–Earthmover sales are a useful economic indicator because China’s construction and fixed asset-driven economy is very heavy equipment-intensive. Also, construction machines are not a speculative asset in the way copper and other commodities can be.

–Earthmover sales are a forward looking indicator, since construction contractors buy machines based not just on current needs, but also on growth potential they see in coming months and years.

–Sales of bulldozers, hydraulic excavators, and wheel loaders in China’s domestic market slowed significantly in the second half of the year and were quite weak compared to trend. This matches up well with housing prices declines in major Chinese cities.

–Anecdotal data point to a large market for used heavy equipment in China, but sales of new machines are still the best bellwether for economic activity as the country’s fleet expands.

–Zoomlion, one of China’s largest heavy equipment dealers by market share, reports that its trade receivables (i.e. money owed to it by customers) was 67% higher on 30 September 2011 than it was at the end of 2010.

–This suggests some equipment buyers are falling behind on making payments, perhaps because a construction slowdown is reducing their revenue streams.

Finding data that accurately reflect real economic activity and are not easily manipulated for political reasons is a key challenge in assessing the Chinese economy. We believe that earthmover sales are one such indicator.

Contractors are very unlikely to treat earthmovers as a speculative value store the way many Chinese have stockpiled copper and other base metals over the past 18 months, despite the fact that they had no ability to consume the metal themselves (Financial Times). Rather, bulldozers, excavators, and wheel loaders are depreciating assets whose prices decline the moment they leave dealership lots.

The machines’ value comes from the work they can do, not because there is a futures contract in bulldozers. As such, earthmover equipment sales shed a truer light on the state of China’s real economy than do “apparent consumption” number for copper and other commodities. The other metrics are undeniably valuable, but their data are more vulnerable to distortion than earthmover sales are.

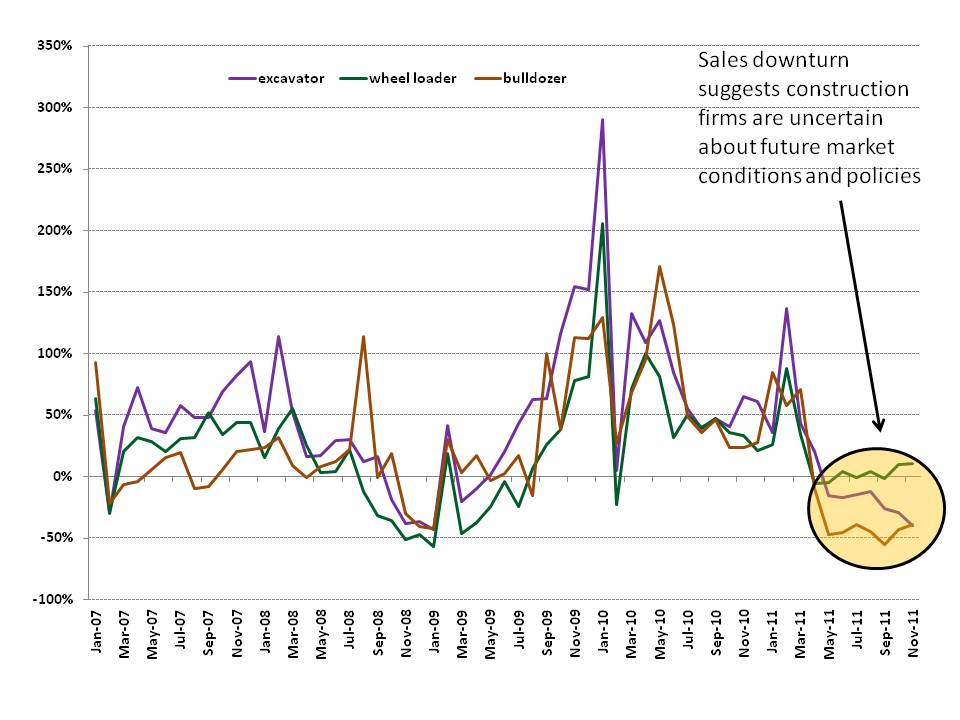

Exhibit 1: Year-on-Year changes in China domestic sales of excavators, wheel loaders, and bulldozers

% change in units sold each month

Source: China Construction Machinery Business Online, CCMA, lmjx.net

The declining earthmover sales volumes beginning in spring 2011 suggest the Central Government’s property tightening measures hit the machinery market before property prices began falling because contractors slowed their heavy equipment purchases in anticipation of a property market slowdown.

