Gabriel Collins, “Where China’s Diesel Fuel Exports Are Coming From and Where They Are Going,” China SignPost™ (洞察中国) 99 (14 November 2016)

As China continues to play an outsize role in exporting diesel fuel and middle distillates into the Asia-Pacific refined products market, two questions arise: (1) what Chinese ports and refineries are these exports coming from and (2) what markets are those molecules being sold into?

This analysis uses China Customs port-level export data to identify key outlet points for middle distillates. China Customs calls diesel fuel “light gasoil” which industry sources generally define as “primarily diesel and kerosene.” Light gasoil export volumes tightly track the outbound diesel fuel volumes reported by the Joint Oil Data Initiative for China. Furthermore, China Customs reports unique data for “Jet Kerosene” exports, strongly suggesting that “light gasoil” is indeed a synonym for diesel fuel.

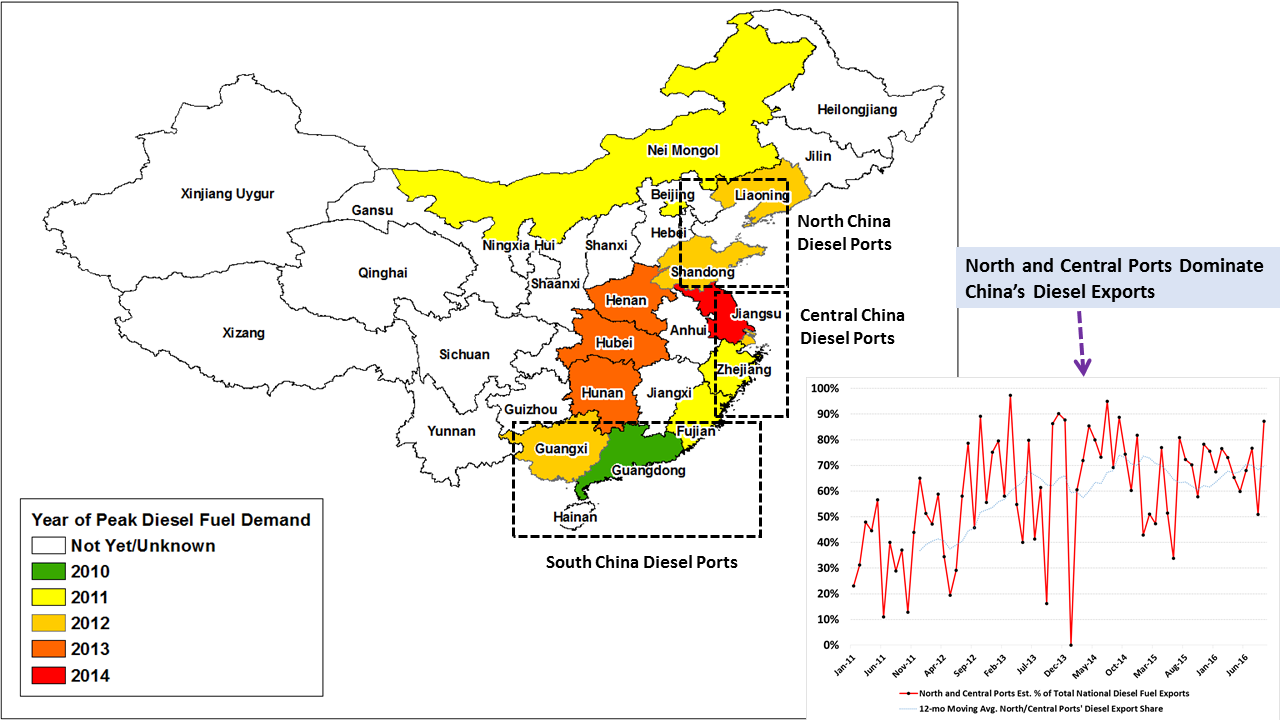

Exhibit 1: China’s Key Export Points for Light Gasoil a/k/a Diesel Fuel

Thousand Barrels Per Day, Converted at 7.5 bbl/tonne

Green shades represent Bohai Gulf ports, Blues East-Central China, and Reds South China

