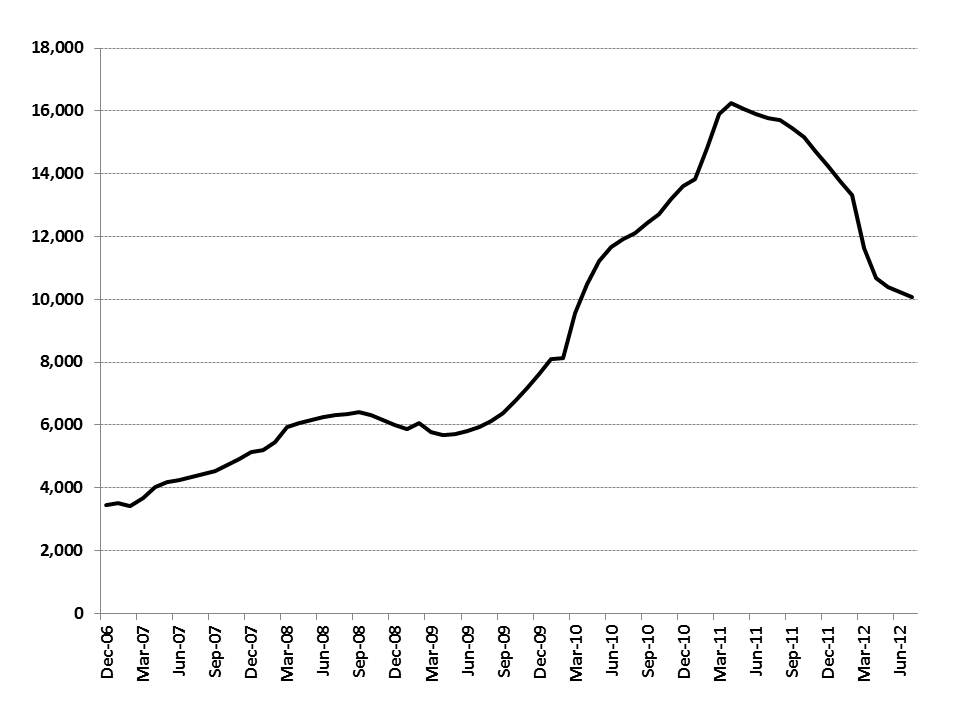

With Chinese consumers holding on to their wallets (See China SignPost 60), the People’s Republic of China (PRC)’s near-term economic fate hinges heavily upon its real economy, which still revolves around heavy industrial activity. This means excavating and building, burning coal, making steel, and so forth. The latest earthmover sales data are not quite as deeply negative as they were late in the first quarter of 2012, but they remain weak, with sales of excavators, a bellwether for construction activity, down 20% year-on-year (“YoY”) in June and down by 28% YoY in July. The structural trend looks bad as well, with the 12-month rolling sales figure still declining, albeit less sharply than it was earlier in the year (Exhibit 1).

Exhibit 1: China domestic excavator sales, 12-month rolling average

Machines sold

Source: China Construction Machinery Business Online

Excavator sales are slowing in key markets that are among China’s most populous and have some of the highest levels of construction activity. For instance, during July 2012, excavator sales were 25% lower in Shandong province than they were one year ago, according to China Construction Machinery Business Online, a leading industry news source.

Other weak spots

–Thermal coal demand is weak in the provinces of Central China, which for the past several years have delivered the highest population-adjusted GDP growth in in the country. On 11 July 2012, Hunan Province reported that thermal coal inventories at power plants were 42% higher than a year ago. This suggests that electricity demand is weak and that the officially reported data showing a sharp slowdown from last year are in fact more or less on point.

–Nationwide, China had an estimated 300 million tonnes of coal inventory in early July 2012—roughly one month of consumption, according to the China Coal Transportation and Distribution Association.

–Coking coal demand is weak as well in Central China, reflecting weakness in the steel market. This past week, a major Mongolian coking coal exporter told us that demand for coking coal in North Central China has been so weak that it was recently forced to idle its mine.

–Daily steel production in China is down by 9% from its peak in late April 2012, according to the China Iron & Steel Association.

–Crude oil refinery runs rose only 1.1% YoY in July, according to Platts. This suggests demand for gasoline for passenger cars and diesel fuel for trucking and industrial applications is weak.

Are there signs of life?

