President Xi Jinping’s vigorous promotion of new policy paths is colliding with powerful vested interests. China’s leaders appear to know what economic reforms are needed, but how, when, and to what degree can they actually implement them without assuming unacceptable political risks? This remains the problem, and it remains unanswered. The bottom line is that China faces increasingly necessary reforms that its political power structure appears ill-suited to implement effectively. Accordingly, those dealing with the PRC should prepare for reforms to progress more slowly, and less successfully, than expected.

Key Challenges to Reforms (rank-ordered in descending order of seriousness):

1. Deep and entrenched corruption

2. Local officials’ significant ability to passively resist reforms

3. State-owned enterprises’ massive economic heft and commensurate behind-the-scenes political influence

Important Takeaways

1. High-profile anti-corruption campaigns will kill a few “tigers,” who also often happen to be political opponents of the current governing elite. But corruption will remain a serious problem until the Party fundamentally revises its personnel management, judiciary, and legal systems.

2. Substantial reforms are likely in the next 2-5 years in sectors key to social stability and human wellbeing—particularly healthcare and hospitals. We also expect the availability and use of clean burning natural gas in large coastal cities and larger inland cities away from the coal belt will each continue to grow at more than 10% annually for at least the next five years.

3. There will be continued piecemeal attempts at state owned enterprise (SOEs) reform—such as Sinopec’s recent packaging for sale of what was technically a ~30% stake in its downstream retail business. But the state will retain deep economic influence even in such “reformed” areas if they have any substantial ties to “commanding heights” sectors such as natural resources, public utilities, high technology, shipbuilding, and aerospace.

Big Meeting

With the 18th Communist Party of China (CPC) Central Committee’s Fourth Plenum on legal issues having just concluded in Beijing, it is time to offer a balance sheet on the results of the Third Plenum and future prospects. At the Third Plenum on 9-12 November 2013, China’s leaders unveiled the “Decision of the CPC Central Committee on Some Issues concerning Comprehensive Reforms.” This was part of an annual meeting of the Central Committee’s 205 members and 171 alternates to “discuss major policy decisions.” What was particularly significant was Xi’s role in personally leading the group drafting the decisions, which included the ideologically ambitious—and as yet unfulfilled—concept of “market forces playing a decisive role in resource allocation.”

The 2013 meeting emphasized that China must shift to a more fiscally and environmentally sustainable growth model. The leadership is now on the clock, since the goal is to have “decisive results” from reforms by 2020—in time for the CCP’s 100th anniversary in 2021.

A key question looms: can the leadership of President Xi and Premier Li—which is stronger than that of their predecessors Hu Jintao and Wen Jiabao—allow the currently proposed reforms to have an impact potentially as large as that of Deng Xiaoping’s reforms? Given the challenging, time-consuming nature of implementation, it will take several years to judge the actual outcome. But we are nearly one-quarter of the way on a four year measuring stick and already the prospects for rapid, comprehensive implementation appear limited.

Xi and Li work in a different environment than Deng did. In the late 1970s and early 1980s there was not the same web of vested interests to block the eventual implementation of reforms. In fact, it was the state-led economic development combined with political retrenchment post-1978 that has produced the present sclerosis. State owned enterprises (SOEs) and lack of a unified construction land market, and most of all, severe and deeply entrenched corruption are likely to remain key obstacles.

Corruption is the single most substantial barrier because any reform instantly threatens thousands of “shadow rice bowls” that were feeding local officials’ lifestyles off the books. High-profile campaigns such as that current being conducted against former Central Political and Legislative Committee Secretary Zhou Yongkang have a “kill the chicken to scare the monkey” aspect in that the Central leadership hopes they will frighten lower level officials and deter them from entering into various corrupt activities. But the reality is that the thousands—if not tens or hundreds of thousands of lower level officials with their hands in the cookie jar—will simply lay low during the high profile purges, then (1) resume with business as usual and (2) drag their feet to try and defeat central edicts that threaten their personal “under the table” financial interests. This massive collective friction will be a powerful brake on many different types of reform—particularly any reforms that require substantial local participation across the country, such as reforms concerning local governments’ involvement in land transactions.

While headlines devote ample space to discussing the sectors affected by the “anti-corruption” crusade, and VIP spending has declined overall, equity markets in China are not simply pricing in austerity. Sales of Maotai liquor—a staple at any official banquet—have declined significantly since Xi’s campaign began, with Wuliangy—a major Maotai producer—reporting that its revenue in the first six months of 2014 declined approximately 25% year-on-year. However, the stock market, which is a forward looking indicator, has for more than six months consistently priced China’s three largest publicly-traded Maotai distillers at significant premiums to both the Shanghai and Shenzhen Composite indices (Exhibit 1).

