Peak China? Not yet. Peak Party? No. Peaks in demand for, and production of, specific commodities? You bet! Here’s our take…

For much of the period since 2000, China-centric commodity analysis focused like a laser on growth. Now the commodity bulls’ horns are being trimmed and the China commodity bears are growling with increasing ferocity. Indeed, the late July heat is re-awakening fears of another market downdraft like we saw earlier this month. On Monday, 27 July 2015, crude oil prices and the U.S. Dow Jones Industrial Average came under significant pressure, in no small part due to investor fears sparked by a continuing stream of negative data points from China.

The markets are cycling into a new paradigm characterized by pockets of peak demand and pockets of significant upside opportunity. To us, the shift deserves classification as a clear, multi-year theme—hence this SignPost. China remains the world’s fastest-growing multi-trillion dollar economy, but its rate of growth is slowing undeniably. Accordingly, China-driven demand has peaked—or is currently peaking—for several large, globally traded commodities to which millions of investors and at least hundreds of billions of USD in capital are exposed. As we churn through this new, volatile world, our focus will be on steel and iron ore, coal, crude oil, passenger cars, and several other commodities and related items to be determined as our analysis unfolds.

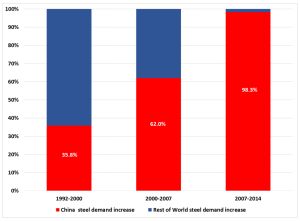

For a snapshot of how profoundly China’s rise has driven global commodity demand, consider the steel market. Here, China accounted for 35.8% of the increase in global demand between 1992 and 2000, 62.0% of the demand increase between 2000 and 2007, and a whopping 98.3% of the net global demand increase between 2007 and 2014 (Exhibit 1). Between 2007 and 2014, steel demand actually fell in the OECD and economically advanced countries, leaving China as the prime mover behind the entire global steel and related raw materials market—including the seaborne iron ore boom which marked that period. While the percentages vary, the concept of China becoming an ever-larger driver of marginal demand (and higher pricing) repeated itself across numerous raw materials markets during the last 15 years.

Exhibit 1: China as a Percentage of Total Global Steel Demand Growth, 1992-2014

Sources: World Steel Institute, China SignPost analysis

We started to have our doubts about the sustainability of China’s nearly hyperbolic growth trajectory in the summer of 2011. Please see Gabe Collins and Andrew Erickson, “China’s S-Curve Trajectory: Structural factors will likely slow the growth of China’s economy and comprehensive national power,” China SignPost™ (洞察中国), No. 44 (15 August 2011). In our view—despite some recent speculation that we believe exceeds available, reliable data—there is no compelling evidence to date suggesting that Peak China or Peak Party lie in the near future. Instead, peaks in specific commodity areas are coming into view, with significant implications for China’s internal development and external impact alike. Indeed, the speed of the real economy slowdown over the past 12 months has been profound. For evidence, one need look no further than the rapid softening of numerous global commodity markets, especially materials such as crude oil and coal that were fueled by China’s ravenous appetite for imported resources. This offers insights into important aspects of China’s economic trajectory: specific commodity statistics are generally more reliable than Beijing’s official aggregate economic figures.

Through the rest of the summer and likely into the fall and winter, we will therefore release a number of analyses focusing on commodity classes where China’s demand has peaked, is peaking now, or is likely to peak/plateau sooner than commonly expected. First up: crude oil. On July 7, The Diplomat published a Feature piece written by Gabe Collins on China’s peaking domestic crude oil production, how the sector is evolving, and what potential global oil market impacts will arise from a peak or plateau of crude oil production in China, the world’s fifth-largest producer.

Structural factors drive the existing slowdown in China’s demand for many key raw materials. Now, the stock market crash, destruction of several trillion dollars in wealth, and erosion of investors’ confidence in Beijing’s ability to steer the market are adding additional bearish factors. Losses of confidence can cripple markets in ways that take years to recover from. And in China’s case, recent events risk catalyzing bricks and mortar demand slowdowns that bring peak consumption of certain commodities sooner than consensus estimates anticipated. Those are the emerging peaks to be scanning the horizon for, and so we shall—expect more research soon!