China’s gas grid expansion is economically, environmentally, and strategically significant. Beijing’s desire to adopt cleaner sources of energy and facilitate their effective movement around China helps reduce pollution and energy price volatility, which hurts Chinese and foreign energy consumers alike. Chinese actions in the natural gas sector sometimes appear alien to those outside the country, particularly Americans and Europeans who are used to the market allocating supplies through price.

China’s response to shortages is much more infrastructure-based than in other countries, emphasizing increased production and construction of pipelines and LNG terminals to deliver gas. Overall, this type of response makes sense given the nature of the gas shortage in China. Gas supply shortages in more developed gas markets typically occur as a result of a major weather event like Hurricane Katrina or human-driven events like the Russia-Ukraine gas war in early 2009.

Gas shortages in China, by contrast, are structural and stem primarily from rapid economic and demand growth. Hence, drilling more wells and laying more pipe does help resolve supply problems if it can be done quickly enough. We think ongoing events in the central Chinese city of Wuhan, a sort of “St. Louis of China,” offer a useful illustration of how the emphasis on “infrastructure first, price reforms later” is improving the local gas supply situation.

Central China has been experiencing gas shortages this winter, prompting administrative responses. Wuhan Gas Company says that as of late November it began curtailing gas supplies to ~ 70 industrial users and the city’s 33 compressed natural gas vehicle fueling stations in order to ensure supplies to residential gas consumers. Wuhan Gas also adds that the city of Wuhan depends on three pipelines run by Sinopec and PetroChina for its gas supplies, according to China5e.

Gas industry officials quoted by Xinhua say in a worst case scenario (such as a severe cold snap), Wuhan’s gas use could rise as high as four million cubic meters per day. Even with major users such as power plants cut off, demand could still hit three million cubic meters per day. The three gas pipelines currently serving the city can deliver two million cubic meters per day, meaning that the city could face a peak supply deficit equivalent to tens of thousands’ of residential users daily consumption.

Instead of using price to re-allocate supplies, China’s gas market is banking on new sources of supply and expanded transport infrastructure that may help alleviate gas shortages this winter, particularly in demand centers like Wuhan that are located along new gas pipeline routes. Unlike last year, China’s gas supply system appears better prepared to ensure supplies throughout this winter. Hong Kong & China Gas tells us that “this year, the government has coordinated with upstream gas suppliers (PetroChina, Sinopec, etc…) in preparation for the anticipated cold winter this year” and that the supply situation this year should improve due to a number of developments, including: better preparation of upstream gas suppliers and increased gas supply from new pipelines such as the West-to-East No.2 and Sichuan-to-East, which each add several billion cubic meters of gas supply capacity.

On the upstream side, Sinopec and PetroChina are increasing gas production, while on the distribution end, city-gas operators such as Hong Kong & China Gas and Towngas China have improved their peak gas supply capability either through optimizing the “line pact” in their pipeline or installing LNG storage in order to better meet peak demand.

The new West East-2 pipeline may prove to be Wuhan’s gas supply savior this winter by helping to bridge the current supply/demand gap. Local media say there is currently a slug of gas en route from Turkmenistan slated to arrive within a few days. New pipeline capacity is helping a range of areas as well. XinAo Gas tells us there are currently no natural gas supply shortages in its service areas (in more than 10 provinces) in part due to new supplies bring brought in by the WEP-2 and the Sichuan-to-East Coast pipeline.

Using small-scale liquefied natural gas (LNG) is another method that can supply areas experiencing shortages like Wuhan. CNOOC plans to use waterborne LNG deliveries in the near-future to help supply gas to Wuhan, according to the Yangzi Daily Times. Chinese companies have been pioneers in using small-scale LNG facilities as peak shaving facilities and for vehicle fuel and other uses in inland areas that are often quite remote. China Natural Gas, for example, says its can supply LNG economically by truck up to 1,600 km from its plant in Yulin, Sha’anxi. Additionally, small LNG tankers will be able to serve ports such as Wuhan that lie along the Yangzi River and navigable portions of its tributaries.

