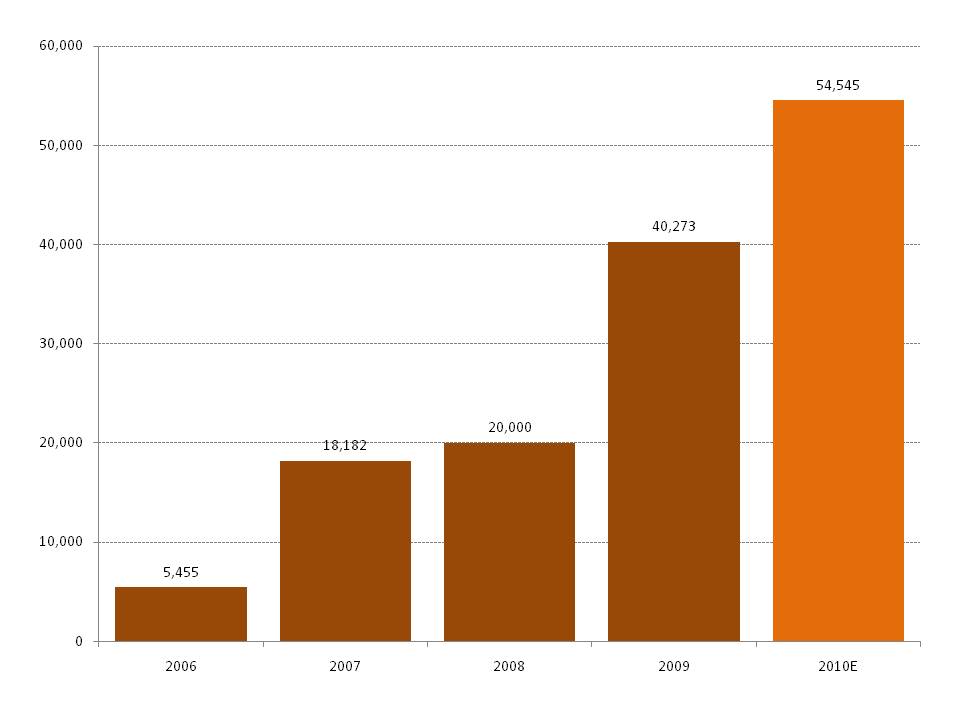

Chinese pecan buyers are accumulating supplies as they prepare for the next Chinese New Year in early 2011, a peak nut consumption period in China. Rising incomes and increased demand for healthy foods are driving higher tree nut purchases in China. Pecan farmers in the US are benefiting from skyrocketing pecan exports to China in recent years. Exports grew from less than 5,455 tonnes in 2006 to 40,273 tonnes in 2009 (Exhibit 1). Based on conversations with growers, we believe U.S. exports of whole, in-shell pecans to China could exceed 54,000 tonnes in 2010.

Pecans are supply constrained because a tree requires up to 10 years before it bears commercial nut quantities. The supply-side crunch will force growers into a balancing act as they work to maintain price competitiveness in their core U.S. and traditional European markets, while also doing their best to develop the huge Chinese market. Jeff Worn of South Georgia Pecan Company says he is concerned that strong Chinese demand for pecans is boosting prices and if this continues, major domestic nut users could be forced to switch to substitutes, thus reducing growers’ options for selling pecans in the North American market.

Exhibit 1: U.S. pecan exports to China

tonnes, in-shell basis

Source: Texas Pecan Growers Association, NFF, Times Record News, West Texas pecan farmer

Chinese consumers’ primary pecan consumption times are the Mid-Autumn Festival and the Chinese New Year. The pecans’ meat is soaked in a flavored brine solution and then dry roasted. In terms of pecan consumption preferences, the growers tell us that Chinese buyers have historically preferred large pecans but that in recent years, smaller varieties are becoming more popular as buyers realize they have higher meat content per weight than larger types.

