North Korea’s recent shelling of South Korea’s Yeonpyeong Island raises the risk of armed confrontation in the region. If its core demands were not met, North Korea might threaten to target such critical economic infrastructure as refineries in South Korea and Japan in the low-probability, but high-impact event that a shooting war erupted. Saddam Hussein’s Scud attacks against Israel during the First Gulf War in 1991 suggest how despots with large missile forces can lash out in unpredictable ways during a conflict, even to their ultimate detriment.

Most likely, North Korea will seek to exploit its artillery and ballistic missile capabilities not to launch a war but rather to increase its deterrence and strategic leverage. Most fundamentally, it would do so to gain attention and thereby further efforts at “shakedown diplomacy,” or generating repeated regional crises to obtain foreign aid for its unsustainable domestic economy. Another, recently emerging rationale is strengthening the 27-year-old Kim Jong-un’s political legitimacy as he becomes the third generation in his family to lead the world’s most hierarchical totalitarian regime. His father, Kim Jong-il, still North Korea’s paramount leader, likely prioritizes (in descending order) personal, family, regime, and national survival. He, his son, and other senior officials are rational actors who know that any sort of all out war would lead the U.S. to seek regime change as its ultimate goal. Moreover, since the 1953 Armistice, North Korean actions have arguably sought to have maximum impact while still not compromising South Korea’s core interests. South Korea’s Northeast Islands, while sovereign territory, are not the nation’s only source of valuable crabmeat. The Cheonan’s sinking, while a human tragedy and painful sovereignty violation, likewise does not threaten South Korea’s fundamental interests.

Viewed in this context, actually striking petroleum supplies in a country that is completely import dependent would completely change the equation: South Korea could not tolerate this kind of threat, nor could Japan or even China. All three countries are highly energy interdependent. For example, China exports raw oil to South Korea and Japan, which in turn refine and then export back to China higher-grade petroleum products such as aviation fuel, plastics, and chemicals. Additionally, China would be very sensitive to any disruptions in energy supplies in Northeast Asia. China would understand the South Korea and Japanese reaction to such threats—and would likely curtail its support for North Korea severely if it took such action. After all, China wants to preserve the status quo, and it too is a rational actor. However, unlike North Korea, China’s preference ordering is stable and transparent, and we should expect that given the billions in trade from Japan and South Korea, if forced to make a decision, China would prioritize the economic relations with those two countries over the patron-client relationship with North Korea.

Still, while other nations in the region have long been unhappy with North Korea’s irresponsible behavior, the unwillingness of treaty ally China to oppose even the most recent provocations in a substantive manner may embolden Pyongyang and lead its increasingly multipolar leadership to conclude that it can get away with even more extreme—if carefully targeted—threats and other behavior if faced with pressures that it deems unacceptable. Given the risk of misperception and miscalculation, particularly as the succession process unfolds, now is a logical time to assess the vulnerability of regional refining infrastructure to a North Korean attack and how the markets might respond to related threats.

Any North Korean threats against South Korean economic assets such as refineries would mark a new front in the countries’ conflict and should be taken seriously by policymakers because even threats made by Pyongyang for deterrence purposes can have meaningful and negative economic impacts. Financial markets and insurance markets are inherently forward-looking and would price in increased perceptions of risk driven by North Korean threats against South Korean refineries. Such threats could come through public statements (a lower-impact event) or in the form of actions such as missile tests landing in international waters near major South Korean oil ports (a lower-probability, but higher-impact event). Market responses to a North Korean threat might include equity market declines, crude oil and oil product price increases, and higher insurance costs for shippers delivering oil to South Korean refineries. The plants would still run, but consumers of oil and equity shareholders in the region would bear the costs as risk managers priced the reality that a key global oil refining region could face attacks. In contrast to other countries in the region, North Korea’s economic isolation from the outside world shields it from the impacts of market disruptions triggered by its behavior, potentially making it more willing to use economic threats as part of its “shakedown diplomacy.”

Refineries, at least for deterrence purposes, could be attractive targets for North Korea, as striking them would cause more economic damage than hitting civilian population centers, while minimizing civilian casualties. Doing so would not require flexibility and decision-making at lower levels (i.e., as might be required for an invasion of Seoul) that might be difficult if not impossible for such a hierarchical regime to allow. Ballistic missiles with a circular error of probability of several hundred meters such as North Korea’s No-dong would have a good chance of scoring a hit against a refinery, whose processing units, storage tanks, and other infrastructure can occupy an area of multiple square kilometers. An added bonus from Pyongyang’s perspective is that a missile hit on critical parts of a refinery could put the plant out of commission for at least several months.

With China’s present diesel fuel shortage, putting refineries elsewhere in Northeast Asia out of commission would likely trigger oil price spikes. This in turn would increase inflationary pressures in China and could force the Chinese government to raise interest rates and take other tightening measures that would drive Chinese and global growth down. South Korea’s entire refining capacity of approximately 2.6 million bpd lies within range of North Korean Scud and No-dong missiles, while Japan’s 4.8 million bpd of capacity lie within the range envelope of the No-Dong and Taep’o-dong systems (Exhibit 1).

