China will likely import 3.0 million tonnes of corn in the 2011/12 market year, more than triple the amount it took in 2010/11 (USDA). As Chinese consumers eat more meat, China’s corn imports are likely to evolve along the trajectory of its soybean imports, which have risen fourfold in the past decade. Because of rapid, highly polluting industrialization and other development, China’s progressively diminishing arable land and clean water base is already almost fully utilized.

As a growing consumer economy demands more grain, China’s transport and infrastructure boom is helping to erode the country’s already thin arable land base. In 2011, road and rail projects took an estimated 700,000 hectares of arable land out of use, according to China Daily. This would be enough land to produce 3.7 million tonnes of corn at China’s average corn yield over the past 5 years.

The likelihood that corn production will receive a higher priority than the cultivation of other essential grains such as wheat and rice in China is low, effectively placing a ceiling on the country’s potential for boosting corn production. Nationally, China harvests nearly as much corn acreage as the U.S. (31.5 million hectares vs. 32.9 million hectares in the 2010/11 crop year), yet only manages to produce about half the tonnage of corn grown in the U.S.

Chinese farmers’ corn productivity, as measured in tons per hectare, has remained relatively stagnant over the past 20 years at a rate roughly half that of the U.S., which now produces nearly 10 tons per hectare. The yield gap suggests that U.S. farmers have a strong competitive advantage vis-a-vis their Chinese peers and that increased corn exports from the U.S. to China make economic sense.

The U.S. and Argentina are the largest global corn exporters, respectively, and are well situated to capitalize on Chinese consumers’ growing taste for corn-intensive meat. Corn farmers in Iowa, Nebraska, and Cordoba can look forward to exporting more corn to China as the inhabitants of Shanghai, Zhengzhou, and countless other Chinese cities put more meat dishes on the table.

How meat consumption is driving corn demand in China

Over the past 20 years, China’s per capita pork consumption has grown at an average of 3.4% per year, while per capita demand for chicken has risen by more than 8% annually. In the 2010 crop year, roughly 70 of every 100 tons of corn used in China were used for feed, according to the USDA.

Growing meat demand in China is driving consolidation in the meat industry that will gradually shift an increasing proportion of Chinese swine and poultry farming to large industrial farms that rely exclusively on grain-based feed, as opposed to the waste and scrap that many animals receive on small farms. At present, such small farm meat production effectively happens “off the books” as far as the global grain market is concerned.

