Just last week, the China Non-Ferrous Metals Industry Association estimated the country’s copper reserves at year-end 2010 to have been 1.9 million tonnes—roughly as much as the U.S. used in 2010 and nearly 27% to 50% higher than the previous estimates of foreign analysts (Financial Times).

We have no reason to doubt the Chinese association’s high number, particularly in light of a number of credible reports in the Financial Times and Wall Street Journal over the past 18 months regarding collateral financing schemes that boosted China’s apparent demand and stockpiles of copper and zinc, among other materials, and off-exchange hoarding of cotton by farmers hoping for better prices.

Markets are not fond of surprises and a lack of reliable data on supply and demand and inventories in China injects unnecessary uncertainty into global markets and injures consumers worldwide. The negative impacts of global commodity price volatility, coupled with China’s rise as a top consumer of a range of energy, metal, and agricultural goods, have heightened the importance of obtaining timely and reliable inventory data from the large and dynamic Chinese market.

The U.S., the world’s other commodity superpower, already has a reasonably sophisticated and transparent reporting system in place for tracking flow and volume changes in its basic material use, especially in the energy and agriculture sectors. In particular, the U.S. Department of Energy (DOE) and Department of Agriculture (USDA) regularly provide a broad range of detailed data on supply, demand, and stockpiles for oil, oil products, natural gas, and agricultural goods and typically present them in a reasonably user friendly way.

China would help all market participants, including itself, by building similar systems to bolster inventory and supply/demand transparency. To be certain, better inventory tracking and reporting will not change the reality that demand and supply can diverge drastically from expectations, but they will provide additional clarity in a timely way that can give brokers and traders a more accurate picture of what the state of the world really is, thereby permitting more rapid adjustments, and reducing the risk of destructive commodity price shocks.

It is, of course, fair to ask “why is it in China’s interest to help build more comprehensive commodity stock and flow tracking infrastructure?” The answer is straightforward: price volatility exacerbated by unexpected and irregular disclosures or leakage of information into the market harms Chinese consumers. In essence, it is better to make inventory and demand changes a routine, and perhaps even boring weekly report than to trigger destructive market turmoil as numbers fluctuate and are disclosed on an irregular and/or incomplete basis.

