Wyoming and Montana have the reserves and production to become significant coal suppliers to China and East Asia but need access to large port capacity on the U.S. West Coast in order to compete on price with coal from Australia and Indonesia.

Jero Wacik, Indonesia’s Energy and Minerals Minister, announced in early June that Indonesia needs to restrict future coal exports in order to preserve supplies for its rapidly growing domestic economy. President Yudhoyono’s plan to end all raw metal ore exports by 2014 and refine them locally will be one factor behind reduce coal export ability.

Indonesia’s ambitious plan could require as much as 1 gigawatt of extra electrical generation capacity—which could consume more than 5 million tonnes per year of coal. And with Indonesians buying more appliances and other power-hungry goods, residential electricity demand is growing as well, providing an additional factor that will trim Indonesian coal export potential.

With Indonesian export caps looming, China will face gaps as its exports rise because Indonesia is the world’s largest seaborne thermal coal exporter and has been one of China’s largest thermal coal suppliers. But a solution is already in sight: imports from Wyoming and Montana. Wyoming Gov. Matt Mead visited China in June 2012, in part to explore the potential for marketing coal from Wyoming, which by itself is one of the world’s largest thermal coal producers. Montana, too, is a major coal producer that is looking to export. Montana Governor Brian Schweitzer visited China in June 2011 to promote his state’s coal, wheat, beef, and tourism.

China may import as much as 250 million tonnes of coal during 2012 (coking and thermal coal combined), according to local sources. As such, Wyoming and Montana coal miners have a solid opportunity to market their low-cost, clean burning powder River Basin coal to power plants in Coastal China.

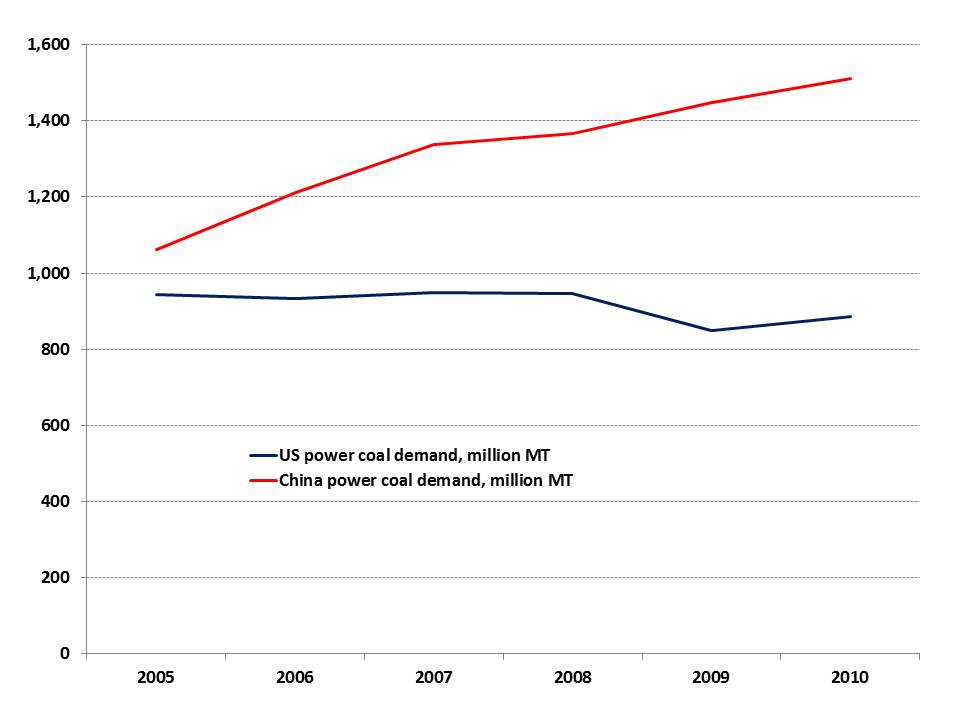

Coal producers in the Powder River Basin (“PRB”) of Wyoming and Montana have increasing reason to explore exports to China, as the U.S. power generation sector—by far and away the country’s largest coal consumer—saw demand fall by 1% between 2000 and 2010, while demand for coal in China’s electric generation sector surged by 163% during that same time to more than 1.5 billion tonnes per year (Exhibit 1).

Exhibit 1: U.S. coal demand for power generation is falling while China’s is rising substantially

Million tonnes per year

Source: EIA

PRB coal supplies can compete economically with a substantial portion of Chinese domestic thermal coal production. This is particularly true in the markets of East and Southeast China (such as Shanghai and Guangdong), where domestically produced coal faces long and expensive journeys by rail and then must be transshipped by coastal vessel or barge to reach the final end users.

