- Major Chinese cities are suffering from a serious shortage of parking space as supporting infrastructure lags rapid car fleet growth. In Luoyang, a man was beaten to death recently in a fight over a parking space.

- China had 79 million cars on its roads in 2009, according to the National Bureau of Statistics and we estimate the number for 2010 is roughly 85.5 million vehicles.

- In eight cities we examined, parking fees likely account for more than 1/3 of the annual costs of owning a car for owners who must pay for parking. Tighter restrictions or higher fees and taxes related to parking could discourage potential car buyers in the next 12 months.

On 20 December 2010, 58-year-old An Henkang died of injuries suffered four days prior in a fight over a parking space in Luoyang, Henan province (People’s Daily). While an extreme case, his tragic death highlights the fierce competition for parking spaces that is heating up in cities across China as car sales outstrip the ability of supporting infrastructure to keep pace.

This brief analysis looks at the current parking space shortage in China and also helps readers understand how parking contributes to the total cost per month of owning a personal car in a range of Chinese cities.

Parking pressures in Beijing have been grabbing headlines in local media. A 5 January 2011 article posted on China News Net notes that of the 110,000 cars current owned by residents of Beijing’s western Shijingshan neighborhood, 11,000 currently lack parking spaces. Recent reports in the Beijing Youth Times complain about a chaotic parking environment and parking space shortages in the Haidian District. A Beijing-based businessman tells us “most” large buildings have underground parking, but it is pricey: in his building, a parking space costs 1,200 RMB per month, versus the 400 RMB per months he pays to park at his apartment.

The parking space shortage is a nationwide phenomenon, not just one that afflicts the wealthier East Coast cities. Chongqing is short 190,000 parking spaces and the deficit is growing by 400 spaces per day, according to People’s Daily. Xi’an, meanwhile, reports a deficit of roughly 400,000 parking spaces at present in a city where residents own around 1.1 million cars, according to hsw.auto.cn.

Predictably, space shortages of this magnitude create chaotic urban parking conditions. Our contacts in Beijing tell us the city is rife with double parking and that many car owners park their vehicles on sidewalks, or in designated bike lanes. We are curious to see how long it is until major Chinese cities develop a ticketing and towing apparatus akin to that which afflicts car owners in major U.S. cities. As one barometer of parking’s role as a growing business in China, we note that there is now a substantial Chinese-language trade publication called Urban Parking, headquartered in Jinan, Shandong, that mainland subscribers can access for 120 RMB per year.

Exhibit 1: China parking images

Guizhou driver gets car stuck

Source: Personal contact living in China

Guangzhou street parking meter

Source: China SignPost™

Resolving the parking shortage in Chinese cities will require significant investment. Not only is there a deficit now, but car sales and fleet growth continue to add millions of new cars per year that will need parking. China had 79 million cars in 2009, according to the National Bureau of Statistics and we estimate the vehicle fleet at year-end 2010 numbers roughly 85.5 million vehicles.

The layouts of major Chinese cities tend to leave a shortage of aboveground parking spaces in both the interior and core residential portions of town. The overhead snapshots of two major US downtown areas (St. Louis and Dallas) and two major Chinese urban centers (Chongqing and Xi’an) show a distinctly more spacious and parking-rich downtown in the U.S. cities than in their Chinese peers, where auto demand is rapidly growing (Exhibit 2). Chongqing and Xi’an are chosen here due to the recent reports of serious parking space shortages in each city.

Major U.S. East Coast cities typically have much more cramped downtown layouts than their western and southern counterparts, but they also have many underground and aboveground parking garages that are either standalone entities or integral parts of buildings. Unlike their U.S. peers, Chinese cities were not built around the automobile, and thus far lack sufficient infrastructure in both their core and suburbs to accommodate growing urban car fleets. The problem is particularly pronounced in the inner portions of China’s cities, with our contacts telling us that in Beijing, for example, many people park streetside but that within the Second Ring Road parking is generally not possible, while within the Third Ring Road it is “risky” but outside the Third Ring Road there is usually no problem.

Exhibit 2: Downtown layouts of sample large cities in the U.S. and China

St. Louis

Dallas

Chongqing

Xi’an

Source: Google Earth, China SignPost™

The advantage China has with its rapid urbanization is that parking space can, and is, being incorporated into new construction in an urban building base that is expanding rapidly enough to allow urban parking space to expand at a similar rate. Construction will be easier in some areas than others. Chongqing, for example, lies amidst rocky limestone hills which will likely make building underground garages more expensive and time-consuming than in flatter cities with more permissive geology like Xi’an, Changsha, or Wuhan.