Real estate transaction volumes have fallen over the past couple of months in major Chinese property markets such as Beijing and Changsha, and the slowing heavy equipment purchases point to a strong possibility that construction firms saw this trend unfolding a few months before the news hit the headlines and put the brakes on their machinery buying. In May 2011, the People’s Bank of China raised banks’ required reserve ratio to a record 21%, tightening up the lending market and forcing property developers to seek more expensive financing from other sources and slowing new construction.

Breaking down the data

Excavators offer the purest reflection of equipment demand in China’s domestic market, for two major reasons. First, over the past two years, on average, only 2.4% of excavators sold by Chinese manufacturers went into the export market. Second, excavators are extremely versatile for construction work, as they can be fitted with equipment that allows them to dig, drill, jackhammer, and perform other functions. As such, they can be used to prepare foundations, to dig paths for water and gas pipes, power cables, and other utilities, and myriad other tasks critical to building and infrastructure construction.

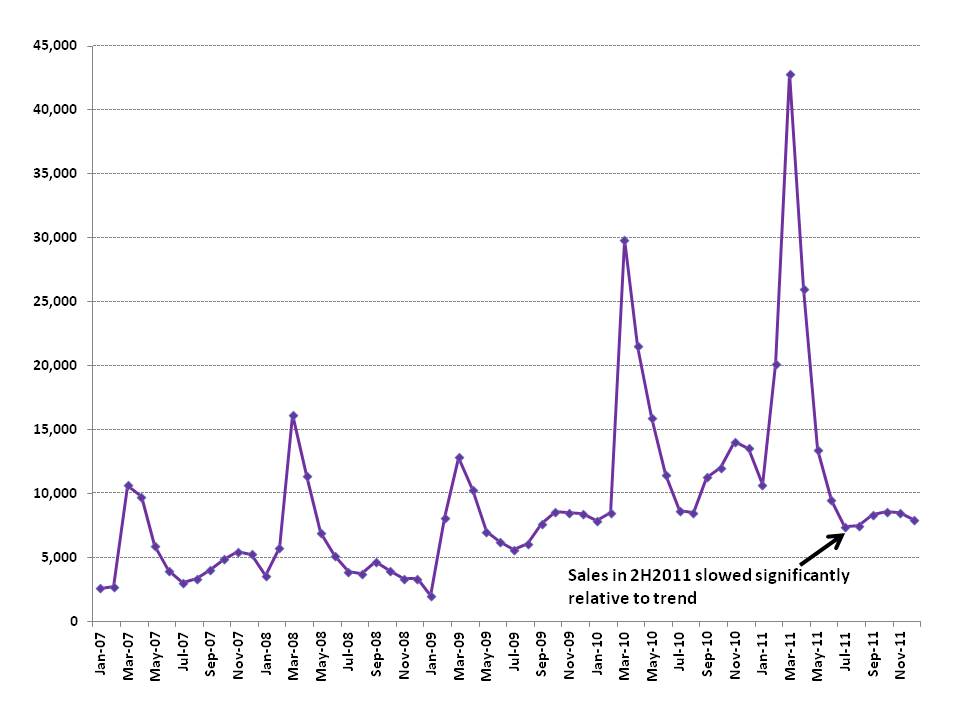

Month by month excavator sales data show weak sales relative to trend from July 2011 onward (Exhibit 2), again suggesting that the Chinese property market’s near-term prospects have created fear among equipment buyers, who do not want to saddle themselves with high acquisition costs or debts until demand for new construction heats back up.

