is beyond the scope of this report, so we have chosen Jiangsu as a proxy for the populated and relatively wealthy coastal markets and use Sichuan as a proxy for the populous but less well-developed interior passenger car markets. These data are current as of 10 December 2014.

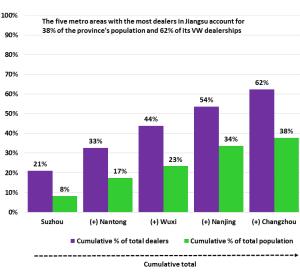

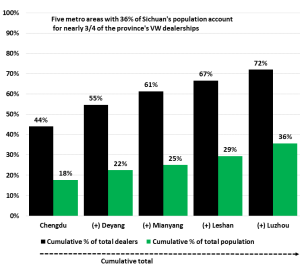

The data reveal that in Jiangsu, five key metropolitan areas—Suzhou, Nantong, Wuxi, Nanjing, and Changzhou—have only 38% of the province’s total population but 62% of VW dealerships (Exhibit 4). Suzhou, which has the most VW dealerships in Jiangsu (34), accounts for 21% of the province’s dealerships. Sichuan’s distribution is even more skewed, with the five key metro areas—Chengdu, Deyang, Mianyang, Leshan, and Luzhou—accounting for 36% of the population but 72% of Sichuan’s VW dealers (Exhibit 5).

Exhibit 4: VW Dealership Distribution in Jiangsu, circa 10 December 2014

Source: Company reports, China SignPost™

Exhibit 5: VW Dealership Distribution in Sichuan, circa 10 December 2014

Source: Company reports, China SignPost™

Chengdu alone accounts for 44% of the VW dealerships located in Sichuan. Chengdu’s proportion of total Sichuan-based VW dealerships is very high and is comparable to that of Shaanxi, where the Xian metro area accounts for 38% of VW dealerships in that province. These data suggest that: (1) certain provinces—especially Sichuan and Shaanxi—host two of China’s largest passenger car cities in terms of total passenger car fleet size (Chengdu and Xian), but (2) outside the provincial economic center of gravity, passenger car ownership rates are much lower. Whether this reflects low market penetration or a market that does not offer much room for car sales growth outside the giant metro areas remains to be seen. Our hunch is that in the poorer rural areas, residents will purchase cheaper local car brands and/or used cars that trickle out of the big cities as their owners upgrade.

Implications

–VW’s continued focus on the East Coast provinces suggest that in these areas the mid- and upper-tier car markets have not yet become saturated. Larger cities such as Shanghai and Suzhou likely are close to saturation, if not there already, but the myriad 3rd, 4th, and 5th tier markets in the coastal provinces still have substantial room for growth, particularly for the lower-cost car brands.

–Likewise, the relative under-representation of Central and Southwest China in VW’s dealership buildout suggests that between 2012 and 2014, company management did not believe these areas were as “ripe” for substantial sales increases as the East and South Coasts were. It is likely that the next two years will see the dealership addition rate relative to population become more balanced between the East Coast and key interior provinces such as Sichuan, where a number of large metro areas such as Deyang, Mianyang, and Leshan are just now turning into significant auto markets.

–For example, Deyang, an industrial metropolis of 3.9 million people located 85km north of Chengdu, had a private passenger car ownership rate of 6.6 vehicles/100 residents in 2013. For comparison, this is where Chengdu’s car ownership rate was in the 2006-07 timeframe and in 2013 Chengdu had 18.1 vehicles per 100 residents.

–Each city is different and Deyang likely won’t triple its car ownership in a short span the way Chengdu did, but the car ownership disparity between the cities suggests that barring a truly epic economic slowdown, Deyang and other large Sichuan cities could see substantial increases in their local passenger car fleets, with commensurate increases in gasoline consumption.

–Similar dynamics exist in many other interior provinces and for this reason, we remain bullish on China’s gasoline demand growth prospects, although it will be some time before gasoline demand growth becomes large enough to fully offset China’s stagnant diesel fuel demand.