We first addressed the issue of potential North Korean threats to oil refining infrastructure in Northeast Asia in the fall of 2010. Unfortunately, the risk of serious crisis or even conflict is once again rising. Because the base level threat is similar, but the specific circumstances somewhat different, we include much of our prior analysis, with relevant updates.

The sequential reminders of military capabilities by the U.S. and South Korean militaries in response to provocations from the North—including a third nuclear test, threats to restart the Yongbyon nuclear facility, and recent ballistic missile tests, with the KN-08 IRBM perhaps being readied—suggest that the Pentagon and its partners in Seoul think there is a very real need to deter Pyongyang from engaging in offensive actions. In Patrick Cronin’s seasoned judgment, “The Korean Peninsula is on a knife’s edge, one fateful step from war. While Koreans are accustomed to periodic spikes in tensions, the risk of renewed hostilities appears higher than at any time in the past 60 years. … the potential for miscalculation and escalation is high.”

Moreover, the high-stakes game of ‘escalation poker’ North Korea has initiated shows no sign of abating soon. Indeed, a number of U.S. military moves—such as hastening the deployment of anti-missile systems to Guam—signal that U.S. military planners view the North Korean threat as an enduring one.

The steady escalation between North Korea and South Korea as well as the U.S. is increasing the risk of armed confrontation, however unintended, in the region. In the still unlikely but nevertheless not impossible event that a shooting war were to erupt, North Korea might threaten to target such critical economic infrastructure as refineries in South Korea and Japan. Saddam Hussein’s Scud attacks against Israel during the First Gulf War in 1991 suggest how despots with large missile forces can lash out in unpredictable ways during a conflict, even to their ultimate detriment.

North Korean actions are steadily eroding the tolerance of both South Korea and its U.S. ally, whose military would almost certainly also participate in military action against the North. North Korea’s sinking of the Cheonan was a human tragedy with 46 crewmembers killed, but at the time it did not sufficiently threaten South Korea’s core interests to make Seoul willing to launch a military response.

Two and one-half years later, the calculus appears to have changed on both sides of the DMZ. South Korea, under President Park Geun Hye’s leadership, seems much more inclined to meet new, serious military provocations by North Korea forcefully. And for its part, North Korea seems to be losing sight of the fact that the now unprecedentedly vitriolic iterations of its chronic ‘shakedown diplomacy’ run a higher risk of sparking real conflict now than even their violently kinetic predecessors did in 2010.

Meanwhile, the U.S. has come to its senses and is no longer willing to be a victim of the periodic Pyongyang hustle. As U.S. Secretary of State John Kerry declared in his remarks with South Korean Foreign Minister Yun Byung-se after their meeting in Seoul on 12 April, “No one is going to talk for the sake of talking, and no one is going to continue to play this round-robin game that gets repeated every few years, which is both unnecessary and dangerous.” This is an extremely sensible approach. Just as Lucy always pulls the football away just before Charlie Brown can kick it in the “Peanuts” comic strip, the Kims of North Korea have long been interested not in any meaningful negotiations but only in manufacturing crises to extract international resources that their own economy is inherently incapable of generating under their totalitarian rule.

Kim Jong-un’s father Kim Jong-il likely prioritized (in descending order) personal, family, regime, and national survival. We are increasingly inclined to think his son is not the same strategically cautious extortion artist that his father was, and that his grandfather eventually became years after unilaterally launching the devastating Korean War. As Chung Min Lee explains, Kim Jong Un, having more to prove than his grandfather or even his father,

“has walked into a self-made trap; namely, that he has to show his people and his generals that he really deserves to be the Young Marshall who can lead his nation to new heights. By rattling his sabers and almost daring South Korea, the United States, China, and Japan to take him on, Kim Jong Un feels that he can earn his military stripes, even though he spent his teenage years at an exclusive boarding school in Switzerland and has lived as a de facto diety, unlike the absolute majority of his countrymen who have lived in fear and hunger.”

What all three Kims have perfected to an art form is finding new and unexpected ways to cause maximum provocation while just managing to avoid a larger escalation that sinks their regime.

Kim Jong-un may have the same basic idea of brandishing a sword to try to extract aid from the outside world, but his regime’s actions now suggest that he has become more risk-acceptant than many observers anticipated. Lacking his predecessors’ sense of when to hold and when to fold, and determined to ensure regime survival by demonstrating nuclear and missile capabilities to a degree that surpasses them significantly, Kim Jong-un has now come too close to the brink for anyone’s comfort, perhaps including ultimately his own.

Consequently, the North’s myriad ballistic missiles and artillery tubes may now increasingly be at risk of being pointed in a worst-case scenario not only at Seoul, but also at regional oil and gas infrastructure, particularly if a conflict started and North Korean leaders realized that regime collapse was imminent, as it likely would be given that the U.S. and South Korea would almost certainly engage militarily until the Kim government was removed from power. Long before that possibility can materialize, it is important to review potential red lines and to warn Pyongyang clearly not to cross them. Indeed, we hope that Beijing is doing just that right now.

