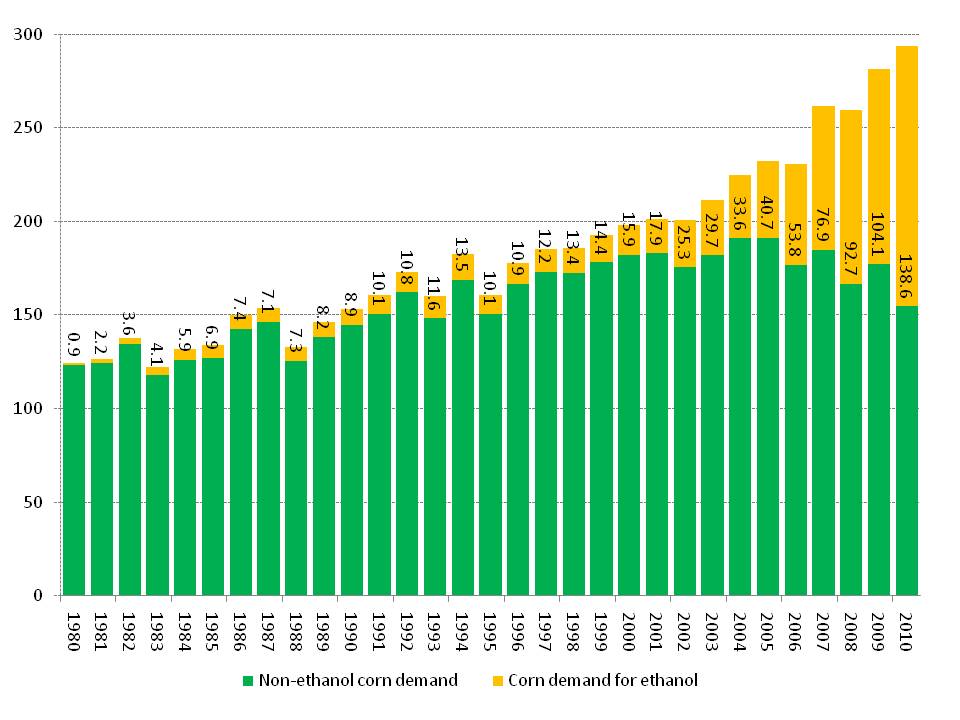

In 2010, the U.S. used roughly 138 million tonnes of corn to produce ethanol—43% of the nation’s total corn crop of 316 million tonnes (Exhibit 1). This is a phenomenal change from 1980, when less than one million tonnes of corn was used for brewing ethanol in the U.S. When considering the environmental and economic merits of any policy, total costs and benefits must be calculated over the entire lifecycle of a given process—not just for a given stage of usage. Biofuels will constitute an important part of the U.S. and global energy portfolio in the future, but a one-dimensional reliance on corn-based ethanol—with its attendant economic and environmental shortcomings[i]—is not the best approach for maximizing the economic and strategic value of U.S. corn production.

Exhibit 1: U.S. corn use for ethanol production and other uses

Million tonnes per year

Source: USDA, China SignPost™

The U.S. is the Saudi Arabia of corn, as it accounts for ~40% of global corn output and 55% of global corn exports. It also has a unique ability to rapidly boost exportable corn tonnage by reducing ethanol production. The US should end subsidies for ethanol production and blending and eliminate all tariffs on imported ethanol and instead take the corn freed up by lower ethanol production and export it to China. This can help directly and sustainably reduce the U.S. trade deficit with China while also helping China manage food price inflation. This, in turn, could help stabilize a key U.S. trading partner and also open diplomatic space for the U.S. to press for more favorable Chinese currency and economic policies.

A recent statement by Chen Xiwen, head of the State Council’s Rural Affairs Leading Small Group, suggests that China’s leadership is becoming more open to having imports comprise a larger portion of total grain supplies, a position change likely reinforced by the country’s positive experience in obtaining soybeans from foreign growers (Sina.com).

How much corn will China need?

