Chinese consumers are rapidly changing their diets as disposable income rises and fast food items from Western companies like Yum Brands are playing a centerpiece role in the shift. The company reports that it now operates in more than 700 Chinese cities. Importantly for policymakers and investors alike, Yum’s China menu is, with the exception of breakfast, dominated by meat-intensive items. As such, the burgeoning growth of Yum and other fast food sellers in China highlights how meat-hungry Chinese consumers are likely to help sustain a global boom in demand for corn, wheat, chicken and other agricultural commodities for some time to come.

Iron ore and base metals may be under the gun as construction slows down in China, but with China’s domestic farm sector already hard pressed to feed the country, continuing demand for grain-intensive meats is great news for farmers in breadbaskets like Brazil, Argentina, the U.S., and Ukraine. At the same time, higher food prices are bad news for Chinese policymakers who are attempting to restrain inflation while still maintaining reasonably robust economic growth rates.

Theme 1: Changing food consumption patterns have penetrated deep into China and more people eating meat-rich dishes helps affirm the durability of a China-driven global agricultural boom.

Meat-rich, high calorie dishes are now increasingly affordable to the average person in many parts of China. In Changsha, for instance, the average annual income is now more than US$3,500 per year. As such, a KFC sandwich meal combo that the company currently prices at roughly US$4.44 is not quite as comparatively cheap as it is in the U.S., but affordable nonetheless.

This affordability has helped fast food take hold countrywide. Indeed, only about 25% of Yum Brands’ nearly 4,000 restaurants are in the large first tier cities such as Beijing and Shanghai. Nearly 1/3 of the company’s outlets reside in Tier 4-6 cities that few people outside of China know exist, even though they may be home to nearly a million people each.

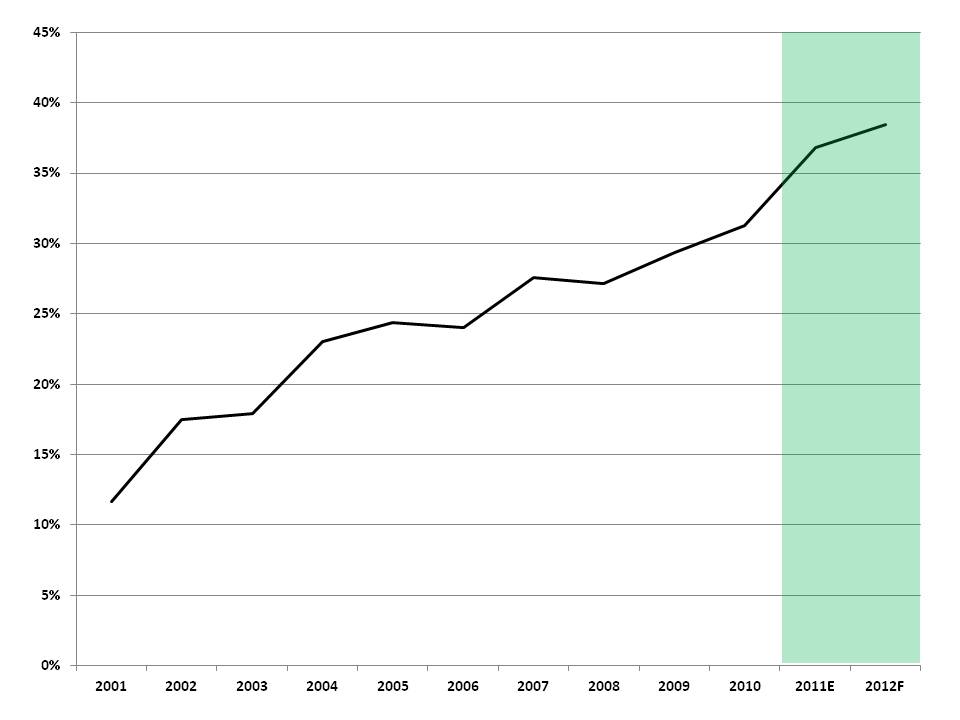

And the company continues to spit out new restaurants at the rate of more than one per day. Of Yum Brands’ new restaurant openings, more than 1 in every 3 now occurs in China—more than twice the proportion just a decade ago (Exhibit 1).

