New deepwater oil & gas exploration and production will likely complicate the South China Sea maritime security environment.

–China is aiming for oil & gas production of 500,000 barrels of oil equivalent (boe) per day by 2015 and 1 million boe per day by 2020 in deepwater areas of the South China, according to China 5e. CNOOC, China’s dominant offshore producer, had total output of roughly 290,000 boe per day from the South China Sea during 2010.

–Shanghai Waigaoqiao Shipyard has built the HYSY 981 drilling rig, which can drill in 3,000 m of water to a total well depth of 12,000 meters.

–The HYSY 981 deepwater rig gives China the physical capacity to drill virtually anywhere in the South China Sea apart from the deepest parts of the abyssal plain.

–Greater Chinese oil & gas production in portions of China’s EEZ in the South China Sea near major international sea lanes could exacerbate Chinese sensitivities regarding freedom of navigation in the area.

–Although China’s sovereign deepwater drilling capabilities are set to rise, we believe Beijing will exercise restraint in unilaterally exploiting energy resources further than 200 nautical miles from the Chinese Coast. Even the benefits of a large new oil or gas field would not outweigh the negative implications of catalyzing more formal anti-China regional security alignments.

Recent developments

Shanghai Waigaoqiao Shipyard has built the HYSY 981 rig, which can drill in 3,000 m of water to a total well depth of 12,000 m. China has thus joined an elite club of countries capable of building deepwater drilling equipment. Of these countries, China is the only one that has serious maritime demarcation disputes with its neighbors, potentially making enhanced domestic deepwater exploration capabilities both a matter of national energy security and an important strategic tool. This analysis explores the drivers behind China’s desire to bolster offshore energy production, assesses its capabilities to do so, and outlines key regional security implications that are likely to arise as China becomes more capable of tapping oil and gas deposits in deep waters of the South China Sea.

Why China’s leaders want to increase offshore energy production

The ongoing unrest in Libya and elsewhere in the Middle East will likely drive Chinese policymakers to seek ways to reduce China’s reliance on imported crude oil and natural gas, which both often come from volatile regions. China’s leadership recognizes that the country cannot simply drill its way to oil supply independence, but views bolstering domestic production as way to slow the growth of China’s increasing reliance on imported oil.

China’s workhorse onshore oilfields are declining inexorably, despite heavy investments in drilling and advanced recovery technologies aimed at stabilizing production. For example, production at both the Daqing and Shengli fields, China’s two largest oil producers (whose combined production is around 1.3 million barrels per day) is declining by 3.4% and 2.0% per year respectively, according to Petroleum Exploration and Development.

This leaves offshore fields as the only domestic oil deposits that can help slow the growth rate in China’s oil import demand. Continuing tensions between Japan and China over maritime demarcation in the East China Sea is likely to hinder exploration and development moving forward in that area. The South China Sea is very different, as China’s rival claimants are easier to pressure.

Against this diplomatic backdrop, Chinese firms’ rising technical competence suggests they will significantly increase their exploration and production operations in deeper waters of the South China Sea. Currently, Husky, a Canadian independent producer, is already developing a large gas discovery in the Liwan trough area roughly 300 km south of Hong Kong, in waters that are more than 1,400 m deep (4,000 ft), while British Gas has made significant gas finds in similarly deep waters south of Hainan Island, according to Offshore Media Group. CNOOC, meanwhile, has made potentially large gas finds in the Liuhua 29-1 and Lingshui 22-1 deepwater blocks.

Looking to the future, CNOOC—China’s flagship offshore oil and gas producer—notes that the deep waters of the South China Sea remain “underexplored” and have “huge potential.” Furthermore, the company plans to boost its exploration expenditures by roughly 50% in 2011, driven in part by plans to drill 2-3 deepwater wells independently and 3 additional wells with partners. Each well could cost upwards of US$100 million to drill and complete.

Offshore oil & gas production in China

Offshore oil, and to a lesser extent gas, play an important and growing role in securing China’s energy supply. The country currently obtains roughly 15%, or more than 600,000 bpd, of its domestic oil production from offshore fields. This makes China one of the world’s largest offshore energy producers. China’s growing emphasis on offshore energy production, including that from new deep water fields in the South China Sea, is likely to have profound effects on Chinese energy security strategies as well as international diplomacy regarding disputed zones in the South China Sea.