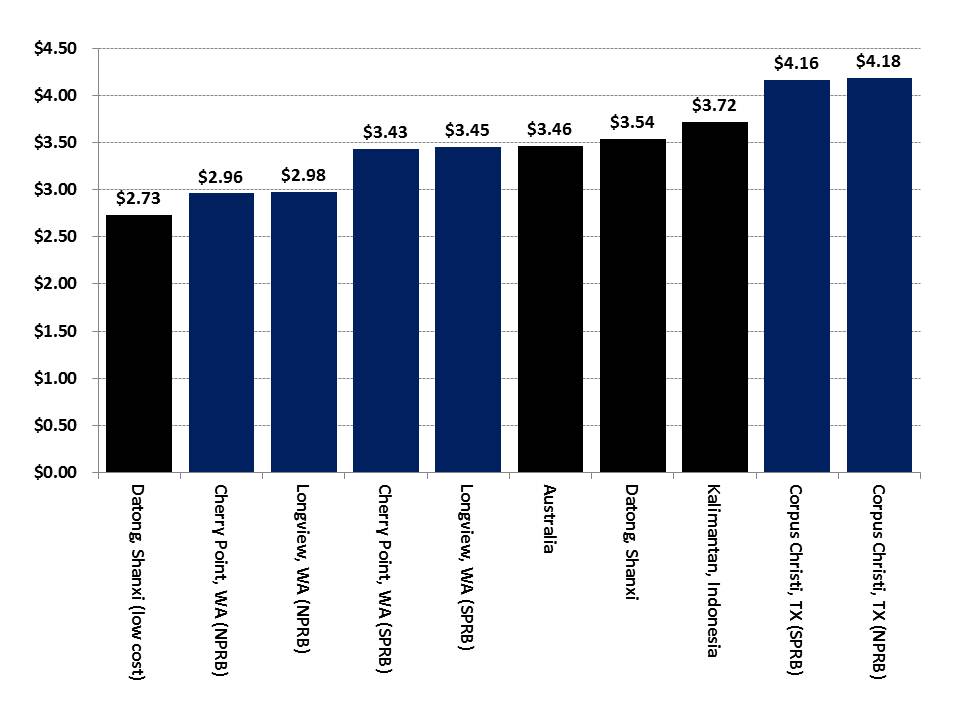

Our model suggests that coal from the Northern PRB exported from ports in Washington state can be delivered to Shanghai at a slightly lower cost per million BTU than coal from Shanxi in Central China, which must be railed to Qinhuangdao and then shipped down the Chinese coast to Shanghai (Exhibit 3B). The PRB coal would have an even larger cost advantage in more southerly Chinese coastal coal demand areas, such as Guangzhou.

Coal from the Northern PRB is more cost-competitive in Asia than coal from the Southern PRB