Exhibit 1: Liquor producers stock prices rising despite official anti-corruption campaign

Source: Google Finance, China SignPost™

Xi’s Vigorous Style and Early Power Consolidation

Xi Jinping combines an outgoing, effective leadership style with an unusually strong background and formative and professional experiences to amass advantages that his immediate predecessors lacked. The general trend in PRC politics has been for the paramount leader of each generation to become more constrained, technocratic, and colorless. While collective decision-making has become the norm overall, in many respects the fifth-generation Xi has turned the clock back toward dynamics enjoyed by the third-generation Jiang. He is taking significant political risk by (1) launching an anti-corruption campaign that targets officials even up to ex-Politburo level (Zhou Yongkang), (2) putting a substantial personal stamp on economic reform plans, and (3) engaging with the Chinese military in ways not seen for decades.

Xi’s relationship with the People’s Liberation Army (PLA) deserves special attention due to the effects it is likely to have on China’s foreign and security policies—an area where a single leader can exert much more control than he can over something as large and diffuse as the world’s second largest economy. In the specific area of relations with China’s military, Xi enjoys rapport and ease of interaction not enjoyed since Mao and Deng.

As the son of first-generation CCP leader and PLA co-founder (as a founder of the CCP guerilla movement in Shaanxi) Xi Zhongxun, Xi undoubtedly benefitted from observing his father’s professional contacts and interactions. A consensus candidate in many respects, Xi understands the CCP, the social dynamics and interconnections of its extended ‘red royalty,’ and the levers of PRC power extremely well. Likely thanks in part to his father’s connections, he served from 1979-82 as secretary to Xi Zhongxun’s former subordinate Geng Biao. As vice premier and Secretary-General of the Central Military Commission (CMC), Geng was effectively China’s secretary of defense.

Xi never gained operational experience and never commanded even a regiment—Mao and Deng were likely the last paramount leaders to enjoy such military credibility. But even Xi’s limited military experience puts him ahead of Jiang and Hu. Hu was widely regarded as uncomfortable and remote when dealing with the PLA, and there is no evidence that he ever succeeded in imposing his will by forcing it to do something it did not want to do bureaucratically, or preventing it from doing something it wanted to do bureaucratically.[1]

Even Jiang, who succeeded in ending PLA participation in most commercial sectors in 1998, took years to consolidate his power and promote key allies in the PLA. Until Deng’s death in 1997 and the retirement of his key allies, Admiral Liu Huaqing and General Zhang Zhen, as Central Military Commission Vice Chairman, Jiang was constrained significantly. By contrast, Xi has appeared extremely comfortable and confident in his interactions with the PLA from the start. He understands the PLA’s traditions, symbolism, and bureaucratic language—factors important to militaries worldwide, but perhaps especially so for this historically-transformative Party Army.

Xi’s closer relationship with the PLA—Is it a potential liability?

From the perspective of external security and stability, Xi’s capabilities and predilections bring both strengths and risks. Certainly the Party has commanded the gun consistently in recent years, so even Xi’s more militarily-limited predecessors were always clearly in charge of China’s military. The likely difference lies in Xi’s willingness and ability to engage closely with the PLA.

In peacetime, he may see it as more of a power base and be more comfortable attempting to cultivate modest tensions for domestic political purposes (e.g., vis-à-vis Japan) than were his immediate predecessors. In the event of a crisis, however, he likely has greater ability to act rapidly and decisively to halt trends that he sees as inimical to Chinese interests, even if it requires making politically-difficult demands of the PLA.

That said, in this respect, Xi’s higher level of comfort with the PLA could prove problematic. If Xi allows or perhaps even quietly encourages a managed confrontation (e.g., with Vietnam or Japan), the encounter could very easily spin out of control. If this happened, the politics would shift from conversations with generals and admirals over whom he has comprehensive influence, to a broader situation in which a popular nationalist reaction creates nearly irresistible escalatory pressures as popular nationalist outrage places the government in a position where it must either (1) escalate the fight with the foreign “foe,” (2) back down and lose legitimacy, or (3) crack down severely on popular elements demanding government action (and thereby also lose legitimacy).

Political risks will temper reform measures

Another key characteristic dating from Xi’s early formative experiences is strong political caution even as he considers economic reforms pragmatically. His father’s being purged by Mao and sent to factory work in Luoyang when Xi was 10, and being jailed during the Cultural Revolution when Xi was 15, before he reemerged as a top reformer under Deng could only have been searing experiences. Xi himself was sent down alone to the Shaanxi countryside in 1969. All CCP leaders must protect their ‘left’ political flank to some extent, but Xi’s background and determination never to face the trials that befell his father impels him to do this more than most. Hence Xi’s Maoist rhetoric, vow that he would never become a ‘Chinese Gorbachev,’ and tightening of domestic security to a degree even greater of that under Hu’s administration.

With regard to the Third Plenum reforms, what is most significant is Xi’s early and apparently comprehensive consolidation of power. This may well have been facilitated by cooperation with Jiang in the unusually-significant and -late inter-factional jockeying preceding the October 2012 18th Party Congress. Xi was well-placed to organize and negotiate the articulation of what are overall a set of ambitious, sweeping reforms. Nevertheless, a significant challenge looms: even a leader as powerful and capable as Xi faces considerable complications endemic to China’s system that will make it extremely difficult to fully match rhetoric with implementation.

