–With the latest price increase on 20 February 2011, Chinese drivers now pay more than US$4 per gallon of gasoline and diesel fuel—more than 30% more than US drivers pay for gasoline and nearly 20% more than they pay for diesel fuel.

–Fuel demand appears to remain strong, as China imported 5.13 million bpd of crude oil in January 2011—a 27% year-on-year increase.

–Future reductions in Chinese oil use would most likely not come from domestic pricing reforms but from higher global oil prices or demand-side measures such as alternative fuel vehicles; these would have a bigger impact on oil use.

The International Energy Agency (IEA) expects oil demand in Iran to fall by almost 8% in 2011, primarily because the Iranian government stopped subsidizing petroleum fuels on 19 December 2010, according to The Wall Street Journal. The same Wall Street Journal article also asserts that oil price reforms in countries like Iran, as well as India and China, could have a substantial impact on global oil demand in the long-term.

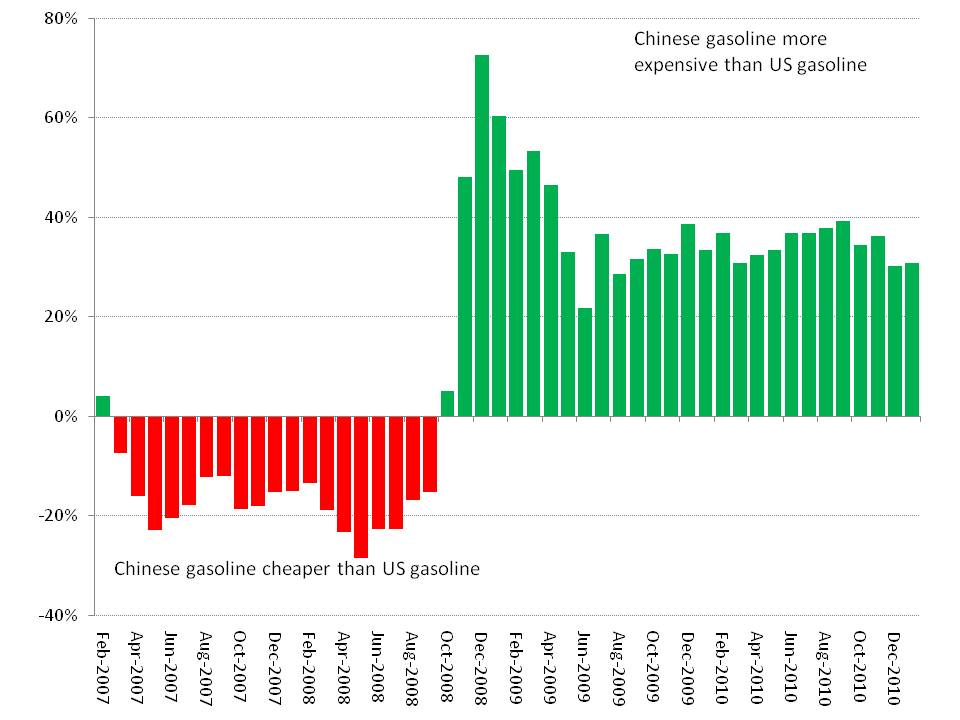

We believe that oil pricing reforms in China, particularly on the motor fuel side, may not affect demand nearly as much as might be expected after seeing Iranian oil consumption begin to plunge after subsidies ended. The reason is simple: for more than two years, Chinese retail gasoline prices have often been more than 20% higher than U.S. gasoline prices (Exhibit 1).

Exhibit 1: Chinese versus U.S. retail gasoline prices

Chinese price’s premium/deficit to U.S. price, monthly average

Source: EIA, NDRC, NBS China, China SignPost™

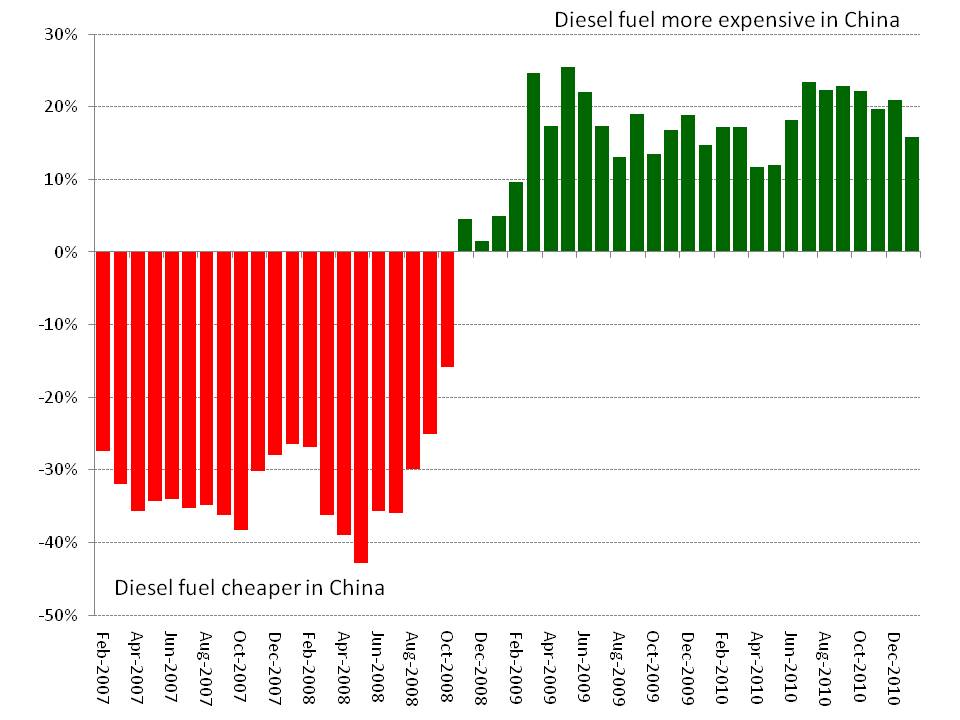

In addition, diesel fuel in China now costs more than US$4 per gallon at the pump, as opposed to approximately US$3.53 per gallon in the US. China’s benchmark #0 diesel average national retail price has also exceeded the US average ultra low sulfur diesel price for more than two years (Exhibit 2). The fact that passenger car and heavy truck sales have generally been robust even after fuel prices exceeded U.S. levels hints that Chinese vehicle owners remain willing to drive even when fuel prices are above US$3.50 per gallon. It is also interesting that Chinese diesel prices have trended upward so strongly given the importance of lower fuel prices for farmers, fisherman, and other rural constituencies who are major consumers of diesel fuel.

Exhibit 2: Chinese versus U.S. retail diesel prices

Chinese price’s premium/deficit to U.S. price, monthly average

Source: EIA, NDRC, NBS China, China Daily, China SignPost™

Implications

In essence, China’s oil pricing policy has reduced price volatility compared to more liberalized markets, but has actually helped keep prices in a range that substantially above the U.S. market price for both gasoline and diesel, although lower than Western European levels. China’s national per capita GDP is only a fraction of the U.S. level, yet fuel demand growth thus far remains healthy although prices significantly exceed those in the wealthier U.S.

Given the Chinese government’s tight focus on controlling inflation, we think it unlikely that Beijing would use European-style high taxes to boost fuel prices and decrease demand. This suggests that China’s transportation fuel conservation programs will likely focus on vehicles, technology, and perhaps higher congestion and car-ownership fees, rather than on fuel price increases.