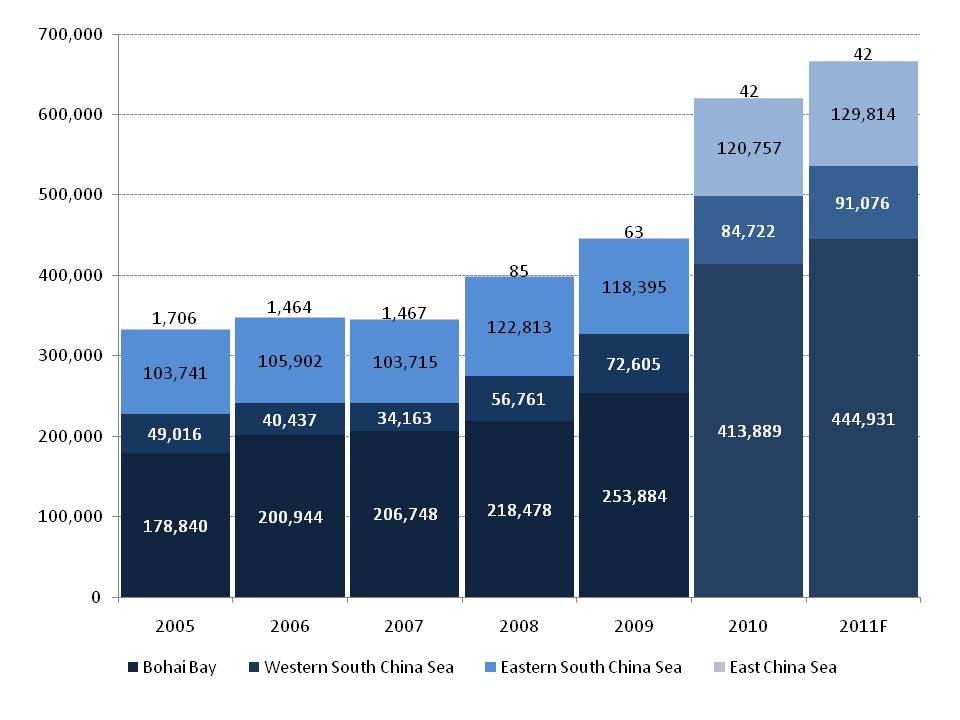

Exhibit 1 (below) shows the production of CNOOC, China’s main offshore oil & gas producer. The Bohai Gulf is presently China’s core offshore production zone in terms of oil output. Yet the South China Sea is poised to become an increasingly important oil and gas supplier in the future as Chinese oil companies gain proficiency in deepwater operations and the local maritime industry becomes an increasingly proficient supplier of deepwater drilling rigs and other important equipment. Oil and gas production in deepwater areas of the South China Sea is slated to hit 500,000 bpd of oil equivalent by 2015 and 1 million bpd of oil equivalent by 2020, according to China 5e.

Exhibit 1: CNOOC oil production in Chinese waters

Barrels per day of oil

Source: CNOOC, China SignPost™

The planned production increase is noteworthy because some of the biggest deepwater finds to date in the South China Sea have been natural gas. For example, Husky Energy’s Liwan 3-1 field likely contains up to 3 trillion cubic feet of gas—enough to support production of 25,000 bpd of oil equivalent, according to Husky management. Further gas discoveries are likely to follow as CNOOC and other firms explore more aggressively in deepwater areas between Hong Kong and Hainan Island and further offshore. The South China Sea currently produces more than 85,000 boe per day of natural gas. China is already a net importer of natural gas and this deficit is likely to expand as cities use more gas to alleviate local air pollution.

China’s imports of natural gas via pipeline from Central Asia and liquefied natural gas from Australia, Indonesia, and other locales currently constitute a relatively small proportion of total supply as compared to oil imports (~50% of national oil supply). Nonetheless, an interruption in gas supplies to a major metro area such as Shanghai or Guangzhou, even if it were only a small part of the national gas supply, could cause economic and political havoc, particularly in the winter months. As such, policymakers would likely welcome plans to reduce growth in imports and boost domestic gas output from deepwater fields in the South China Sea. Such efforts might be championed by ambitious local officials and elites, as apparently happened with the construction of oil and gas pipelines from Kyaukphyu on Burma’s coast to Yunnan Province. South China Sea gas supplies are likely to move from being seen as useful to have to being considered an essential element in national energy security.

Security implications of China’s deepwater energy ambitions

For decades, mainland China and Vietnam, and to a lesser extent, Malaysia, Indonesia, Taiwan, Brunei, and the Philippines have made overlapping seabed claims in the South China Sea. Claims to the Paracel and Spratly archipelagoes are especially important because if legal claims supporting a specific country’s ownership are recognized, that country’s exclusive economic zone (EEZ) could extend up to 200 nautical miles from the shore of each islet under its control, giving it sole jurisdiction over natural resource extraction in that area. China and Vietnam actually exchanged fire in the Paracel Islands in 1974 and the Spratly Islands in 1988, with loss of life and transfer of control each time. Key natural resources in the disputed areas include oil and gas, as well as fish. The archipelagoes also lie close to some of the world’s most vital commercial shipping lanes.

Tension is rising again in the South China Sea between claimants to the Spratly Islands, in particular China and Vietnam. On 2 March 2011, Vietnamese and Chinese diplomats met to discuss Chinese naval activities in the area around the Spratly Islands, according to AFP. Vietnam has complained frequently in recent years about China detaining and seizing Vietnamese fishing boats in the Spratly area.