Areas of Special Concern

Areas of particular emphasis in the Third Plenum reforms include opening-up, ‘new type’ urbanization, and “Beautiful China” environmental conservation. Areas of opening-up include deregulation of government administration, liberalization of the financial system, and adjustment of the fiscal policy and taxation system. An overall approach is to use financial tools to “let the market play a decisive role in the allocation of resources” (要紧紧围绕使市场在资源配置中起决定性作用深化经济体制改革). This may involve reducing energy and land subsidies. Among other applications, “Beautiful China” is to be facilitated in part by increased market pricing of resource inputs. Another issue is “food security” which was explicitly singled out in recent CPCCC sessions. In the short-run, grain supplies appear bountiful, but this is certainly going to be a hot topic given the association between previous Party policies and famine. Finally, an anti-corruption drive appears targeted at recentralizing authority rather than addressing root systemic causes of China’s endemic corruption. Yet many of these areas were priorities of China’s previous generation of leadership under Hu-Wen. What will be different this time?

One difference is greater efforts to establish bureaucratic structures to facilitate implementation of the reforms. After all, a high-level bureaucratic footprint is one of the greatest indicators of prioritization and political power in PRC system. This includes establishing a Central Comprehensive Reforms Group, drawing in part on capabilities and responsibilities associated with the National Development and Reform Commission. According to China Daily, “Part of the new group’s duties, apart from economic reform, is to plan and carry out reform on modernizing China’s ‘governance system’ and ‘governance capability’.” The other major bureaucratic announced in the context of the Third Plenum is the establishment of a National Security Commission (国家安全委员会).[2] This appears intended in part to ensure a stable environment for the reforms, which will create temporary winners and losers even if they offer major positive-sum contributions in the long run.

Reforms’ Relative Prospects

As explained above, the key determinant of the reforms’ success and significance will be their actual implementation. It is therefore useful to review their relative prospects. Here, three major categories suggest themselves for progress over the rest of Xi’s term: (1) lowest prospects for substantive reform, (2) likely mixed results, and (3) greatest prospects for tangible achievements.

- Lowest Prospects for Substantial Near-Term Reform: State-Owned Enterprises

In the Third Plenum-related text, China’s SOEs are in many respects akin to the dog that didn’t bark. Here, lack of significant wording changes signals unwillingness/inability to implement meaningful reform in this key area. Efforts are clearly underway to separate the incentives, loyalties, and compensation of Party administration from executive management, but these strands remain extremely entangled. Given the high-level interconnection among Chinese political and economic elites and their families, this is hardly surprising. China’s ~120 large SOEs have become a textbook case of vested interests: an unholy alliance of 钱 (money) and 权 (power), including at highest central elite level.

Efforts to date have been a mixed, tightly-cinched bag. Under a drive toward equity ownership, “mixed shareholding” structures are promoted but state shareholders retain de facto control of the companies. This undermines reform by curtailing incentives to enhance corporate governance. Moreover, centrally-owned SOEs are partially paralyzed by the high-level anti-corruption investigations unleashed by Xi, with China’s national oil companies particularly affected due to their recent connection with Zhou Yongkang. In the energy sector, retail petrol and diesel fuel stations, as well as some CNPC pipeline assets, are being put up for sale. However, due to the underlying strategic nature and sheer size of these assets, most prospective buyers are state or state-controlled entities, which undermines the ostensible goal of bolstering economic efficiency and instead simply creates an additional layer of SOEs that future reform actions will have to contend with.

Meanwhile, the National Development and Reform Commission (NDRC) continues to set prices in key sectors such as refined products, coal, electric power, and natural gas. Elsewhere in infrastructure, the Ministry of Railways has been corporatized, with possible spin outs of regional railway bureaus and/or discrete operating companies such as Railway Express. “Experimental” market pricing of freight rates has been introduced in some jurisdictions. As in the energy sector, however, foreign investment is not welcomed. Ultimately, these types of “reforms” break up monopolies, but effectively create a situation where each elephant that formerly lived on the state-run farm has been replaced by four cattle or eight sheep, all of which are still state-controlled.

The SOEs’ economic heft in China is massive and their political clout—and thus ability to dilute and resist reforms not in their self-interests—is commensurate. Credit Suisse estimates that at the end of 2013, the total assets of non-financial SOEs were equivalent to 160% of China’s GDP. Even a leader with Xi’s capabilities would not want to expend his political capital goring politically-well-connected ‘oxen.’ The CCP seeks to maintain control, influence, positions, and profit even beyond key sectors with national security implications. The proof is in the pudding: Chinese airlines, banks and other SOEs continue to grow in size and geographic reach, often using obvious state subsidies.

At most, there are likely to be compromises among key interest groups, and an incrementalist, lowest-common-denominator approach. This is readily apparent even in the two areas where SOEs are envisioned to be linked to reforms.

