Gabriel Collins,” China Now Exports as Much Diesel Fuel and Gasoline as Saudi Arabia Does,” China SignPost™ (洞察中国) 98 (14 November 2016)

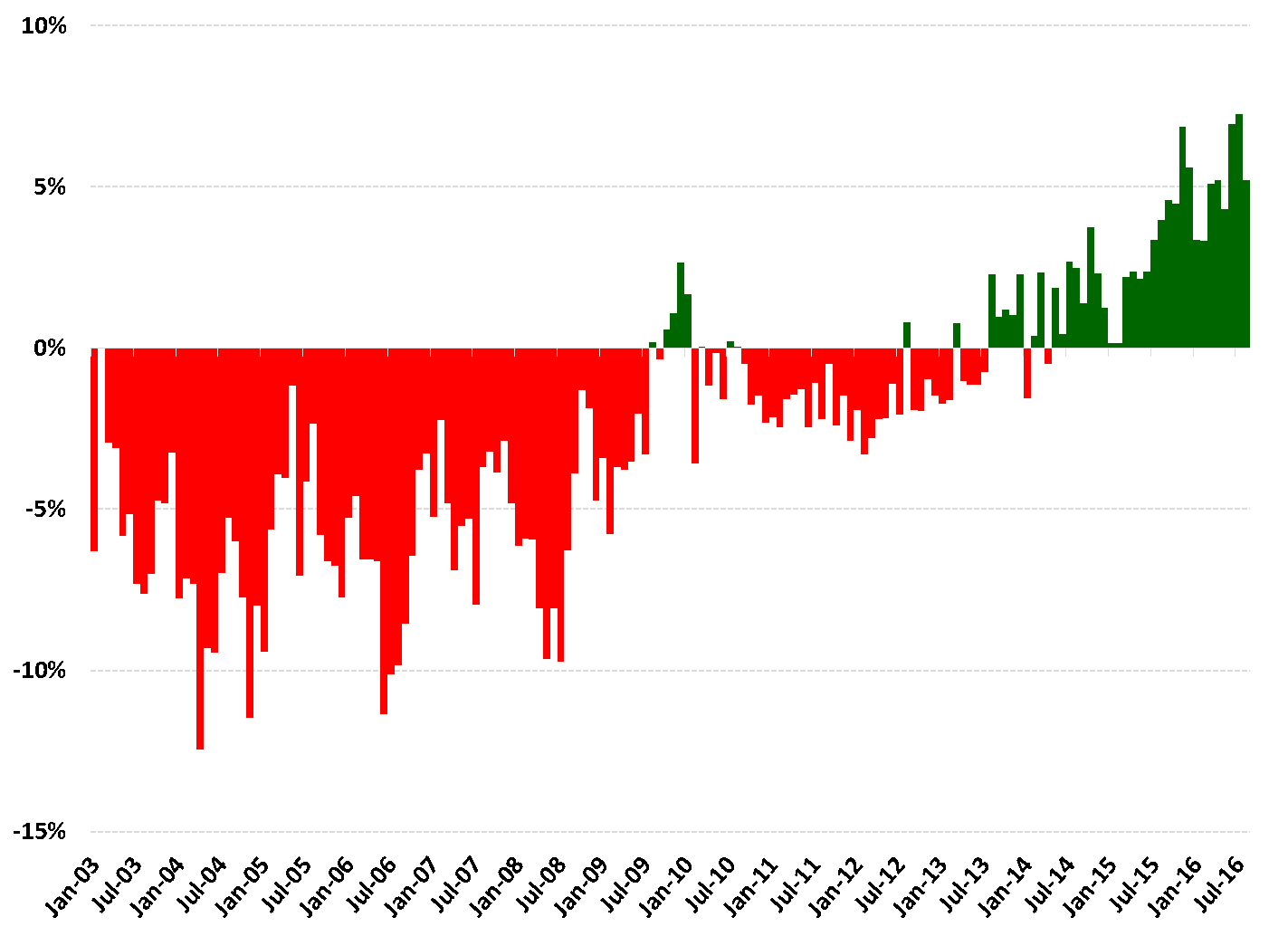

Slowing domestic middle distillate demand and substantial new refining capacity coming online are making China into one of the world’s largest net exporters of refined products, at times trailing only the U.S. and Russia. In June 2016, China’s net exports of gasoline and diesel fuel flirted for the first time with the 600 kbd mark—on a par with Saudi Arabia’s net refined product export level (Exhibit 1).