To that end, our analysis here focuses on one critical red line that Pyongyang must not cross, and that all nations share an interest in it avoiding completely: actually striking petroleum supplies in a country that is completely import dependent. South Korea could not tolerate this kind of threat, nor could Japan or even China. All three countries are highly energy-interdependent. Additionally, China would be very sensitive to any disruptions in energy supplies in Northeast Asia.

China would understand the South Korean and Japanese reaction to such threats—and would likely curtail its support for North Korea severely if it took such action. After all, China wants to preserve the status quo, and it too is a rational actor. However, unlike North Korea, China’s preference ordering is stable and transparent, and given the billions in trade from Japan and South Korea, China will prioritize the economic relations with those two countries over the increasingly tense relationship with North Korea.

Given the risk of misperception and miscalculation, however, now is a logical time to assess the vulnerability of regional refining infrastructure to a North Korean attack in a worst-case scenario and how the markets might respond to related threats.

North Korean threats against South Korean economic assets such as refineries would mark a new front in the countries’ conflict. The rising risk of this happening should be taken seriously by policymakers because even threats made by Pyongyang for deterrence purposes can have meaningful and negative economic impacts. Indeed, refined oil products are now South Korea’s single-largest export earner, and the country has become Asia’s key regional refined product supplier. North Korean attacks on South Korean refineries would thus have an outsize regional oil market impact and a global one as well.

Financial markets and insurance markets are inherently forward-looking and would quickly price in increased perceptions of risk driven by North Korean threats against South Korean refineries. Such threats could come through public statements (a lower-impact event) or in the form of actions such as missile tests landing in international waters near major South Korean oil ports (a lower-probability, but higher-impact event). Market responses to a North Korean threat might include equity market declines, crude oil and oil product price increases, and higher insurance costs for shippers delivering oil to South Korean refineries.

Unless North Korean gunners managed to hit key portions of the refineries such as cat crackers or used chemical weapons, the plants could still run, but consumers of oil and equity shareholders in the region would bear the costs as risk managers priced the reality that a key global oil refining region could face attacks. In contrast to other countries in the region, North Korea’s economic isolation from the outside world shields it from the impacts of market disruptions triggered by its behavior, potentially making it more willing to use economic threats as part of its “shakedown diplomacy.”

Refineries, at least for deterrence purposes, could in a worst-case scenario represent tempting targets for North Korea, as striking them would cause more economic damage than hitting civilian population centers, while minimizing civilian casualties. Doing so would not require flexibility and decision-making at lower levels (i.e., as might be required for an invasion of Seoul) that might be difficult if not impossible for such a hierarchical regime to allow.

Ballistic missiles with a circular error of probability of several hundred meters such as North Korea’s No-dong would have a good chance of scoring a hit against a refinery, whose processing units, storage tanks, and other infrastructure can occupy an area of multiple square kilometers. An added bonus from Pyongyang’s perspective is that a missile hit on critical parts of a refinery could put the plant out of commission for at least several months.

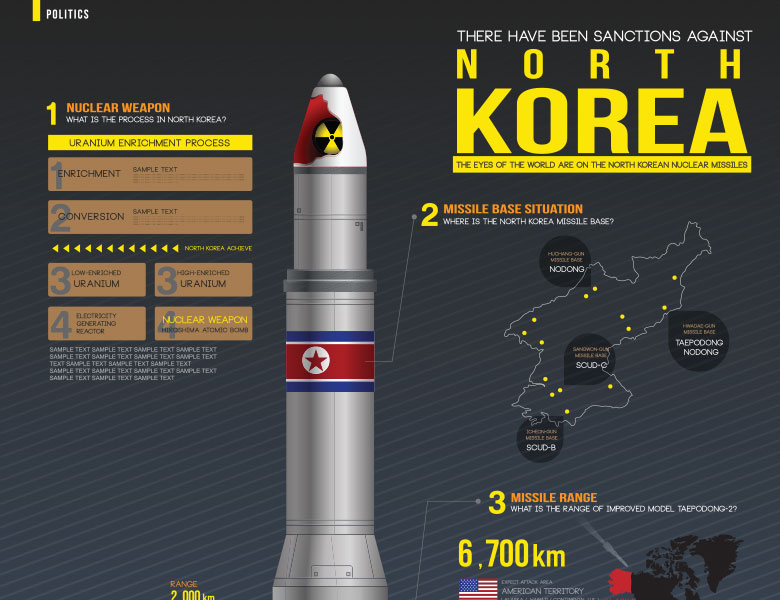

Based on the latest missile data from Jane’s and other sources, South Korea’s entire refining capacity of approximately 2.8 million bpd lies within range of North Korean Hwasong 6 and 7 and No-dong missiles, while Japan’s 4.7 million bpd of capacity lies fully within the range envelopes of the No-Dong 1 and 2, Musudan, Taep’o-dong, and KN-08 missiles (Exhibit 1).