The first is an eventual state levy on 30% SOE dividends. On the one hand, the SOEs are a known quantity and will have to make some ‘patriotic contributions.’ This will help fund the development of a welfare state (detailed in category three, below). Yet given the latitude for creative accounting as the State Owned Assets Supervision and Administration Commission (“SASAC,” 国务院国资委) deals with the SOEs under its supervision, this may well yield less revenue that one might think. To further their bureaucratic interests, SOEs will no doubt figure out how to shift some rent seeking from bottom line profits to top line cost items. There are many ways to ‘compensate’ employees, particularly at the top level, that need not show up on the books as such.

Second, there is a proposal to cut SOE executives’ salaries by as much as 70%. Such an action makes sense, given the fact that some SOE corruption already stems from the fact that managers’ official salaries are arguably far out of alignment with their actual value contributions, there will be costs to further decreasing incentives to profitability.

But it is not without potentially serious side effects. For instance, one immediate result may to make managers even more cautious and less innovative, as avoiding mistakes under their tenure is their surest guarantee of promotion to a better future assignment in China’s bureaucracy. It may also drive SOEs to compensate executives “in kind” via housing subsidies, payment of private school tuitions or to issue stock options or other “deferred compensation.” Either route opens ample avenues for malfeasance and continued corruption if the salary reforms are not coupled with meaningful improvements to oversight—such as creation of truly independent auditors.

The idea the SOEs can be subjected to market forces through closer association with other entities—including private capital—is similarly likely to play out more complexly in practice. SOEs remain the 800-pound gorillas in China’s economic ecosystem, so at very least they will shape the entities with which they are associated, not simply be shaped by them. Cross-shareholding among SOEs and collective and private ownership may extend the State’s control top-down at the expense of entrepreneurship and competitiveness having a chance to percolate up from bottom. Paradoxically, this could create a new wave of 国进民退 (“advancing of the state advances, retreating of the private sector”), and thereby further exacerbate the already serious problems caused by SOEs “crowding out” smaller, more dynamic private enterprises.

- Areas likely to see mixed results

China’s new leaders, particularly Li Keqiang, view continued urbanization as one of the few ways to ensure continued economic growth. Increasing rural property rights and possible creeping residence permit (户口, hukou) reform are logical ways to attempt to continue urbanization while preserving social stability. Indeed, a leading source of protests has been rural land appropriation and the impact on the environment of the polluting industries that are often developed on this land.

But urbanization is far from being a panacea for China’s structural economic problems. First, the rate of urbanization appears to be slowing. This development is in part driven by China’s troublesome demographic profile, where its rapidly aging population has highlighted the relative lack of younger workers and contributed to rapid wage inflation in many parts of the country. Essentially, fewer young workers means fewer potential migrants to cities.

Urbanization reforms highlights local officials’ vital role in successful implementation

Second, attempts at reforming China’s urbanization model highlight a broad challenge that affects all reforms proposed by the Xi government—the necessity of persuading local officials to truly and positively participate in policy implementation. In some ways local officials may produce greatest resistance: they are least efficient, with fewest alternatives, and the most to lose. How can the districts over which they preside remain solvent and meet growth and employment targets without their land sales tool, particularly as resources are likely to be continually diverted to keep SOEs’ official balance sheets acceptable?

The raw numbers show why local officials are so critical to implementation. China has ~3,200 local party leaders: 2,862 counties, 333 prefectures and 31 provincial-level divisions (not counting Hong Kong and Macau). The central government will likely attempt to reorient local leaders’ incentives by assuming more responsibilities of its own and thereby reducing ‘unfunded’ or ‘underfunded mandates.’ Even if tax reforms and other schemes are implemented to compensate for lost revenue, however, local officials are likely to be skeptical that this will fully meet their needs.

While local officials cannot defy their superiors outright, they nevertheless have their own sources of leverage, under the time-honored rubric of 上有政策, 下有对策 (“from above there is a policy, from below there is a countermeasure”). In many cases, they will be able to feign compliance while resisting, delaying, or slow-rolling implementation. They can benefit from strength in numbers: the central government cannot evaluate or pressure them all simultaneously.

Hukou reform faces similar obstacles. As an upgrading of welfare benefits for certain category(ies) of individuals, it will raise the cost of urban social services provision significantly; increased consumption will only partially offset this. If the central government does not clearly provide sufficient funding alternatives, there are likely to be some of the same problems of official resistance as with rural property rights.

Even if local officials can be made to see hukou reform as better than a zero-sum game, resistance from existing urban hukou holders is likely to be significant and a sensitive issue for the CCP. One of China’s greatest challenges lies in its sheer internal disparities—most dramatically, between coastal cities with major swathes of G7 living conditions and Third World hinterlands. In China and around the world, people at different stages of economic development typically have very different life priorities.

To a degree that is unusual for a country of its economic size and aggregate development, China contains individuals on virtually all conceivable rungs of such a hierarchy. Geographic segmentation of residential rights and benefits, through the hukou system, has been the CCP’s primary method to deconflict these contradictory expectations as much as possible and thereby avoid social unrest and challenges to its leadership. In effect, China has established different social contracts with individuals at different levels of its hukou hierarchy.