How parking factors into total car ownership costs

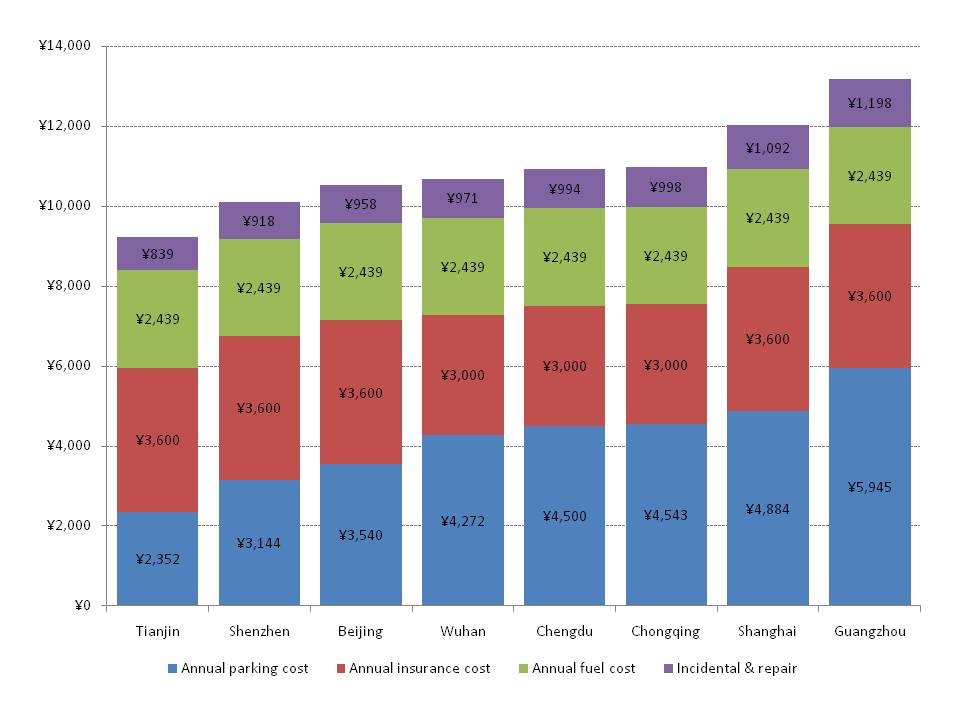

In the eight cities shown, we estimate parking accounts for approximately 37% of the annual cost of owning a car for those drivers who must pay for parking (Exhibit 3). The estimated annual parking cost ranges from slightly above 2,300 RMB per year in Tianjin to more than 5,900 RMB per year in Guangzhou. Our contacts in Beijing say that a substantial portion of drivers appear to be street parking for the time being, which means that they sidestep these costs. This is far more difficult inside the Third Ring Road, however. However, as city governments work to resolve chaotic local parking situations, it is likely that higher vehicle taxes, stricter parking enforcement, or a combination of the two will lead to broad increases in parking cots and car ownership costs overall. Some cities may also make rental or ownership of a parking space a prerequisite for purchasing and registering a car.

Exhibit 3: Estimated annual car ownership cost in select Chinese cities[1]

Source: Chinaparking.org, NBS, China SignPost™

Implications

Parking space shortages and political statements on the issue highlight how rising car ownership has distinct political implications as car owners demand places to park vehicles. We expect rapid continued growth in construction of above and below-ground parking spaces in Chinese cities as municipalities struggle to keep pace with growing car ownership. President Hu Jintao recently set forth a five point parking improvement plan, entailing the following elements: (1) the state must build more parking spaces, (2) private capital should also be used for building parking spaces, (3) the parking market should be liberalized, (4) businesses and adjacent residential areas should better coordinate so that industrial areas, which have high daytime and low nighttime parking space utilization, can offer spaces for nearby residents, whose area has low daytime capacity utilization, but high demand when workers return home at night, and (5) city governments must strengthen parking enforcement and better utilize the parking space available in the city.

[1] We sum up the average monthly parking cost, insurance cost, fuel use, and incidental and repair costs. We estimate parking cost by averaging the available monthly parking garage rates for each selected city based on data from Chinaparking.org. For insurance, we use a figure of 300 RMB per month for coastal cities and 250 RMB per month for inland cities based on conversations with contacts in China and spot checking of other information sources in China. For fuel cost, we use the current benchmark price of 7.17 RMB per liter for #93 gasoline and assume that vehicles are driving 25km per day and have an average fuel economy of 14 km per liter (30 mpg).