Summary:

–Chinese farmers are likely to continue abandoning tough and unprofitable farm work to seek their fortunes in cities across China.

–Land ownership reforms would also likely send waves of farmers into the cities in search of work.

–By 2019, the Economist Intelligence Unit estimates that the cities of Chongqing, Chengdu, Zhengzhou, Tianjin, Beijing, Xi’an, Changsha, Shanghai, Shenzhen, and Dongguan will see a net increase of roughly 4.0 billion m2 of housing space—more than 50% larger than the 2.6 billion m2 net increase that the entire U.S. market is expected to experience by 2020 (based on data from Macroeconomic Advisors and the U.S. Census Bureau).

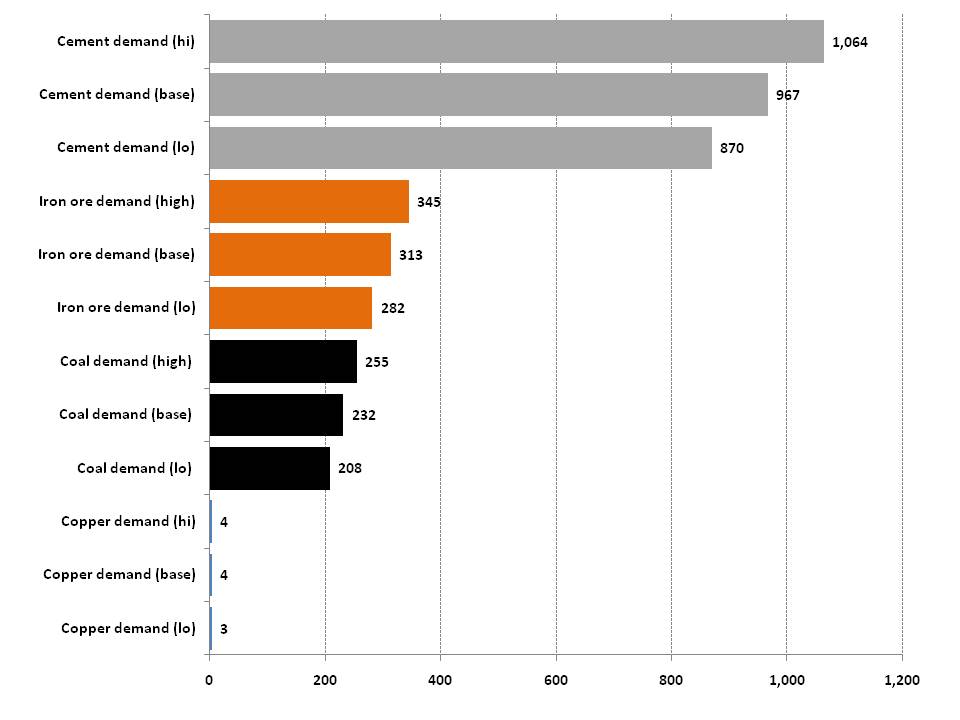

–Our base case commodity demand analysis anticipates that housing construction in the 10 target cities between now and 2019 will use at least 967 million tonnes of cement, 313 million tonnes of iron ore, 232 million tonnes of coal, and 4 million tonnes of copper.

–This would mean annual iron ore demand roughly equivalent to the entire annual ore production of Cliffs Natural Resources, the largest North American producer, which says it expects to produce more than 38 million tonnes of iron ore worldwide in 2011.

–The 10 cities’ average annual cement demand in our base case scenario would be 35% larger than the entire volume of cement consumed by the United States in 2010.

China watchers, and investors in particular, increasingly fall into two major camps: the China housing bulls, who perceive substantial housing shortages that will keep prices up and drive construction; and the housing bears, who believe that Chinese property buyers have overextended themselves and that in the memorable words of prominent hedge fund James Chanos, the country is on an economic “treadmill to hell” driven by overinvestment in fixed assets. Time will tell whose view is more accurate regarding this globally consequential set of questions. That said, amidst the heavy focus on what China’s residential property prices are doing “this month,” or even “this year,” we believe it is important to:

1) Look beyond 2011

2) Consider that, among other factors, the fundamental inefficiency of Chinese agriculture is likely to continue driving farmers and their families into China’s urban areas

3) Assess the attendant implications

China faces a double dilemma with respect to agriculture, which currently employs more than 35% of its workforce, according to the CIA World Factbook. First, the bulk of its farmers currently cannot compete with large, low-cost grain producers in the U.S., Brazil, Argentina, Australia, Russia, and Ukraine and are likely to continue abandoning tough and unprofitable farm work and seek their fortunes in cities across China. Second, the land ownership reforms necessary to make Chinese farming more efficient would fly in the face of the Party’s rural revolutionary history of “land for all” and would also send waves of farmers into the cities in search of work.