Exhibit 1: Net Exports of Gasoline and Diesel Fuel from China and Saudi Arabia

Source: JODI, Author’s analysis

Oil refining is the latest chapter in a long saga of Chinese industrial overcapacity that first supplies a burgeoning domestic market and then ends up flooding product into the global market. Data on planned refinery expansions and plant buildouts suggest China could add at least a million bpd of additional crude processing capacity by 2020. As such, the overcapacity situation is unlikely to rectify itself in the near-term, particularly if local diesel fuel demand remains stagnant or continues gradually declining.

Product exports will likely remain strong through 4Q2016 because domestic diesel demand remains tepid and China’s largest refiners only used about a third of their 2016 refined product export quotas during the first 5 months of 2016. Domestic gasoline growth continues to grow and is more strongly and directly consumer-oriented than diesel demand is. As such, month-to-month volatility in gasoline export volumes will likely be comparatively higher than that of diesel.

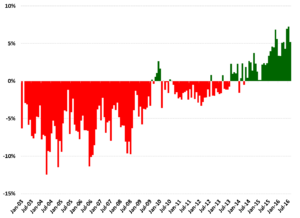

The data suggest China’s shift to becoming a major net exporter of oil products is one that will endure for years to come. Consider the following data points: between January 2003 and July 2013, only 10 months out of 127 saw China have net exports of refined products as a percentage of total refinery intake of crude oil. But of the next 37 months—July 2013 to August 2016—all but 2 months saw net exports of refined products (Exhibit 2). Furthermore, the overall volume of net refined product exports grew significantly both in absolute terms and as a percentage of total crude oil intake at refineries in China.

Exhibit 2: Net Exports of Core Refined Products as Percentage of Total Refinery Intake of Crude Oil

*Core Refined Products* means diesel fuel, fuel oil, gasoline, and kerosene

Source: JODI, Author’s Analysis

The durable shift to higher net refined product export volumes and the fact that these volumes have come to occupy a larger share of crude feedstock put into Chinese refineries suggest that a watershed moment has occurred. In essence, China has almost certainly structurally overbuilt its refining system and is now effectively exporting that overcapacity to the world market in the form of gasoline, diesel, and other refined products.

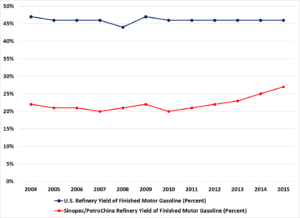

In a sign of how significant China’s domestic diesel fuel oversupply has become, in late 2015, Sinopec—the country’s largest refiner—actually offered its refineries a bonus of approximately USD 5 per barrel to export diesel fuel. The bonus reflects a struggle in which refiners seeking to meet growing gasoline and kerosene demand must run larger volumes of crude oil through refineries that are fundamentally optimized for diesel fuel production, but due to weakening domestic demand cannot readily find downstream markets for the extra diesel in China. The problem will endure because China’s refining system—unlike that of the U.S.—is not fundamentally optimized for production of gasoline. Sinopec and PetroChina still turn only 27% of each barrel of crude refined into gasoline, as opposed to a 46% gasoline yield seen across the U.S. refining system (Exhibit 3).

Exhibit 3: Sinopec/PetroChina and U.S. National Average Gasoline Yield

% of Total Products Output

Source: Company Reports, EIA

Implications

China’s rising refined product exports, combined with its continued importance as Saudi Arabia’s largest crude oil customer, strongly suggest an interesting outcome. Namely, Saudi Arabia’s biggest crude oil buyer is now also becoming one of its chief competitors in the global refined products export market—particularly for sales east of Suez.

As China’s core oil products market becomes more consumer-driven (e.g., regarding gasoline and jet fuel), demand volatility is also likely to increase. Whereas diesel fuel demand for much of the 2000-12 commodity supercycle tended to be tightly leveraged to 5-Year Plans and multi-year stimulus packages, gasoline and jet fuel are much more subject to the short-terms whims of fickle consumers.

As such, more volatile retail sales patterns are likely to combine with the structural overcapacity in China’s refining industry to yield a persistent story of sustained world-class oil product export volumes out of China. Diesel/gasoil will be the primary refined product export, but meaningful amounts of gasoline and jet fuel will also set sail from Chinese ports.