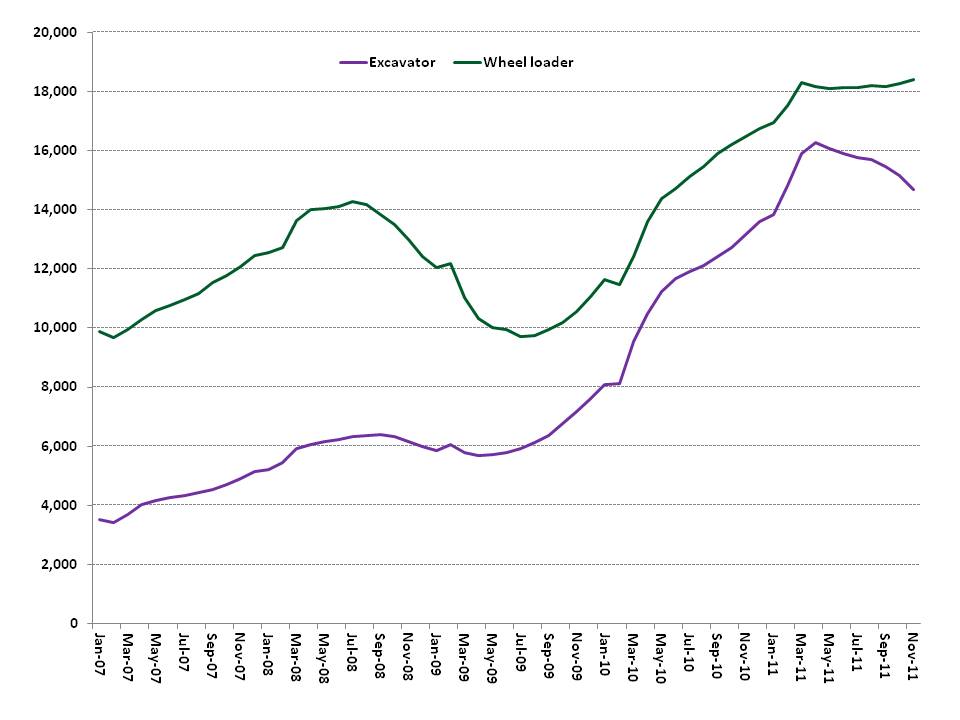

Using a rolling average helps smooth the seasonality of earthmover sales in the Chinese market and give a clearer picture of the market’s underlying trend. Domestic earthmover sales peak in the spring. Measuring earthmover sales in China from the perspective of a 12-month rolling average shows a major rollover and decline in bulldozer sales (Exhibit 3). On the 12-month rolling average, excavator sales have rolled over and wheel loader sales have plateaued (Exhibit 4).

Zoomlion, one of China’s biggest heavy equipment dealers, reports that its trade receivables (i.e. money owed to it by customers) were 67% higher on 30 September 2011 than it was at the end of 2010. This suggests that some equipment buyers are falling behind on making payments, perhaps because a construction slowdown is reducing their revenue streams.

Exhibit 2: Raw monthly excavator sales in China domestic market

Units sold per month

Source: China Construction Machinery Business Online, CCMA, lmjx.net

Exhibit 3: Sales of bulldozers in China

Units sold, 12-month rolling average

Source: China Construction Machinery Business Online, CCMA, lmjx.net

Exhibit 4: Sales of excavators and wheel loaders in China

Units sold, 12-month rolling average

Source: China Construction Machinery Business Online, CCMA, lmjx.net

Implications

Slowing earthmover sales are most valuable for what they tell us about the state of construction and infrastructure building activity in China at present; and to some extent, about how heavy equipment operators view their future prospects in these areas. In particular, weakness in excavator sales, which are tightly leveraged to the domestic market and integral for construction work due to their versatility, suggests that a real estate price decline in 2012 poses substantial risks to GDP growth.

Agricultural Bank of China recently estimated that real estate prices in First Tier cities like Beijing and Shanghai would need to fall by as much as 25% in 2012 and those in Second Tier cities like Changsha would need to decline by as much as 15% to return to reasonable levels. Given the outsize role that real estate investment has played in China’s economic growth in recent years, such price declines bode poorly for 2012’s GDP growth prospects.

Bank of China recently trimmed its 2012 GDP forecast from 9.3% growth to 8.8% growth (China Daily). Other banks have followed suit. We believe China’s economy will face an uphill climb just to exceed 8% growth in 2012. The current Five Year Plan calls for target GDP growth of 7% per year, but the psychological and expectational effect of Chinese growth in 2012 falling below the major banks’ forecasts would likely be substantial.

Weakness in China’s domestic earthmover market also sheds light on several other interesting stories. First, the Chinese earthmover manufacturing sector has added significant capacity in recent years and an industry wide shakeout and consolidation becomes more likely with weak demand that drives the least competitive firms out of business.

