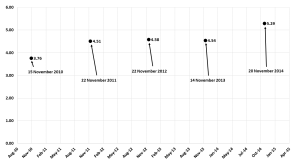

Coal inventories at 14 key power plants in Hubei province stood at 5.29 million tonnes as of 20 November 2014 —16.5% higher than they were at this time last year (Exhibit 1).

Two core factors account for the significant expansion of coal stockpiles at the 14 key power stations in Hubei. On the supply side, shipment of seaborne coal from Northern China (and probably some imports) up the Yangtze River—known in Chinese as “海进江”—dramatically increased in 2014. Local media report that coal volumes shipped up the Yangtze rose by nearly 32% YoY in the first 6 months of 2014.

On the demand side, Hubei’s electricity demand has been weak—growing only 1.4% YoY between January and October 2014. Moreover, thermal power generation in Hubei province fell 23.7% YoY for the month of October 2014. Normally, we would expect power output to begin rising again as the weather cools, since Hubei is a net power importer and also needs additional thermal power supplies during the drier winter months to compensate for lower hydropower supplies.

Exhibit 1: Coal Stocks at Key Hubei Power Plants Rose Sharply in November 2014

Source: NBS China, Local media

Implications:

We do not want to overstate what the data says, but the implications from multiple signals is clear: coal stockpiles grew less rapidly that they otherwise would have because coal production expanded. To the contrary, China’s coal imports declined by nearly 8% YoY in the first 10 months of 2014 and domestic coal production actually fell by 1.5% YoY in the first 10 months of 2014. If demand were even semi-strong, power plants would be struggling to obtain coal supplies under such conditions. Yet Hubei’s coal-fired plants are now swimming in coal.

Most likely, the coal piles are stacking up in Hubei because demand for electricity is weaker compared to prior years and the reason it is weaker is that a range of core economic activities are slowing. Hubei is an industrial and transport hub in the heart of the Yangtze River valley—China’s riverine artery of economic activity—where coal supplies 64% of primary energy. The analogy would be seeing coal demand weakness in Germany’s Ruhr Valley, the country’s industrial heartland.

No matter what the 4Q2014 official GDP growth figure ends up being, we take the growing coal stockpiles in Hubei as one signal in a rising chorus of signals that growth is slowing more rapidly than Beijing would like to admit.