China’s involvement in volatile places is testing its principle of “non-interference”

Key Points

• The independence referendum in Southern Sudan scheduled for 9 January 2011 is likely to test China’s non-interference policy.

• China increasingly faces: 1) assumptions by the global community that it will behave as a global stakeholder that engages with humanitarian and security matters beyond those of immediate national interest, and 2) nationalistic pressure from its own citizens who think that economic assets and PRC expatriate communities in volatile areas should be more robustly protected.

• If Southern Sudan gains independence, there is threat of renewed North-South fighting, as well as internecine conflict in the South. The vote may also inspire separatists in Angola’s oil-rich Cabinda province, fomenting instability in another African country where China has significant economic interests and a large worker presence.

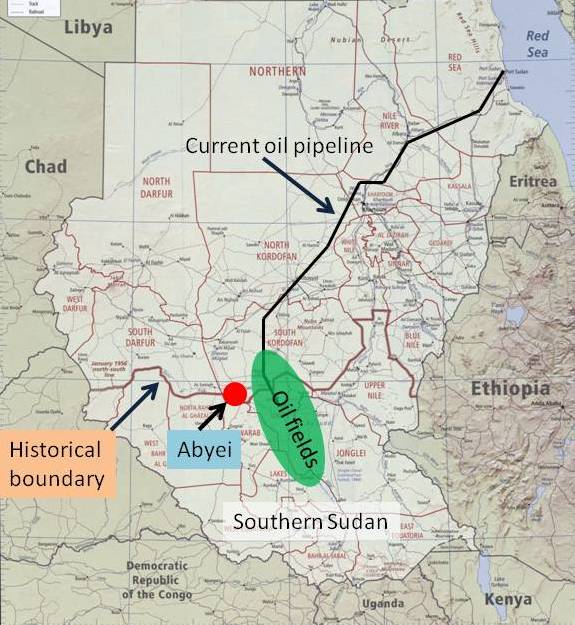

Sudan is a case study because China has major commercial interests and a large expat worker presence in the country and will face tough choices regarding its “non-interference policy” if renewed civil war erupts between the North and South in the wake of a pro-independence vote by the South, which accounts for around 80% of Sudan’s roughly 490,000 bpd of oil production. Exhibit 1 shows the location of Southern Sudan, currently a centrally-administered autonomous region, as well as the position of oilfields along the North-South border and the oil export line.

Exhibit 1: Southern Sudan map

Source: University of Texas, FT, China SignPost™

The global oil market can currently draw on sufficient spare supplies to offset a crude oil supply disruption resulting from conflict in Sudan. However, among foreign investors in the country, China would face a disproportionately large economic and human impact and hence higher pressure to get more actively involved than it would otherwise prefer. China has spent the past several years working hard to establish a triangular diplomatic relationship between Beijing; Khartoum, Sudan’s capital; and Juba, the capital of Southern Sudan. These ties will receive an acid test if conflict re-ignites. We believe the probability of large-scale violence erupting both in the immediate term and during the following 12-18 months is significant. There are a number of potential catalysts for new and violent conflict in Sudan:

Near-term (next 6 months)

• Conflict between North and South over the disputed province of Abyei, particularly if the Dinka tribe votes to join Southern Sudan and the Arab Misseriya tribe opposes.

• Referendum yields a pro-unity vote, leading to accusations of Northern Sudanese interference in the voting process.

• Internecine fighting in Southern Sudan as the SPLA and local tribes contend for influence in running the new country, which would derive more than 90% of state income from oil.

Medium-term (12-18 months)

• Oil transit fee, volume, or production revenue sharing dispute with Khartoum motivates Juba to pursue alternative oil export options.

• Khartoum launches military operation to protect its oil revenue stream.

• Continued disputes over border delineation.

In July 2010, Sudanese Minister of Petroleum Lual Deng said a new oil pipeline that bypasses the North, such as the proposed 450,000 bpd line from Southern Sudan to the Kenyan island of Lamu, was “uneconomical.” Other press outlets focused on coverage of issues in Sudan attack his objectivity by pointing out that he is a Southern Sudanese who is serving in the Khartoum government and that he is a strong proponent of national unity, not independence for the South.

Threatening to build a pipeline to Kenya gives the South a strong bargaining chip vis-à-vis Khartoum. That said, there are four cautionary points for those who would consider a pipeline from Southern Sudan to the Kenyan coast to be economically unfeasible and nothing more than a bargaining chip. First, the preponderance of oil reserves in what is likely to become an independent Southern Sudan would give the government a range of options to sweeten the pot for Chinese or Japanese investors who might bankroll and build the pipeline.

Second, it is likely that the Greater Nile Petroleum Operating Company (GNPOC), which runs the pipeline north from the Unity Field to Port Sudan, has already paid back much of the cost of building the line. We estimate that the pipeline has yielded at least US$4.5 billion in transit revenues over its lifetime and that its total project finance cost is somewhere between US$1.2-to-US$1.8 billion, depending on interest rate and payback time assumptions. The consortium thus has more financial latitude to quickly move to back a new alternative export pipeline.

Third, in the extreme case, an independent government in Juba could likely use its sovereign leverage to impose a punitive fiscal regime on companies who balked at supporting a new export pipeline. Khartoum would protest, but the South’s larger reserves would be a strong incentive for companies to align with the South’s wishes.

Fourth, a cooperative oil transport corridor could co-mingle Sudanese and Ugandan crudes headed for the Kenyan coast. Tullow Oil is leading the way in developing oil reserves in Uganda’s Lake Albert area and the company says that by 2014-2015, it aims to be producing at least 200,000 bpd of crude oil in Uganda and have an export pipeline. With such volumes, a joint Southern Sudan-Uganda oil pipeline project could deliver upwards of 450,000 bpd of crude to an export terminal on the Kenyan coast. We believe that if local political issues can be managed, a broad range of foreign investors would consider supporting such a project.

Implications

Violence during or after Southern Sudan’s impending independence vote could create major challenges for Chinese interests in the country that undermine its non-interference policy. For a detailed look at how China might consider dealing with protecting overseas workers and assets, please see China SignPost #2, “Looking After China’s Own: Pressure to Protect PRC Citizens Working Overseas Likely to Rise.”

Potential challenges to Chinese interests in Africa from the upcoming vote extend beyond Sudan itself. If Southern Sudan becomes independent, this may also inspire separatists in Angola’s Cabinda province, triggering instability in another oil-rich country where China has a large economic and human presence.

Beijing is also finding out yet again that relations with Iran, Burma, Pakistan, the Democratic Republic of Congo, North Korea, Sudan, and Venezuela expose Chinese interests to a substantial risk of serious civil and international conflicts in which the Chinese government will face more pressure than in the past to get involved. New fighting in Sudan would not have the same international magnitude as a showdown between the U.S. and North Korea or Iran, for example, but it will nonetheless place China in a difficult spot as it navigates between Khartoum and Juba.