The recent flurry of trade deals and MOUs (worth US$35 billion) signed during Premier Wen Jiabao’s recent visit to Pakistan have brought the possibility of a more robust Pakistan-to-China transport corridor back into the spotlight. The trade deals stand to drive increased economic activity by Chinese companies in Pakistan in coming years.

However, our assessment is that while the trade and investment agreements may help cement an “all weather” alliance between Beijing and Islamabad, they do not mean that an all weather transport corridor becomes viable. An expanded road and rail network linking Pakistan to China faces three key challenges. The bottom line is that maritime shipping routes will remain a cheaper, simpler, and more secure option for moving crude oil and other goods into China.

1) Security. The proposed transport corridor would go through areas that are subject to flooding and insurgent activity, as well as avalanches, landslides, and seismic activity in the Karakoram Range. If any of these disruptive events materializes, rail and road traffic cannot re-route around the trouble point the way that ships at sea can.

2) Capacity. A modern one-track rail line in the United States can currently handle around 16 trains per day, according to Cambridge Systematics. A Pakistan-to China rail corridor would likely be built with one track each way, but with reduced throughput of around 12 trains per day. U.S. freight trains carried an average of 2,800 tonnes of cargo in 2004, according to the Bureau of Transportation Statistics. Trains transiting the Khunjerab Pass would likely carry smaller loads, perhaps 2,000 tonnes, due to the large vertical gradient. With these train frequency and load parameters, the corridor would be able to handle 8.75 million tonnes of cargo per year, or approximately 175,000 barrels of oil per day if all the trains carried oil.

To move the volumes that would be necessary to make this route able to handle enough cargo to reduce sea transport reliance measurably, there would need to be a rail setup with 3 or 4 lines. Furthermore, bringing that much cargo into Western China’s rail network and then having to move it into industrial areas in the central and eastern regions would likely necessitate additional capacity expansions of the national rail system. These investments would likely be cost-prohibitive.

3) High construction and transport costs. The tariffs needed to pay off the finance costs of the route and move freight over a 15,000 foot vertical relief would likely make the cost highly uncompetitive with sea routes. The roughly 2,000 km-long Qingzang railway to Lhasa, Tibet cost roughly US$4 billion to build (US$1.85 million per km). The cost per km to build a rail line connecting Islamabad and Kashgar could be several times more expensive to build given the tough geologic and political circumstances along the route.

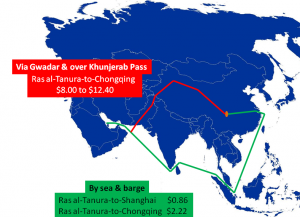

In terms of transport costs, we estimate that moving a barrel of oil by sea to Shanghai at a ship rate of US$75,000 per day at 23 km per hour with a 2 million barrel cargo costs around US$0.90 per barrel, while moving it by barge upriver to the rapidly-growing inland demand center of Chongqing would cost an additional US$1.23 per barrel, for a total transport cost of US$2.22 per barrel (Exhibit 1). In contrast, moving oil from Ras al-Tanura to Gwadar and then by rail into the heartland of China would likely cost closer to US$8.00 to US$12.40 per barrel, making that route economically uncompetitive, as well as limited in capacity.[1] The disparity would be slightly greater for major cities on China’s east coast.

Exhibit 1: Estimated costs of moving oil to Chongqing, China from the Persian Gulf by sea and via Pakistan

U.S. Dollars per barrel

Source: BNSF Railway, Bureau of Transportation Statistics, NBS, ND Petroleum Council, China SignPost™

In short, there are compelling reasons why sea transport has been dominant for so long. To even build a Pakistan-to-China rail corridor would require massive upfront investments, would be economically uncompetitive relative to sea routes, and due to the many physical and political risks along the route, commercial shippers would likely be highly reluctant to use it.

For further details, see:

Andrew Erickson and Gabriel Collins, “Oversea Trumps Overland: The Strategic Trajectory of China’s Oil Imports,” China SignPost™ (洞察中国), No. 1 (May 26, 2010).

Andrew Erickson and Gabriel Collins, “China’s Oil Security Pipe Dream: The Reality, and Strategic Consequences, of Seaborne Imports,” Naval War College Review, Vol. 63, No. 2 (Spring 2010), pp. 88-111, http://www.andrewerickson.com/2010/03/china%E2%80%99s-oil-security-pipe-dream-the-reality-and-strategic-consequences-of-seaborne-imports/.

[1] Based on BNSF Railway domestic oil hauling tariff rates and economic studies of crude oil transportation out of North Dakota’s Williston Basin that cite costs of US$6.00 to US$10.00 per barrel to move crude out of the Basin by rail. See Ron Ness and Lynn Helms, “Williston Basin Crude Oil Transportation Bottleneck White Paper,” July 2006, https://www.dmr.nd.gov/pipeline/assets/bottleneck7-06.pdf