Deep Dive—Special In-Depth Report #2

Executive Summary:

–Engines commonly used in Chinese and other modern aircraft may be divided into several major categories: (1) low-bypass turbofans typically power military jets; (2) high-bypass turbofans typically power jet airliners; (3) turboprops typically power more fuel-efficient, usually lower-speed aircraft, including civilian commuter aircraft and military transports and surveillance and battle management aircraft; and (4) turboshafts typically power helicopters. This study will address the first category, low-bypass turbofan engines; other categories will be addressed in follow-on China SignPost™ reports.

–China’s inability to domestically mass-produce modern high-performance jet engines at a consistently high-quality standard is an enduring Achilles heel of the Chinese military aerospace sector and is likely a headwind that has slowed development and production of the J-15, J-20, and other late-generation tactical aircraft.

–The Chinese aerospace industry is driven by four key strategic imperatives as it pursues the ability to manufacture large volumes of high-performance tactical aircraft[1] engines: (1) parts dependence avoidance, (2) Russian supply unwillingness, (3) aircraft sales autonomy, and (4) poor Russian after-sales service.

–To address these shortcomings, AVIC is treating engine development as a high priority and plans to invest 10 billion RMB (US$1.53 billion) into jet engine research and development over the next 5 years.

–However, evidence still suggests that AVIC’s engine makers are having trouble maintaining consistent quality control as they scale up production of the WS-10, causing problems with reliability and keeping China’s tactical aircraft heavily reliant on imported Russian engines.

–Key weak points of the Chinese military jet engine industry include: turbine blade production and process standardization.

–Standardization and integration may be the one area in which the costs of China’s ad hoc, eclectic approach to strategic technology development truly manifest themselves. The Soviet defense industrial base failed in precisely this area: talented designers and technicians presided over balkanized design bureaus and irregularly-linked production facilities; lack of standardization and quality control rendered it “less than the sum of the parts.”

–We estimate that based on current knowledge and assuming no major setbacks or loss of mission focus, China will need ~2-3 years before it achieves comprehensive capabilities commensurate with the aggregate inputs in the jet engine sector and ~5-10 years before it is able to consistently mass produce top-notch turbofan engines for a 5th generation-type fighter.

–If China’s engine makers can attain the technical capability level that U.S. manufacturers had 20 years ago, China will be able to power its 4th generation and 5th-generation aircraft with domestically made engines (3rd and 4th-generation in Chinese nomenclature, respectively). These developments would be vital in cementing China as a formidable regional air power and deserve close attention from policymakers.

China has a clear strategic interest in developing indigenous high-performance aeroengines to power its military aircraft. This is one of the greatest aerospace engineering challenges, however, one that only a small handful of corporations worldwide have truly mastered. This should not be surprising: an engine is effectively an aircraft’s cardiovascular system; it can be transplanted but not easily modified. Unlike a human system, it can be designed and developed independently, but faces temperature, pressure, and G-force challenges that only the most advanced materials, properly machined and operated as an efficient system, can handle. While China has made progress in recent years with materials and fabrication, it appears to remain limited with respect to components and systems design, integration, and management—the keys to optimizing engine performance in practice—and to making logistical and operational plans at the force level based on reliable estimates thereof.

Based on available open source evidence, Chinese progress in this critical area remains uneven and the whole remains “less than the some of the parts.” Given the overall capabilities inherent in China’s defense industrial base and the resources likely being applied to this problem, we expect that China will make significant strides, but barring major setbacks or loss of mission focus, it will take ~2-3 years before it achieves comprehensive capabilities commensurate with the aggregate inputs in this sector and ~5-10 years before it is able to consistently mass produce top-notch turbofan engines for a 5th generation-type fighter. When it does, however, the results will have profound strategic significance, as China will have entered an exclusive club of top producers in this area and eliminated one of the few remaining areas in which it relies on Russia technologically.

How is domestic engine production strategically relevant?

The Chinese aerospace industry is driven by four key strategic imperatives as it pursues the ability to manufacture large volumes of high-performance tactical aircraft engines: (1) parts dependence avoidance, (2) Russian supply unwillingness, (3) aircraft sales autonomy, and (4) poor Russian after-sales service. First, China likely seeks to avoid dependence on Russian suppliers for vital parts. Chinese leaders will not want the country’s most modern fighter aircraft to be dependent on foreign inputs for a core system such as propulsion. Second, Russia’s own armed forces are likely to buy significantly more of its jet engines in the next 10 years than they did over the 20 years since the Soviet Union dissolved. This is an important development given that the collapse in military procurement after the Soviet Union fell was the key driver of Russian jet engine sales to China.

The Russian Air Force’s plans to enhance its aircraft through refurbishment and re-engineering of existing systems and acquisition of new platforms like the SU-34, SU-35, and T-50/PAK FA could stretch Russian engine makers to the point that they have little export willingness, and perhaps restrained export capacity. The Kremlin, which controls Russia’s jet engine makers, will likely prioritize the export of entire aircraft such as Sukhoi Flankers that require advanced engines and the Indo/Russian 5th generation fighter project, which will also demand the most advanced engines Russia’s defense suppliers can produce. The bottom line is that the combination of new Russian Air Force aircraft purchases, continued exports of late model Flankers, and Russia’s joint 5th generation fighter project with India will stretch suppliers enough that even if the People’s Liberation Army Air Force (PLAAF) can get some advanced Russian engines, it likely will not be able to obtain enough to support its desired levels of aircraft production.

Exhibit 1: Estimated Total Chinese Demand for Non-Russian Military Turbofans (2011-20)

Sources: Sukhoi, Ria Novosti, Reuters, India MoD, UMPO, Jane’s, Sinodefence.com

Third, China is a growing exporter of advanced combat aircraft, as shown by its recent deals to sell FC-1 and J-10 fighters to Pakistan, and will not want foreign engine suppliers having veto power over its arms sales. A major hang-up in the FC-1 deal was that the aircraft uses the same Russian-made RD-33 engines as the MiG-29, but sells for a much lower price and is thus a threat to Russian aircraft exports in the developing world. Russia finally granted China permission to make the FC-1 sale to Pakistan, but the experience almost certainly taught Chinese aircraft makers that it will be much easier to export Chinese-made aircraft if they use Chinese engines.