Source: Bloomberg, Author’s analysis

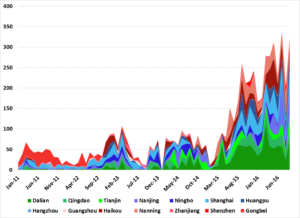

China’s key diesel fuel export points fall into three core groupings. First are the Bohai Gulf ports of Dalian, Qingdao, and Tianjin (shaded in green). These three ports all host major refining complexes and also sit in or near Beijing, Liaoning, and Shandong—administrative areas that are large diesel fuel consumers and have seen near-term diesel demand peaks within the past 5 years (Exhibit 2). Second are the East-Central ports of Hangzhou, Huangpu, Nanjing, Ningbo, and Shanghai. Each of these ports’ adjacent administrative areas has already experienced a near-term diesel fuel demand peak, while refinery crude run levels have remained strong and helped create diesel fuel surpluses that are being exported. Finally, there are the South China ports of Gongbei, Haikou, Nanning, Shenzhen, and Zhanjiang. In this region, Guangdong—China’s largest refined products market—was the canary in the coalmine, as diesel demand peaked there in 2010.

The North and Central Ports dominate China’s diesel export volumes, accounting for 70% of outbound volumes by August 2016 as measured in a 12-month rolling average basis (Exhibit 2). Moving forward into the next 6-to-12 months, it is likely that North and Central ports will continue accounting for most of China’s diesel export base flow. In 2019 and beyond, significant additional refinery capacity additions are planned across the three port regions. Assuming continuing gradual declines in manufacturing activity in the Pearl River Delta, there is a significant probability that capacity expansions in South China will be scaled back.

Exhibit 2: China Provinces Where Diesel Demand Has Peaked Near Term

Source: NBS China, Author’s analysis

Framing the China Diesel Demand Slowdown’s Magnitude

The data show a strong upward trend in diesel fuel export volumes since 1Q2015. Such a clear move amply reflects the structural overcapacity and imbalances in the Chinese refining sector that we describe in China SignPost 98. The volumes are also meaningful, as evidenced by multiple statements over the past 12 months from Vopak, one of the largest refined product storage operators in Singapore, noting that slowing economic growth and high refinery run rates continue driving significant middle distillate oversupply in the Asia-Pacific region.

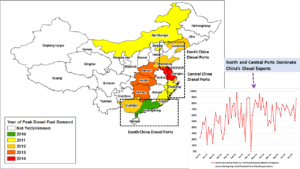

One concrete way to think about the erosion in China’s diesel fuel demand is to examine it through the lens of trucking. The average heavy truck in China consumes 44 liters of fuel per 100 kilometers driven and each vehicle drives an average of 52,000 km per year—yielding an average diesel fuel consumption of 144 barrels of fuel per truck per year.

Using that metric to analyze the volume of light gasoil exported through the major Chinese ports between March 2015 (when diesel fuel exports began to rapidly rise) and August 2016 (the last available month of Customs data) suggests that during that 18-month span, the major Chinese middle distillate ports sent out enough fuel to supply 756,000 heavy trucks for a year (Exhibit 3). The port of Dalian alone saw fuel exports equivalent to the annual diesel fuel demand of 184,000 heavy trucks. The port data reflects the overall magnitude of China’s trucking activity slowdown, highlighted by the fact that China’s nationwide diesel fuel consumption tapered off in 2014 and 2015 despite nearly 1.3 million new heavy trucks entering the fleet.

Exhibit 3: How Many Heavy Trucks’ Worth of Fuel do China’s Light Gasoil Exports Represent?

Source: Bloomberg, Author’s analysis

Which Chinese Refineries Are Most Involved in Diesel Exports?

The China Customs data do not trace diesel/gasoil exports back to specific refineries, but the anecdotal data suggest the bulk of the volume comes from the large coastal refineries operated by Sinopec and PetroChina. These plants tend to have much better connectivity to high-volume pipelines, export docks, and other relevant infrastructure than the smaller “teapot” plants that have recently ramped up activities in Shandong Province.

Teapot refiners typically lack their own retail distribution infrastructure (i.e., gas stations) and reportedly sell as much as of their refined products through Sinopec and PetroChina. To compete in the market, they often significantly discount their fuels relative to official guidelines prices—sometimes by as much as $18-to-$36 per barrel.

While the teapots’ direct refined product exports remain much smaller than those from the large state-owned refiners, they are nonetheless playing a critical role in driving up China’s net refined products export volume. The mechanism is straightforward: the teapots have dramatically increased crude runs over the past 18 months and as they compete to sell their diesel fuel in the stagnant North China marketplace, large coastal refiners on the Bohai rim find their diesel fuel displaced and turn to exports.