Exhibit 1: Outlets in China as proportion of Yum Brands’ total global restaurant openings

% of new restaurants opened, by year

Source: Yum Brands, China SignPost™

As Chinese diets become more meat intensive and land and water more scarce, the country’s farm sector will likely not be able to keep up with rising grain demand. In 2011, road and rail projects likely took an estimated 700,000 hectares of arable land out of use, according to China Daily. This would be enough land to produce 3.7 million tonnes of corn at China’s average corn yield over the past 5 years.

China is also short on water. Local experts such as Zheng Chunmiao, director of Peking University’s Water Research Center, say that China needs to begin reducing water consumption or it will face dire consequences within 30 years. Given that agriculture accounts for more than 60% of China’s water consumption, a logical step would be to either increase water prices or enact administrative restriction on use. Both options would likely reduce domestic grain production and force the country to import more staple grains. China would also likely have to import larger volumes of edible oils, such as palm oil, for which it is already the world’s second largest importer.

Increased grain imports strike a deep nerve among China’s leaders, who have a keen sense of history and know how quickly chaos can ensue when food supplies prove inadequate. Our research indicates that of 17 major dynastic periods in China, famine played a major role in catalyzing dynastic declines and collapses in five instances: the Xin, Han, Tang, Yuan, and Ming dynasties.

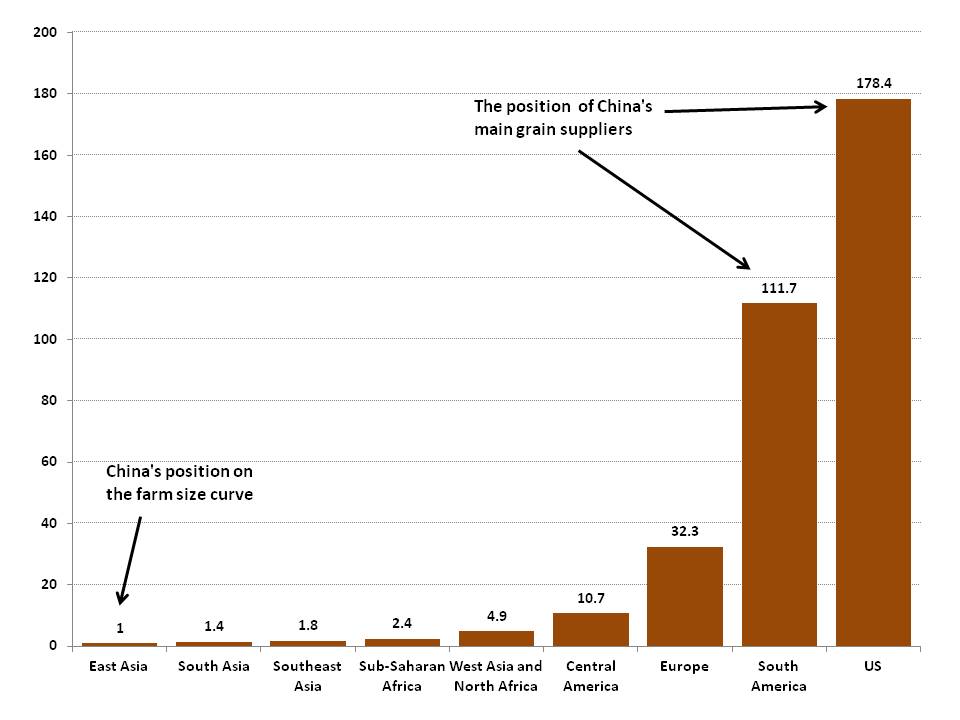

Finally, China’s small farmers cannot compete with large industrial grain growers in Brazil, Argentina, and the U.S. Size matters in the farming world and the economies of scale that an average farmer working nearly 280 hectares in the U.S. and 112 hectares in South America are simply unattainable for their Chinese counterpart, who typically grows crops on a mean size of 1 hectare (Exhibit 2). In practice, this suggests that even the larger Chinese grain farms will be much smaller and more manpower-intensive than a Midwestern U.S. farming operation that may be nearly 1,000 hectares in size and achieves a wage cost-to-acreage ratio that Chinese farms will find hard to match, especially as wage inflation continues.

Exhibit 2: Mean size of Chinese farms versus those of other regions

Hectares per farm

Source: World Bank, China SignPost™

Theme 2: China is becoming a fast food nation before it becomes a rich one that can afford to address the health problems that often result from diets rich in high fat, processed foods.