This is especially true given the fact that China’s J-10 and J-11B (if SAC is permitted to export it) are comparable to existing Russian tactical aircraft exports and would likely be formidable competitors in terms of price and capability. We note here that a January 2011 editorial in Nanfang Daily anticipates China becoming a major jet engine exporter within the next 10 years.[1] High aspirations by no means imply the ability to actually achieve the desired capability, but these sentiments shed light on the broad importance Chinese policymakers and thinkers place on bolstering domestic jet engine production capabilities.

Fourth, China has had painful experience with poor Russian after-sales service for components, e.g., engines. This includes engineering and spare parts support that is expensive, delayed, or simply nonexistent and manuals that are limited, in Russian only, or not available at all.

Where does China’s tactical turbofan sector stand today?

In an April 2011 interview, China Aviation Industry Corporation (AVIC) head Lin Zuoming noted that despite China’s rapid development as an aerospace power, the country’s ability to produce modern jet engines remains a glaring weakness.[2] To address these shortcomings, AVIC is treating engine development as a high priority and plans to invest 10 billion RMB (US$1.53 billion) into jet engine research and development over the next 5 years.

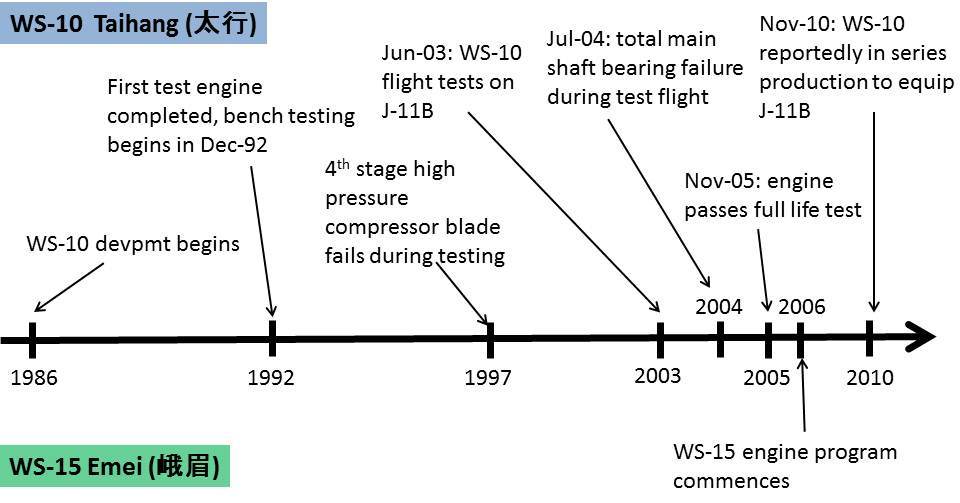

China’s WS-10 Taihang turbofan engine and its derivatives have performance parameters on par with the Pratt & Whitney (P&W) F100 and GE F110 engine families, which power the U.S. F-15 and F-16 fighters. The Taihang family is said to power the J-11B and is also likely slated to eventually take over from the Russian AL-31 as the main powerplant for the J-10 and J-15. Media reports from November 2010 state that a version of the WS-10 Taihang turbofan producing 27,500 lbs of thrust is now in series production and is being used to power the J-11B fighter-bomber.[3] Exhibit 2 (below) shows a timeline of China’s advanced military turbofan production.

Exhibit 2: China Military Turbofan Development and Production Timeline (WS-10, WS-15)

Sources: Jane’s, Global Times, China.com

However, evidence still suggests that AVIC’s engine makers are having trouble maintaining consistent quality control as they scale up production of the WS-10, causing problems with reliability and keeping China’s tactical aircraft heavily reliant on imported Russian engines. Russia’s defense industry appears to believe that China will continue to be unable to attain reliable mass production of high-performance military turbofans. For example, NPO Saturn, a key Russian military jet engine maker, forecasts that it will continue serving as the primary engine supplier for China J-10 and FC-1 fighter programs through 2019.[4] Saturn’s optimism may stem in part from the fact that is it currently in talks with China over the possible sale of 190 D-30KP-2 turbofans, which could be used on China’s IL-76 aircraft.[5]

The lack of a sufficient supply of reliable domestically made jet engines could significantly impede future production of the J-10, J-11, J-15, and J-20 fighter aircraft. The J-20 program especially needs domestic engine development and production breakthroughs because the Russia appears reluctant to sell the 117S series engines that could enable the J-20 to have sufficient power to allow the aircraft to supercruise (sustain supersonic flight without using inefficient afterburners) and match the performance of 5th-generation fighters such as the Lockheed Martin F-22 and Sukhoi T-50/PAK FA.

Software is a vital aspect of aeroengines, one that China will have to master to produce its own high-performance engines; and one that it will likely consider controlling carefully should it decide to market them when they reach the requisite quality and price level. Many aeroengine performance parameters can be adjusted using software; a manufacturer may charge a customer significantly for upgrades that are easily implemented but may alter engine function significantly. There is a tremendous disparity between civilian (uncertificated) and military (certificated) source codes: the former may have explanations embedded in them, while the latter may have source codes and explanations stored separately.

Military source codes can take up to twenty times longer to produce on a per-line basis because of requirements concerning annotation, documentation, line traceability, integration, and module- and robustness-testing. How to handle the relevant engine source code is therefore a key question for any exporter of packages that include aeroengines. The U.S. is typically able to avoid divulging source codes, despite repeated requests from such customers as Israel, because its military aircraft are so desirable.

Recent developments increasingly suggest that it is unwise to underestimate China’s defense-industrial complex. We believe that barring major unforeseen disruptions or shifts in focus, China’s aerospace industry already has sufficient financial support and is close to attaining a critical mass of human capital that over the next ~2-3 years will help it make substantial breakthroughs in its ability to produce sufficient volumes of reasonably dependable jet engines, and reach the ability to consistently produce 5th-generation fighter performance-level aeroengines in ~5-10 years. This, in turn, will help enable robust growth of modern Chinese airpower if the country’s civilian and military leaders choose to expand and upgrade China’s Air Force and Navy tactical air fleets. Ongoing limitations in tooling, design capability, and systems operations and maintenance and will be key areas to monitor, however, as these may limit the performance parameters of Chinese engines and shape their development in “path dependent” ways (meaning that future options are limited by are limited by past actions, even after the circumstances that shaped those actions are no longer relevant).

