Forbes Magazine recently published “rich lists” of the wealthiest people in China and the US. Analyzing the holdings of the 100 wealthiest people in each country helps give insights into the structure of the Chinese economy at present and what types of shifts and evolution might be expected as the country attempts to move toward a more consumption-oriented economy. The US does not, of course, provide a precise blueprint of what the Chinese economy will evolve toward, but gives some a sense for the direction general trends could take.

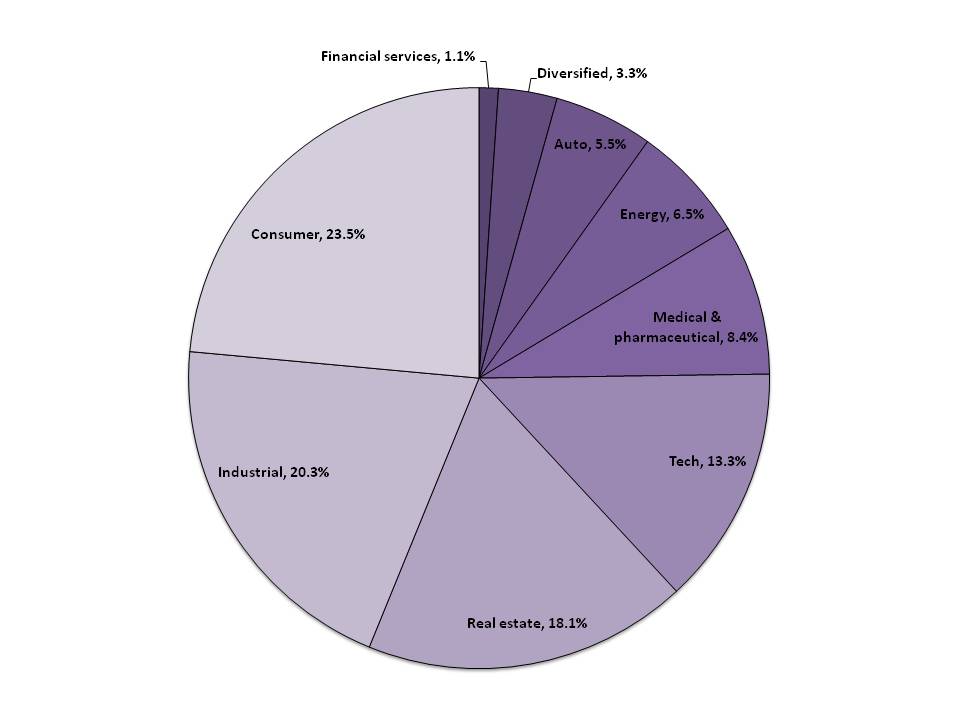

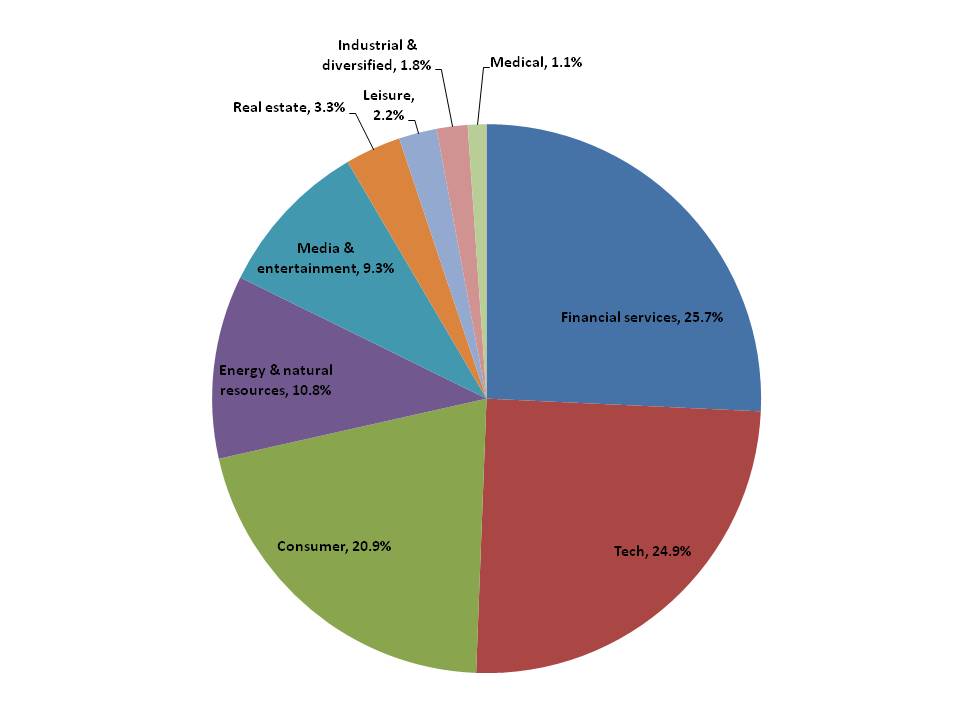

At present, of the assets held by China’s 100 wealthiest people, the largest portion is in consumer-oriented businesses at 23.5%, industrial firms (primarily manufacturers) at 20.3%, and real estate at 18.1% (Exhibit 1). In the US, by contrast, more than 2/3 of the assets held by the 100 wealthiest people are in either the financial services (25.7%), tech (24.9%), or consumer sectors (20.9%).

Sectors more likely to see dynamic growth

Retail financial services. China’s finance sector is presently largely equated with multi-billion USD bank IPOs and large loans for massive infrastructure projects. Yet some of the biggest fortunes in other countries come not from starting major industrial banks, but from creating more retail-oriented financial services companies. As Chinese consumers become wealthier and more sophisticated in how they save money and manage their financial assets, additional market opportunities will arise for home-grown financial advisors. The rise of a “Chinese Charles Schwab” and its peers could be a major driver of wealth creation.

Exhibit 1: Wealth distribution of the 100 wealthiest Chinese and Americans, by sector

% of total reported asset holdings

China

US

Source: Forbes, China SignPost™