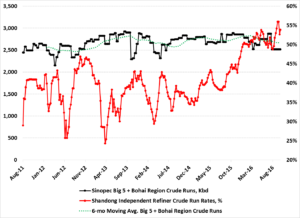

Regional refinery data support this thesis. For the past 2 years, Sinopec’s 5 largest coastal refineries, Sinopec’s Qilu plant in Central Shandong, and the remaining large plants along the Bohai Gulf near Dalian, Tianjin, and Qingdao have maintained a level of crude runs that, accounting for seasonal maintenance, is roughly on trend (Exhibit 4).

During that same timeframe, Shandong’s independent refiners (i.e. the “teapots”) have almost doubled their plant utilization rates and as the teapots ramped up, China’s net exports of diesel fuel also began to climb noticeably. The teapot utilization increase is primarily driven by recent policy changes that allow them to directly import crude oil and move away from low quality fuel oil that used to be their primary feedstock.

Exhibit 4: Crude Runs at Large Coastal Refineries Remained Close to Trend While the Teapots Sharply Ramped Up Utilization

Source: Bloomberg, Author’s analysis

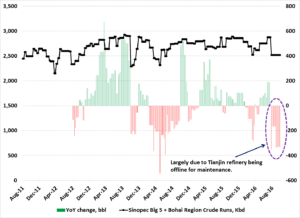

Exhibit 5: Sinopec Big 5 Plus Bohai Region Refinery Weekly Crude Runs vs. Year-on-Year Change, by Week

Thousand bpd

Source: Bloomberg, Author’s analysis

Known Unknowns: How Far Inland Are China’s Diesel Exports Coming From?

This is a crucial blind spot at present. The author strongly suspects that on a straight logistics cost basis, China’s inland refiners probably cannot competitively supply middle distillates into the Asia-Pacific export market. The author also believes that China’s oil product transport infrastructure—especially pipelines—are fundamentally geared toward sending products to inland markets, vice shipping refined fuels back to the coast. Take for instance the 1,700 km long Maoming-to-Kunming oil products pipeline, which moves gasoline and diesel fuel from the coastal Maoming refinery deep into interior Southwest China.

What Are The Main Markets For Distillate Exports From China?

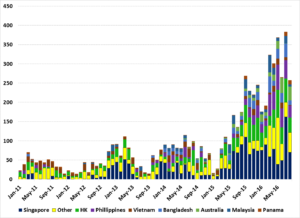

As China’s diesel fuel exports ramp up, Singapore has consistently been the largest market, followed by Hong Kong. Between March 2015 and August 2016, China’s light gasoil exports to Singapore accounted for approximately 34% of total outbound volumes (Exhibit 6). Chinese exporters’ decisions to send diesel to Singapore are not surprising given the island state’s world-class storage assets and commensurate opportunities for blending and selling diesel into an active, liquid marketplace.

To date, the highest monthly average light gasoil volume exported from China into Singapore is approximately 162 kbd (July 2016). July was an exceptional month for China’s diesel exports, as severe flooding in many regions substantially disrupted industrial and transport activities, which crimped diesel demand accordingly and drove a spike in exports.

Exhibit 6: Destinations of Light Gasoil Exports from China

Thousand barrels per day

Source: China Customs (via Bloomberg), Author’s Analysis

Implications

The most immediate impact of China’s rising diesel fuel exports falls on refiners in Singapore and elsewhere in Southeast Asia. Singapore is a major regional refining center and products trading hub, hosting the largest refining capacity in the Asia-Pacific Region outside of China, Japan, and South Korea.

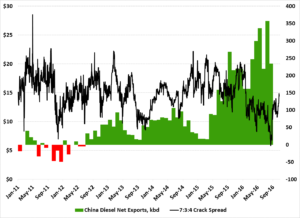

The rapid rise in China’s net exports of diesel fuel in early 2016—a sizeable portion of which ended up in Singapore according to Customs data—coincided with a significant drop in Singapore refiner’s crack spreads (Exhibit 7). This analysis uses Arab Medium crude as the feedstock, and assumes an output of 3 barrels of gasoline and 4 barrels of diesel fuel for every 7 barrels of crude run through the refinery.