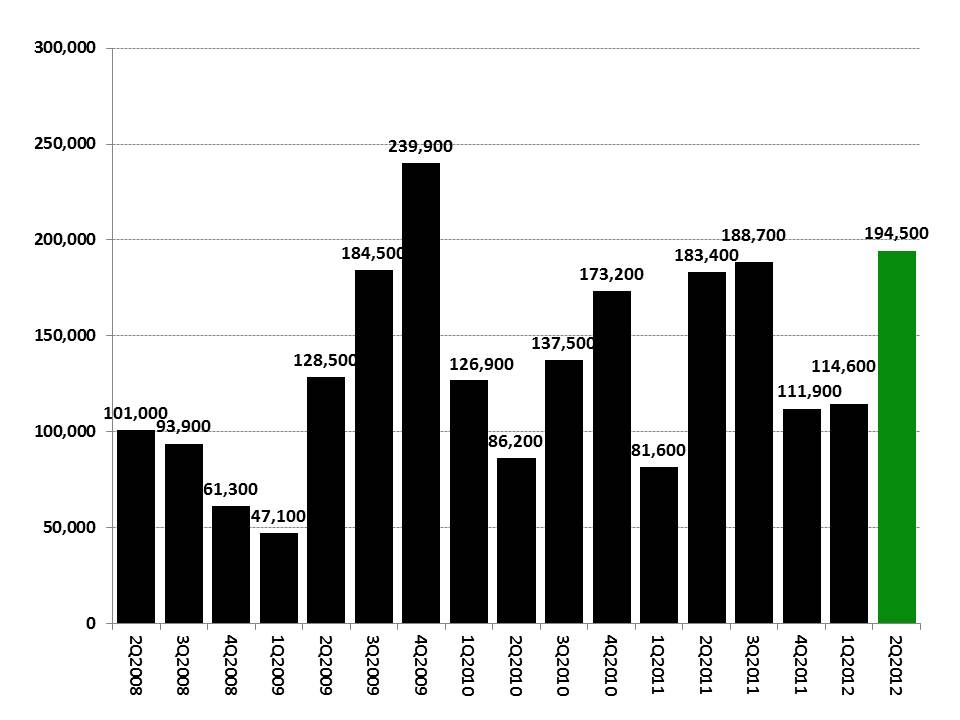

While a significant slowdown is clearly underway in China’s long-dynamic coastal regions, there appear to be pockets of greater growth potential in less-developed areas further inland. Despite the continued decline in earthmover sales, data from smaller real estate developers focused on the Second and Third-Tier cities suggests some construction companies are tip-toeing their way back into the market. For instance, Xinyuan Real Estate had a robust second quarter, posting sales of 194,500 square meters, the company’s second highest quarterly sales volume since early 2008 (Exhibit 2).

Exhibit 2: Xinyuan Real Estate property sales volumes

Square meters

Source: Company reports

To give a sense for how the company fits into the overall market, at the average Chinese apartment size of ~50 square meters, Xinyuan sold the equivalent of nearly 1,300 average units per month, a meaningful number. The company is a small slice of the national residential real estate pie, but given its presence in key cities such as Chengdu, Zhengzhou, and Xuzhou, its activities merit attention as an indicator of how strong consumers’ demand for property is in these important emerging Chinese markets.

Second and third tier cities have more real estate growth potential than the coastal first tier cities, a reality reflected by the growing consumer economies in interior provinces such as Inner Mongolia, where Porsche opened a dealership in the mining town of Ordos in March 2012, according to Bloomberg. Also, some real estate buyers may believe that the market in the second and third tier cities has definitively bottomed and that now is a good time to buy in order to capture future growth.