Exhibit 1: Threat to refineries from North Korean ballistic strike systems

Source: FAS, China SignPost™

To provide a clearer sense of how risk to refineries could shift as a result of North Korean threats, we use four scenarios (four significant probability and one worst case) to illustrate what we see as the major possible potential outcomes. The probability represents the chances that a particular scenario will materialize. All probabilities are notional, as they are intended to suggest the relative likelihood of possible future scenarios rather than an absolute prediction.

Scenario 1: Confrontation short of full conflict

Probability: >45%

Risk of refinery threats: slightly elevated

In this scenario, South Korea and its allies would work to pressure the North without resorting to direct military force. Possible means employed could include restricting North Korean maritime transit through South Korean waters, identifying and freezing North Korean-controlled financial assets overseas, imposing travel restrictions on North Korean officials, and further severing economic and trade ties between North and South Korea. We also see potential for imposing sanctions on companies that do business in North Korea or products produced using North Korean labor or raw materials, which could affect a number of Chinese firms.

Still, Seoul might be extremely reluctant to impose any measures that risked harming economic growth. During the Cheonan and Yeonpyeong Island incidents, for instance, South Korea never evacuated its 700+ workers from the Kaesong Industrial Complex, despite the potential that they might become hostages—or even human shields for North Korean artillery/missiles.

It is very likely, however, that the US and South Korea will continue making a public display of military power to bolster their diplomatic position. The Pentagon has already dispatched the USS George Washington to the Yellow Sea for joint US-South Korea military exercises, which sends a strong message, since carriers are powerful as both a defensive and offensive weapons system.

Taking the matter to the UN Security Council, by contrast, would likely be a symbolic measure with few teeth. Notable high-casualty provocations North Korea has perpetrated against the South include the October 1983 bombing in Myanmar that just missed the South Korean President and killed 17 members of his entourage and the bombing of Korean Air Flight 858 in 1987, killing all 115 civilians aboard. In these tragic cases, Myanmar and South Korea both brought evidence to the UN showing that North Korea was behind the attacks. In both instances, the Security Council did not act against North Korea. China, which as one of the Permanent Five members of the Security Council enjoys a veto, would likely oppose or seek to weaken any efforts to pressure Pyongyang substantively unless tensions truly escalated.

Scenario 2: Sparring

Probability: 35%

Risk of refinery threats: moderate

Under this scenario, the two Koreas would enter into a period of heightened tensions, to include brinksmanship and threats, and even possibly limited military actions against each other at a level beyond the occasional exchanges of fire. Records of North Korean provocations compiled by the Congressional Research Service show the 1960s were a time of particularly high North Korean activity against the South and there is a meaningful possibility that the ongoing leadership transition process in North Korea will spark a similar pattern, albeit perhaps at a lower level of casualties, over the next several years (Exhibit 2).

Exhibit 2: Selected North Korean provocations

Source: CRS, China SignPost™

Scenario 3: Return to normal

Probability: 15%

Risk of refinery threats: unchanged

There is a lower probability that once the immediate political heat from the shelling incident passes, the two countries will return to the pre-attack status quo. We believe this is less likely than the first two scenarios because our sense is that an increasing portion of the South Korean populace is questioning the merits of previously accommodative “Sunshine” policies toward Pyongyang in the face of its belligerent behavior and disregard for South Korean lives.

Scenario 4: Major North Korean military attack

Probability: <5%

Risk of refinery threats and attacks: high

Since the 1953 armistice, there has been a substantial record of North Korean provocations and assaults on South Korean and US assets and citizens. The lack of significant military conflict to date underscores the extraordinary restraint shown by South Korea and its U.S. ally, as well as the lack of attack options that do not allow the North to threaten Seoul with significant civilian casualties via border-based artillery. The probability of a more significant North Korean military attack is the scenario we are most concerned about. Missile strikes or sabotage against South Korean or Japanese refineries would probably be construed as an act of war and we believe these are only actions the North Korean leadership would take 1) if it were involved in a full-scale shooting war, and more likely, 2) if it realized that the conflict was likely to end in loss and that regime change at the hands of ROK and US forces was likely.

These factors are unlikely to materialize both because North Korea’s leadership prioritizes regime survival and because it has been in the interest of South Korea, China, and the U.S. to prevent tensions from escalating to kinetic conflict, even if this entails tolerating extremely escalatory behavior on North Korea’s part. While this scenario is the lowest-probability outcome by far, then, we believe the probability of a more significant military exchange has risen significantly with North Korea’s recent belligerence and the calls for a stronger response that it is prompting in many quarters of South Korean society. Moreover, there is the risk of misperception and miscalculation, particularly by a Pyongyang leadership that may find it extremely difficult to back down in certain situations. And there is always the risk of surprise—many analysts failed to anticipate that North Korea would actually strike land territory on South Korea’s Yeonpyeong Island in broad daylight and thereby kill both military personnel and civilians. The risk of some larger military attack or exchange must therefore be viewed in proper context, but deserves serious consideration.

