- China’s oil demand growth each year is likely to exceed the delivery rate of the current Russia-to-China pipeline.

- Oil production in Eastern Siberia will likely increase, but Moscow clearly wants to market this oil to a diverse customer base via seaborne sales from the port of Kozmino.

- Despite oil pipeline projects such as the Skovorodino-to-Daqing line, China’s dependence on seaborne crude oil imports will rise.

- China’s leaders are likely to remain preoccupied with maritime oil transport security.

- China will continue to “free ride” on U.S. provision of sea lane security for now, but desire to achieve limited autonomous capabilities in this area could help to drive its future naval development.

- The difficulty and undesirability of implementing a distant or close blockade of China’s seaborne oil supplies will continue to provide some protection for China, however.

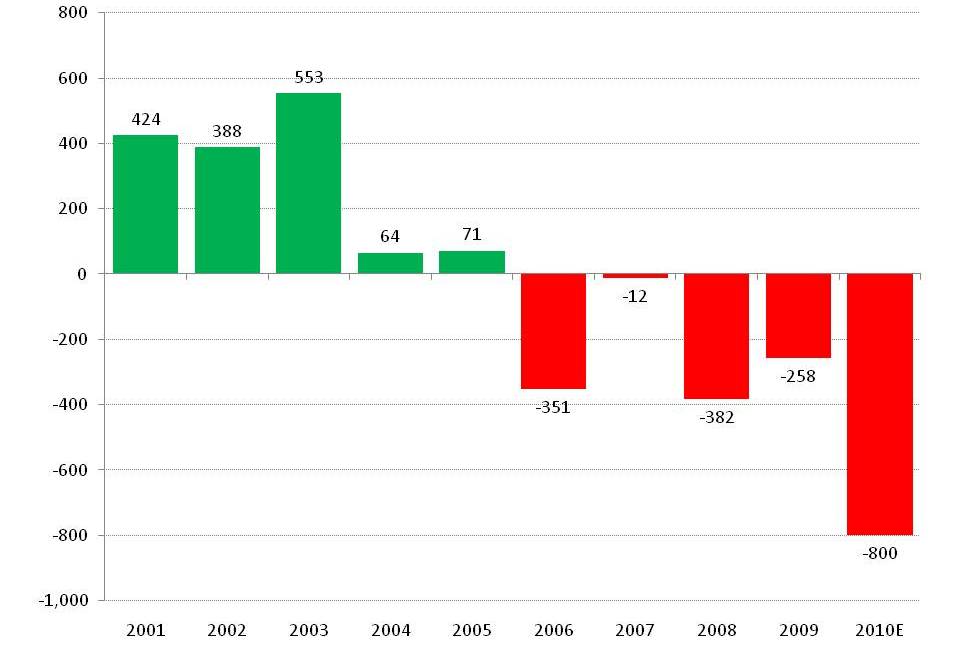

Oil output growth in Russia and Kazakhstan—the two countries able to produce and move large volumes of oil to China by pipeline—has not been able to keep pace with expected Chinese oil demand growth.[1] From 2001 to 2005, annual oil production increases in Russia and Kazakhstan substantially exceeded China’s annual oil consumption growth (Exhibit 1). However, since 2006, Russia’s stagnating oil production and continued robust growth in Chinese oil demand have created large deficits that strongly suggest China’s seaborne oil imports will continue rising.

Exhibit 1: Annual changes in Russian & Kazakh oil output vs. increase in Chinese oil demand

Thousand barrels per day

Source: EIA, China Daily, Russian Ministry of Energy, China SignPost™

Russian crude production is flattening as drillers struggle to overcome natural decline rates that some analysts believe may be as high as 19% annually. The government of Kazakhstan seeks a total increase in oil production of roughly 400 kbpd over the next 4 years. Even at a conservative annual oil demand growth rate of 4%, China’s incremental oil demand in 2011 would basically equal the entire planned oil production increase Kazakhstan seeks to achieve by 2015.

In theory, either country could choose to ship more crude oil to China. However, the cost of new or expanded China-oriented export infrastructure could only be justified by major output gains or strategic decisions to shift crude away from existing markets in Europe, Japan, and other locales. In our assessment, this is unlikely.

Indeed, recent Russian news articles say any increase in oil shipments to China above the currently contracted 300 kbpd level will not occur until after the second stage of the East Siberia-to-Pacific Ocean Pipeline connecting Skovorodino to the Pacific port of Kozmino is completed. To us, this suggests Russia fears becoming dependent on China as the dominant buyer of East Siberian crude oil. We suspect similar concerns drive thinking in Kazakhstan as well.

Domestic production declining at key fields

With the limited production growth prospects in Russia and Kazakhstan, one last potential point of hope is domestic production in China.

