Déjà vu is the operative word today, at least in part. Beijing’s desire to see lower energy intensity in the economy is manifesting itself through power supply restrictions to industrial users in Guangdong, Guangxi, Jiangsu, Zhejiang, and other provinces, according to Sinopec.

The result is that power demand normally supplied by coal is now being met by diesel-fired generators. The impact of power cuts on the diesel market is two-sided since not only do cuts increase demand for diesel, but also because some refineries are experiencing constricted power supplies, according to Sinopec.

As the Chinese government flirts with price controls on food and energy as a way to keep inflation in check, the Chinese stock market has declined sharply and global markets are following. Given China’s importance as a source of crude oil demand growth and the global ramifications of fiscal and monetary policy measures Beijing might use against inflation driven in part by rising energy prices, we think it worthwhile to examine some of the key factors behind the diesel fuel shortage.

Overall, the drivers for China’s diesel fuel shortage break down into two main categories. One is the temporary drivers, which are the result of either policy decisions by the government or seasonal factors that occur each year. Administratively-driven power cutoffs, harvest season, seasonal refinery maintenance, and higher demand for diesel-fired power due to low hydropower reservoir water levels all fall into this category. The other category is structural, with factors that are driven primarily by economic forces. One overriding factor is the Chinese government’s insistence on controlling oil product prices. Because the majority of crude oil refined in China is imported, this creates strong incentives for refiners to reduce runs when crude prices rise sharply, knocking the supply/demand balance out of whack.

Two key structural factors that put pressure on diesel fuel supplies in China and have not been widely discussed to date are: (1) rebounding chemical demand that is causing competition for middle distillates and (2) diesel fuel’s tight leverage to economic activity.

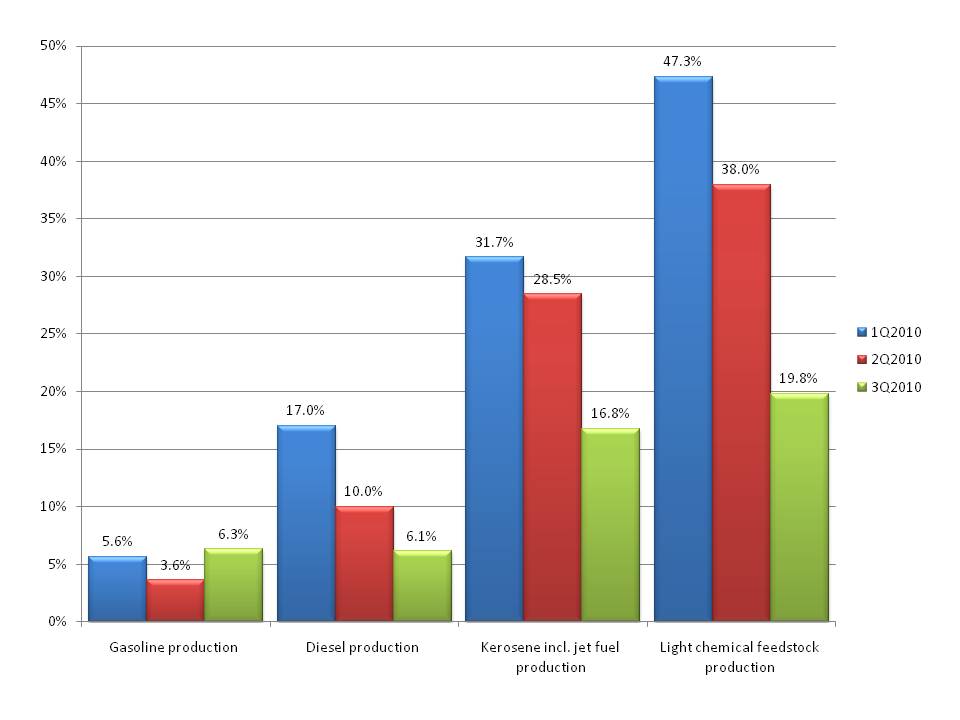

First, key chemical feedstocks, particularly naphtha, come from the same middle distillate range as diesel fuel does. Sinopec’s combined output of kerosene and light chemical feedstock production in the third quarter of 2010 was nearly 40,000 barrels per day higher than last year, assuming the light chemical feedstock production consists primarily of naphtha-range chemicals. Kerosene production rose by nearly 17% year-on-year in the third quarter of 2010, light chemical feedstock production rose by nearly 20%, and ethylene production, which is often naphtha-based, rose by 39% year-on-year (Exhibit 1). Output of gasoline and diesel fuel, by contrast, rose by slightly more than 6% year-on-year in the third quarter.[1] Domestic refined oil product sales rose by 16.2% year-on-year in the first 9 months of 2010, while refinery throughout rose by 14.4% during that time.

Exhibit 1: Year on Year change in Sinopec’s oil product output in 2010, by quarter

Second, diesel use is more sensitive to the condition of the economy than gasoline is. Gasoline use in cars owned by private drivers who often have access to public transit systems is much more discretionary than diesel use in trucks that must run to move goods if demand is there and which move much less if demand is weak.

China’s heavy truck dealers sold 788,300 vehicles in the first 9 months of 2010, a nearly 75% year-on-year increase, according to China Truck. Truck sales figures are an important barometer, because in general, trucks are much less likely to sit idle after being sold. Trucks are typically a business item that the owner has high financial incentive to use once purchased. The continued strong growth of China’s truck sales, driven in part by robust growth in Central and Western China, and the high likelihood that trucks that are sold will be regularly used, suggest that Chinese diesel fuel demand will continue to grow for at least several years to come.

[1] We recognize that production is typically not an ideal yardstick for measuring demand, but in China’s case, the vast majority of its refined oil products are consumed domestically, so we believe using production data to assess demand is acceptable given the lack of published oil demand data by product type.