Strong and Weak Points of China’s Jet Engine Industry

High performance jet engines are exceedingly hard to produce, as they can contain tens of thousands of parts that must be made of durable exotic materials machined to tolerances measured in microns. In addition, jet engines used in tactical fighter and strike aircraft must be able to operate reliably under extreme conditions including high temperatures, high speeds, intensive maneuvering, and frequent throttle changes. Jet engine compressor blades, for instance, can experience centrifugal forces as high as 20,000 times the force of gravity during flight.[6] The challenge that a turbofan blade faces in performing without significant deflection despite being exposed to heat that exceeds the melting point of most metals, and consequent materials and metallurgical requirements, has been likened to stirring hot soup with a spoon made of ice.

Chinese design capabilities remain uncertain, though manufacturing capabilities are clearly improving. To reach the pinnacle of aeroengine development and performance, China must model, refine, and optimize the total system, which can only be done with top-level total lifecycle tools, software, and cradle-to-grave support. Even in a less complex machine such as an automobile, for instance, it is relatively easy to manufacture a crankshaft, but relatively difficult to make the system perform well as a unified whole and to understand the complex interaction of its components under different conditions.

To consider an aeroengine-specific example, for optimum aerodynamics, it is necessary to model the airflow implications of a turbofan blade changing slightly. A high-pressure turbine might be strengthened, but if its thermal characteristics change, then it might not expand in the same way, and the resulting discontinuity in surface geometry could lead to a failure that destroys the engine. Important areas to design for and model therefore include airflow, fatigue, and reliability.

The most important aeroengine performance metrics include mean time between failure (MTBM)—i.e., how long an engine lasts; and mean time before overhaul (MTBO)—i.e., how often an engine must be serviced fully. This, in turn, is linked to the degradation pattern/structure, which is vital to managing engine maintenance and anticipating performance. “Hitting the wall,” or experiencing a sudden and marked decline in engine performance, is particularly hazardous in military aviation, where even slight deviation from optimum performance parameters can be highly problematic. Unpredictable dynamics, or lack of knowledge of existing patterns, can be make it much more difficult to make the best use of engines—even in training, but especially in combat.

Compensating for shortcomings in either of these areas might require factoring in a substantial margin of error by dedicating additional engines and airframes; were the need great enough, something like 200 Flankers might be needed to ensure the mission fulfillment capabilities of roughly 100 F-15s. Other important metrics include acceleration/deceleration patterns, foreign object damage (FOD) resistance (Russian engines have historically fallen significantly short in this regard), and cold/hot temperature starts (the former is usually more difficult than the latter, but the amount of difference varies by engine model).

In short, an aeroengine system is only as good as its design, monitoring, and lifecycle management. This may be an area of particular weakness for China, as it has traditionally relied heavily on copying and emulating foreign designs. This approach does not confer ability to design and manage aeroengines; on the contrary, it can impose path-dependent limitations that lead to dead ends or substandard, poorly integrated systems that are costly and difficult to alter and thus remain “less than the sum of their parts.”

While this systemic component of Chinese turbofans remains uncertain, however, the techniques and processes to support their manufacture are clearly improving. Chinese gas turbine experts say the country’s aerospace industry has improved its jet engine manufacturing abilities in key areas, including:[7]

–Precision cutting, welding, and machining, e.g., five-axis milling for production of turbine blades.

–Special materials blade production. China’s largest turbine blade production facility, located at Xi’an Aero-Engine, can now undertake mass-production of turbine blades made from superalloys, titanium alloys, cobalt alloys, and stainless steel. The turbine blade quality rate is now said to exceed 95%.

–Hollow fan blade production. China is entering the nascent stages of being able to produce hollow fan blades. Hollow titanium fan blades are 15-20% lighter than their equivalents and make an engine more fuel efficient. They also reduce rotating mass and allow a tactical aircraft engine to spool up more quickly during maneuvers.[8]

–Greater automation. This improves standardization and efficiency.

–Process modeling. Computer-aided process modeling help manufacturers anticipate problems with materials, welds, and behavior of parts under heat stress. Flagging potential trouble spots before machines are started helps save time and money and also ultimately helps produce a higher quality, more durable engine.[9]

–Enhanced ability to use numerically-controlled milling machines to produce turbine disks.

–Better ability to produce high-quality, standardized spare parts. Reliable access to such parts is essential to supporting aircraft performance, particularly at the high and unpredictable operational tempo inherent in many operational scenarios. Spare parts have traditionally represented an area of weakness in China’s aviation industry.

Still unclear, however, are key design, system, software, and reliability aspects of engine systems and components. Vibration testing of components is important (e.g., under high-G forces for military engines). It is difficult to determine China’s stage of development for Fully Automatic Digital Engine Control (FADEC), or the capability of the engine to communicate with the cockpit; and for Engine Control Units (ECU), the “brain” of the engine, which helps it to regulate itself.

Many of the Chinese jet engine industry’s recent improvements center on turbine blade production, which is logical given turbines’ location at the heart of any jet engine. However, a comprehensive analysis by experts from the China Gas Turbine Establishment, which played a major role in designing the WS-10 engine, does not discuss improvements in engine reliability. Thus, better blade manufacturing and machining may still not have brought about commensurate improvements in quality control and engine reliability. The WS-10A is now said to be flying in the PLAAF’s J-11B, and as engines accumulate flight hours it will be telling to see how powerful and efficient they are, how they hold up, and how frequently they require overhaul. The PLA is notably opaque about aircraft losses, but occasional reports do slip through, providing a barometer of reliability to watch as domestically-made engines spend more time in the air.

What challenges do Chinese military jet engine makers continue to face?

China’s attempts to mass produce P&W F100-class jet engines and develop an engine powerful enough to give the J-20 true 5th generation performance levels face a range of technical and process challenges. On the technical side, Chinese gas turbine researchers say weaknesses remain in turbine casting, powder metallurgy for creating turbine disks, and molding hollow titanium parts.[10] Many of these areas were named as ones in which substantial progress has taken place in recent years. Nonetheless, progress may be from a very low baseline, making the claims that problems remain while progress has occurred compatible with each other.