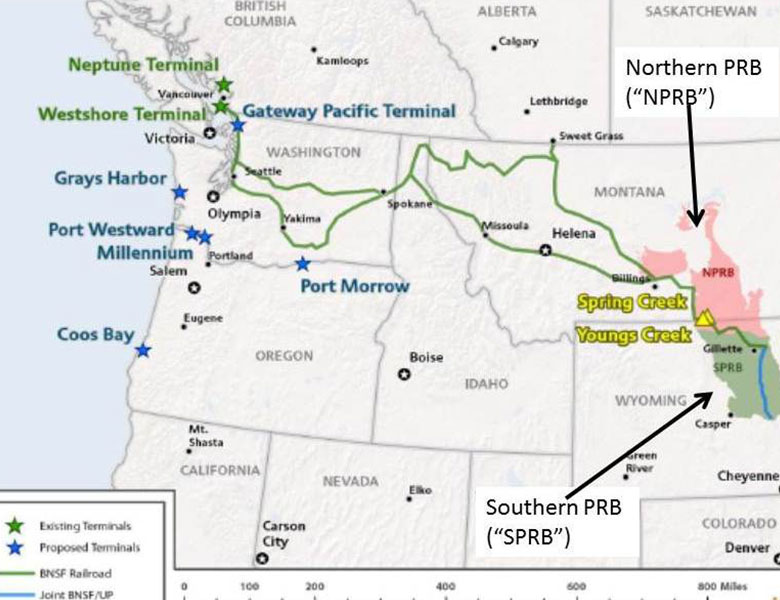

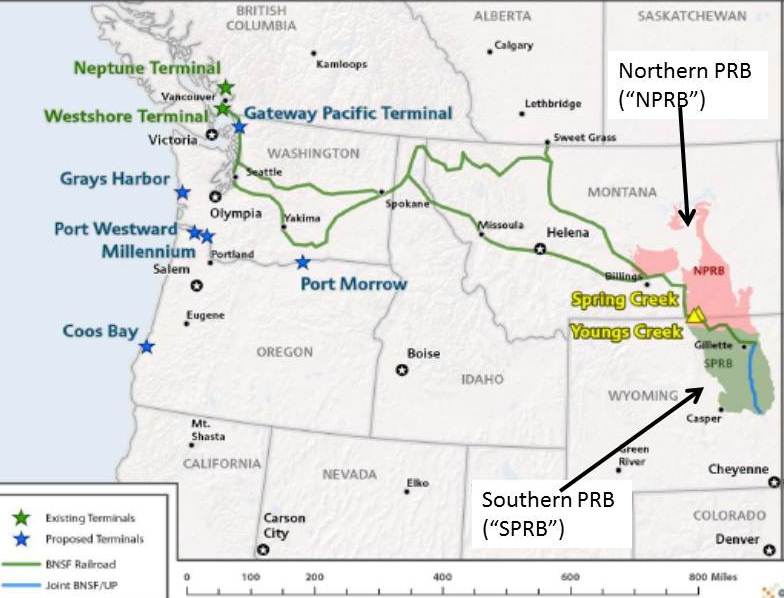

We estimate that coal from the Northern PRB will be substantially more price competitive than coal from the Southern PRB in Asia against coals from Queensland (Australia) and Kalimantan (Indonesia). Exhibit 2 shows the location of the PRB and its northern and southern halves. Miners who are more focused on the Northern PRB report substantially lower production costs per ton of coal mined than those focused on the Southern PRB do. In addition, the coal also has to travel several hundred fewer kilometers by rail in order to reach the ports.

Exhibit 2: PRB location and the Pacific ports coal could be shipped from

Source: Cloud Peak Energy

Northern PRB coal could be delivered through the planned Gateway Pacific port at Cherry Point, Washington at a price of as little as US$2.96 per million British Thermal Units (“BTU”) to the port of Qinhuangdao in Hebei Province, China’s largest seaborne coal handling port. As such, the northern PRB coal would have a delivered cost roughly 17% lower than that of thermal coal from Queensland and 26% lower than that of Indonesian coal from Kalimantan (Exhibit 3A, 3B).

