The comfort of a hot shower is hard to beat and Chinese homeowners are moving quickly to install water heaters as they move into new housing or refurbish existing dwellings. China’s total water heater sales are booming, with 27 million units sold thus far in 2010 (20% more units year to date than in the comparable period in 2009), according to appliance dealer Wanhe.

Sales growth has been especially fast in the heat pump water heater segment, as these newer units are more efficient than their gas and electric-powered peers, are competitively priced, and can have a service life of more than 10 years. The heat pump units (空气能热水器) use only ¼ the energy per unit of water that an electric water heater does, 1/3 the energy of a gas-fired unit, and ½ the power needed by a solar-powered water heater. Heat pump water heaters’ high efficiency is a key selling point both for consumers wanting to limit power bills and for officials worried about overloaded electricity grids. They also offer a consumer-level solution for restraining the growth of energy demand in China.

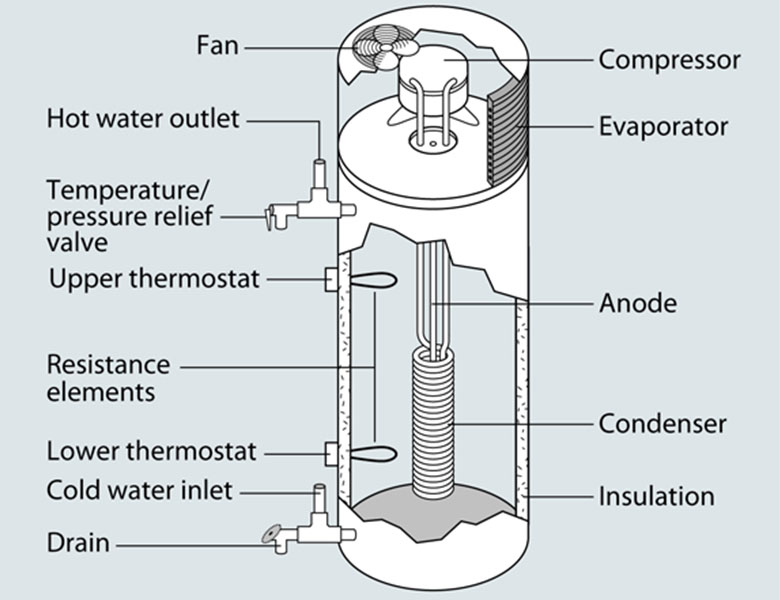

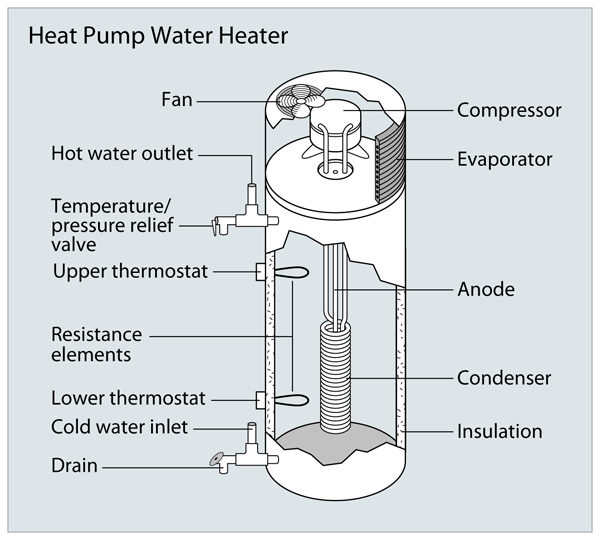

A heat pump water heater basically works like a refrigerator in reverse, according to the U.S. Department of Energy. Instead of pulling heat from inside a space and dumping it outside, the water heater extracts heat from the surrounding air, amplifies it, and dumps it into the water-filled tank. Exhibit 1 shows a cutaway drawing of a heat pump water heater.

Exhibit 1: Heat pump water heater schematic

Source: US Department of Energy

More than 500,000 units will be sold in China in 2010 and annual sales growth rates in the past few years have ranged between 150% and 200%, according to the Henan Business Report. Local analysts believe the market for heat pump water heaters still has significant room for expansion, with NewEnergy.com forecasting that the market will grow to between five and 10 times larger than its present size.

One catch is that heat pump water heaters work best in locations that remain between 40°F and 90°F (4.4°C and 32.2°C) year-round and offer at least 1,000 cubic feet (28.3 cubic meters) of air space around the unit, according to DOE. The temperature constraints are not a problem for many of China’s most populous provinces such as Sichuan, Henan, and Guangdong, which lie in the country’s warm center and Southeast Coast. The other potential catch is that some homeowners may only want a small “just-in time” water heater, as opposed to a larger heat pump unit.

That said, these minor hang-ups likely will not impede sales growth. Heat pump water heaters are likely to continue seeing strong sales growth among customers seeking larger capacity units (50 liters and up), as they are very price competitive with electric units, particularly considering their higher energy efficiency. A sampling of Chinese online appliance retailers shows an electric water heater capable of holding 80 liters of water retails for roughly 3,600 RMB, while a heat pump unit of the same capacity can be found for around 4,000 RMB.

Implications

Power & coal demand

The higher efficiency of heat pump water heaters reduces the potential electricity demand that could result from residential water heating, which helps reduce coal demand growth as well.

Natural gas demand

Our contacts tell us residential natural gas consumption in China overall is currently dominated by cooking at 70% of total use, followed by water heaters at 18% and space heating at 12% of total consumption. As heat pump water heaters gain a greater share of the market, we anticipate that space heating will become a larger driver of residential gas use than water heating.

Copper demand

The heat pump water heaters are large and bulky compared to the small gas-fired and electrical units that can be located inside a bathroom to produce warm water for showers. Some of the 100 liter and larger units we have examined weigh upwards of 220 lbs (100kg). Copper is a key input for the internal tubing and heat pump compressor and we believe it is reasonable to assume that each heat pump water heater uses a total of 8-10 kg of copper. As such, every one million units sold boost Chinese copper demand by 8-10 thousand tonnes per year, which is a meaningful volume of marginal copper demand.

Residential water consumption

We are not aware of any data quantifying the potential changes in residential water usage that occur as water heating that is integrated with the home plumbing system becomes more prevalent in China. The biggest driver of higher residential water use is not likely to be water heaters making showers more comfortable, but rather, the growing degree of urbanization that is helping to drive water heater sales in the first place.