Chinese engine makers likewise need to create advanced production lines to ensure effective logistical support for domestically-made engines and must also automate their production facilities to a greater extent. Part of the technical challenge stems from the fact that machining the tough superalloys used in jet engines requires twice the cutting force of other types of machining and that cutting tools may have to be changed up to 10 times more often than when machining softer materials like those used for making auto parts.[11]

While this necessitates highly specialized production lines, however, a given engine needs to be produced on the same line to ensure economies of scale and quality consistency. Once systems are optimized, separating production into different lines should be avoided, as a stand alone approach could disrupt or crack the system. It is one thing to make a single turbofan blade in a laboratory, and another entirely to ramp up to mass production of several thousand (a single engine contains 400-500 blades in up to two dozen stages of 2-3 dozen blades each) blades of standardized, reliable quality. This requires mastering both the metallurgy grade and mastering the industrial process to reliably produce a high-quality product.

In the very limited publicly available discussions of China’s jet engine manufacturing weaknesses, local experts focus heavily on process weaknesses as major constraints on China’s ability to produce high-performance turbofans of consistently good quality. Chinese analysts cite the need to better integrate the research and manufacturing segments of the industry, creating databases to save knowledge that can be used to make construction more effective, reducing the boundaries between the jet engine design, materials, and fabrication sectors, and doing a better job training new technical and engineering staff.[12] Exhibit 3 (below) depicts key technical and process weaknesses currently affecting China’s tactical turbofan production.

Exhibit 3: Where China’s Military Jet Engine Makers Continue to Experience Problems

Source: Defense Manufacturing Technology, USCC, China SignPost™

To put these weaknesses into context, they suggest that in some areas Chinese engine makers are roughly three decades behind their U.S. peers. Technical reports by U.S. manufacturers discussing challenges of actually making hollow fan blades that date back to 1977, implying that Chinese engine fabricators could be three decades behind the state-of-the-art curve at present.[13]

Abstracts of P&W technical papers from 1976 discuss using nickel superalloy powders to forge turbine discs for the F100 engine.[14] In contrast, as mentioned above, researchers from the China Gas Turbine Establishment cite powder metallurgy for turbine disc production as an enduring weak spot for China’s jet engine industry.[15] Of course, this may represent an attempt to secure additional funding, as opposed to a true reflection of current status; when did the U.S. Air Force (USAF) ever run out of update programs for its fighters?

One cautionary point here is that Chinese jet engine makers have a latecomer advantage, which allows them to learn from other engine makers’ successes and failures and potentially to shave years from their own research-development-production sequence. To put matters in perspective, the P&W F119 engine that powers the F-22 Raptor was developed and refined in the 1980s and ’90s, so China does not necessarily need to attain the current 2011 state-of-the-art in tactical jet engine technology to field formidable propulsion systems that could give the J-20 true 5th generation fighter performance characteristics.

What China must achieve, however, is a methodology akin to Six Sigma or Total Quality Management (TQM) to ensure quality control and sufficient organizational honesty to ensure that actual problems are reported and that figures are not doctored. Otherwise, standardization and integration may be the one in which the costs of China’s ad hoc, eclectic approach to strategic technology development truly manifest themselves. The Soviet defense industrial base failed in precisely this area: talented designers and technicians presided over balkanized design bureaus and irregularly-linked production facilities; lack of standardization and quality control rendered it “less than the sum of the parts.”

Mapping China’s Key Jet Engine R&D and Production Assets: Size and Resources

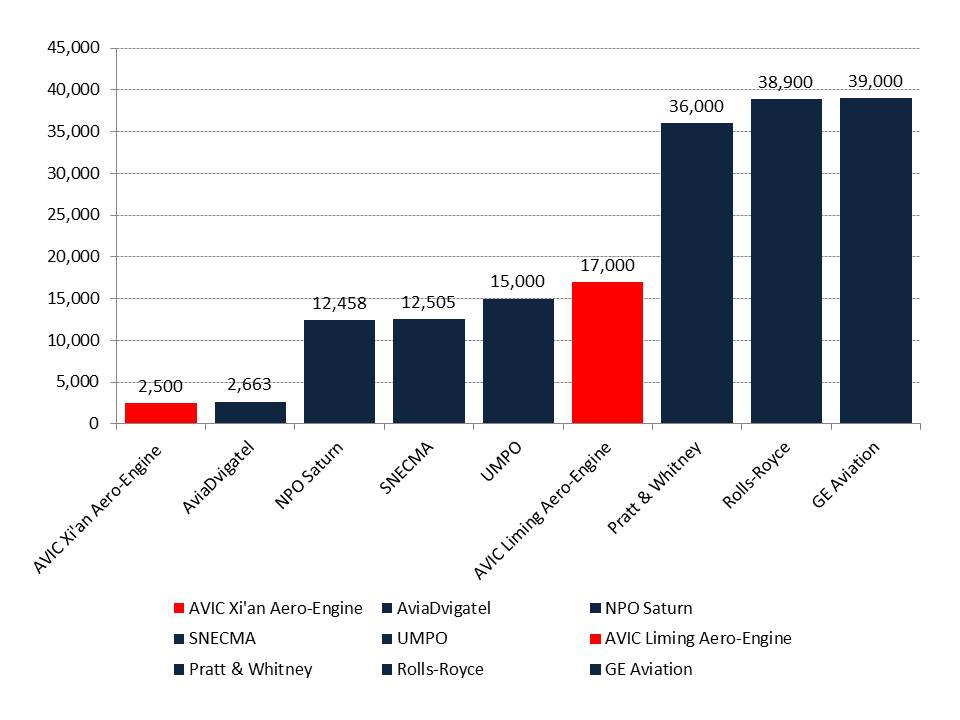

Chinese jet engine makers may remain slightly understaffed relative to U.S./UK producers of military jet engines, but comparably staffed relative to their Russian and French peers. Liming Aero-Engine and Xi’an Aero-Engine, AVIC’s flagship large military jet engine makers, have a combined staff of less than 20,000. By comparison, P&W, Rolls-Royce, and GE Aviation, the world’s largest military jet engine makers, each have more than 35,000 staff (Exhibit 4).

Exhibit 4: Number of Workers at Major Global Tactical Turbofan Makers

Source: Company reports

Examining overall employment figures tends to over count personnel relevant to “Big Three” engine production and undercounts it for other manufacturers, however. The total head count at the former includes individuals involved in civilian, military, and global services programs (typically fairly-evenly-subdivided), not just dedicated R&D personnel. That at the latter does not include many R&D and metallurgy-relevant individuals employed in other organizations.