This is where a volatile challenge to hukou reform comes in. China’s relatively urban dwellers are some of the nation’s most privileged and globally aware. Part of the CCP’s bargain with them has been that in exchange for accepting limitations on specific areas of political expression and participation, they enjoy a protected position at the top of Chinese society. Implicit in this contract is that the present authoritarian system will protect them from hordes of needy peasants with very different priorities. Preserving urban privileges while expanding rural opportunity appears difficult.

Even if new hukou benefits are more modest in name and substance, there is likely to be urban opposition—witness local reactions to integrating an outlying district of Chongqing into the urban core. China’s leadership is clearly aware of these problems. Not surprisingly, hukou-related proposals appear extremely modest thus far. Top-tier coastal cities are not even under consideration. Modest pilot programs thus far appear to target cities of such low tiers that many rural hukou residents would not want to move there anyway—the opportunities available there are too modest to outweigh the limitations but relative security of a rural homestead and plot of land. Such a parcel has the added benefit that agricultural property rights are more easily claimed if and when genuine land reform ever occurs. For reasons such as these, few want to move to, or live in, T3/4/5 cities. They can hand out hukous all day, but it won’t accelerate real urbanization.

Other areas pose challenges as well. Reigning in bank lending will likewise be difficult. Major infrastructure investment continues, shifting in part from highways to subways. Anti-corruption actions will remain selective and symbolic. This will likely remain a high-end luxury goods suppression story (e.g., regarding expensive watches) at most. A major concern for Beijing, particularly if PRC conditions are expected to deteriorate, will be how to limit capital flight through Macau while safeguarding casino revenues, on which the local economy depends.

- Best Prospects for Reform: Where the CCP Can, and Must, Show Results

Despite the above areas of difficulty, there are also substantial opportunities for implementation of Third Plenum reforms. Xi Jinping will need to show results, making this ‘low hanging fruit’ particularly important to grasp. Substantial, decisive measures should thus be anticipated in several key areas.

- Opening the Welfare State Floodgates

As Xi Jinping and his generation of leadership seek to make virtue out of the necessity of economic slowdown, furthering their vision of improving living standards and a more just society while safeguarding social stability. Building a Chinese welfare state is thus an idea whose time has clearly come. Societal pressure will likely ensure that social responsibility is shifted upward from local governments to central government for national medical and pension coverage, as Yanzhong Huang has documented cogently, but doing so will divert tremendous resources from future economic growth and defense spending. Pension reserves currently stand at only about 2% of GDP and benefits are extremely small, especially in rural areas.

Social or Policy Housing is another societally-compelling idea that risks falling victim to political contradictions. As the recent Pledged Supplementary Lending (PSL) facility opened to China Development Bank for Shantytown (slum) Redevelopment illustrates, this is an area of serious policy effort. As with hukou reform, the political lowest common denominator of targeting numerous smaller cities where few want to live is likely to bolster official reports but underperform on the ground.

One of China most critical—and most underappreciated—challenges is the fact that it is getting gray and becoming unhealthy well before it becomes rich. There is an increasingly broad consensus that the rapid aging resulting in large part from decades of toughly enforced “One Child” policies will slow China’s economic growth relative to what it potentially could have been. Citigroup economists estimated in late 2013 that 3.25 percentage points could be shaved from China’s annual GDP growth over the next two decades as a result of rapid aging that leaves society top-heavy in terms of pension obligations and short of workers it needs to fully staff the economy.

In addition, a rising burden from chronic health conditions also threatens to weight on China’s economic growth prospects moving forward. To some extent, the full economic effects may be masked by the fact that rising healthcare expenditures still show up as positive GDP data. But the reality is that spending vast sums to treat patients with diabetes, heart disease, cancer, and other ailments is not as “productive” in terms of propelling sustainable growth as investment in technology, education, and other economic sectors would be.

To give a sense of the problem’s scale, China already has approximately as many diabetics per capita as the U.S., even though the Middle Kingdom’s annual per capita GDP levels are only a fraction of those in the U.S. Similarly, China is in the throes of a world-scale Alzheimer’s/dementia crisis. A 2013 study published in The Lancet estimates that China now has nearly 6 million Alzheimer’s patients and more than 9 million elderly suffering from dementia. For comparison, the Alzheimer’s Association estimates that the U.S., which has a much more developed (albeit still incomplete) mental health system than China, currently has roughly 5.2 million Alzheimer’s sufferers. When compared to the challenges and costs aging-related mental health issues pose in the wealthier U.S., it becomes clear just how serious a burden China faces.

To address these and other problems, the hospital system—and indeed the national healthcare infrastructure overall—badly needs investment and operational reforms, which could be driven by managers brought in by private investors. But for at least the next 3-5 years, private investment will likely come nowhere near the volumes of capital the sector needs. The reason? The legal status of privately invested hospitals is deeply unclear and private investors are likely to be very gun shy about entering a sector that is politically charged, and one in which the government may well turn private capitalists into scapegoats for any hiccups in reforming and attempting to improve the system. This is a deep irony because the government’s own missteps and failures to act when needed have helped create the gargantuan health and welfare challenges China now faces.