Tech. In the tech sector, e-commerce and social networking are already well underway, with Alibaba, Taobao, Tudou, and Tencent among the leaders in the space. China already has the world’s largest population of Internet users and the number is likely to rise. According to Pew, roughly 75% of Americans use the Internet. In China, by contrast, roughly one third of the population is online, according to CNNIC. For example, data from Pew and China Network Information Center show that roughly 90% of US internet users use e-mail, as opposed to only around 60% in China at present.

Private education. The strong emphasis on education and acquisition of professional skills are likely to make the private education sector one of dynamic growth. The key variable is how Chinese companies react to the investments current or potential employees make in online or onsite courses at private educators such as ChinaCast Education Corporation and New Oriental Education and Technology Group.

Health care and pharmaceuticals. China’s aging population, rising incomes, and government efforts to create a national health insurance system are likely to drive demand for medicines and health care products over the next two decades. Furthermore, the Chinese pharmaceutical and bioscience industry is rapidly gaining global prominence as companies supply not only Chinese domestic consumers, but also export their products. Life sciences and medical ventures currently account for more than 8% of the wealth held by China’s wealthiest 100 people and we do not think it unreasonable to see this share increase to more than 10 percent over the next five years.

Sectors less likely to see dynamic growth

Strategic industries. It is unlikely that China’s media sector will generate the level of wealth that it has in the US (more than 9%), given the state’s desire to tightly control this sector. China’s energy sector is also unlikely to serve as a major engine of wealth creation in the next decade, given Beijing’s unwillingness to relinquish control over the economy’s “commanding heights.” In China, the commanding heights presently include oil & gas production and refining, electric power distribution, rail transportation, media & communications, and aircraft production and will likely remain so for at least five more years.