Statements by authoritative Chinese scholars suggest that China clearly views the South China Sea as its own waters. For example, Wang Hanling of the Chinese Academy of Social Sciences laments China’s weak enforcement capacity, saying “in the South China Sea, our administrative vessels can’t catch the Vietnamese ships fishing illegally” (People’s Daily).

Problems are cropping up again with other neighbors of China as well. The Philippine Coast Guard recently deployed three patrol ships to protect a Philippine government oil survey vessel operating roughly 80 nautical miles off Palawan in the South China Sea that was reportedly harassed by two Chinese civil maritime patrol ships, according to the Manila Bulletin.

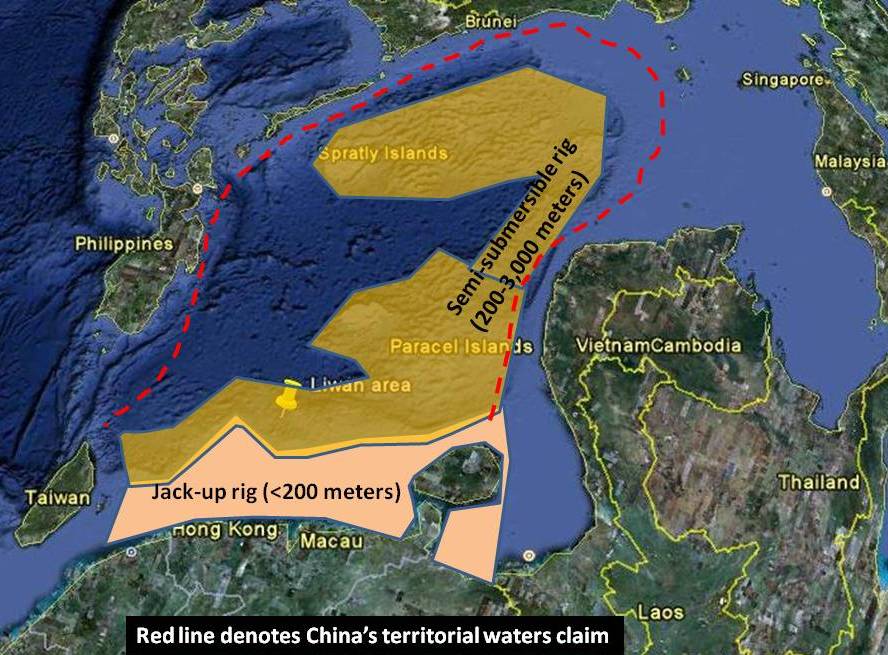

The existence of China’s new HYSY 981 deepwater rig is meaningful amidst regional maritime demarcation disputes because there is now a domestically manufactured and operated platform that extends Chinese companies’ options for drilling in the South China Sea. Jack-up rigs of the kind that constitute much of the current Chinese drilling fleet are typically only able to drill in waters less than 200 m deep.

Semi-submersible rigs such as the new HYSY 981, however, can drill in up to 3,000 m of water, giving CNOOC the ability to drill virtually anywhere in the South China Sea apart from the deepest parts of the abyssal plain (Exhibit 2). Notable areas include deep waters near the Paracels, Spratlys, and Vietnamese coast. These areas all lie within China’s traditional territorial waters claim, as denoted by the “nine-dashed,” or u-shaped line printed on maps published in the PRC.

Exhibit 2: South China Sea areas Chinese firms could drill with assets they own

Jack-up rig box represents previous drillable area, semi-submersible represents expanded area

Note: Map is oriented to show the South China Sea from a Chinese perspective.

Source: Continental Margins Biogeochemical Research and Education, China SignPost™

Increased deepwater drilling by CNOOC and other firms in the South China Sea also brings increased environmental risks as relatively inexperienced firms undertake possibly the most technically challenging type of drilling on earth: deepwater operations in one of the world’s most active tropical storm zones. The China Offshore Oil Operations Safety Office (COOOSO), which was established in 1985, has extensively studied past offshore accidents, including the tragic Piper Alpha blowout in the North Sea in 1988 and the Deepwater Horizon incident in the Gulf of Mexico in 2010. However, the risk of accidental spills will likely increase in the South China Sea until CNOOC gains more operational experience; and, as the U.S. experience suggests, the potential for catastrophic damage cannot be fully eliminated.

We believe that for the near future CNOOC’s deepwater drilling operations will remain in the Liwan trough and other areas that lie unequivocally within China’s EEZ. For Beijing, the diplomatic costs of drilling in a disputed zone such as the Spratlys against the wishes of the other claimants would likely substantially exceed the additional oil or gas production gained. Even a large new oilfield producing 200,000 bpd or more in a disputed zone would not be worth drilling unilaterally if doing so catalyzed further development of anti-China regional security alignments.