China’s jet engine complex may increase staffing somewhat if it seeks to become largely or fully self-sufficient in military turbofan production. With 15,000 workers, Russian manufacturer UMPO planned to produce 109 AL-31 and AL-41 engines in 2010.[16] Larger firms like GE Aviation, by contrast, can deliver approximately 200 high performance turbofans and 800 total military jet engines and helicopter engine turboshafts per year.

Technical Challenges

High-performance tactical jet engines are difficult to produce, but the work does not stop there, as the engines often undergo demanding usage and pose key maintenance and logistical challenges. Key potential constraints China will likely face in operating the high-performance tactical turbofans it is beginning to series-produce include issues involving technical, performance, and environmental factors, the ability to obtain sufficient materials for mass production of multiple engine families, and political/economic challenges.

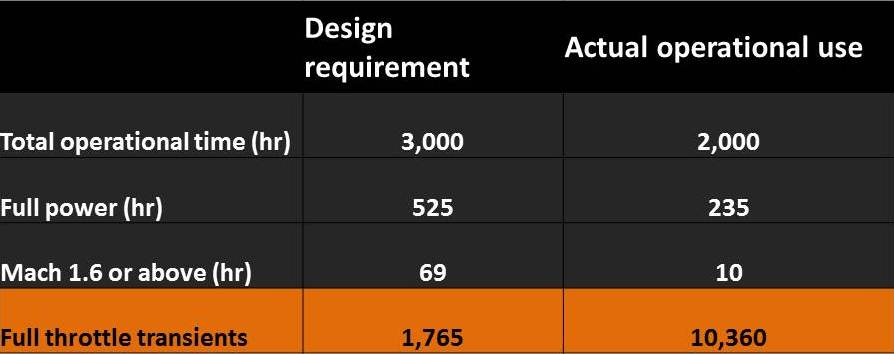

Thermal cycling. The engines on a large transport or tanker typically run at a fairly steady speed setting for most of a flight. Engines on tactical aircraft, by contrast, undergo extreme speed changes as pilots frequently and quickly change throttle settings during high-intensity maneuvering. As the engine undergoes rapid temperature changes, thermal cycling generates significant wear. The experiences of the USAF with the first truly high-performance U.S. afterburning turbofan, the P&W F100, exemplify the unexpected safety and maintenance challenges that thermal cycling can generate.

While developing the F100, P&W engineers believed that the key determinant of stress on engine parts would be the length of time spent at the highest temperatures (i.e. full power and/or very high speed flight).[17] In practice, however, the F100’s unprecedented performance enabled new air combat techniques and training regimens that emphasized rapid and frequent maneuvering. This incurred relatively little time at full power or high Mach numbers, but entailed far more throttle changes than the engine designers had anticipated.

In fact, while the F100 design requirements called for being able to accommodate 1,765 full throttle transients during the engine’s service life, actual operational use showed that engine life ended up being more than 30% lower than expected because the engine was undergoing more than five times the number of full throttle transients it had been designed for—10,360 cycles (Exhibit 5).

Exhibit 5: Key usage parameters of the F100 afterburning turbofan, November 1979

Source: The Great Engine War

As China develops indigenous high performance tactical turbofan engines, more intensive air combat training will make shortened engine life from thermal cycling an important issue to resolve. It is unclear how much experience China has in this area to date given that most Chinese pilots do not fly nearly as much as their U.S. counterparts and also may not be engaging in as intensive or realistic training. PLAAF and PLA Navy (PLAN) newspapers and other documents describe exercises in which engine use in particular is minimized wherever possible, as well as a variety of accidents that were caused by engine failures. Likewise, lower flight times in the Soviet/Russian air force, combined with different tactics, may mean that Russian engine makers are not able to draw on the same firsthand experience with combating thermal cycling wear that their American peers have.

Chinese technicians are making real progress in learning how to improve engines that are already fielded and wring the maximum life possible out of them. China’s 5719 Jet Engine Repair Plant has allegedly found a way to extend the operating life of Russian-made AL-31F engines from 900 hours to 1,500 hours.[18] It is almost certain that the WS-10 and any new jet engines made in China will incorporate any life extension and other improvements that the PLAAF and PLAN Aviation have gleaned from the Russian engines that are currently the backbone of their flight operations.

Other Environmental Factors

Vibration resistance is another key determinant of engine performance. If an engine sucks in a small stone, for instance, it can nick a plate, thereby producing a small vibration, which in turn can lead to performance degradation and even failure. Environmental factors that can have negative impact include high/hot airfields (H&H), “sandy” air, salt-water corrosion, and FOD. Russian engines, for example, typically have less FOD resistance than those of Western design. Indian Air Force Su-30MKI aircraft reportedly exhibited significant limitations at the Red Flag 2008 exercises at Nellis Air Force Base because of the FOD vulnerabilities of their Russian engines. These problems were not caused by Indian maintenance procedures; agreements with Russia require that any damaged engines be shipped back to Russia for servicing.[19]

Performance Possibilities

It remains to be seen whether China can develop reliable engines with key high-performance capabilities essential for world-class military aircraft. These include thrust vectoring, the ability to control an aircraft’s attitude or angular velocity by redirecting its exhaust slightly; continuous power-output at all speed and altitude settings without performance drops; and stall resistance. The last two factors could be particularly important, yet difficult, for China to master. The engine used in the Russian Su-27, the AL-31F turbofan, reportedly experiences performance power drops at certain power demands, e.g., high angle of attack (AoA) maneuvers. Under such conditions, there is a risk of disturbed air and fuel flow.

Particularly in a non-thrust vectored aircraft, if the engine becomes air-strained at a high AoA, the engine can suddenly have difficulty in using fuel, possibly leading to blade stall or discontinuous airflow, thereby starving the engine of oxygen. China’s J-11 variant uses these engines, and its canards suggest that it is designed for precisely these sorts of maneuvers. The key to avoiding such problems is to design the engine inlet to optimize its cross-section geometry while avoiding a tendency toward stalling. Sophisticated modeling is needed to deconflict these countervailing factors, however; hence the importance of determining Chinese capabilities and approaches in these critical areas.