- Cleaning up the Air: Beautiful China

For a variety of reasons mentioned above, “Beautiful China” environmental conservation and resource pricing initiatives will be another area of significant achievement. First, China’s leadership realizes that the tremendous environmental damage wrought by three decades of meteoric economic development imposes an increasing toll on health and economic growth. Second, stemming environmental degradation has become a key objective for preserving CCP legitimacy. Pollution is an increasing source of both urban and rural protests. It is also one of the greatest disappointments of privileged urban dwellers, whose priorities have evolved to the point where they would support trading off economic growth for environmental improvement—a common dynamic that has driven the cleanup of other nations’ environments after they initially profited from developing their economies dirtily.

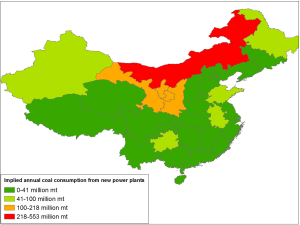

Third, environment and resource issues lend themselves to the sorts of statistical metrics, engineering solutions, and green technology development opportunities with which China’s technocratic leadership is comfortable and which its system is oriented to support. But environmentalists should not jump for joy just yet, as China is not killing the use of coal—it is simply shifting coal fired plants away from cities and clogged railway lines, and closer to the world-class thermal coal deposits in Central and Western China. Exhibit 2 (below) highlights this overall trend with data from the sometimes-optimistic World Resource Institute showing the amount of coal-fired generation capacity planned by province as of late 2012. Some specific data point have almost certainly changed on the margins, but this body of data reflects the core dynamic—coal will still grow for some time along with other energy sources. This is an especially important concept to consider given the fact that installing coal-fired capacity with significant capital investments now effectively “commits” the plants to emitting billions of tonnes of carbon dioxide over their operating lifetimes—which may be as much as 40 years.[3]

We have adjusted the data (originally in megawatts) to show how many millions of tonnes of additional coal per year will be needed to fuel these plants if they run at capacity.

Exhibit 2: China Planned Coal Power Capacity Additions, by Province (million tonnes’ coal demand)

Source: World Resources Institute, China SignPost™ analysis

The single biggest ‘deliverable’ from Third Plenum reforms in this regard is likely to be increased use of natural gas. This gas supply will come from four core sources (in descending order of anticipated importance): (1) pipeline gas from Central Asia, Myanmar, and possibly Russia, (2) liquefied natural gas (“LNG”), (3) conversion of Western China coal deposits into synthetic natural gas (“SNG”) and (4) greater domestic drilling.

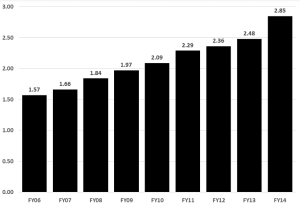

Previously, LNG consumption was constrained by relatively high prices and limited infrastructure, which produced periodic shortages, particularly in winter months and away from coastal import terminals. Now that natural gas offers one of the few ways to quickly, and substantially, offset air pollution, China’s government is supporting greater gas supply and use through pricing incentive schemes and constructing coastal LNG terminals and inland pipeline infrastructure. For example, China Gas, one of the country’s largest private city gas suppliers, has increased its gas prices for industrial consumers by approximately 82% since 2006 (Exhibit 3).

Exhibit 3: China Gas price for industrial consumers, FY 2006-FY 2014, RMB/M^3

Source: China Gas, China SignPost™ analysis

To temper its growing reliance on imported natural gas and help speed the switch from direct burning of coal to generate electricity, China is also working to increase output of coal-based synthetic natural gas. We estimate each billion cubic feet (“BCF”) of SNG produced will require ~85,000 tonnes of coal. In terms of import substitution, four million tonnes of coal could generate enough SNG to replace one million tonnes of LNG imports. To put the SNG sector into perspective, gasifying 1 million tonnes per day of coal would supply more than 1/3 of China’s current total natural gas needs. SNG by itself cannot replace other sources of supply, but it holds the potential to substantially reduce China’s dependence on imported gas and gives it a bargaining chip to use against Russia and other potential suppliers it is currently negotiating with.

SNG is not an environmental panacea, as the production process uses massive volumes of water and emits significant volumes of carbon dioxide. It also poses engineering challenges that are manifesting themselves as companies begin to ramp up SNG output. For instance, Datang Power had to shut down its Keqi plant for three months in early 2014 to repair corrosion in its gasifier units. The need for alternative gas sources is sufficiently great that we have high confidence Chinese producers will resolve engineering problems resulting from scaled up SNG production.