Facility vulnerability

To quantify the vulnerability of regional refining facilities, we use a simple index based on the plant’s distance from North Korea (relevant for vulnerability to accurate missile strikes), its distance from the sea (vulnerability to covert sabotage missions), and its capacity (bigger plants would be more appealing targets). The metrics are also weighted to reflect what we believe would be key elements of North Korea’s targeting calculus in the event a decision was taken to launch strikes, and therefore potentially relevant to its attempts to bolster deterrence.

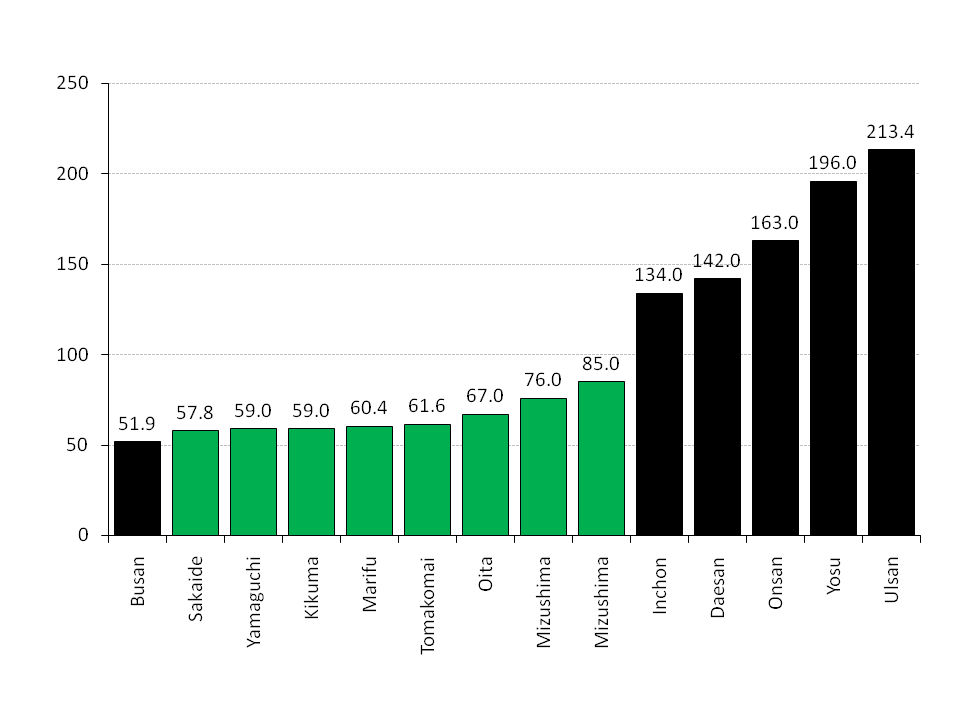

Overall distance receives the highest weight in our scoring, since targets need to fall in a weapon system’s range envelope. This is followed by distance from the sea, since a covert sabotage operation would have higher deniability than a missile strike, whose origin can be traced based on the rocket’s trajectory. Finally, capacity gets a lower weighting since the main target set of South Korean refineries are, with the exception of Hyundai’s Busan plant, some of the largest facilities in the world, with the ability to process 270,000 barrels of oil per day (kbd) or more. SK’s Ulsan plant (817 kbd) gets the highest score at 213.4, with the other four large South Korean refineries rounding out the five most vulnerable plants, all with scores of between 134.0 and 213.4 (Exhibit 3).

We assess the risk of attacks on Chinese and Russian refineries in the region as negligible. Russia’s capacity in the Far East is small and a military response would likely follow any attack. China is North Korea’s primary international relationship, with high diplomatic importance due to Beijing’s position as a permanent member of the UN Security Council and as the only regional power willing and able to offset the weight of the US in diplomatic fora such as the Six Party Talks.

So far, the Kim regime has focused on military assets and isolated areas as targets for its provocations. With that in mind, the retaliatory pressures North Korea is likely to face for its latest infractions, such as freezing of senior leadership assets abroad, could trigger further attacks that could expand to include sabotage operations against industrial and economic targets like refineries.

Given South Korea’s vulnerability and the U.S.’s lack of further non-military options and unwillingness to endure further “shakedown diplomacy,” only China has the ability to ensure that North Korea does not resort to more escalatory measures. Unfortunately, Beijing’s actions to date suggest that it would prefer to accommodate almost any action by Pyongyang rather than apply pressure that it believes might destabilize the regime. The Korean peninsula appears headed for a very difficult period.

One possible approach would be to multilateralize the issue further by inviting such as Asian nations as Australia, the Philippines, Thailand, Japan, and India to participate in future exercises in the West Sea of Korea. They could send military observers, or actual boats/planes to help demonstrate a show of force that has international legitimacy versus a US/ROK exercise. This would demonstrate a unity of effort and perhaps send a strong message to China to help encourage it to participate constructively, at least by sending observers.

Exhibit 3: Vulnerability of South Korean and Japanese refineries to North Korean attack, index