Structural Challenges

China’s military jet engine sector faces a number of critical structural problems. Many of these are human and bureaucratic issues that can be much more difficult to resolve successfully than technical problems are. Two vulnerabilities stand out.

First, China’s defense officials will have to deal with single source contractor risks. China’s domestic military jet engine production all lies under the control of Aviation Industry Corporation of China (AVIC), a state-owned aerospace conglomerate. AVIC’s jet engine production facilities at Shenyang, Xi’an, and Guizhou compete to some extent, but we suspect that the competitive and innovative pressures are not as acute as those which companies like P&W and GE Aviation face. When present in moderation, competitive pressure helps produce innovative engines, lowers costs, speeds up development, and tends to incentivize better aftermarket service. In the late 1970s and early ’80s, the behavior of P&W, then a single-source supplier that the USAF felt was not being responsive to its concerns, prompted the government to foster competition between GE and P&W in the military jet engine sector. The resulting “Great Engine War” helped create architecture whereby U.S. combat aircraft can be designed around a range of powerplants produced by two competing firms. This organizational structure appears to work well. In China’s case, by contrast, there may be less “competition” at the macro level but more at the micro level. This may allow for localized bargaining and patronage that leads to duplication of effort, mismanagement of resources, and an increase in time to market. Here it will be necessary to determine how the “system” of organizations involved in Chinese aeroengine development and production actually work in practice, and whether and to what degree they are “more than the sum of the parts” in practice.

Second, analyses of jet engine development and production in the U.S. credit inter-service cooperation, management stability in both the companies and government, and the use of small teams that were allowed to take risks with a minimum of red tape helped foment jet engine development and production breakthroughs.[20]

Of these two areas, China is likely to struggle most deeply with issues of inter-service cooperation, since service chiefs in China likely view themselves as competitors for slices of the pie in any given budgetary period. Resource constraints will pose less of a challenge since military jet engines typically cost between US$2.5 million and US$5 million apiece. Supporting a very aggressive tactical aircraft buildout by producing 500 tactical turbofans per year would account for only about 2% of China’s total 2011 defense spending. Overall, structural issues pose major challenges, but can be dealt with incrementally once a country masters the basic technology and metallurgy of jet engine making.

Technologies and business practices to improve engine production

Quality control shortcomings have plagued Chinese indigenous jet engine production to date, particularly for high performance engines like the WS-10 series. In response to this and broader concerns, AVIC has declared 2011 to be a “year of quality” and pledges a tight focus on quality control across the aerospace production chain, which presumably will apply to aeroengine manufacturing as well.[21] AVIC’s motion follows on the heels of a September 2010 State Council document that outlines steps for achieving better quality control in military hardware production in China.[22] The report does not specially mention aerospace or jet engine production, but its existence implies that the commitment to improving China’s indigenous military systems production of all varieties runs straight to the top. How and to what extent these directives are realized in practice will hinge on design capability (e.g., involving materials, airflow, simulation and calculations, MTBF, systems integration, and FADEC/ECU design). It will be essential to avoid imbalances in which some parts are “better” than others, as this can introduce asymmetries and problems at the system level.

AVIC’s press statement covering its desire to bolster quality control does not discuss specific details. That said, well-documented quality control programs implemented by key global jet engine makers can shed light on the likely basic mechanics of how AVIC’s plans may take shape. P&W, one of the largest military jet engine makers in the world, has a system known as Achieving Competitive Excellence (ACE). ACE entails a focus on the following factors:

–Total productive maintenance

–Quality Clinic Process Chart

–Root Cause Analysis

–Mistake Proofing (this can be measured by first pass or final yield)

–Process Certification

–Setup Reduction

–Standard Work

China currently does not use total lifecycle (design) tools like the ones that Western corporations such as France’s Dassault employ. The CAD-CAM (computer-aided design and computer-aided manufacturing) stand-alone tools widely employed in China are optimized for design, not operational usage. Focusing only on design at the expense of buildability and maintainability can lead to situations in which fixing parts may be problematic because of problems with fitting hydraulic tubes between electric lines, etc.

There appears to be recognition that current approaches are inadequate. A number of sources reflect the Chinese jet engine industry’s interest in using process modeling and computer simulation to reduce build costs and construction time by envisioning problems before metal is cut.[23] China’s shipbuilding industry already uses these technologies on an industrial scale and there is significant potential for the aerospace and jet engine sectors to learn best practices from shipbuilders, with the caveat that different tolerances become a terrible problem for aircraft under extreme environmental conditions in ways that ships never experience.

China’s privately-owned shipyards are leading the way in this area. Jiangsu-based Rongsheng Heavy Industries is using concurrent design and computer simulation techniques to boost its production efficiency.[24] Concurrent design entails designing the ship hull, as well as electronics, internal components and other “guts” of the ship simultaneously using Tribon software.

Potential for Technology Transfer Between Civil and Military Industries

Military and commercial jet engines often have radically different performance parameters, but unlike other dual-use sectors like shipbuilding, the materials and construction techniques used to make key components of high-bypass turbofans for commercial airliners are in many cases quite similar to those used in making low-bypass turbofans for higher performance tactical aircraft. This is particularly true for the engine core. For example, the highly popular CFM56 commercial engine appears to share aspects of the core of the P&W F101 engine that powers the B-1B—at a minimum, there seems to be significant design overlap.

China’s aerospace industry has a growing list of joint ventures (JVs) with foreign partners including GE Aviation, P&W, and SNECMA, primarily in the areas of final assembly (vice basic design and components) and maintenance, repair, and overhaul (MRO). A good example of the latter is MTU Maintenance Zhuhai, a 50-50 joint venture between MTU Aero Engines and China Southern Airlines.[25] MRO is perhaps the most important are of major aeroengine JVs for China, as it can help Chinese experts figure out how to perform after-market, in-service overhaul and how to feed repair data back into the design and MTBF loop to improve design and performance.