Factors behind rapid gas demand growth in Central China

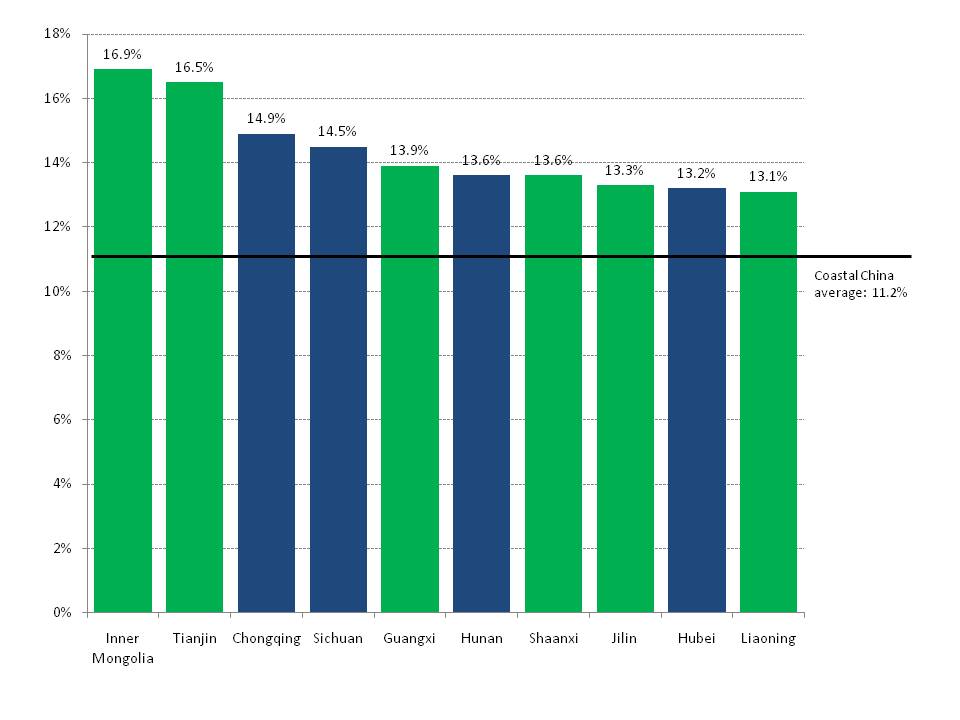

In 2009, four of China’s ten fastest growing provincial economies were located in South-Central China (Exhibit 1). Strong GDP growth and rising industrial and residential gas use are fueling demand, which is colliding with limited pipeline capacity in the Yangzi valley and triggering shortages. In Wuhan’s home province of Hubei, natural gas demand has more than tripled since 2005, according to Sina.com. China Gas reports that it has connected about 1/3 of the eligible households in its Hubei area of operations. We believe this number is a reasonable proxy for Wuhan and Hubei as a whole.

Chinese gas distributors say the saturation point comes at around an 80% penetration (i.e., connection) rate, so there is likely significant growth potential for residential gas demand in the area. Chinese gas companies have strong financial incentives to boost their network reach. For FY2010, China Gas reports a gross margin of just under 21% for gas sales, while connection fees from adding new users to its network yielded a gross margin of nearly 71%. XinAo Gas tells us that consumers “receive no financial assistance from the government” to offset connection fees, which for residences can run upwards of 2,300 RMB (US$346) and are much more expensive for commercial and industrial gas users.

