–Chinese dealers sold more than one million heavy trucks in 2010 and sales could hit 1.2 million vehicles in 2011.

–New heavy trucks sold in China during 2011 could add 380,000 barrels per day of diesel fuel demand.

–Truck buyers have high incentive to maximize their trucks’ use and we believe that there is tighter correlation between heavy truck sales and diesel fuel consumption than is the case for cars and gasoline.

In 2010, heavy truck sales in China rose by roughly 60% versus 2009 levels, driven in part by the government’s 4 trillion RMB stimulus plan. Truck sales are important to watch because they offer real-time and forward looking insights into oil demand and industrial and construction activity. Chinese oil demand growth is especially relevant in light of the oil price spike triggered by Egypt unrest, with Brent crude hitting US$100 per bbl for the first time since 2008.

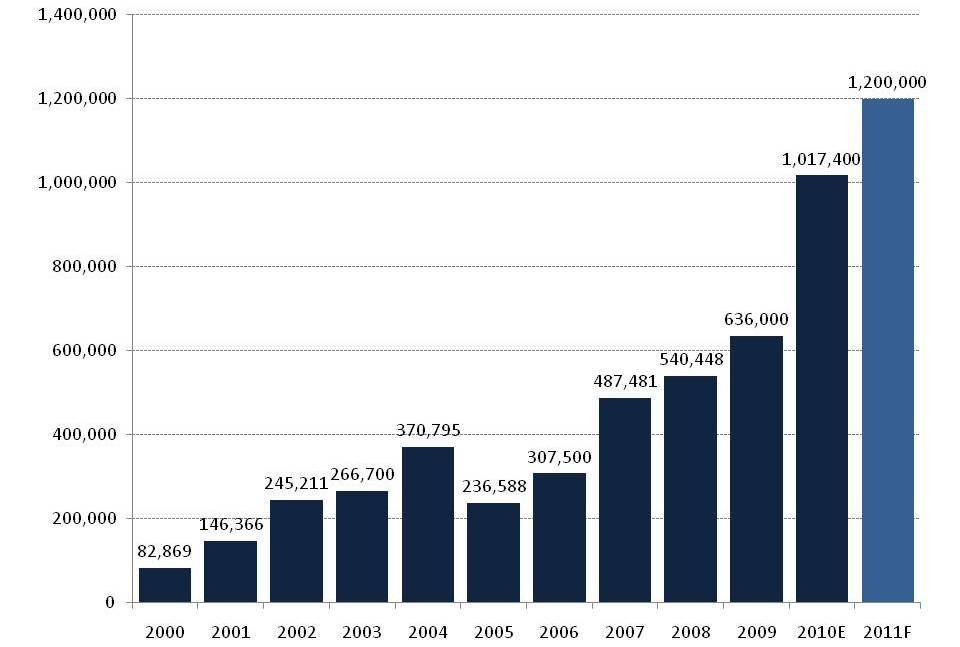

Sales of new heavy trucks in China have grown rapidly in recent years, rising from roughly 86,000 vehicles in 2000 to roughly one million in 2010. Truck sales are likely to slow in 2011 as stimulus-related investment projects wrap up and the government works to reign in food and real estate price inflation. Based on our analysis of Chinese company statements and sales forecasts by Chinese vehicle sector experts, we believe heavy truck sales in China during 2011 will be approximately 1.2 million vehicles, for a year-on-year sales increase of slightly under 18% (Exhibit 1).

Exhibit 1: Sales of new heavy trucks in China

Vehicles

Source: China Car Research Net, CAAM, Argonne Nat’l Laboratory, Cummins, China SignPost™

Why truck sales are a better oil demand growth indicator than car sales

Passenger cars are a luxury purchase, car use is often intermittent, and when vehicles are used, the distances driven are typically moderate. As such, the correlation between rising car sales in China and increases in gasoline demand is not as strong as one might expect at first glance.

Heavy trucks are a very different proposition. These vehicles are purchased by commercial users who: (1) buy the vehicles because they need them to move goods, and (2) are either taking out loans or using cash flow from their business to finance the purchases. Under such circumstances, the incentive to maximize the trucks’ use is high and we believe that there is tighter correlation between sales of heavy trucks and increases in diesel fuel consumption than is the case for cars and gasoline.

What natural resources are likely to be most affected by heavy truck sales in China?

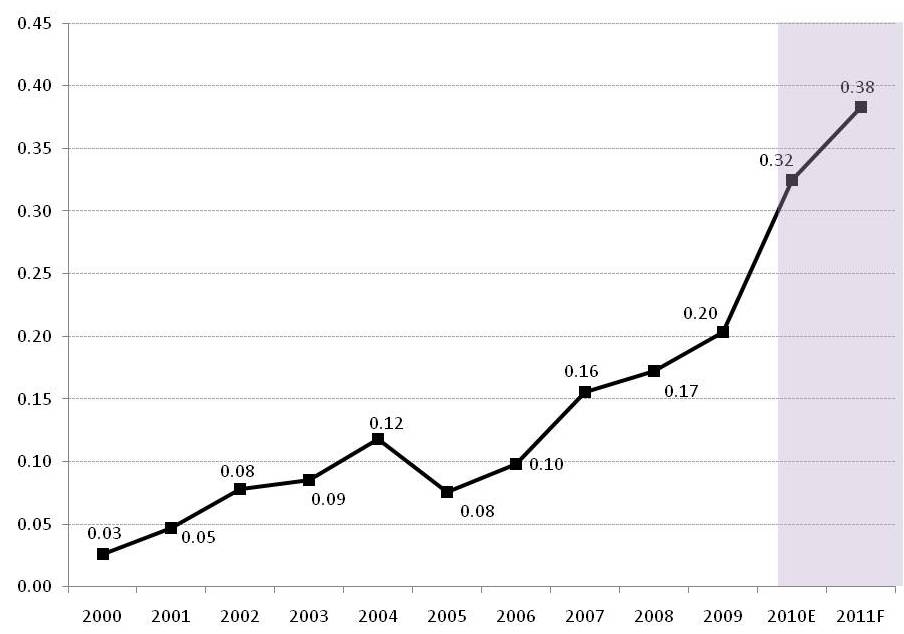

Heavy truck sales in China will drive demand for crude oil (via diesel fuel) and rubber (used in tires). Industry sources tell us Chinese heavy trucks typically use a smaller displacement engine (e.g. 6 to 10 liters) than those used by trucks sold in the U.S. and European markets (10 to 15 L). Based on this, we estimate that the heavy trucks sold in China during 2010 likely added 320,000 bpd of diesel fuel demand (Exhibit 2).

Exhibit 2: Estimated additional diesel fuel demand from new heavy trucks sold in China

Million barrels per day

Source: China Car Research Net, CAAM, Argonne Natl Laboratory, Cummins, China SignPost™

We forecast that heavy trucks sold in 2011 will add 380,000 bpd of diesel fuel demand. As a consequence, China’s demand for middle distillate-rich crude oils like Murban from the UAE is likely to continue rising. Trucks are also very natural rubber-intensive. An average new car tire weighs only about 25 pounds and uses 3.5 pounds of natural rubber, while a new truck tire weighs 120 pounds and uses 32.4 pounds of natural rubber, according to the Rubber Manufacturers Association. As such, the heavy trucks we think will be sold in China in 2011 are likely to require at least 100,000 tonnes of natural rubber.