Gabe Collins, The Diplomat, 9 September 2015

China’s military shipbuilders – now the world’s most prolific builders of large surface combatants and submarines – are leading a push to access local and global capital markets that other Chinese defense enterprises will likely emulate.

Between January 2004 and January 2015, the publicly listed arm of China Shipbuilding Industry Corporation, CSIC Limited and that of China State Shipbuilding Corporation, CSSC Holdings, raised a combined total of $22.26 billion from selling stock and bonds. This is approximately 20 percent more than the combined total that Huntington Ingalls, General Dynamics, and Lockheed Martin – three of the world’s largest and most sophisticated defense contractors – raised from the capital markets during that same timeframe.

Every dollar or RMB raised on the market and ploughed into upgraded yard infrastructure, staff, and warship equipment frees up military budget funds for other uses. Consider that each Type 054A frigate delivered to the PLAN likely costs approximately $360-375 million. Each billion dollars raised on the market thus can effectively fund naval hardware activity equivalent to the delivered cost of nearly three Type 054As—a substantial impact by any measure.

Quantifying the Activity

This analysis features the highlights of a paper my co-author Eric Anderson and I presented at the “China’s Naval Shipbuilding: Progress and Challenges,” conference held by the China Maritime Studies Institute at the U.S. Naval War College on 19-20 May 2015.

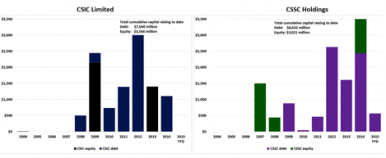

We created a unique proprietary dataset showing the number, type, and volume of capital markets transactions CSSC and CSIC executed between January 2004 and January 2015. These include both debt sales and equity issuances, and typically involved the companies’ respective listed arms: CSSC Holdings, Ltd. (SHA:600150) and CSIC Limited (SHA:601989.). Between January 2004 and January 2015, we count 31 transactions by the companies, for a combined total capital raised of $22.26 billion. Twelve transactions were by CSIC Limited, and nineteen by CSSC Holdings. Despite the initial public offerings of stock by CSSC in 2007 and CSIC in 2009, overall the companies have thus far issued much more debt than equity. To date, CSSC Holdings has raised a total of $8.63 billion from the debt markets and $3.02 billion from equity sales, while CSIC Ltd. has raised $7.04 billion from debt issuances and $3.57 billion from equity sales.

Figure 1. CSIC Ltd. and CSSC Holdings Capital Markets Transactions. Jan. 2004-Jan. 2015

Million USD

Sources: Company reports, Chinese media, Authors’ analysis