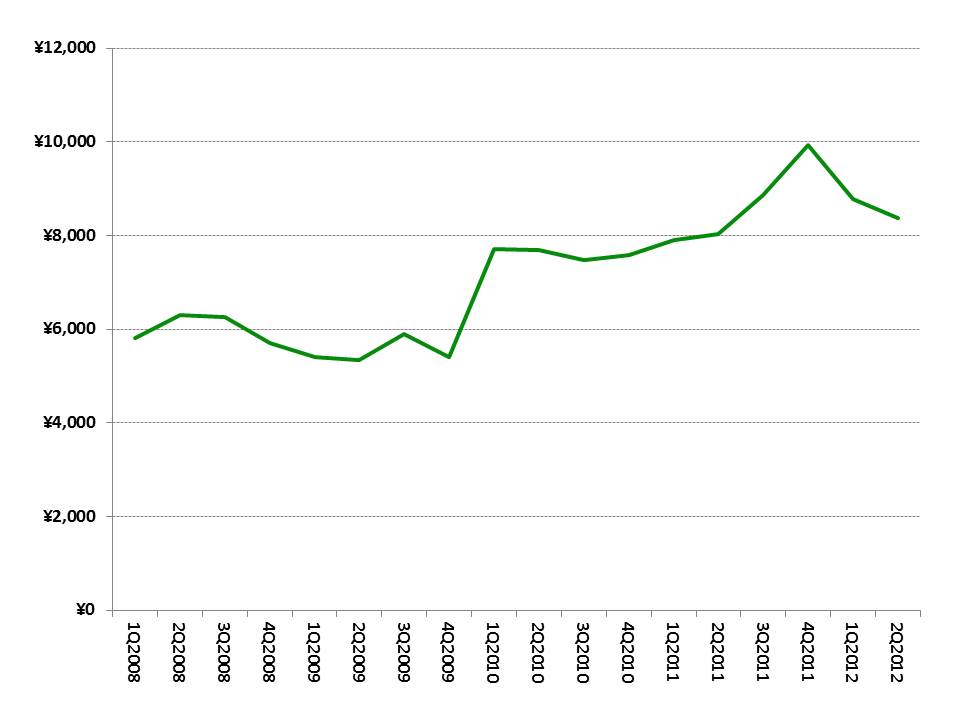

Two facts bear noting as we analyze Xinyuan’s sales. First, in the city of Zhengzhou, Henan, one of Xinyuan’s core markets, residential property sales volumes citywide rose 46% month-on-month in May 2012 to 9,521 units sold (National Bureau of Statistics, Henan Survey Organization). Second, the company’s pricing has remained firm, with management noting that Xinyuan did not have to reduce prices in order to drive increased sales volumes in the second quarter of 2012 (Exhibit 3). Xinyuan tends to price its properties at a premium to the local market average—in Zhengzhou, for instance, the average apartment sells for around 6,300 RMB/square meter, while Xinyuan’s properties sell for roughly 32% more per square meter based on the company’s latest reported data.

Exhibit 3: Xinyuan Real Estate average sales price

RMB per square meter

Source: Company reports

Implications

Slowing earthmover sales reflect substantial uncertainty among construction companies, who fear spending large sums on machinery that could end up sitting idle if the property and infrastructure markets do not pick up soon. China has been announcing a number of “stimulus” measures since April 2012 (Exhibit 4). However, our sense is that many of the projects included in the announcements were already on the drawing boards when the economy slowed down and are simply being re-packaged as “stimulus measures.” In practical terms, this means they have political significance, but that the main construction commodity markets (earthmovers, steel, concrete, copper) have already effectively priced in the demand the projects are likely to create. Also, not all projects are equal in size or potential impact, and some projects counted for statistical purposes are not very large or significant.

Exhibit 4: Select Chinese stimulus measures announced since April 2012

Source: Rio Tinto

Unlike the massive economic stimulus plan of 2008-09, announced as a RMB 4 trillion (US$586 billion) investment, subsequent stimulus measures are likely to be limited. Investors should avoid being swayed by what may become a fool’s rally in which major traders ride the small bursts of stimulus while they can, only to dump holdings once it becomes clear that the ride is over. Small investors and poorly-managed funds that don’t move quickly enough may face a hard landing indeed. There will be a big commodities piece to this story, as China’s real economy is fueling a substantial part of the global and regional commodities boom, and its softening will affect prices across the board.

China’s overall economic downturn will serve as an acid test of whether or not the Central and Western provinces can return to robust growth and meaningfully compensate for the slowdown on the East Coast. Four of China’s 10 largest provincial economies in 2011 were in interior provinces (Henan, Hunan, Sichuan, and Hubei), accounting for 28% of the combined GDP of the 10 largest provincial economies.

The presently weak thermal coal demand and drop off in steel production evidenced by reduced coking coal demand bode poorly for these interior provinces’ ability to underpin growth in the near-term and we think it realistic to expect continued economic stagnation at least through the October 2012 political transition period. No major policy changes are likely until after the 2,270 delegates of the 18th National Congress of the Communist Party of China meet to transfer power to a fifth generation of PRC leadership.