Pecans have historically been sold into China through spot sales. Growers and traders tell us they hear rumors that some Chinese buyers are now beginning to contract ahead of time for production from orchards they like, but that the market remains centered on short-term sales. The pecan supply chain into China is complex and involves many middlemen, which helps drive up the final retail price of nuts in the country.

The Texas Pecan Growers Association and Georgia Pecan Growers Association have told us that some growers negotiate directly with buyers from China, but that most tend to use export brokers. As buyers compete in this fragmented market, prices are driven higher and some market participants believe consolidation is essential to keep prices at manageable levels and maintain healthy market growth by keeping nuts affordable and thereby discouraging consumers from shifting to such alternatives as walnuts.

Pecans remain expensive by local standards in China and the primary marketing focus is on middle class consumers, as they have more latitude for discretion based on a food’s health benefits, even if the cost is higher than traditional staples. Based on our own observations during trips to China, we do not believe pecans have penetrated Chinese cooking, which still relies on peanuts and cashews.

In China, walnuts are the main competitor to pecans as a snack food. China is the world’s largest producer of walnuts (although it remains a net importer). China’s chief pecan growing areas are Hangzhou and Zhejiang, where the climate is similar to that in the Southeastern U.S. pecan-growing areas. US growers associations tell us the basic dividing lines for orchard size are: 1-to-100 trees is “small,” 101-10,000 trees is a medium size orchard, and anything with over 10,000 tress is “large.”

Based on the difficult topography of China’s growing areas and the still-small domestic pecan output, we believe most Chinese pecan farms are in the small range, with some in the medium range. NFF tells us new orchards are being planted in Zhejiang, Anhui, and Yunnan provinces, but believes that “it will be years before domestic producers can come close to meeting domestic pecan demand.” Other U.S.-based market watchers think China will probably never be able to produce significant volumes of pecans domestically.

We are told a key barrier to pecan farming in China is that the flat land which is ideal for planting a neatly arranged orchard is also in high demand for rice and grain farming, which takes precedence given grains’ baseline food security importance. Instead, Chinese growers tend to plant pecan trees on terraced hillsides. This poses operational problems for farmers since the trees can become very large, often exceeding 100 feet in height when fully mature.

On a steep hillside, pruning and harvesting such trees is almost impossible, which decreases farm efficiency. Limited pruning ability also hampers growers’ ability to smooth harvests by pruning limbs in order to ensure more consistent flowering. Growers in New Mexico, for example, have found that strategic pruning allows consistent nut-bearing and eases the normal “on year off year” cycle in which high nut production one year is followed by diminished output the next. Chinese farmers are attempting to create smaller trees that will be more manageable for hillside orchards. Tree grafting in which American pecan limbs are being grafted onto the smaller Chinese hickory tree is underway, but the results are not yet certain.

The long payout time is a major barrier to a supply side response to high nut demand and prices in China. Farmers and lenders are likely to be much more comfortable with funding greenhouses that grow vegetables and yield cash flow in their first growing season than they will in funding a farm that could take a decade to begin yielding large nut crops and during the entire time will be highly exposed to drought, severe weather, and disease risks. High margins and fast plant-to-yield times are one key factor behind China’s rising domestic vegetable production for domestic and export markets.

Chinese pecan growers would also likely face disease problems because the climate of China’s main nut-growing areas more closely approximates that of Georgia or East Texas than that of the arid southwestern U.S. Farmers in the southeastern U.S. face significant disease risks and must spray consistently to avoid casebearer, pecan weevils, and fungal diseases that thrive in hot and humid climates like that of the southeastern U.S. or south-central China.

At the very least, U.S. growers will have a window of opportunity at least through 2015 to serve as the primary source of pecans for China. As long as nut prices do not reach levels that prompt consumers to switch to walnuts, Chinese pecan consumption has substantial room to rise. The U.S. average per capita pecan consumption over the last decade has been around 0.6 kg per year, while China’s per capita consumption is closer to 0.03 kg per year. If more consumers acquire a taste for pecans and even half the per capita consumption gap closes, China could consume 400,000 tonnes per year of pecans, more than twice what consumers worldwide used during the 2008/2009 market year, according to the USDA.