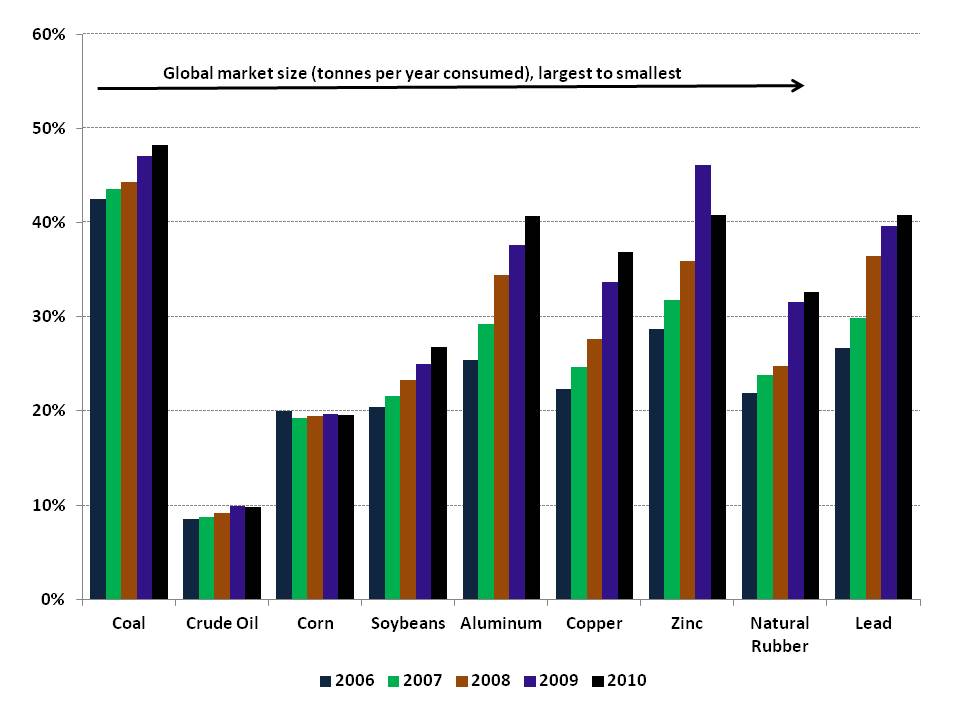

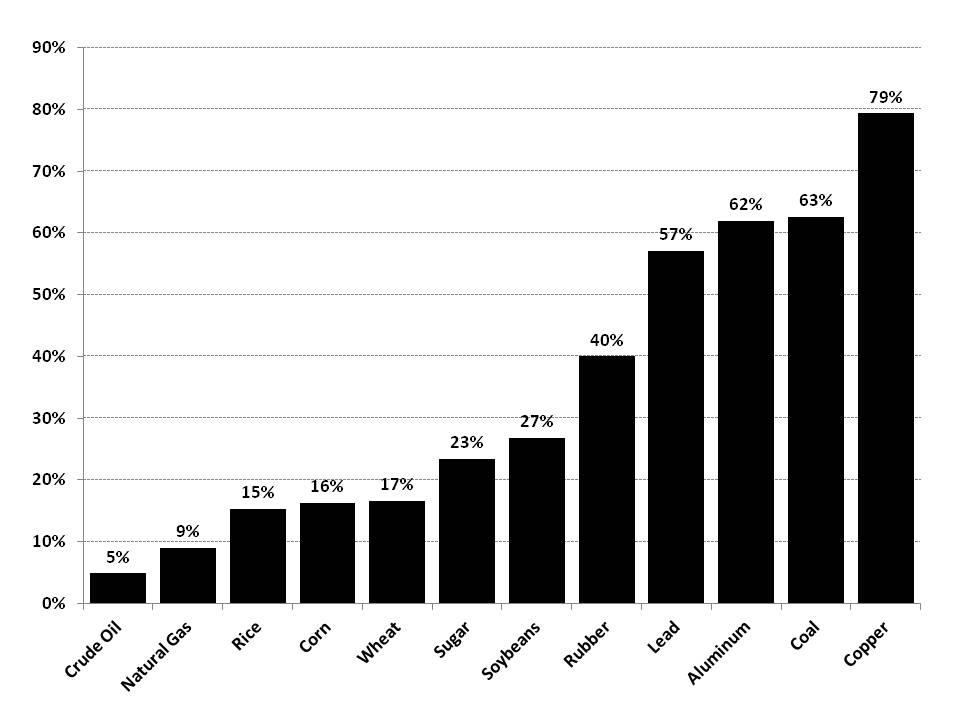

To give readers a sense of China’s heft in selected commodity markets and how it has changed over time, we provide two charts outlining how China’s share of global consumption of these commodities has evolved over the past five years. Because the marginal consumers are the most important price setters in a market, we also show China’s proportion of global commodity demand growth in 2010 to illustrate how big a player the country is in select markets.

To put the numbers in Exhibit 2 in context, China accounted for 5% of global oil demand growth in 2010, yet remained one of the most important barometers in the market. As such, the country’s proportionally larger presence in a range of other markets, such as corn, soybeans, aluminum, lead, and zinc, give it great market-moving influence. Demand for energy and grains is driven by Chinese internal consumption as consumers drive more, use more household appliances, and eat more meat whereas metal demand is driven by a combination of growing internal consumption and the outsourcing of energy and pollution-intensive industries that use large volumes of aluminum, copper, zinc, and other metals.

Exhibit 1: China role as a consumer of key energy, metals, and agricultural commodities

% of total global consumption

Source: Company reports, Brook Hunt, Antaike, ABARE, BGRIMM, USDA, NBS China, China SignPost™

Exhibit 2: China’s contribution to global commodity consumption growth

China’s proportion of total global consumption growth in 2010

Source: Company reports, Brook Hunt, Antaike, ABARE, BGRIMM, USDA, NBS China, China SignPost™

Implications

For consumers in China and beyond, the best outcome is a more complete Chinese reporting regime for supply, demand, and inventories of metals, agricultural, and energy commodities. As China struggles with inflation, deeper insights into the drivers and nature of its domestic commodity use, production, and stockpiling can also help China’s trade partners better anticipate how inflation in China could impact them and what measures they might take in response. From Lanzhou to London, the market stabilizing effects would likely be substantial as greater transparency and knowledge of the state of the world would aid Beijing’s economic policy making.

A Chinese reporting regime would also provide clearer signals to commodity producers inside and outside of China, helping to trim the risk of boom-bust market cycles that could otherwise be exacerbated if miners and farmers make their production and project planning decisions based on an unnecessarily incomplete picture of where the Chinese market is headed. Additionally, commodity data tracking and disclosure offers an area for mutually beneficial technocratic cooperation with global benefits—it is not simply a bilateral U.S.-China affair.

China’s Current Membership in Global Commodity Sharing Institutions

At present, China’s presence in international commodity information sharing institutions is not commensurate with the country’s deeply influential role as a consumer and producer in key raw material markets. China participates in the Joint Organizations Data Initiative (JODI), which tracks a range of oil data in countries that are not necessarily members of the International Energy Agency (IEA), which does have a comprehensive inventory tracking and reporting system. China reports basic supply and demand numbers to JODI, but does not break them down by region (as the U.S. DOE’s reporting system does) and also still does not report oil inventory data.

A Roadmap for Multilateral Commodity Diplomacy with China

The following suggests practical approaches for encouraging Beijing to further integrate itself into international commodity data reporting bodies:

1) Prioritize improving tracking and disclosure of energy and metals data because agricultural commodities are more politically sensitive in China. In the agricultural sector, cotton might be a simpler commodity to build a data exchange regime for than would be the case for staple grains (one of the more sensitive areas, given government-induced and –exacerbated famine in previous decades).

2) Consistently reiterate that better commodity market data disclosure is absolutely in China’s own interest and that even if the reporting is only in Chinese or a subscriber only system, getting the higher quality information into the market ultimately benefits everyone.

3) Get European and other Asian countries involved, as well as major commodity exporters like Australia, Brazil, and Canada.

4) Encourage complete Chinese participation in JODI, including reasonably detailed oil inventory reporting. Back this up with advice and insights into how the IEA and the U.S. DOE have built and managed their oil and gas supply, demand, and inventory tracking systems.

5) Promote closer cooperation between Chinese domestic metals industry associations and the International Metal Study Groups based in Portugal. The China Non-Ferrous Metals Industry Association’s unprecedented October 2011 disclosure of estimated nationwide copper inventory is a positive step in the direction of closer collaboration.

6) Be patient—if China’s political and industrial leaders decide to cooperate on better commodity data transparency, developments will likely unfold gradually.