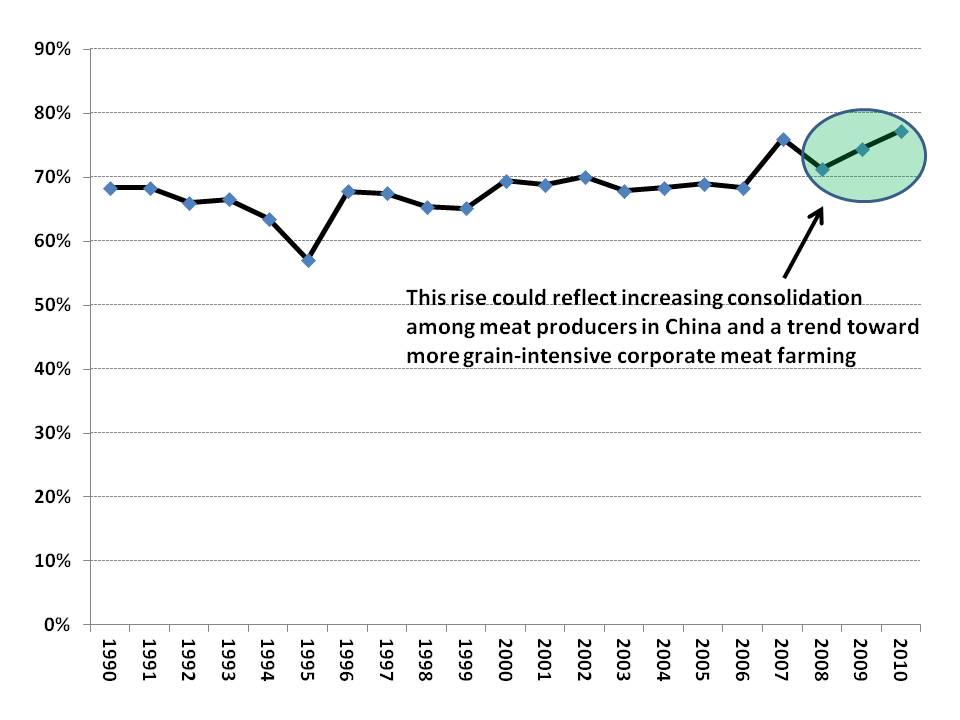

Over the past three years, however, the ratio of China’s reported feed grain demand to the total grain amount that would be required if all pork and chicken consumed in China was grain-fed has risen steadily, moving from 71% in 2008 to 77% in 2010 (Exhibit 1). The rise could be due to improved official data gathering, but given China’s centuries-old tradition of detailed agriculture record keeping (albeit with tragic lapses during years of Maoist excess, as detailed in China SignPost 22), we suspect the data reflect a slow but steady migration of animal production from family farms to grain fed corporate farms like those run by Yurun, a major Chinese pork producer.

Exhibit 1: Ratio of reported feed grain use to demand implied by total pork & chicken production in China

Source: USDA, China SignPost™

Note: Pork and chicken are used as the primary proteins displayed in Exhibit 1 because pork demand in China has risen 30% since 2000 and chicken demand has risen 37% in the same time, while beef is not a major part of the Chinese diet and consumption has risen by only 8% on a much smaller base volume.

Implications

1) In the carbs versus protein fight, corn imports (carbs) will likely win out over fresh meat imports (protein). Directly importing fresh meat could displace a substantial chunk of corn imports, as producing 100lbs of boneless, skinless chicken requires 207 lbs of corn while producing 100lbs of boneless, skinless pork would require 448lbs of corn, according to Tyson Foods. China has shown some willingness to import pork and chicken, but our data analysis suggests that fresh meat imports are likely to remain marginal and that for food security and job creation reasons, Beijing would prefer to see companies like Yurun build a larger and more efficient domestic meat value chain. Even if the government blesses substantially increases in fresh meat imports, domestic meat production using imported grain is still likely to be treated as the more attractive option.

2) Rising meat consumption will not replace the use of other staple grains—it will simply augment them with more protein on the plate. Many domestic and foreign analysts estimate that in the next five years, China’s corn imports are likely to more than triple from the 2011/12 level. As meat occupies a larger portion of the Chinese diet, it is likely that meat will not necessarily replace wheat and rice on plates in Shanghai, Chongqing, and other places. Rather it will augment consumption of staple grains. As such, rising corn consumption will slow wheat and rice demand growth in China, but will likely not erode it nearly as much as some observers expect.

3) The U.S. and Argentina, the world’s largest and second-largest corn exporters, respectively, are the countries best placed to capitalize on China’s rising corn import needs. Biofuel policies in each country will be key determinants of how much extra corn will be potentially available to export and supply China’s hunger. Argentina’s exportable corn supply has grown much faster than that of the U.S. to date, but ambitious plans to boost corn-based ethanol production in Argentina could constrain corn export growth potential in coming years. Likewise, stabilizing motor fuel demand in the U.S and less support in Washington for ethanol subsidies could increase exportable corn supplies.

Bottom Line: The U.S. is the longstanding number one global corn exporter, and in the past 10 years has also become a major meat exporter (pork and chicken). Whether China ultimately chooses to import more corn, more fresh meat, or balance the two, U.S. agriculture will be a winner. If China prioritizes corn imports, the U.S. and Argentina win. If it places more emphasis on fresh meat imports, the U.S. and Brazil win.