With respect to emissions, the bottom line is that CO2 will not restrain China’s push to make coal-based SNG a significant portion of the national gas supply. As we wrote in February 2014:

“Chinese leaders care the most deeply about emissions that are visible (smoke) or acutely toxic (sulfur, NOX, and mercury). Such properties increasingly generate local opposition, particularly in wealthy coastal cities where residents’ priorities have changed rapidly to emphasize quality of life over rapidity of economic growth. Greenhouse gas emissions—which produce global, not local, problems, are a very different story.

With respect to carbon dioxide (CO2), an odorless, colorless, and non-toxic gas, Zhongnanhai clearly emphasizes the economic and social benefits of stable, low-cost energy generated from domestic coal. China’s leaders will pay lip service to concerns about CO2 emissions, but the reality is that growth still wins out over green energy.

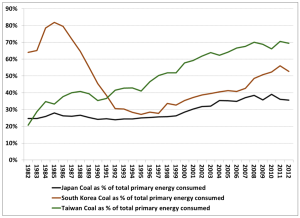

Other Asian industrial powers with significantly less imperative for all-out economic growth than China have already calculated that higher CO2 emissions are a price worth paying to maintain economic competitiveness. Since 2000, South Korea, Taiwan, and Japan have all significantly increased the share of coal in their power generation at the expense of nuclear energy (Exhibit 4).

In South Korea, coal use rose from 35% of primary energy consumption in 2000 to nearly 53% in 2012, while Taiwan boosted coal use from 57.7% of primary energy use in 2000 to 69.4% in 2012. Japan increased coal use from 28.5% of primary energy in 2000 to 35.6% in 2012, a trend that could continue with opposition to nuclear power.

It is especially telling that each of these Asian Tigers increased coal use relative to that of other fuels even after they had far surpassed China’s current per capita GDP level. This strongly suggests that leaderships of industrial powers in the region will readily prioritize affordable, secure electricity supplies over more abstract concerns about possible long-term effects of CO2 emissions. This is a classic ‘tragedy of the commons’ problem—individuals and societies tend to prioritize present parochial benefits over future collective goods.

Exhibit 4: Coal as % of Total Primary Energy Consumed in Japan, South Korea, Taiwan

Sources: BP, China SignPost™

Given that South Korea, Taiwan, and Japan are all representative democracies, it also suggests the populations supported greater use of coal because it was in their economic interest to do so.

Such regional evidence from societies far wealthier (and environmentally conscious) than China and ones in which the government must sell policy changes to citizens directly points to a future in which President Xi and his advisors continue supporting coal use—just in less air-polluting ways.”

On the visible air pollution front, reforms and technical development unfolding now are likely to have a substantial impact—particularly in China’s wealthier East Coast cities. However, on the carbon emissions front, change is likely to come much more slowly. The bottom line is that nuclear, wind, and hydro power cannot meet China’s call for affordable power in coming years unless significant new coal-fired capacity continues to come online each year.

Wind is inefficient and intermittent, requiring huge land areas and substantial thermal power backup ready to come online if the wind dies down. Nuclear power is a superb baseload electricity source, but China is not adding sufficient capacity for nuclear to significantly displace coal-fired generation. Even with the current aggressive reactor buildout, China is slated to add a maximum of 32 GW of nuclear power in the next five years—roughly half of the coal-fired capacity it has added annually in recent years. Moreover, this high-end number assumes that all reactors currently under construction are (1) actually built and (2) completed on time. Finally, hydropower is vulnerable to droughts and environmental opposition that is much fiercer and more locally-concentrated than coal plants face.

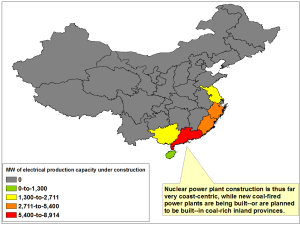

The nuclear plants currently under construction are also exclusively located in coastal provinces (Exhibit 5). This strongly suggests that coastal nuclear plants are simply displacing coal-fired generation capacity that is then effectively re-constituted further inland. Moreover, NIMBY opposition to nuclear plants may grow, particularly in the most affluent coastal areas.

Exhibit 5: China Nuclear Power Capacity Under Construction, by Province

Source: IEAE, WNI, China SignPost™

Gathering Slowdown and Dissipation: S-Curve Factors Setting In

One of the greatest challenges facing Xi Jinping and the success of the Third Plenum reforms is that even as overall implementation remains challenging over the next few years, larger structural factors are already beginning to slow China’s economic growth overall.

S-Curve Trajectory

China’s present growth trajectory may not be sustainable. The economic model that served China so well for the past three decades appears unlikely to propel rapid economic growth much longer. China already suffers from acute domestic problems, including resource (water) constraints, environmental degradation, corruption, urban-rural division, and ethnic and religious unrest; these may grow further and be combined with looming demographic and gender imbalances to strain both China’s economic development and internal stability. These problems could combine with rising nationalism to motivate Chinese leaders to adopt more confrontational military approaches, particularly concerning unresolved Near Seas claims. Rather than portending an impending “collapse,” however, these factors may herald China’s version of the same slowdown in national trajectory that has afflicted great powers throughout history.