Exhibit 1: North Korean ballistic strike systems

Source: Jane’s, Global Security.org, Nuclear Threat Initiative

Hyundai’s refineries at Incheon and Daesan lie within 100km of the border and could be targeted by the KN-02 SRBM, North Korea’s most precise ballistic strike system with a reported circular error probable (CEP) of 160 meters.[1] Exhibit 1 highlights in yellow the weapons systems (KN-02, Hwasong-5, and No Dong-2) which have reported CEPs of less than 1,000 meters and would thus presumably be able to target specific portions of large industrial facilities like refineries, particularly if armed with warheads containing submunitions that enabled the missile to impact a larger area of the target. North Korea’s other ballistic missiles, in contrast, would be operating more as weapons intended to sow fear and cause disruption of refinery operations, but not necessarily able to specifically target portions of even a large plant.

Because South Korea and Japan are such important refining hubs (8.5% of global capacity), both categories of North Korean missile threat (area- and precision-strikes) would likely cause significant market disruptions. We believe it would not be unreasonable to expect regional seaborne gasoline and diesel fuel prices to spike by 20% or more in the aftermath of a successful strike on a refinery in South Korea and/or Japan. Regional and global crude oil prices would also likely spike by more than 10% in the event of a North Korean ballistic strike on even a single regional refinery.

How missiles might change regional energy supply risk

To provide a clearer sense of how risks to refineries vary with North Korean threats, we use four scenarios (four significant probability and one worst case) to illustrate what we see as the major possible potential outcomes. The probability represents the chances that a particular scenario will materialize. All probabilities are notional, as they are intended to suggest the relative likelihood of possible future scenarios rather than an absolute prediction.

Scenario 1: Confrontation short of full conflict

Probability we attached in November 2010: >45%

Probability we attach now: 40%

Risk of refinery threats: slightly elevated

In this scenario, South Korea and the U.S. would work to pressure the North without resorting to direct military force. Possible means employed could include restricting North Korean maritime transit through South Korean waters, identifying and freezing North Korean-controlled financial assets overseas, imposing travel restrictions on North Korean officials and their family members, and further severing economic and trade ties between North and South Korea. We also see potential for imposing sanctions on companies that do business in North Korea or products produced using North Korean labor or raw materials, which could affect a number of Chinese firms.

Still, Seoul might be extremely reluctant to impose any measures that risked harming economic growth. During the Cheonan and Yeonpyeong Island incidents, for instance, South Korea never evacuated its 700+ workers from the Kaesong Industrial Complex, despite the potential that they might become hostages—or even human shields for North Korean artillery/missiles. It is only North Korean disbarment in recent days that has kept South Korean workers from Kaesong.

Scenario 2: Sparring

Probability we attached in November 2010: 35%

Probability we attach now: 40%

Risk of refinery threats: moderate

Under this scenario, the two Koreas would enter into a period of heightened tensions, to include brinksmanship and threats, and even possibly limited military actions against each other at a level beyond the occasional exchanges of fire. Records of North Korean provocations compiled by the Congressional Research Service show the 1960s were a time of particularly high North Korean activity against the South and there is a meaningful possibility that the ongoing leadership transition process in North Korea will spark a similar pattern, albeit perhaps at a lower level of casualties, over the next several years (Exhibit 2).

Exhibit 2: North Korean provocations (selected)

Source: Congressional Research Service, China SignPost™

Scenario 3: Return to normal

Probability we attached in November 2010: 15%

Probability we attach now: 15%

Risk of refinery threats: unchanged

There is a lower probability that once the immediate political heat from the current crisis passes, the two countries will return to the pre-attack status quo. We believe this is less likely than the first two scenarios because Kim Jong-un is more risk-acceptant and in need of military credibility than his father, while an increasing portion of the South Korean populace is questioning the merits of previously accommodative “Sunshine” policies toward Pyongyang in the face of its belligerent behavior and disregard for South Korean lives.