As China’s diesel fuel exports ramped up in the first quarter of 2016, the crack spread for Arab Medium crude in Singapore plummeted from nearly $20/barrel in January 2016 to $5.86/bbl by late August. The 7:3:4 crack has recovered recently. As regional refiners come back online after seasonal maintenance and if winter weather is warmer than usual in East Asia, continued Chinese net exports of diesel fuel in the range of 250 kbd or higher could send the crack back below $10/bbl.

Exhibit 7: Singapore Arab Medium 7:3:4 Crack Spread vs. China Diesel Net Exports

Source: Bloomberg, JODI, Author’s analysis

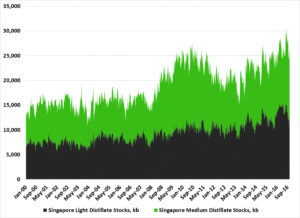

While there are not yet sufficient data to draw a firm conclusion, Singapore’s July 2016 LGO intake volume from China exceeded the previous high point by roughly 50%, and barring special circumstances, there may be an effective ceiling as to what the Singapore gasoil/diesel market can absorb from China without run cuts at other regional refineries, significant discounts, or other enticements. The next 2-4 months will likely provide additional insights into whether or not there is effectively a “ceiling,” past which the Singapore market struggles to absorb middle distillate exports from China. The recent rise of Singapore’s light and middle distillate inventories to the highest levels seen in the past 15 years suggests a ceiling could be tested sooner rather than later (Exhibit 8).

Exhibit 8: Singapore Weekly Inventories of Light and Middle Distillates

Thousand Barrels

Source: Bloomberg

If a ceiling does exist, Chinese refiners and traders will have to more aggressively seek other markets for their diesel exports. Such alternative markets most likely exist in the Asia-Pacific region, or more broadly, east of Suez including India, Pakistan, and Bangladesh, which according to China Customs data has begun importing more Chinese diesel over the past 6 months. The further west Chinese refiners try to market their diesel fuel, the more directly they will be competing with Saudi Aramco and Reliance Industries’ world-scale export oriented refineries.

China Customs data show very little in the way of consistent Chinese light gasoil/diesel fuel exports into the Atlantic Basin. Chinese refiners’ focus on Singapore and other markets “East of Suez” is logical given their geographical position. It also makes sense because Chinese refiners or traders seeking to move diesel fuel into Atlantic Basin markets must face off with highly competitive U.S. Gulf Coast refiners that enjoy access to competitively priced domestic crudes and low-cost shale gas, which gives them advantageous access to hydrogen for producing ultra-low sulfur diesel fuel.

For reference, US refiners enjoyed an average external crude oil acquisition cost advantage of roughly 6.5% in 2013, nearly doubling to 12.6% by 2015 (Exhibit 9). As China’s domestic oil production continues to taper off and Chinese refiners procure a larger share of their crude oil from abroad, the U.S. plants’ cost-advantage is likely to endure and along with their geographical advantages, generally keep their diesel exports more competitive than those from Chinese refiners in the Atlantic Basin.

Exhibit 9: Sinopec and US Refiners’ Crude Oil Acquisition Costs

| Sinopec Cost of Externally Purchased Crude Oil, USD/bbl | US PADD 3, Refiner Acquisition Cost of Domestic Crude Oil (USD/bbl) | US PADD 3, Refiner Acquisition Cost of Imported Crude Oil (USD/bbl) | US PADD 3, Refiner Acquisition Cost of Crude Oil, Composite (USD/bbl) | US Refiners’ Implied Crude Oil Acquisition Cost Advantage’ | |

| 2013 | $110.12 | $104.64 | $101.42 | $103.02 | -6.45% |

| 2014 | $103.55 | $94.67 | $90.84 | $93.06 | -10.13% |

| 2015 | $55.79 | $50.16 | $46.49 | $48.75 | -12.61% |

Source: Company Reports, EIA

Over the next 1-to-3 years, the biggest impacts of China’s rising diesel fuel export volume may be Korean and Japanese refiners. In particular, South Korea has made a concerted effort over the past decade to become an export-oriented regional oil refining center. In the best case, South Korean and Japanese refiners will lose competitiveness in China’s refined products import market—especially for diesel and middle distillates. In the worst case (from their perspective), South Korean and Japanese plants will see a greater volume of high-quality China-origin diesel fuel eroding their market share in Australia and other premium regional markets.