Beijing is likely to come under more significant pressure to implement stimulus measures as key parts of the consumer economy slow. With growth remaining lethargic in the U.S. and Euro zone, China’s consumers are badly needed to pick up the slack. But the data over the last two quarters suggest that China’s consumer class is also becoming a bit less sure about the future, and guarding their wallets accordingly.

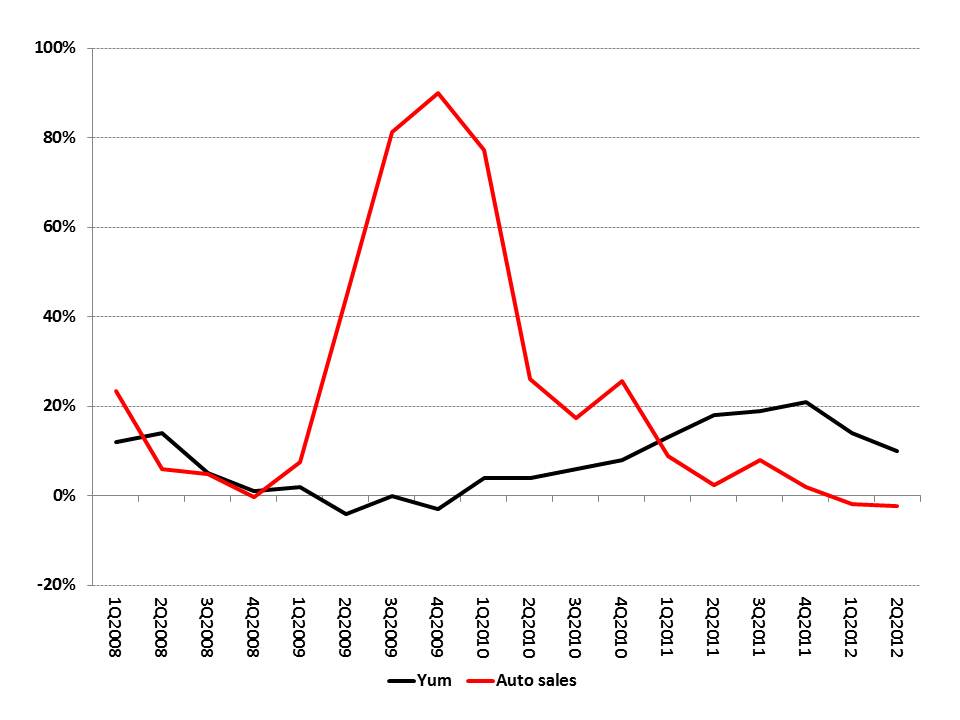

For big ticket items, passenger car sales declined by 2% year-on-year (YoY) in the first quarter of 2012 and fell by 2% YoY in the second quarter as well (Exhibit 1). As for small ticket items, Yum Brands has seen same store sales growth slow over the past 6 months. Same store sales growth of 10% would be a great quarter in the U.S., but for the past five quarters, Yum’s same store sales grew at an average rate of 17% YoY.

Exhibit 1: Chicken and Cars both see slowing sales YoY change by quarter

Source: Yum Brands, CAAM

Yum’s sales slowdown concerns us because the company sells productsall over China products are that are priced to suit the lower middle class consumers who still are not able to buy cars, but are happy to eat out a few times per week. As we said in February 2012:

