As analytical attention (including a substantial portion of ours) focuses on China’s growing military power and economic influence, both in East Asia and further afield, it is also important to step back and realistically assess major domestic challenges that Beijing faces. Healthcare costs are becoming a key issue as China grapples with a rising incidence of diabetes, which already afflicts roughly 10% of Chinese adults—almost identical to the U.S. rate of 11%. China is now has roughly 92.4 million diabetes sufferers, the largest number of any country. Sadly, the numbers continue to rise rapidly, exacting an increasing toll in economic and human terms.

In 2007, China’s diabetes epidemic accounted for more than 14% of healthcare expenditures and cost the country at least 0.6% of GDP in lost productivity, according to the Economist Intelligence Unit. The EIU based its assessment on the assumption that 4.3% of Chinese have diabetes, but new estimates place the rate at around 10%, meaning that the costs of diabetes on China’s economy from productivity losses are probably closer to 1.5% of GDP. Atop this, the International Diabetes Federation estimates that in 2010, China directly spent around US$6.9 billion on diabetes treatment.

This suggests that many patients are not being treated or are receiving inadequate care, setting the stage for additional costs and higher mortality from complications later. Managing Type 2 diabetes (the most common type) currently costs an average of US$6,000 annually per patient in the U.S., according to The New York Times. Assuming China can treat diabetes patients at 1/3 of the annual U.S. per patient cost and that even 25% of China’s estimated 92.4 million diabetes population is being actively treated, the annual cost for treatment alone would come out to roughly US$46 billion per year. This is equal to half of China’s officially stated 2011 defense budget.

Chronic Disease Driver: China’s Population is Graying before Getting Rich

China’s diabetes problems highlight the twin challenges of chronic diseases stemming from changing consumption habits enabled by China’s economic boom and from the graying of its society, which is also a source of substantial healthcare costs. Chronic diseases will likely continue to tax the economy and could also distract leaders’ strategic focus on externally-oriented efforts such as military development. More specifically, China’s military development will be subject to major internal constraints such as diabetes. We believe health-related costs in China deserve increasing attention for these and reasons of human interest.

Changing Diets likely to Continue Fueling the Epidemic

As China urbanizes and becomes wealthier, diets are shifting from the traditional rice and vegetables and toward meats, sweets, and processed foods. In the past decade, per capita sugar consumption in China has risen by 48%, according to the USDA. As in the U.S. and other countries, sweet beverages are a significant and growing source of sugar consumption.

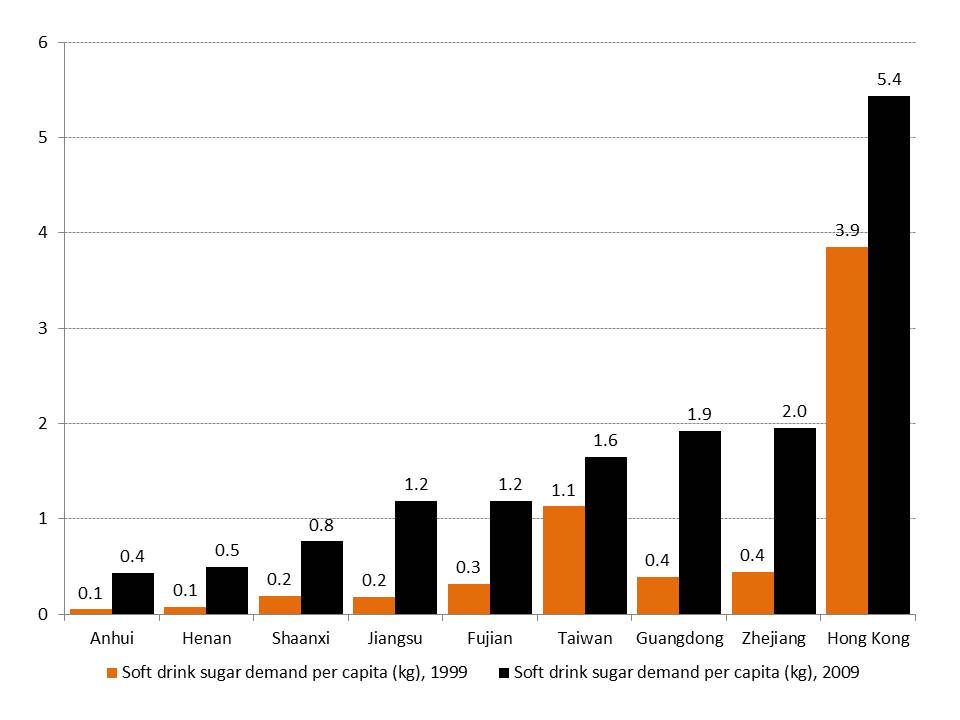

Data from Swire Pacific, a major soft drink distributor, show that soft drink sales in its sales areas rose five-fold on average between 1999 and 2009. Swire’s China sales zone encompasses provinces with a range of income levels, with Guangdong, Zhejiang, Jiangsu, and Fujian at the upper end and Anhui, Henan, and Shaanxi at the lower end. In the high-income provinces, Swire’s sales were 4.9 times larger in 2009 than 1999, but were nearly 6.3 times higher in the lower income provinces (Exhibit 1). This suggests that consumers throughout China are developing a sweet tooth regarding beverage preferences, particularly amongst emerging consumers in China’s fast-growing lower income markets. To get a sense for just how much greater sales growth in Swire’s Mainland China sales areas is proceeding than that in more developed markets, consider that sales volumes in Taiwan rose by 46% between 1999 and 2009 and those in the company’s U.S. markets rose by only 7%.