As such, these JVs hold real potential for transferring technology and know-how that then could trickle into military jet engine design, production, and maintenance and potentially provide tangible improvements in Chinese air combat capabilities. China’s 2010 Defense White Paper states explicitly that “Defense-related enterprises and institutions are regulated and guided to make use of civilian industrial capabilities and social capital to conduct research into and production of weaponry and equipment.” The concept of harvesting civilian technology for military use is already being implemented in practice, as exemplified by the recent jet engine research and development cooperation agreement signed between China Southern Airlines and the PLA’s Armed Forces’ Engineering Institute in May 2011.[26]

Against the backdrop of China’s stated intention to use civilian industry as a source of militarily-relevant technology, presuming that jet engine-related cooperation is “commercial only” is at best naïve. JVs involving the construction and/or maintenance of jet engines deserve scrutiny based not only on the simple adherence to the letter of the law in export control regulations, but also on the potential for such jet engine technology transfer to erode U.S. competitive trade advantages and to potentially facilitate the development of a much more formidable Chinese air warfare capability, as well as contribute to greater Chinese exports of highly capable aircraft that U.S. forces might later face with respect to a third country such as Iran.

CFM International, one of the world’s largest commercial jet engine makers, is a joint venture between GE Aviation, a division of General Electric of the United States; and Snecma, a division of Safran of France. Thus drawing on some of North America and Europe’s most advanced aeroengine technology, it is also a designated aeroengine supplier for China’s C-919 Large Aircraft Program. CFM International signed an MOU with AVIC in December 2009 to discuss the potential of establishing a final jet engine assembly line in Shanghai, as well as an engine test facility, but says nothing has been finalized yet. The company tells us that as of May 2011, it has not determined where LEAP final assembly will take place.[27]

CFM sources extensively in China for its current product line and is likely to do so for the advanced new Leap-X1C engine as well, but says it is too early to say what parts will be produced in China. The company’s parts sourcing for the Leap-X1C merits close attention because the engine’s core uses advanced technologies including integrally bladed rotor disks called “blisks” in which the rotor disk and fan blades are machined or cast from a single, unitary piece of metal.[28]

Blisks offer the advantage of greater reliability and significant weight savings—up to 30% over conventional blades and disks in some cases.[29] Blisks are now utilized in a range of advanced military turbofans including the GE F414 (F/A-18 Super Hornet), P&W F119 (F-22 Raptor), and P&W F-135 and GE F136 (F-35 Lightning JSF) and learning how to manufacture blisks via commercial engine cooperation would be very helpful to Chinese engine makers as they work on the WS-15 and other advanced military turbofan engines.

Engine materials

Obtaining exotic materials and having the ability to properly machine them are vital both to physically making jet engines and for keeping manufacturing costs competitive. The General Manager of IHI’s Soma No. 2 Aeroengine Works in Japan says materials account for 50% of the cost of engine components made at his plant.[30]

Modern high-performance jet engines incorporate a number of high-strength, high-temperature materials. These include titanium, nickel, aluminum, composites, and superalloys based on nickel and cobalt. China is well-positioned to source many of these key materials from domestic producers. For example, flagship producer BaoTi says it can supply 95% of the Chinese aerospace industry’s titanium needs. Similarly, Jinchuan Nickel uses imported ores and concentrates to produce nickel and cobalt and has the capacity to produce 130,000 tonnes per year of nickel and 10,000 tonnes of cobalt. Jinchuan produced around 4,000 tonnes of cobalt in 2010—18% of the global total—according to Norilsk Nickel. To put this number into context, a large commercial jet engine (40,000 lb thrust) typically contains between 50-60 kg of cobalt, meaning that if Jinchuan supplied only 5% of its annual cobalt output to jet engine producers, there would theoretically be enough to manufacture more than 3,000 engines per year.

“Theoretically” is the operative word because the main material constraint faced by jet engine producers is not limited to securing the raw nickel, cobalt, and other metals they need. Perhaps the most critical area is being able to purchase or produce the high-temperature superalloys needed for making a jet engine. China currently is not self-sufficient in superalloys according to Sealand Securities, which estimates that the country produces around 10,000 tonnes per year of superalloys, against consumption of 20,000 tonnes per year.

Commercial jet engines typically contain between 0.7 and 2.0 tonnes of superalloys per engine, according to the Metal Powder Industries Federation. Since most high performance tactical turbofans weigh less than 2 tonnes, we assume 1 tonne of superalloy per engine, giving China to current capability to supply superalloy for 1,000 military turbofans per year if it devotes 10% of domestic superalloy production to the jet engine sector. As such, superalloys pose a more significant potential bottleneck for jet engine production in China than base metal supplies do and are likely to see higher production facilities investment in the next 5 years.

Outlook and Strategic Implications

The history of U.S. jet engine and aircraft development shows an average correlation of nearly 1-to-1 between the creation of new aircraft and new jet engines. China is now entering a period of more rapid aircraft development, and in particular, one that increasingly involves indigenous designs or modifications of airframes that are sufficiently radical to potentially warrant the development of entirely new engines or derivatives to power them. At present, China is developing or preparing to mass produce a range of tactical aircraft including the J-15, J-16, J-20, and potentially others.

Robust aircraft development and production programs plus a desire to move into the 5th generation aircraft space where the Russians may be reluctant to supply later model engines such as the 117S create powerful motivators for achieving a greater measure of domestic jet engine production self-sufficiency. It is likely that the next 2-3 years will bring surprising breakthroughs in China’s ability to produce high performance jet engines for tactical aircraft independently, with Chinese production of reliable top-notch engines perhaps 5-10 years away.

Key metrics to watch in determining Chinese progress in engine capabilities include engine thrust-to-weight ratio and specific fuel consumption. The first is an indicator of both design quality and production quality (i.e., of material tolerance). The second denotes the amount of fuel that the engine burns to reach a given level of performance, which in turn determines combat range, time over target, and the amount of strain on the engine.

Major systems management indicators include on-wing reliability (MTBF) and ease of in-field replacement and repair. China could take a variety of approaches to address these issues, including overcoming low MTBF by simply having more engines available, a process that the U.S. employed for many years when its own engines were less reliable, as was the case with the F-4 Phantom in Vietnam (in contrast to, e.g., the F-15 today).

If China’s engine makers can attain the technical capability level that U.S. manufacturers had 20 years ago, China will be able to power its 4th generation and 5th-generation aircraft with domestically made engines (3rd and 4th-generation in Chinese nomenclature, respectively). These developments would be vital in cementing China as a formidable regional air power and deserve close attention from policymakers.

[1] For the purposes of this analysis, “tactical aircraft” means fighter aircraft, strike-fighters, and attack planes.