As the American political scientist Robert Gilpin has documented, great powers tend to follow an “S-curved” trajectory in which the very process of growth and development sows the seeds for its eventual abatement. Initial territorial and institutional consolidation and infrastructure development underwrites rapid growth, fueled by cheap labor and resources. Particularly impressive results may be achieved if the government promulgates and enforces effective policies in the right areas, and stays out of the way in other areas. Eventually, however, a wealthier society demands increases in wages and social spending. Commitments abroad become unprofitable because of allied free-riding and collective action problems in public goods provision. Urbanization and improved living conditions change social mores and individual priorities, thereby reducing birth rates while life spans lengthen. However morally desirable any of these three trends may be, they all reduce the growth of economic and national power. If it does not fall in absolute terms, it levels out or at least slows.

While China may have limited its foreign commitments for now—and even abandoned forms of foreign aid that were burdensome to an impoverished China during the Cold War—it may be headed for rapid changes in the other two areas. In fact, the unleashing of Chinese society in 1978 after a century of foreign predation and internal turmoil and three decades of abnormally constricted individual possibilities and economic growth may have disguised the subsequent three decade economic boom—facilitated though it was by pragmatic policies and globalization—as a “new normal” when in fact it was an exceptionally-well-managed catch up period that cannot last. Indeed, this one-time funneling of national potential, which has produced urbanization of unprecedented scale and rapidity, coupled with the world’s greatest artificial demographic restriction (the “one child” policy) and dramatic internal disparities, may be sending China along the “S-curve” faster than any other major power has gone before. Any relaxation of one child policy comes too little too late for averting demographic slowdown. A new CASS report projects that by 2030, China will have world’s highest proportion of people over 65, higher than even Japan. China is already approaching a Lewis Turning point into a labor shortage economy. China may thus be further along the “S-curve” than many realize. A 2012 OECD report forecasts that India and Indonesia will surpass China’s GDP growth rate by 2020.

Even if implemented with the greatest success conceivable, some of the key reforms that Xi Jinping is proposing—and many of the most likely to garner popular support sufficient for their successful implementation—are themselves connected with potent S-curve factors, and will even accelerate and deepen their impact. Expanding China’s welfare state, for instance, will crowd out other forms of spending. One of China’s greatest strengths in recent years is its ability to obligate tremendous resources rapidly to programs for security, infrastructure, and technology development. Many of these programs are not seen as particularly efficient at yielding results commensurate with resources allocated, however. As competition for resources intensifies, ability to generate goods efficiently will face unprecedented tests. This is the central problem with “forcing growth” at ~7.5% of whatever target is specified. China is achieving this only through the accumulation of debt, which—while still moderate—is mounting very rapidly.

Not the Last Word, But…

Xi’s present efforts could conceivably help create political and security context for more difficult future reforms. But is that his intention, and if so can he pull it off? Specifically: Can China achieve an economic rebalance to avoid the middle-income trap that typically plagues developing economies before S-curve factors develop overwhelming momentum of their own?

It seems unlikely that the leadership’s goal of rebalancing to a domestic consumption-based economy sufficient to support a new growth model can be achieved. A true transition from government investment and manufacturing toward an innovative service economy would appear to require reforms that vested interests are likely to block and leaders are likely to view as being too politically risky.

The heart of the problem is that China’s leaders are beset with strategic ambivalence: they know what they need to do from an economic standpoint, but cannot do it fully because this would undermine their authority. Beijing cultivates notions of a “Chinese dream,” but cannot afford to allow individuals to define it for themselves—particularly in the public square. Faced with this dilemma, short-term stability to preserve the CCP’s power will always prevail. And true reform will always yield to strengthening the existing political-institutional order. Even the dynamic Xi-led leadership is thus likely to muddle through some of the most difficult areas, leaving insufficient progress before S-curve slowdown factors become increasingly limiting.

As Larry Summers warns, it would be a mistake to fall for “Asiaphoria.” Given these realities, “Chinaphoria” is a sort of irrational exuberance that should be particularly avoided.

**The authors thank two anonymous China political risk and investment experts for helpful inputs.

[1] Nan Li, Chinese Civil-Military Relations in the Post-Deng Era: Implications for Crisis Management and Naval Modernization, Naval War College China Maritime Study 4 (January 2010), http://www.usnwc.edu/Research—Gaming/China-Maritime-Studies-Institute/Publications/documents/China-Maritime-Study-No-4-January-2010.aspx.

[2] Joel Wuthnow, “Decoding China’s New ‘National Security Commission’,” CNA China Studies (November 2013), CPP-2013-U-006465-Final, http://cna.org/research/2013/decoding-chinas-new-national-security-commission.

[3] For more on this emerging mode of thought, please see the work of two eminent climate scientists from UC Irvine and Princeton who pioneered the idea. Stephen J. Davis and Robert H. Socolow, “Commitment accounting of CO2 emissions,” Environ. Res. Lett. 9 (2014), http://iopscience.iop.org/1748-9326/9/8/084018/pdf/1748-9326_9_8_084018.pdf.