China’s level of urbanization remains quite low, even by developing economy standards, a fact that—taken in conjunction with the agricultural reform dilemma mentioned above—suggests that there remains substantial upside for movement into the cities. It also hints that the estimates that McKinsey and others make of the urban population in China growing by as many as 350 million people in total over the next 20 years are realistic.

China’s leaders do not want to see Mumbai- or Johannesburg-style shantytowns on the outskirts of Chinese cities, raising the question of how housing will be built to accommodate new arrivals, as well as current urban residents who may wish to upgrade their domiciles as incomes rise. This in turn raises the question of what level of raw material demand new housing additions are likely to create.

Commodity Demand Assessment

This analysis uses estimates from the Economist Intelligence Unit (EIU) for estimated net housing space increases in the 10 major Chinese cities that are poised to add the most residential housing space between 2011 and 2019 to construct a scenario-based framework to offer a sense of what volumes of steel, cement, copper, and coal are likely to be needed to help build these homes.[1] The cities are: Chongqing, Chengdu, Zhengzhou, Tianjin, Beijing, Xi’an, Changsha, Shanghai, Shenzhen, and Dongguan.

We consulted a broad range of industry associations and academic reports on commodity intensity of housing construction in China and other countries and use the following parameters to calculate the potential demand for key base commodities from China’s anticipated 10-city housing build out: 240 kg of concrete/m2 of housing, 100 kg/m2 of steel to reinforce the structure and supply appliances, and 1.6 kg of copper/m2 to wire the home and supply appliances. The coal demand figures are derived from the coking coal needed to make the structural steel, adjusted for the fact that roughly 15% of Chinese steel comes from electric arc furnaces fed with scrap, as well as the coal needed for making cement.

Over the next 8 years, the EIU anticipates that these 10 cities will see a net increase of roughly 4.0 billion m2 of housing space—more than 50% larger than the 2.6 billion m2 net increase that the entire U.S. market is expected to experience by 2020 (based on data from Macroeconomic Advisors and the U.S. Census Bureau). Our base case analysis anticipates that housing construction in the 10 target cities between now and 2019 will use at least 967 million tonnes of cement, 313 million tonnes of iron ore, 232 million tonnes of coal, and 4 million tonnes of copper (Exhibit 1).

Exhibit 1: Potential Demand for Commodities from Housing Development in China’s 10 Largest Housing Growth Markets (2011-2019)

Million tonnes

Source: NBS China, EIU, UNECE, Lawrence Berkeley Labs, World Coal Association, Bloomberg, Arizona Dept. of Commerce, Roa Mining Co.

To put these numbers in perspective, on an annual basis during the next 8 years, the 10 Chinese housing markets cited in this analysis could use nearly 4% of global cement demand each year, more than 3% of global iron ore demand, nearly 3% of global coal demand, and nearly 2.5% of global copper demand. In practical terms, this would mean annual iron ore demand roughly equivalent to the entire annual ore production of Cliffs Natural Resources, the largest North American producer, which says it expects to produce more than 38 million tonnes of iron ore worldwide in 2011. The 10 cities’ average annual cement demand in our base case scenario would be 35% larger than the entire volume of cement consumed by the United States in 2010.

Implications

Domestically, the success of China’s housing buildout will matter greatly to those who need housing and those who want to upgrade their present living arrangements. It also holds great importance for the Chinese economy, given real estate’s high proportion of national GDP.

We note that while this analysis covers China’s most important housing growth markets, the combined floor space additions in hundreds of smaller cities will likely have a substantial impact on national construction-related commodity demand. In this vein, we suggest that readers wishing to gain a greater understanding of China’s urban expansion potential examine our analysis of 10 key lesser-known Chinese cities.

Looking outside of China, China’s urbanization holds great promise and risk for major global mining companies such as BHP Billiton, Anglo American, Xstrata, Fortescue, and Vale, all of which are making investments in new production capacity that are heavily predicated on the assumption that Chinese demand for metals, coal, iron ore, and other bulk commodities will continue growing and keep global commodity prices high as the country builds out its housing stock. By extension, China’s future housing growth path also will have a deep impact on the fortunes of the countries that are supplying the commodities: especially Brazil, Australia, Mongolia, and others that are deriving a major portion of their economic growth from China’s ravenous appetite for commodities.

[1] We were not able to locate estimates for how much old housing might be torn down to make space for new buildings and thus caution that the commodity demand volumes contained in this report are likely to be conservative, since they are based on the net housing space additions in these cities, as opposed to total construction volumes.