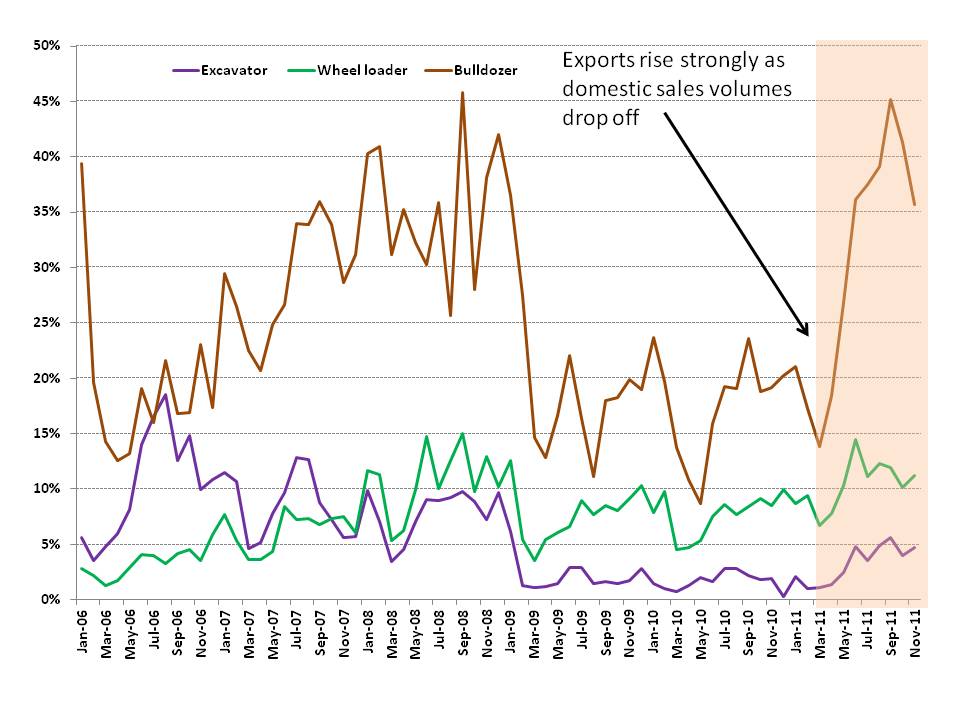

Second, Chinese earthmover manufacturers such as Shantui, Sanyi, Longking, and Liugong are exporting more machines in response to slowing domestic sales. As internal sales slowed in spring of 2011, Chinese earthmover exports shot up as a percentage of total sales for bulldozers, excavators, and wheel loaders (Exhibit 5).

While weaker internal demand for heavy equipment likely drives most of this export volume increase, exports are likely to increase in the short term as a proportion of total machines sold because the Chinese domestic market is becoming increasingly saturated with earthmover manufacturing capacity. In the medium-term, shakeouts are likely as the strongest brands prevail in a Darwinian contest for market share. The firms mentioned above, as well as Zoomlion, are well-positioned for this domestic market dogfight.

Chinese-made construction machinery sells well in locations like Africa, where many of the buyers are Chinese contractors working on infrastructure projects in places like Angola, Sudan, and Kenya. The next big question will be “can Chinese machines crack into the North American and European heavy equipment markets in a significant way?” Our sense is that perceptions of low quality Chinese manufacturing still plague many potential exporters, but over the next five years, the higher-end Chinese equipment makers may surprise Caterpillar and Komatsu by posing real challenges in those firms’ core markets.

Exhibit 5: Exports as % of total earthmover sales

Units sold

Source: China Construction Machinery Business Online, CCMA, lmjx.net

Finally, heavy equipment uses substantial quantities of diesel fuel and slowing sales of new equipment would likely erode China’s off-highway diesel fuel demand in 2012. We estimate that the new bulldozers, excavators, and wheel loaders added to the Chinese construction equipment fleet in 2010 and 2011 could conceivably account for 200,000 bpd of diesel fuel use. The net effect on diesel fuel demand will of course be smaller, as outdated equipment is retired each year.

Nevertheless, our analysis of the total horsepower of China’s construction machinery fleet suggests that the absolute volume of fuel used by earthmovers in China will rise despite efficiency gains because the fleet is growing and fleet average horsepower per machine has risen significantly in recent years. For instance, between 2001 and 2009, horsepower per machine in China has risen by an average of 3.5% per year.