[1] “胡参谋长: 中国航空发动机超越俄罗斯不是神话” [Chief of Staff Hu: The Idea of China’s Jet Engines Surpassing Russia’s is Not a Myth], Nanfang Daily, 23 January 2011, http://opinion.nfdaily.cn/content/2011-01/23/content_19516764.htm.

[2] “林左鸣: 投资一百亿打一个航空发动机的翻身仗” [Lin Zuoming: 10 Billion RMB Will be Invested in Standing up China’s Military Jet Engine Development], 17 April 2011, http://military.people.com.cn/GB/52934/67858/14407966.html.

[3] “军报: 国产太行量生并装备歼-11B推力12.5吨” [Military Times: China’s Domestically-Made 12.5 Tonnes Thrust Taihang Engine Now Being Series Produced to Equip the J-11B], Global Times, 19 November 2010,

http://mil.huanqiu.com/china/2010-11/1270688.html.

[4] NPO Saturn, Quarterly Report, 1st Quarter 2011, http://www.npo-saturn.ru/upload/editifr/2011/38_0_greport_201101.pdf.

[5] Ibid.

[6] Global Gas Turbine News, International Gas Turbine Institute, 51:1 (February 2011): 51.

[7] “先进航空发动机关键制造技术研究” [Key Manufacturing Technology Research of Advanced Aero-Engine], China Gas Turbine Establishment, Defense Manufacturing Technology, 6 (2009): 47.

[8] G.A. Fitzpatrick and A.D. Lloyd, “Establishing Best Practice in the Design and Manufacture of Hollow Titanium Fan Blades,” Paper presented at the RTO AVT Workshop on “Intelligent Processing of High Performance Materials,” 13-14 May 1998, 4-1.

[9] R.C. Reed, P.D. Lee, and M. McLean, “Process Modelling of the Fabrication of Critical Rotating Components for Gas Turbine Applications,” Paper presented at the RTO AVT Symposium on “Reduction of Military Vehicle Acquisition Time and Cost through Advanced Modelling and Virtual Simulation,” 22-25 April 2002.

[10] “先进航空发动机关键制造技术研究” [Key Manufacturing Technology Research of Advanced Aero-Engine], China Gas Turbine Establishment, Defense Manufacturing Technology, 6 (2009): 48.

[11] Carol Hui, “High-Flying Investments,” Metalworking World, No. 2 (2008): 11, http://www2.coromant.sandvik.com/coromant/downloads/articles/aerospace/MWW208_aerospace_japan.pdf.

[12] “先进航空发动机关键制造技术研究” [Key Manufacturing Technology Research of Advanced Aero-Engine], China Gas Turbine Establishment, Defense Manufacturing Technology, 6 (2009): 48.

[13] M.M. Allen, “Iso-Forging of Powder Metallurgy Superalloys For Advanced Turbine Engine Applications,” P&W, April 1976, DTIC.

[14] CEK Carlson, JL Cutler, WJ Fisher, and JV Memmott, “Diffusion Bonded Boron/Aluminum Spar-Shell Fan Blade,” June 1980, DTIC.

[15] “先进航空发动机关键制造技术研究” [Key Manufacturing Technology Research of Advanced Aero-Engines], China Gas Turbine Establishment, Defense Manufacturing Technology, 6 (2009): 48.

[16] «В 2010 году ОАО ‘УМПО’ планирует увеличить товарный выпуск на 4.7%», AviaPort, 16 February 2010, http://www.aviaport.ru/digest/2010/02/16/190463.html.

[17] Robert Drewes, The Air Force and the Great Engine War (Honolulu, HI: University Press of the Pacific, 2005), 60.

[18] “Rise with Enthusiasm: China’s Jet Engine Technology is Surpassing that of Russia’s AL-31F,” 28 August 2010, MilChina, http://www.milchina.com/2010/0828/4519.htm.

[19] “USAF Pilot Describes IAF Su-30MKI Performance at Red Flag-08,” The DEW Line, 5 November 2008, http://www.flightglobal.com/blogs/the-dewline/2008/11/usaf-pilot-describes-iaf-su30m.html.

[20] William S. Hong and Paul D. Collopy, “Technology for Jet Engines: Case Study in Science and Technology Development,” Journal of Propulsion and Power, 21.5 (September-October 2005): 775-76.

[21] “中航工业全面推进航空产品质量管理工作” [AVIC Seeks to Comprehensively Improve Quality Control Management of Products it Produces], Aviation Industry of China, 28 January 2011, http://www.avic.com.cn/xwzx/jtxw/364941.shtml.

[22] “‘现公布’武器装备质量管理条例” [Ordinances Pertaining to Weapon Equipment Quality Control], 30 September 2010, State Council of the People’s Republic of China, http://www.gov.cn/zwgk/2010-10/08/content_1717050.htm.

[23] 陈美宁, 朴英, 王大磊 [Chen Meining, Piao Ying, and Wang Dalei], “某型航空发动机风扇串列叶栅的数值模拟” [Numerical Simulation of Tandem Cascades in an Aeroengine Fan], Journal of Aerospace Power, 5 (2010).

[24] Rongsheng Heavy Industries, http://www.rshi.cn/Design.html.

[25] “MTU Aeroengines,” http://www.mtu.de/en/company/corporate_structure/locations/zhuhai/index.html.

[26] “装甲兵工程学院与中航南方公司签约燃气轮机应用研究” [Armed Forces Engineering Institute and China Southern Airlines Sign Agreement on Research of Gas Turbine Applications], Ministry of National Defense of the People’s Republic of China, 16 May 2011, http://news.mod.gov.cn/headlines/2011-05/16/content_4242087.htm.

[27] Interview with company representative, May 2011.

[28] John Croft, “CFM: Serving no LEAP before its Time,” FlightGlobal, 8 March 2010, http://www.flightglobal.com/articles/2010/03/08/339093/cfm-serving-no-leap-before-its-time.html.

[29] “Repair of Blisks Made of Ti 6246,” Fraunhofer-Institut für Lasertechnik ILT, Annual Report 2005, 76, http://www.ilt.fraunhofer.de/eng/ilt/pdf/eng/jb05/s76.pdf.

[30] Carol Hui, “High-Flying Investments,” Metalworking World, No. 2 (2008): 14, http://www2.coromant.sandvik.com/coromant/downloads/articles/aerospace/MWW208_aerospace_japan.pdf.