Shoe and sporting apparel sales are also taking a tumble

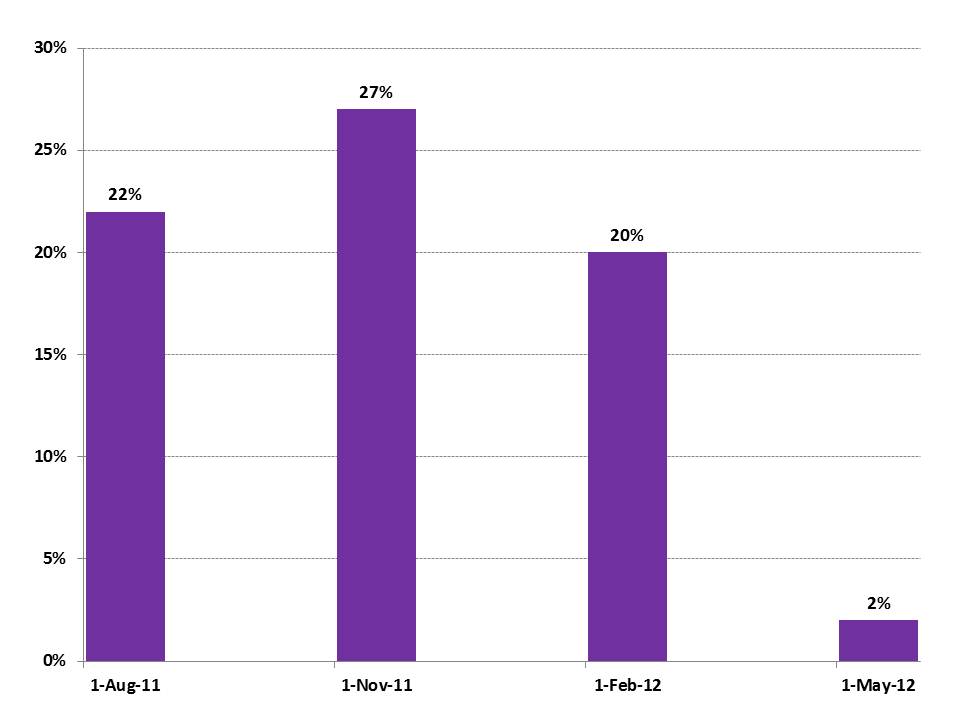

Exhibit 2: Nike futures orders in China

YoY change, by quarter

Source: Nike

While Nike’s sales climbed 10% in its second reporting period of 2012, it is unsettling that futures orders—a good indicator of what store managers think customers’ demand will be—fell off a cliff in the second quarter of 2012. After rising by 20% or more each quarter between August 2011 and February 2012, Nike’s Greater China futures orders managed only a 2% increase in the last reported quarter (Exhibit 2).

The slowdown in sales of key consumer goods is a telling element of today’s larger China market story: growth that might seem reasonable or even impressive in mature Western economies, but that is a significant comedown from China’s largely pedal-to-the-metal growth since reforms began in 1978. The Chinese Communist Party’s legitimacy and policies revolve around robust economic growth and the slowdown poses a major challenge for China’s fifth-generation leadership, poised to assume power at the 18th Party Congress this October.

The old growth model that worked so well in many ways for the past three decades has largely run out of gas, a new model based on greater consumer demand will be hard to implement because of strong vested interests that join political and economic power to degrees unparalleled in the West, and global demand for Chinese exports appears likely to remain disappointing for at least the next 12 months. Major policy changes in Beijing are unlikely as everyone waits for China’s next paramount leader, Xi Jinping, to consolidate power and build consensus behind the policies he will pursue.

Implications

China’s continuing consumer slowdown spells volatility for global farm commodity and crude oil markets, which are being depressed by drought, economic weakness in the U.S., and ongoing turmoil in the Euro Zone. It also promises to undermine electricity and coal demand in China, as factories slow down and consumers purchase fewer power-hungry appliances.

Indeed, electricity generation and consumption, widely regarded as relatively reliable (and hard to manipulate) if imperfect indicators, were weak in June 2012, with power production flat (YoY) and power consumption up by 4.3% YoY, as opposed to the 13% growth in power consumption reported during June 2011. In this vein, market watchers should not be deceived by rising Chinese seaborne coal imports, as these are currently being driven more by rising production costs and inland transport bottlenecks in China than they are by actual net demand growth.

We believe that because of the political succession period coming up for both China and the U.S., major pro-growth policy steps will be tough sells politically, with political gridlock and policy paralysis reigning in the meantime. At least two quarters of stagnant economic growth in the U.S. and China and sideways-to-mildly-downward macro-level commodity market movements are in the offing. Quarters are the appropriate increment by which to analyze these markets, because the China passenger car, coal, and farm commodity stories—which we believe in over the next 5 years—are cyclical beasts and looking from month to month fails to provide adequate analytical context.

Beyond the current Chinese consumer downdraft, the next 12-18 months of car, chicken, and shoe sales will reveal what the “new normal” of Chinese consumer behavior is likely to look like. And from that, the forces likely to shape key global commodity markets will become clearer. From around the world to within the corridors of power in Beijing, everyone is waiting to see what will happen—the stakes are high for all concerned.

About Us

China Signpost™ 洞察中国–“Clear, high-impact China analysis.”©

China SignPost™ aims to provide high-quality China analysis and policy recommendations in a concise, accessible form for people whose lives are being affected profoundly by China’s political, economic, and security development. We believe that by presenting practical, apolitical China insights we can help citizens around the world form holistic views that are based on facts, rather than political rhetoric driven by vested interests. We aim to foster better understanding of key internal developments in China, its use of natural resources, its trade policies, and its military and security issues.

China SignPost™ 洞察中国 founders Dr. Andrew Erickson and Mr. Gabe Collins have more than a decade of combined government, academic, and private sector experience in Mandarin Chinese language-based research and analysis of China. Dr. Erickson is an Associate Professor at the U.S. Naval War College’s China Maritime Studies Institute (CMSI) and an Associate in Research at Harvard’s John King Fairbank Center for Chinese Studies. Mr. Collins is a law student at the University of Michigan Law School. His research focuses on commodity, security, and rule of law issues in China, Russia, and Latin America.

The positions expressed here are the authors’ personal views. They do not represent the U.S. Naval War College, Navy, Department of Defense, or Government, and do not necessarily reflect the policies or estimates of these or any other organizations.

The authors have published widely on maritime, energy, and security issues relevant to China. An archive of their work is available at www.chinasignpost.com.