Rabobank says China could maintain 95% grain supply self-sufficiency, as per official targets, and still import 25 million tonnes of corn per year by 2015. By comparison, China’s 2010 corn imports, which reached unprecedented levels, were only 1.2 million tonnes. Rabobank and other investment houses rightly point out that the world currently lacks large additional corn supplies. Yet the approach advocated below could free up sufficient U.S. corn production to supply even a high growth case Chinese corn import scenario. The availability and high quality of U.S. corn will make it highly attractive to Chinese buyers if the price is right.

Currently, corn futures on China’s Dalian Commodity Exchange are priced at more than US$10 per bushel and the 25 March spot price in Jilin province—one of China’s main corn growing regions—is more than US$8 per bushel, as compared with the roughly US$6.50 per bushel that ethanol makers in Iowa—the heart of the U.S. Corn Belt—are currently offering for corn. This price differential is in line with the longer-term trend of Chinese corn prices averaging 20-40 percent higher than US prices (USDA).

In the last three months of 2010, shipping U.S. corn from Minneapolis to Japan via Pacific Northwest ports cost approximately US$2.50 per bushel, according to the USDA. The premium prices in China would be attractive to those farmers who have not actually invested capital in local ethanol plants and the price differentials would likely become more favorable for exports to China if U.S. ethanol subsidies and import tariffs were phased out.

How the U.S. can help

The U.S. currently has 217 ethanol plants, according to Ethanol Producer Magazine. Of these, the 199 that use corn account for approximately 98% of US ethanol production, which in 2010 exceeded 860,000 barrels per day. We recognize that corn-based ethanol production is an important economic activity in the U.S. Corn Belt and also understand that a sudden surge of corn onto world markets could depress prices.

As such, our proposal focuses on obtaining ethanol from U.S. producers that can compete with imports without subsidies and protective tariffs, as well as imports from Brazil and the Caribbean/Central America region. We estimate that reducing U.S. corn-based ethanol production by 15% through a phase out of the least efficient plants and more ethanol imports from Brazil could free up nearly 20 million tonnes of corn for export to China or other markets. This freed-up corn would likely be worth at least US$5 billion on the export market at current prices and would help sustainably reduce the U.S. trade deficit with China, which in 2010 stood at approximately US$273 billion.

Ethanol production, on the other hand, carries high economic costs, as well as the global human costs of contributing to food price inflation by using such large amounts of a staple grain to make a fuel that is less thermally efficient than its competitors.

In energy terms, it takes 1 unit of energy input[1] to produce 3 energy units of ethanol. In contrast, each unit of energy that goes into refining a barrel of crude oil in the U.S. yields 11.6 units of energy. Part of the reason corn-based ethanol has such a low “energy profit” is because corn must be heated before fermentation in order to break down complex starches into simpler sugars—a step that sugarcane-based ethanol production in Brazil does not require because the sucrose-rich juice from cane crushing can go straight into the fermentation vat.

Federal ethanol tax credits will cost the U.S. Treasury US$5.7 billion in 2011 if they are renewed (GAO), while ethanol plants are likely to consume enough natural gas in 2011 to heat 5 million U.S. homes for a year—an amount of gas likely to be worth at least US$2.5 billion.

In light of these myriad costs, the U.S. should stop subsidizing domestic corn-based ethanol production, reduce tariffs to encourage ethanol imports from lower cost producers like Brazil, and instead export more grain to China and other consumers.

Reducing domestic corn-based ethanol production would free up millions of acres of America’s best farmland to produce corn, as well as soybeans and wheat, for export to other global markets, especially China. The U.S. is in a special position because it can substantially boost exportable corn and soybean supplies without putting any additional land under cultivation. This is a unique position and opportunity, since farmers in other major grain exporters like Australia, Argentina, and Brazil would likely have to plow up additional acreage under plains, pampas, and rainforest to increase their grain output—at significant social and environmental cost.