Chinese oil companies have done a remarkable job maintaining production rates at major fields like Daqing and Shengli. However, the production from these workhorse reservoirs are declining at a rate of 2.0-to-3.5% per year, according to research published in Petroleum Exploration & Development. The researchers note that other smaller, but still significant fields like Huabei, Dagang, and Changqing are declining at rates between 8% and 9% per year.

Offshore production increases in the Bohai Gulf have been a bright spot, but the gains here are not likely going to large enough to offset China’s fundamental trend of high relative and absolute dependence on seaborne crude oil imports in the next 10 years. As such, China’s civilian and military leaders will likely remain deeply concerned about sea lane security as their country’s oil import dependence increases further.

Implications

A new round of sustained high global oil prices as large economies resume growing is likely to sharpen the fears of resource nationalists in China who believe the country needs the military capacity to defend seaborne oil supplies. That said, we believe that in scenarios other than total war, China is less vulnerable to a maritime oil blockade than many assume. In our 3-point explanation below, we draw upon “No Oil for the Lamps of China,” an in-depth scholarly analysis of China’s vulnerability to maritime energy blockades by Gabe Collins and William Murray that was published in the Naval War College Review’s Spring 2008 issue.

Point 1: A distant naval energy blockade, i.e., in the Indian Ocean, could probably not prevent the delivery of oil to China via alternative sea routes, purchasing cargoes after they have passed the blockade, falsifying bills of lading, or transshipping oil through third countries in Asia. Tankers at sea can take several alternative routes into China, albeit with higher transportation costs. Bills of lading can be falsified. Or oil cargoes can be bought and sold while the ship is at sea, a normal commercial practice. Additionally, cargoes can be “parceled out,” which is also a normal commercial practice. For example, of a VLCC’s two-million-barrel crude oil cargo, five hundred thousand barrels might be headed to Singapore, five hundred thousand barrels to South Korea, and a million barrels to the PRC. Even if a shipper declared honestly that a quarter of the cargo was headed to China, a blockader might create very serious diplomatic and economic repercussions if it detained a vessel that were also carrying crude to South Korean and Singaporean buyers. Finally, if tankers were flying a flag of convenience or PRC-owned tankers reflag if a conflict seems imminent, discerning where a vessel is ultimately headed or who the real owner is becomes more challenging.

Point 2: China’s rising oil shipment volumes also pose significant logistical challenges for a potential blockader and could quickly overwhelm a blockader’s boarding capabilities. The sheer flow of long-distance maritime oil shipments to China means a minimum of 80-100 very large crude carriers (VLCCs) will be bound for Chinese ports at any given time.[2] The number of ships is likely significantly larger since some shipments travel on smaller vessels or are parceled out.

Point 3: Attempting a truly effective maritime oil blockade would be a highly platform and resource-intensive endeavor that would carry a high opportunity cost by taking platforms away from whatever conflict prompted the blockade in the first place. For a distant blockade, if a significant number of vessels resist boarding, the number of fast boats, boarding crews, and helicopters or other air assets needed for the operation becomes formidably large. A close blockade near China’s main oil-offloading ports would require large numbers of ships to operate in close proximity to the PRC’s impressive and increasingly lethal anti-access/area denial (A2/AD) weaponry, where they would be subject to attrition, with attendant escalatory risk. In addition, a close blockade would require an even larger number of warships and air support than a distant blockade, once again taking platforms away from the fight that triggered the desire to blockade in the first place.

Point 4: Even were some of the above obstacles to be overcome, China retains significant domestic and land-supplied energy resources, including oil. China uses coal for the majority of its energy needs, and has significant supplies. China’s overland pipelines cannot offset its rising oil demand, and can be severed easily with precision-guided munitions, but this would be highly escalatory and harm the interests of supplier nations such as Russia. While oil is irreplaceable as a transportation fuel, China’s government at present retains significant capability to control its use and direct it to military purposes if necessary. The bottom line is that in a true conflict, China would not face a choice between immediate decisive action and energy strangulation.

It is to be hoped that these extremely regrettable worst case scenarios never materialize, and that the realization that China’s fundamental vulnerability to a maritime energy blockade in circumstances other than total war is relatively low will influence Chinese naval strategy debates, procurement policies, and deployments in a way that ultimately fosters trust and motivates the PLA to accept and seek further coordination of regional maritime security policies, particularly with the larger regional naval forces such as those of India, Japan, Australia, South Korea, and the U.S.

[1] We do not count the Burma-to-China pipeline because it is not a true overland supply source. Oil must still traverse the Indian Ocean in order to reach the start point of the Burmese oil pipeline and is thus potentially vulnerable to naval interdiction.

[2] Assuming a voyage time of at least 20 days between the Persian Gulf and China.