Scenario 4: Major North Korean military attack

Probability we attached in November 2010: >5%

Probability we attach now: >5%

Risk of refinery threats and attacks: high

Since the 1953 armistice, there has been a substantial record of North Korean provocations and assaults on South Korean and American assets and citizens. The lack of significant military conflict to date underscores the extraordinary restraint shown by South Korea and its U.S. ally, as well as the lack of attack options that do not allow the North to threaten Seoul with significant civilian casualties via border-based artillery. The probability of a more significant North Korean military attack is the scenario we are most concerned about, despite its relatively low probability. Missile strikes or sabotage against South Korean or Japanese refineries would probably be construed as an act of war and we believe these are only actions the North Korean leadership would take if (1) it were involved in a full-scale shooting war; and more likely, if (2) it realized that the conflict was likely to end in a North Korean loss, with regime change at the hands of ROK and U.S. forces imminent. While such escalation is highly unlikely, Patrick Cronin imagines a conceivable action that could trigger deadly escalation: “…the North Korean leadership orders an assault on South Korean patrol vessels and military fortifications built after the 2010 shelling incident. The regime feels safe in striking out along the maritime boundary because the two sides have repeatedly skirmished in the area in the past 15 years.” Escalation risk comes not just from one side’s actions but the reactions those actions can trigger from others.

Worst-case outcomes are unlikely to materialize both because even North Korea’s currently even more risk-acceptant leadership prioritizes regime survival and because it has been in the interest of South Korea, China, and the U.S. to prevent tensions from escalating to kinetic conflict, even if this entails tolerating extremely escalatory behavior on North Korea’s part. While this scenario is the lowest-probability outcome by far, then, we believe the likelihood of a more significant military exchange has risen significantly with North Korea’s recent belligerence and the calls for a stronger response that it is prompting in many quarters of South Korean society. Moreover, there is the risk of misperception and miscalculation; particularly by a young, uncredentialed leader unprecedentedly-reliant on his king-making military’s support, who may find it extremely difficult to back down in certain situations.

This is a serious risk: what happens if Kim runs out of blustery but relatively non-escalatory cards to play and has no concessions to show for it? Moreover, there is always the risk of surprise—for instance, many analysts failed to anticipate that North Korea would actually fire artillery at South Korea’s Yeonpyeong Island in broad daylight and thereby kill both military personnel and civilians. The risk of some larger military attack or exchange must therefore be viewed in proper context, but even very-low-probability worst-case scenarios deserve serious consideration given the potentially devastating consequences.

Facility vulnerability

To quantify the vulnerability of regional refining facilities, we use a simple index based on the plant’s distance from North Korea (relevant for vulnerability to accurate missile strikes), its distance from the sea (vulnerability to covert sabotage missions), and its capacity (bigger plants represent more appealing targets). The metrics are also weighted to reflect what we believe would be key elements of North Korea’s worst-case targeting calculus in the event a decision was taken to launch strikes, and therefore potentially relevant to its attempts to bolster deterrence.

Overall distance receives the highest weight in our scoring, since targets need to fall in a weapon system’s range envelope. This is followed by distance from the sea, since a covert sabotage operation would have higher deniability than a missile strike, whose origin can be traced based on the rocket’s trajectory. Finally, capacity receives a lower weighting since the main target set of South Korean refineries are, with the exception of Hyundai’s Busan plant, some of the largest facilities in the world, with the ability to process 270,000 barrels of oil per day (kbd) or more. SK’s Ulsan plant (817 kbd) gets the highest score at 213.4, with the other four large South Korean refineries rounding out the five most vulnerable plants, all with scores of between 134.0 and 213.4 (Exhibit 3).

We assess the risk of attacks on Chinese and Russian refineries in the region as much lower. Russia’s capacity in the Far East is small and a military response would likely follow any attack. China, technically an “ally,” remains North Korea’s primary international relationship, with high diplomatic importance due to Beijing’s position as a permanent member of the UN Security Council and as the only regional power willing and able to offset the weight of the U.S. in diplomatic fora such as the Six Party Talks.

So far, the Kim regime has focused on military assets and isolated areas as targets for its provocations. With that in mind, the retaliatory pressures North Korea is likely to face for its latest infractions, such as freezing of senior leadership assets abroad, could trigger threats of further attacks that could expand to include sabotage operations against industrial and economic targets like refineries. But with so much at stake, such threats would simply be intolerable. As Cronin reminds us, “Kim Jong Un may not want war, but amid heightened tensions there are many ways one could start… should war begin again in earnest, its intensity and its duration could prove a nasty surprise, as it did the first time. And the consequences could affect Northeast Asia for the rest of the century.”

Given South Korea’s vulnerability and the U.S.’s lack of further non-military options and unwillingness to endure further “shakedown diplomacy,” China may be the only party left that can talk and pressure North Korea back from the brink. Message to Beijing: your “ally” is, first and foremost, your problem; please act accordingly to safeguard your interests and those of the region. Message to Pyongyang: threatening your neighbors’ sensitive infrastructure is not a card to play to exact concessions, but an un-crossable red line. Don’t even talk about going there.

Exhibit 3: Vulnerability of South Korean and Japanese refineries to North Korean attack (highest to lowest)

Source: Oil & Gas Journal, Petroleum Association Japan, China SignPost™