Rising corn imports in China

China’s corn imports rose to 1.2 million tonnes in 2010 and may rise as high as 2.5 million tonnes this year, according to the Financial Times. Because of rapid, broad-based, highly polluting industrialization and other development, China’s progressively diminishing arable land and clean water base is already almost fully utilized. As a growing consumer economy demands more grain, China’s transport and infrastructure boom is helping to erode the already thin arable land base. In 2011, road and rail projects will take an estimated 700,000 hectares of arable land, according to China Daily. This would be enough land to produce 3.5 million tonnes of corn at present Chinese yields.

The likelihood that corn production will receive a higher priority than the cultivation of other essential grains such as wheat and rice in China is low, effectively placing a ceiling on the country’s potential for boosting corn production. China’s Corn Belt primarily lies in the Northeastern provinces of Jilin, Heilongjiang, and Shandong; nationally, China has more than 90% as much corn area under cultivation as does the U.S. (31.5 million hectares vs. 32.9 million hectares in the U.S. in the 2010/11 crop year), yet only manages to produce about half the corn tonnage grown in the U.S.

China’s leadership is especially concerned about maintaining as much self-sufficiency as possible in the production of human consumption staple grains like wheat and rice, suggesting that corn acreage will not grow much and that corn imports will rise significantly in China over the next 5-10 years. Chinese farmers’ corn productivity, as measured in tons per hectare, has remained relatively stagnant over the past 20 years at a rate roughly half that of the U.S., which now produces nearly 10 tons per hectare. The yield gap suggests that U.S. farmers have a strong competitive advantage vis-a-vis their Chinese peers and that increased corn exports from the U.S. to China make economic sense.

Drivers of corn demand in China

Chinese grain demand will have three primary demand drivers in coming years. First, meat consumption is growing along with rising incomes. Over the past 20 years, China’s per capita pork consumption has grown at an average of 3.4% per year, while per capita demand for chicken has risen by more than 8% annually. In the 2010 crop year, roughly 70 of every 100 tons of corn used in China were used for feed, according to the USDA.

Second, growing animal protein demand in China is driving consolidation in the meat industry that will gradually shift an increasing proportion of Chinese swine and poultry farming to large industrial farms that rely exclusively on grain-based feed, as opposed to the waste and scrap that many animals receive on small farms. At present, such small farm meat production effectively happens “off the books” as far as the global grain market is concerned.