Yum Brands now opens more than twice as many new restaurants per year in China as it does in the U.S., formerly its core market. Yum’s China outlets are also more profitable than the company’s global average, and have higher sales per outlet. The firm reports that its China outlets average US$1.7 million per year in sales each—nearly 55% higher than its global average sales volume per outlet.

Yum’s high sales volumes per restaurant suggest Chinese consumers’ taste for eating out continues to rise robustly and points to higher healthcare costs from chronic diseases such as diabetes, which already afflicts roughly 10% of Chinese adults—almost identical to the U.S. rate of 11%. China is now has roughly 92 million diabetes sufferers, the largest number of any country. The true costs of diabetes on China’s economy from productivity losses are probably now close to 1.5% of GDP.

Theme 3: Sales data from fast food vendors give insights into how China’s growing consumer class might respond to an economic downturn.

Quarterly changes in same store sales can be used as a proxy for consumers’ willingness to spend under various economic conditions. Consumers who decide to forego a 20 RMB (US$3.17) outlay for lunch are unlikely to buy clothing, furniture, and other items that are more expensive and less fundamentally necessary than eating is.

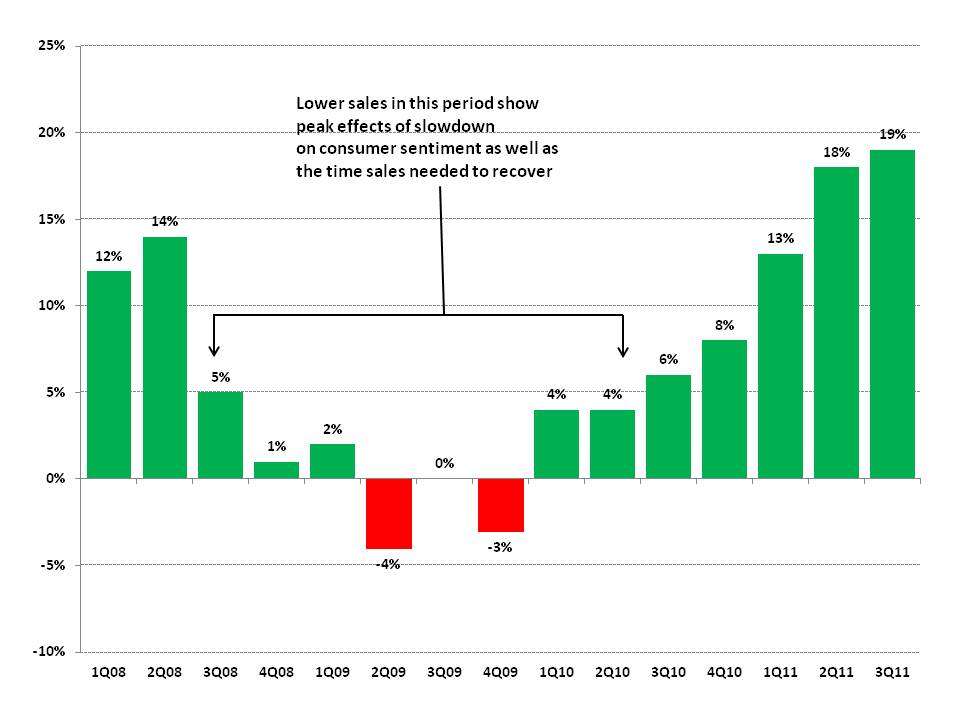

Yum’s sales in China responded quickly to the onset of the 2008 financial crisis, expanding only 5% in the 3rd quarter after growing 14% in the 2nd quarter (Exhibit 3). Once the full decline set in during the winter of 2008, sales continued to fall and then took over 18 months to recover. Bear in mind that in the 4th quarter of 2008 China’s economy grew at the slowest pace of the prior seven years (6.8%) and that growth in 2008 was “only” 9% in the wake of a 13% growth year in 2007. In 2012, growth is likely to moderate, but not drop-off as it did between 2007 and 2008. Barring an unexpectedly hard landing, consumer sentiment is likely to remain reasonably optimistic.

Exhibit 3: Quarterly changes in Yum Brands same store sales in China

% change year-on-year

Source: Yum Brands, China SignPost™