Exhibit 1: GDP growth in China’s 10-fastest growing provinces, 2009

Source: National Bureau of Statistics, China SignPost™

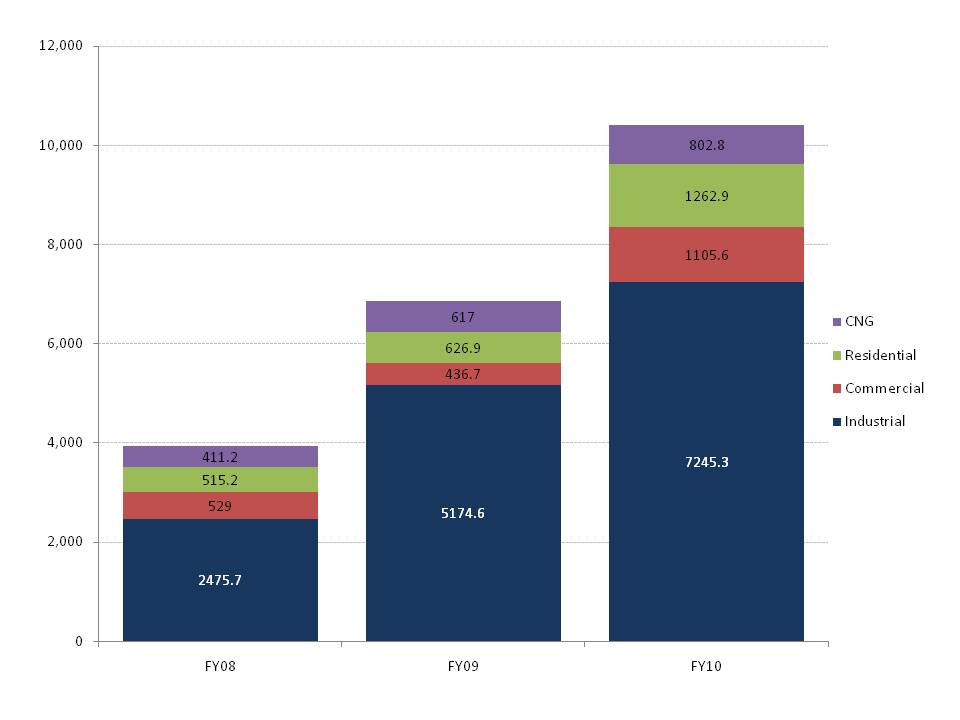

Industrial users are the baseline gas consumers in China, but growth in gas use by businesses, residences, and drivers of compressed natural gas vehicles is rising quickly. For FY2010, data from China Gas show that gas sales to commercial consumers (business users) rose by 153% year-on-year, while residential sales volumes increased by nearly 102% and sales volumes to CNG users rose by roughly 30% YoY. Industrial gas sales volumes experienced a 40% year-on-year increase, to roughly 7.2 billion cubic meters (Exhibit 2).

For the time being, the National Development and Reform Commission (NDRC) is unlikely to support more flexible gas pricing due to concerns about inflation. While natural gas is still a very small part of Chinese consumers’ collective household expenditures, energy writ large is a meaningful component of the consumer price index (CPI). China’s official November 2010 CPI came in with a 5.1% increase and local forecasters expect December 2010 CPI to be around 4.5%, which while low by recent historical standards, still points to strong inflationary pressures. Indeed, some sources claim that inflation may be higher in real terms than official figures would suggest.

Exhibit 2: China Gas daily customer use, by sector

million cubic meters

Source: China Gas

Longer-term trends

China’s structural gas supply shortage, which has existed for several years in key areas, is now even more attractive to LNG producers. The U.S. shale gas boom has sharply trimmed the outlook for rising North American LNG import demand, leaving China as the biggest game in town for sellers seeking a large growth market to sell gas into. Markets without additional sources of gas supply like Japan, Korea, and Taiwan, are often more attractive for gas marketers due to the opportunities for premium pricing, but China can deliver far more robust LNG demand volume growth than the more mature Asian gas markets.

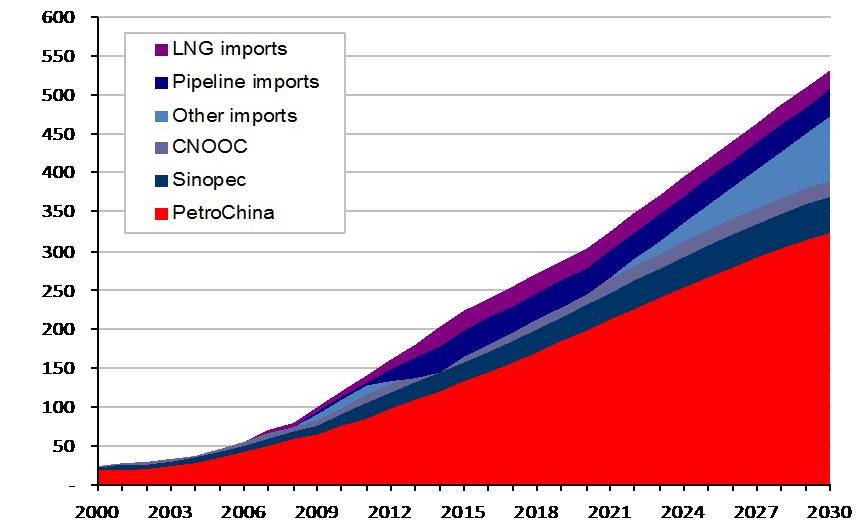

NDRC data and estimates show that China, which was essentially self-sufficient in gas in 2003, could import as much as 25% of its total gas supply by 2030 (Exhibit 3). Coal will likely remain king as an overall source of energy during the next 15 years, but in urban areas especially, gas demand will see strong demand growth and yield the potential to generate solid economic returns. Here we note that China Gas says it typically does not proceed on a gasification project unless it can get an internal rate of return of at least 15%. Gas will be different from oil in that imports will be a much smaller portion of total supply; nonetheless, the impact of Chinese demand on the global LNG market will be substantial.

Exhibit 3: China gas supply history and projection, by source

billion cubic meters

Source: NDRC, China Gas