Exhibit 1: Estimated China per capita soft drink sugar consumption by province/economic area

Kg of contained sugar (from cane/beet sugar and corn or other sweeteners)

Source: Swire Pacific, China SignPost™

Soft drink consumption is China is still far lower than in the U.S., but given the country’s already substantial problems with diabetes, further increases in consumption of non-artificially-sweetened soft drinks will likely pose costly public health challenges. China will lose U.S.$558 billion in national income over the next 10 years from cardiovascular disease and diabetes, according to the New England Journal of Medicine (NEJM). This cost is still far less than that borne by the U.S., which faces costs of U.S.$750 billion annually from these ailments (NEJM), but China is seeing a rapid increase in many of the chronic disease risk factors that plague large swathes of the U.S. Among them, car ownership, heavier and sweeter diets, and more sedentary lifestyles stand out. In addition, China’s low birthrate and lack of immigration (in sharp contrast to America’s exceptional, favorable demographics in both areas for a developed country) means its population is aging quickly, an additional risk factor for diabetes.

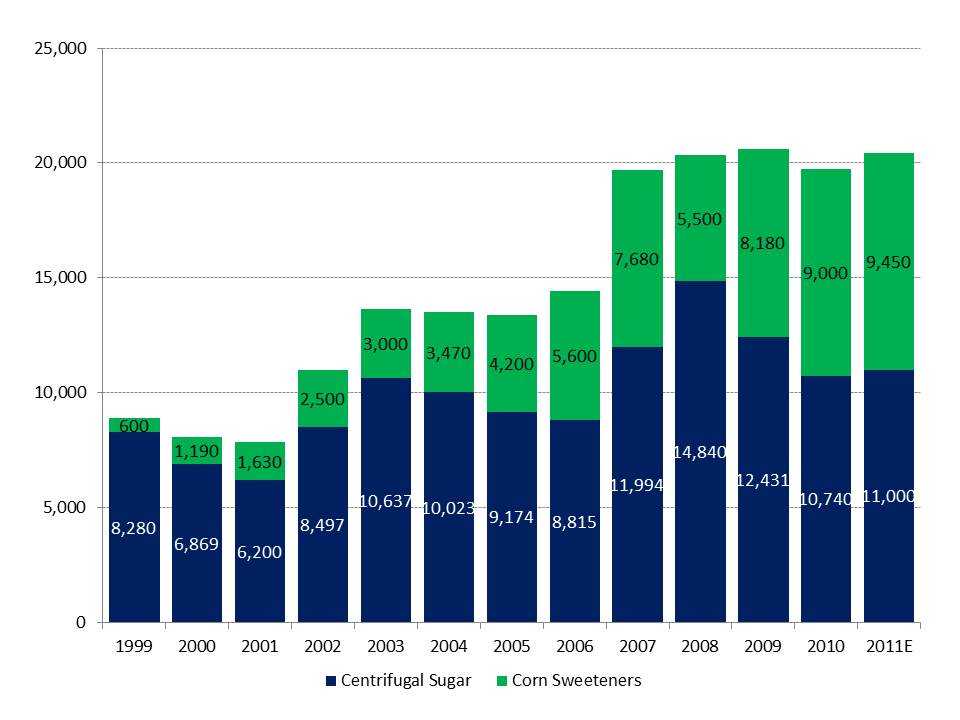

China’s food and beverage industries are also increasingly emulating a negative aspect of their peers in developed countries: greater use of corn sweeteners. China’s flattening sugar demand and production and rise in corn sweetener production suggest that high fructose corn syrup and other corn-derivative sweeteners are catching on fast. In 2000, corn sweeteners accounted for 15% of China’s plant-derived sweetener output, but by 2010, they accounted for nearly half (Exhibit 2). Company level data hint that local firms see a strong market for corn sweeteners in China in coming years. For example, Global Sweeteners, one of China’s largest corn processors, plans to expand its high fructose corn syrup production capacity from 180,000 tonnes in 2011 to 480,000 tonnes per year by 2013.

Exhibit 2: Production of centrifugal sugar (cane and beets) and corn sweeteners in China

Thousand tonnes

Source: DNCNET, Guangxi Sugar Association, USDA

Implications

1) Diabetes alone is a bearable cost for China, at least at current incidence rates, but it highlights the potential for chronic disease and related health and social factors to meaningfully reduce China’s potential for investing in military modernization and other potential facilitators of external influence.

2) Chronic diseases are typically highly expensive to treat, putting additional pressure on Beijing to improve the national healthcare and social welfare system. Such pressure has the potential to further focus China’s leaders on internal matters.

3) China will need robust economic growth to ensure sufficient funds to address chronic diseases and other internal concerns. This has the potential to drive assertive behavior abroad as China works to ensure that its natural resource supply lines and other economic assets can operate without disruption.

4) China’s current needs for diabetes treatment create major commercial opportunities as China’s public health apparatus works to identify and treat sufferers. In addition, China’s burgeoning life sciences and biotechnology complex offers significant research potential to help find ways to prevent or potentially cure diabetes.

5) Public health initiatives such as diabetes prevention and management offer excellent opportunities for increasing humanitarian engagement between China and partners such as the U.S.