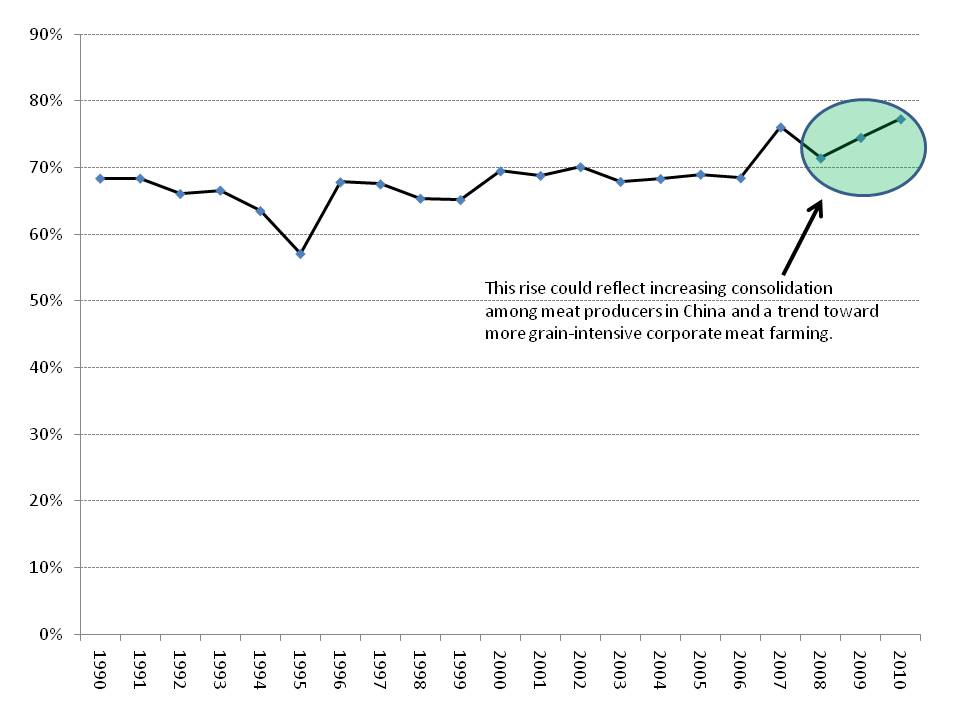

Over the past three years, however, the ratio of China’s reported feed grain demand to the total grain amount that would be required if all pork and chicken consumed in China was grain-fed has steadily risen, moving from 71% in 2008 to 77% in 2010 (Exhibit 2). The rise could be due to improved data gathering by China’s official statisticians, but given China’s centuries-old tradition of detailed agriculture record keeping (albeit with tragic lapses during years of Maoist excess, as detailed in CSP 22), we suspect the data do reflect a slow but steady migration of animal production from family farms to grain fed corporate farms like those run by Yurun, a major Chinese pork producer.

Exhibit 2: Ratio of reported feed grain use to demand implied by total meat production, China

Source: USDA, China SignPost™

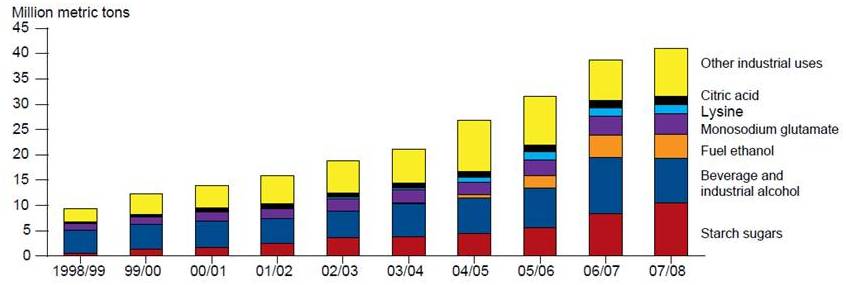

Third, China’s industrial corn use is growing rapidly. In a 2010 report, USDA analysts noted rapid growth in China’s production of corn-based sweeteners and ethanol, which in China is primarily used by industry and for making alcoholic beverages. Industrial corn use in China now likely exceeds 40 million tonnes per year (Exhibit 3). China’s “industrial” corn consumption category deserves special attention because many of the products included—such as beverage alcohol, sweeteners, and flavor enhancer monosodium glutamate—should still be considered food products for human consumption.

Exhibit 3: Much of China’s “industrial” corn consumption goes into food products

Source: USDA

Policy recommendations

–Substantially reduce or eliminate the current US$18.10 per barrel subsidy on ethanol production and blending in the United States.

–Substantially reduce or eliminate the current US$0.54 per gallon import duty on ethanol imported from Brazil, and increase exports of corn that would have otherwise been used to make ethanol.

–Make the subsidy and import duty phase-outs gradual (perhaps 20% per year) to reduce the risk of price shocks to global grain markets. Whether through higher available corn supplies or decision by farmers to switch to other crops like soybeans, the subsidy phase-out has important economic dimensions that will need to be managed adeptly.

–Increase cultivation of biofuel crops such as camelina, jatropha, and algae that can grow on marginal land or in unused water, thereby truly avoiding the food vs. fuel competition that corn and soybean-based biofuels exacerbate.

–Prepare U.S. roads, railways, inland waterways, and grain ports to handle significant additional corn export volumes. This could be part of a larger effort to improve U.S. infrastructure, which—aside from maternal and child health, public education, and immigration of talented students and professionals—is one of the best ways to invest in America’s economic future.

[1] Measured in British Thermal Units (BTU)

[i] See for example, Pew Center on Global Climate Change, “Climate TechBook: Ethanol,”

http://www.pewclimate.org/docUploads/Ethanol-Fact-Sheet.pdf and Richard Harris, “Study: Ethanol Worse for Climate than Gasoline,” http://www.npr.org/templates/story/story.php?storyId=18784732.