Exhibit 3A: Estimated delivered costs per million BTU to Qinhuangdao

Exhibit 3B: Estimated delivered costs per million BTU to Shanghai

Sources: Company reports, Platts, Reuters, Authors’ estimates

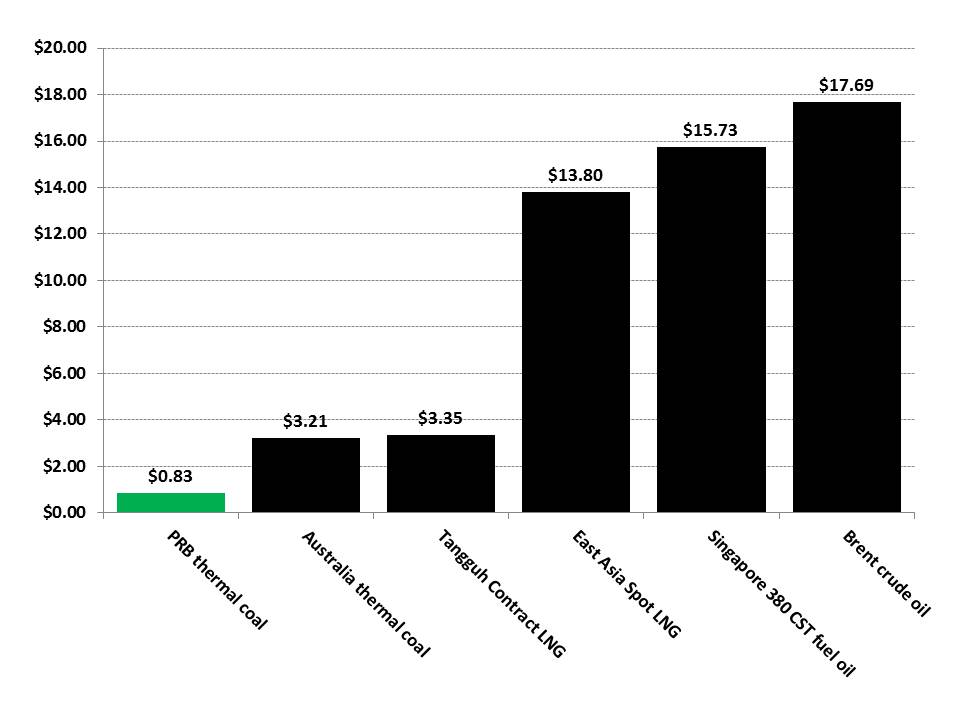

In comparison to other imported fuels—such as LNG from Indonesia now being sold at US$3.35 per million British Thermal Units (MMBTU)—PRB coal looks cheap at US$0.83/MMBTU. Asian spot LNG prices are closer to US$14/MMBTU and crude oil and fuel oil prices are higher still (Exhibit 4). Coal is of course not the only option for an imported fuel, but for baseload applications such as power generation, Wyoming and Montana’s cheap, clean thermal coal offers substantial economic and environmental benefits.

Exhibit 4: PRB coal vs. competing fuels delivered cost to China (Sep. 2012)

USD/MMBTU

Source: Company reports, EIA, Platts, Reuters

For the next 3-5 years, exporters need Gulf Coast and Canadian ports to get PRB coal to Asian markets

The economics-driven market potential is high for U.S. producers to significantly increase their coal exports to China and other Asian markets. While the economics are favorable for shipping PRB coal to China, aspiring coal exporters face a steep uphill slog against environmental groups who oppose coal exports on a number of grounds. The U.S. Pacific Northwest is closest to the PRB coal producers, but also has the most vociferous environmental opposition to coal exports.

Based on the strength of opposition to coal exports, we think the earliest point at which U.S. Pacific coast terminals might become meaningful coal exporters is in the 2015 timeframe, and actual export momentum will likely begin later than that. Meanwhile, the U.S. Gulf Coast and Canada’s Pacific coal ports will be the key points at which expanding capacity and a relative lack of environmental opposition will coincide to allow increased exports of PRB coal to the Asian market. Perhaps progress and profits there will ultimately spur development in the Pacific Northwest.

U.S. coal producers may be able to access nearly 300 million tons per year of nameplate port capacity by 2015, but the regional spread of these terminals means that the large ports on the U.S. East Coast may not be economically feasible for PRB coal exports given the long and expensive rail journey required to move the coal from Wyoming to Mid-Atlantic ports.

Canada’s Pacific coal ports are favorably located for PRB coal exports, but their capacity is already largely booked, which leaves only a small fraction of the capacity PRB producers need to access for the Asian market to become a viable alternative to declining U.S. domestic markets. The U.S. Gulf Coast, accessible and lacking significant environmental or political opposition to coal exports, will likely seize the resulting opportunity.

However, the extra costs imposed by the Panama Canal passage make coal cargoes much less competitive in Asia than they would be if exported from the Pacific Coast of the U.S. or Canada. Also, PRB exports through the Gulf Coast must compete for terminal capacity with exports from Colorado/Utah and the Illinois Basin, which produces a higher heat-content coal grade.

Implications

1) The U.S. thermal coal export volumes will hinge on a number of factors. First, how U.S. natural gas prices move as more gas-fed petrochemical capacity comes online in the U.S. and drilling programs provide a better sense of just how much gas is available at specific price thresholds from different shale plays. Second, how harshly U.S. environmental regulators will treat proposals to construct and refurbish coal-fired power plants. Third, how the U.S. carbon and emissions taxes environment evolves.

2) U.S. thermal coal export potential will also depend upon how wage and cost inflation in Australia and Indonesia affects those countries’ coal production costs relative to the U.S. PRB coal producers. Australia has suffered from especially-rapid cost inflation in its mining sector, but the recent decisions of major miners like Rio Tinto and BHP Billiton to scale back projects due to weaker commodity demand could reduce inflationary pressures.

3) U.S. rail companies will need to invest in greater rail capacity leading from the Powder River Basin into export ports in Washington and the Texas Gulf Coast.

4) If environmental opposition impedes major U.S. West Coast coal terminal development, U.S. producers could consider investing in, or reaching strategic agreements with, Canadian Pacific Coast terminal operators in order to secure additional export capacity.

5) Greater coal exports from the Powder River Basin may erode China’s future LNG demand.

6) If PRB coal exports to China move forward in a big way, Wyoming and Montana could become some of China’s largest trading partners among the U.S. states. The traditional U.S trade pattern has seen states such as Washington and California with large manufacturing sectors become the largest exporters to China (please see China SignPost 33). Now, with China’s rising import demand for raw materials such as coal, commodity-producing Rocky Mountain states stand to gain substantially if port capacity can be found to move low-price, low-sulfur PRB coal into the Chinese and Asian market.